The Australian share market has recorded its worst opening session in five years, tumbling dramatically in early trade on Monday as fears of a global recession mount. The benchmark S&P/ASX 200 index plummeted by 6.4% within the first 10 minutes, wiping out an estimated $187 billion in market value — far exceeding the predicted $115 billion drop.

The sudden plunge marks the most severe start to a trading day since the COVID-19 pandemic lockdowns in March 2020, and investor sentiment has rapidly turned from cautious optimism to outright panic. The market crash is being attributed to fresh economic uncertainty, primarily driven by aggressive new trade tariffs announced by former U.S. President Donald Trump, sparking fears of global stagflation and trade wars.

ASX Crash: The Numbers Behind the Market Meltdown

The S&P/ASX200 index, which tracks the performance of Australia’s top 200 listed companies, dived to 7,111.30 points in the first few minutes of trade — a collapse more dramatic than even the futures market had forecast earlier in the day. The futures had pointed to a 5.11% decline to around 7,387.5 points.

However, the real-time losses exceeded expectations, erasing more than $187 billion in value from Australian investors’ portfolios, making it one of the most brutal trading days in the post-pandemic era.

Tech and Mining Stocks Suffer Massive Losses

Among the sectors hardest hit were technology, mining, and financial services, which had been among the market’s top gainers throughout 2024.

-

Life360, a U.S.-based location tracking company listed on the ASX, fell a staggering 10.99% to $16.10. This was a sharp reversal for a stock that had tripled in price during 2024, propelled by strong user growth and investor optimism in tech.

-

Zip Co, once hailed as the best performing Australian stock of 2024, also suffered a major blow. Its share price tumbled 12.45% to $1.12, signaling a swift loss of confidence in fintech and buy-now-pay-later platforms amid tightening global credit conditions.

-

Mining giant BHP, one of Australia’s most valuable companies, dropped 9.13% to $33.46, reflecting fears over reduced commodity demand as China — a major buyer of Australian iron ore and coal — comes under economic pressure due to the trade spat.

Even previously resilient sectors like energy and infrastructure weren’t spared, with market-wide selling suggesting that investors are bracing for long-term global economic disruptions.

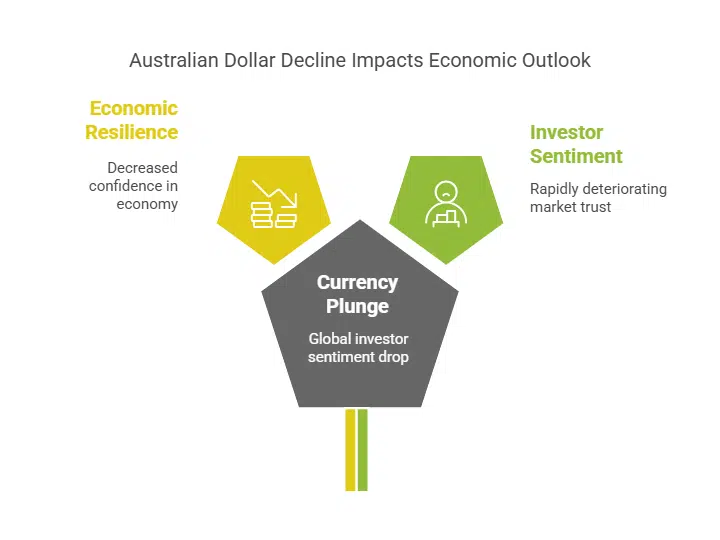

Australian Dollar Hits Five-Year Low Below 60 US Cents

In a further blow to Australia’s economic outlook, the Australian dollar (AUD) slid below the psychological threshold of 60 US cents, reaching its lowest point since March 2020. This steep fall reflects declining global confidence in Australia’s economic resilience in the face of a potential global downturn.

Michael McCarthy, Chief Commercial Officer and Market Strategist at Moomoo, described the currency’s plunge as a clear signal that global investor sentiment is rapidly deteriorating.

“The Aussie dollar, if nothing else, is signalling we are in crisis mode already,” McCarthy told Daily Mail Australia. “People have been conditioned to buy the dips over the last few years, but the dollar is clearly saying now is not the time.”

Australia’s heavy reliance on commodity exports, especially to China, means the AUD is often seen as a proxy for global growth. The fall below 60 US cents is now being compared to the crash following the 2008 collapse of Lehman Brothers, which led to intervention from the Reserve Bank of Australia (RBA) to prevent further depreciation.

Trump’s Tariffs Spark Global Economic Panic

The root cause of Monday’s market chaos stems from newly imposed American tariffs targeting major global economies. Under directives from former President Donald Trump, who is campaigning for re-election in 2025, the U.S. has enacted sweeping tariffs:

-

34% on imports from China

-

10% on Australian goods

-

Additional levies on goods from Europe and Latin America

These tariffs have led to widespread concerns about a revival of 1970s-style stagflation — a dreaded economic scenario where inflation rises while economic growth and employment stagnate.

According to McCarthy:

“It’s the tariffs — there’s no two ways about it. The concern here is stagflation, and tariffs feed both sides of that equation. They increase prices (driving inflation), and they disrupt global supply chains (slowing economic growth).”

This double-whammy effect has raised the probability of a global recession to over 50%, according to several international financial analysts. If both the U.S. and China — the world’s two largest economies — enter a slowdown, the effects will inevitably ripple across Australia, McCarthy warned.

Safe-Haven Investments Show Mixed Signals

Traditionally safe-haven assets like gold and government bonds are being closely watched by investors seeking stability. However, even gold prices retreated from their record highs of US$3,155 per ounce last Friday, leaving few places to hide from the market turbulence.

Additionally, global bond markets are flashing warning signals, with inverted yield curves and surging demand for U.S. Treasuries — a classic precursor to economic slowdowns.

Meanwhile, currencies like the Japanese yen and Swiss franc have strengthened, further illustrating the flight to safety as risk aversion grows globally.

Coles and Woolworths Defy the Downturn — For Now

Amid the widespread carnage, consumer staple stocks like Coles and Woolworths bucked the negative trend, with investors flocking to companies that offer steady domestic demand and reliable dividends.

“The only stocks to perform well were those very steady businesses like supermarkets and home retailers — both in Australia and the U.S.,” said McCarthy.

These businesses are seen as more resilient during economic downturns, offering essential goods that consumers continue to purchase regardless of broader economic conditions.

Elon Musk’s Exit from DOGE Amid Tariff Fallout

Adding to the political and economic drama, reports have emerged that billionaire Elon Musk is preparing to step down from his role as head of the Department of Government Efficiency (DOGE). The agency, a Trump-era initiative, was established to reduce U.S. government spending by $1 trillion.

While Musk’s departure aligns with the federal regulation limiting special government appointments to 130 days per calendar year, sources claim his frustration with Trump’s new tariffs may have hastened his decision.

His potential exit from DOGE is already raising concerns about leadership instability in Washington during a volatile time for both U.S. and global markets.

Market Repricing and Economic Uncertainty

Monday’s sell-off is being described as more than just a correction — it’s a wholesale repricing of economic expectations for 2025 and beyond. With tariffs reigniting fears of trade wars, central banks tightening monetary policy, and geopolitical tensions mounting, many investors are preparing for a prolonged period of volatility.

While some market veterans urge patience, others warn that strategies like “buying the dip” may no longer apply in this new economic regime. The message from global markets is clear: caution is warranted as the world edges closer to a potential recession.

The Australian market’s staggering losses are a stark reminder of how quickly investor confidence can shift in an interconnected global economy. With trade wars escalating and political volatility on the rise, the coming months will test the resilience of businesses, consumers, and governments alike.

Investors are advised to stay updated, diversify assets, and consider risk management strategies as the global outlook continues to darken.