Founding a company is an exercise in managing chaos. You are building a product and hiring a team while trying to find customers. The last thing you need is a banking disaster that freezes your funds or hits you with hidden fees. Finding the best business bank account for startups is a critical foundational step. It is the operating system for your financial life.

In 2026, the landscape of business banking has shifted dramatically. The line between a bank and a software company has blurred. Modern fintech platforms now offer features that traditional banks cannot match. They provide automated bookkeeping and tax tools. They offer seamless integrations with your tech stack. They give you high-yield interest on your idle cash. However, traditional banks still hold the advantage of physical branches and cash deposits.

This guide cuts through the marketing noise. We have analyzed the fee structures and tested the mobile apps. We have compared the APY rates to bring you the definitive list of the top banking solutions for the year. Whether you are a venture-backed tech unicorn or a bootstrapped agency, you will find the right partner for your money here.

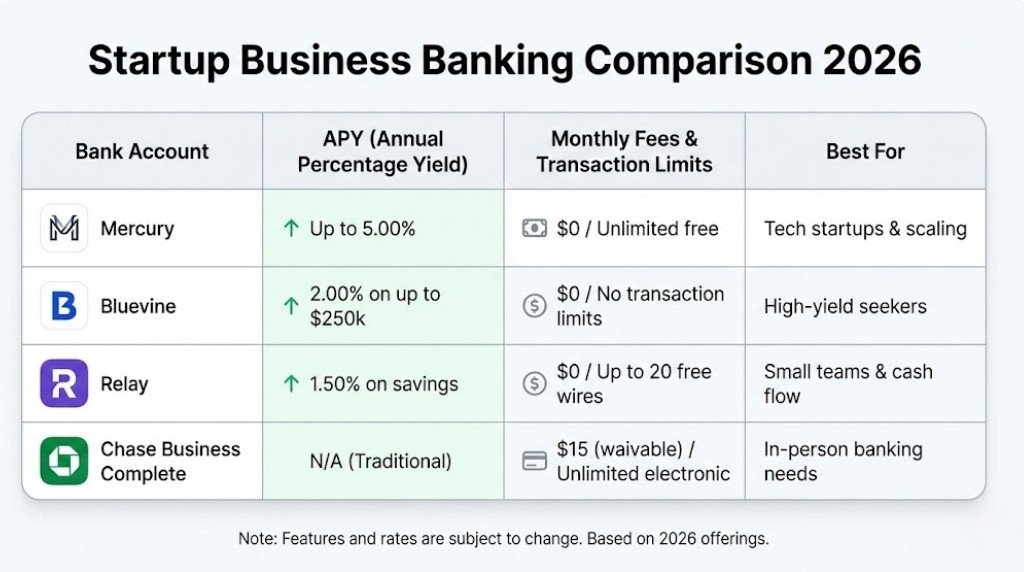

Here’s a quick overview:

| Bank Name | Best For | APY (Yield) | Monthly Fee | Primary Feature |

| Mercury | Tech Startups | Up to 5.00%* | $0 | $5M FDIC Insurance |

| Bluevine | High Yield | 1.5% – 3.0% | $0 | Interest on Checking |

| Relay | Teams & Budgeting | 1.0% – 3.0% | $0 | 50 Debit Cards |

| Chase Business | Local Branches | 0% | $15 (Waivable) | Cash Deposits |

| Novo | Fast Invoicing | 0% | $0 | Stripe Integration |

| Found | Solopreneurs | 1.5% (Plus) | $0 | Built-in Tax Tools |

*Yields on Mercury Treasury are variable and subject to market conditions.

The 6 Best Business Bank Accounts for Startups in 2026

Here are our selections for the 6 best business bank accounts for startups in 2026:

1. Mercury

Mercury has firmly established itself as the gold standard for the modern tech startup. It is not technically a bank. It is a financial technology company that partners with FDIC-insured banks to store your money. This distinction allows them to focus entirely on building a superior user experience. The interface is sleek and intuitive. It feels more like using a modern SaaS tool than logging into a legacy bank portal.

The standout feature for 2026 is the Mercury Treasury product. This automated cash management account puts your idle funds into government-backed securities or money market funds. This allows startups with significant funding to earn high yields without actively managing a portfolio. Furthermore, Mercury offers the Vault. This feature uses a sweep network to spread your deposits across multiple partner banks. It extends your FDIC insurance coverage up to $5 million. This is crucial for startups raising millions in venture capital who cannot risk keeping all their eggs in one uninsured basket.

Best For: Venture-backed technology companies and startups seeking scale.

Pros:

-

Offers up to $5 million in FDIC insurance through partner sweep networks

-

Mercury Treasury automates yield generation on idle cash reserves

-

Zero monthly fees and free domestic and international wire transfers

-

Cleanest user interface in the industry with powerful API access

-

Perks program provides significant discounts on AWS and QuickBooks

Cons:

-

No ability to deposit physical cash

-

Eligibility is strict, and they often reject businesses outside the tech sector

-

Customer support is email-only with no phone line for immediate issues

2. Bluevine

Bluevine addresses the biggest complaint business owners have about traditional checking accounts. Most business checking accounts pay zero interest. Bluevine changes the game by treating your checking account like a high-yield savings account. You can earn 1.5% APY on balances up to $250,000 if you meet simple activity requirements. This rate can go even higher with their Premier tier. For a startup sitting on operating capital, this “free money” can cover a software subscription or a utility bill every month.

The platform is designed for flexibility. You can open up to five sub-accounts. Each sub-account gets its own unique account number. This is fantastic for separating revenue streams or setting aside VAT. Unlike many fintech competitors, Bluevine also solves the cash deposit problem. They partner with the Green Dot network. You can deposit cash at thousands of retail locations like CVS or Walgreens. This makes it a viable hybrid option for businesses that are mostly digital but occasionally handle physical currency.

Best For: Business owners who want to earn passive income on their operating capital.

Pros:

-

Industry-leading APY on checking account balances

-

Allows cash deposits through the Green Dot retail network

-

Unlimited transactions with no monthly maintenance fees

-

Includes a master bill pay feature to manage accounts payable

-

Fast access to working capital through their line of credit products

Cons:

-

You must meet debit usage or deposit thresholds to unlock the APY

-

Green Dot cash deposits come with a hefty fee per transaction

-

Savings accounts are not available as separate products

3. Relay

Relay markets itself as “banking that puts you in control.” It lives up to that promise by giving you granular control over your money. The core philosophy here is digital envelope budgeting. You can open up to 20 individual checking accounts. You can label one “Payroll” and another “Taxes” and another “Marketing.” You can then set up automatic transfer rules to move a percentage of your revenue into these buckets. This ensures you never accidentally spend your tax money on ad spend.

Relay is also the best business bank account for startups with multiple founders or employees. You can issue up to 50 physical or virtual debit cards. You can set strict spending limits on each card. You can restrict a card to only work at gas stations or only for software subscriptions. This replaces the need for a separate expense management platform like Ramp or Brex for smaller teams. It integrates deeply with Gusto and QuickBooks Online. This means your transaction data flows directly into your accounting software. It saves hours of manual reconciliation work at the end of the month.

Best For: Teams that need detailed expense management and profit-first budgeting.

Pros:

-

Ability to open 20 checking accounts and issue 50 debit cards

-

Granular spending controls on every single card issued

-

Direct integration with Gusto for payroll management

-

Completely free with no minimum balance requirements

-

Auto-transfer rules make profit-first accounting easy to implement

Cons:

-

Check deposit limits can be low for new accounts

-

Outgoing wire transfers have a small fee on the free plan

-

No interest-bearing checking options are available

4. Chase Business Complete Banking

Sometimes you just need a real bank. Chase is the largest bank in the United States. It offers a level of stability and physical presence that fintechs cannot replicate. If your internet goes down or your account gets locked, you can walk into one of their 4,700 branches and talk to a human being. The Chase Business Complete Banking account is their entry-level product. It is designed to compete with the digital newcomers while leveraging Chase’s massive infrastructure.

The killer feature here is Chase QuickAccept. This is a built-in payment processor that lets you take card payments via the mobile app or a card reader. The funds hit your account the same day. There is no waiting two days for a Stripe transfer to clear. This is a game changer for service businesses or retail pop-ups. While there is a $15 monthly fee, it is very easy to waive. You just need to maintain a $2,000 minimum balance.

Best For: Businesses that deal with cash or need in-person branch services.

Pros:

-

Massive network of physical branches and ATMs

-

QuickAccept allows for same-day access to card sales revenue

-

Reliable mobile app with robust fraud protection features

-

Waivable monthly fee makes it accessible for small businesses

-

Easy to scale into business credit cards and loans later

Cons:

-

Earns zero interest on your checking balance

-

Foreign transaction fees and wire fees can be expensive

-

The application process is longer than digital-first competitors

5. Novo

Novo is built for the entrepreneur who lives in their apps. It is arguably the most “connected” bank account on this list. It features a dedicated app marketplace. You can connect your Novo account to Stripe, Shopify, Etsy, Slack, and Zapier. These integrations allow for powerful automations. For example, you can set a rule that every time a sale happens on Shopify, a percentage of that sale is automatically moved to a tax reserve bucket in Novo.

Novo is fantastic for speed. Their “Novo Boost” feature accelerates Stripe payouts. Instead of waiting the standard 2-4 days for your ecommerce funds to arrive, Novo Boost gets them to you hours after the transaction clears. They also offer unlimited free invoicing. You can create professional invoices directly in the app and send them to clients. The clients can pay by card or ACH. This effectively replaces the need for a separate invoicing tool like FreshBooks for many freelancers.

Best For: E-commerce stores and digital freelancers who use Stripe or Shopify.

Pros:

-

Novo Boost provides faster access to Stripe payouts

-

Thousands of dollars in perks and software discounts

-

Unlimited refunds on all ATM fees globally

-

Robust integration ecosystem connects to all your other tools

-

Built-in invoicing tool is free and unlimited

Cons:

-

No native outgoing wire capability (uses a third-party integration)

-

Cannot deposit physical cash anywhere

-

Customer support can be slow during peak times

6. Found

Found is a unique hybrid. It is a business bank account combined with a bookkeeping software and a tax calculator. It is designed specifically for the “company of one.” If you are a freelancer or a solo consultant, Found eliminates the administrative headache of self-employment. Every time you swipe your Found debit card, the app automatically categorizes the expense. It then updates your real-time tax estimate. You can see exactly how much you owe the IRS at any given moment.

The “Tax Pockets” feature is brilliant. You can set the app to automatically withhold a percentage of every incoming deposit. This money is locked away in a separate pocket until tax season. When it is time to pay your quarterly estimated taxes, you can pay the IRS directly from the app. There is no need for TurboTax or a separate accountant for simple returns. The paid “Found Plus” tier adds even more value. It gives you 1.5% APY on balances and allows you to categorize expenses from other bank accounts.

Best For: Solopreneurs and freelancers who hate doing taxes and bookkeeping.

Pros:

-

Automatically tracks write-offs and categorizes expenses

-

Real-time tax estimates prevent end-of-year surprises

-

Ability to pay taxes to the IRS directly from the app

-

No credit check is required to open an account

-

Combines three different software subscriptions into one free app

Cons:

-

Not suitable for businesses with employees or multiple partners

-

Check deposit limits are very low initially

-

No option to send or receive international wire transfers

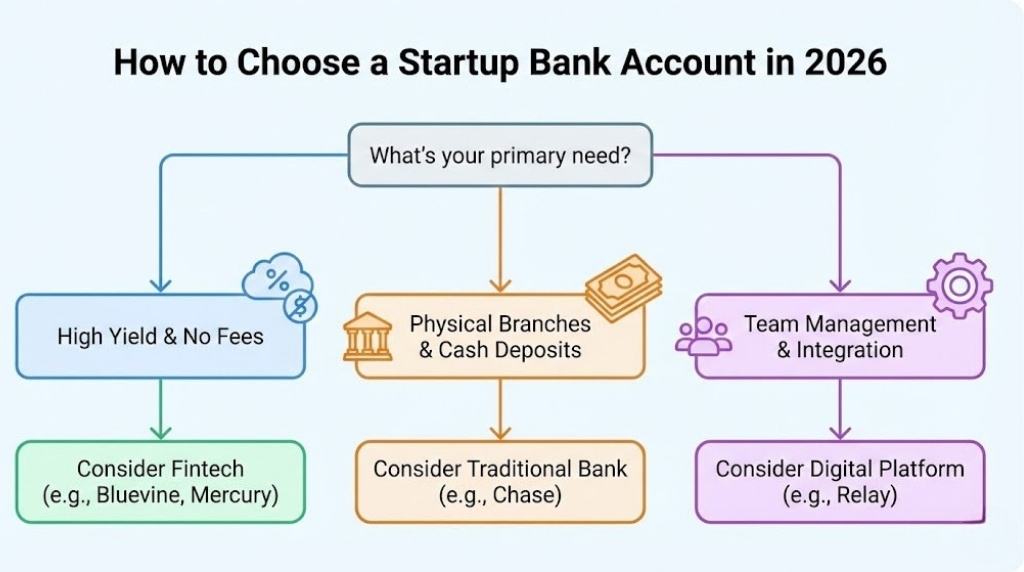

How to Choose the Best Business Bank Account

Choosing the right partner is not about finding the “best” bank in a vacuum. It is about finding the best business bank account for startups that matches your specific operational model. A restaurant has very different needs than a SaaS company. Here are the vectors you need to consider before applying.

The Cash Question

Do you receive physical currency from customers? If you run a coffee shop, a food truck, or a laundromat, you need a way to deposit bills.

-

Yes: You need Chase or Bluevine. Chase allows you to walk into a branch. Bluevine allows you to use the Green Dot network at retail stores.

-

No: You are free to choose purely digital options like Mercury or Relay. These banks have no branches and often no way to accept cash deposits.

Interest Rates (APY) vs. Features

Your operating account can be a profit center or a tool center.

-

Profit: If you hold large cash balances (over $50,000), you are losing money by using a 0% interest bank. Bluevine or Mercury (with Treasury) are the logical choices. They put your money to work.

-

Tools: If your balance is lower but your transaction volume is high, prioritize features. Relay helps you budget. Novo speeds up your cash flow. The utility of the software is worth more than the $10 a month you might earn in interest.

Team Size and Scalability

Are you a solo founder or do you have a team of ten?

-

Solo: Found is unbeatable. It handles the administrative burden so you can focus on work.

-

Team: You need Relay or Mercury. You need the ability to issue multiple cards. You need to be able to set spending limits. You need read-only access for your accountant. Do not try to share a single login for a bank account with three people. It is a security nightmare.

Integration Requirements

Your bank should talk to your other software.

-

Accounting: All options on this list integrate with QuickBooks and Xero. However, Relay and Mercury tend to have the most reliable, glitch-free connections.

-

Payment Processing: If you live in Stripe or Shopify, Novo offers the deepest integration. The ability to see your sales data inside your banking dashboard is a powerful insight tool.

Fee Tolerance

-

Zero Fees: Most fintechs (Mercury, Relay, Novo, Bluevine, Found) have no monthly fees. This is the new standard.

-

Waivable Fees: Traditional banks (Chase) charge fees ($15+) but waive them if you keep a minimum balance. Only choose this if the branch access is worth the “opportunity cost” of locking up that $2,000 minimum balance.

Decision Checklist

Use this quick checklist to finalize your decision:

-

[ ] Do I need to deposit cash more than once a month?

-

[ ] Do I need to issue debit cards to employees?

-

[ ] Will I be sending international wire transfers frequently?

-

[ ] Do I have more than $50,000 in idle cash?

-

[ ] Do I need a paper checkbook? (Many fintechs only offer bill pay).

Wrap-Up

The banking industry has finally woken up to the fact that startups need more than just a digital vault. They need a financial operating system. The best business bank account for startups in 2026 is one that saves you time, earns you money, and integrates with your workflow.

If you are building the next great tech company, Mercury remains the undisputed king. Its feature set is perfectly tuned to the rhythm of a high-growth startup. If you are a small business owner who wants to maximize every dollar, Bluevine offers the yield you deserve. And if you are navigating the complex world of payroll and teams, Relay offers the structure you need.

Do not let analysis paralysis stop you. All six of these accounts are excellent. The most important thing is to separate your business and personal finances today. Pick the one that fits your current stage. You can always switch later as you grow.