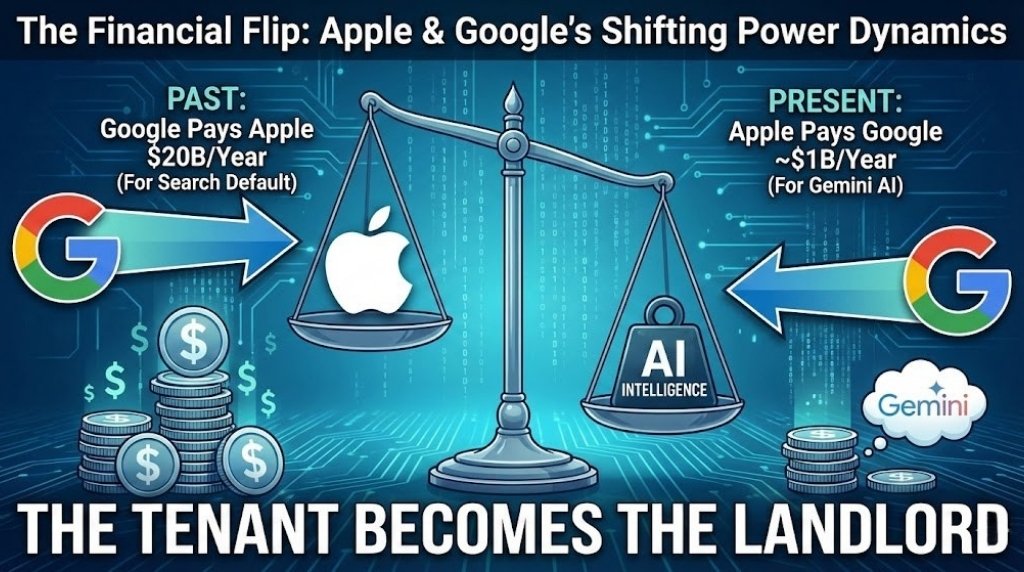

For fifteen years, the iPhone was the landlord, and Google was the tenant. Every single year, Sundar Pichai wrote a check—last year it was nearly $20 billion—just to keep Google Search in the Safari guest room. It was the ultimate silicon power move: Apple didn’t need to build a search engine because it owned the toll road. It could evict the tenant at any time, or at least threaten to, leveraging that fear into an ever-higher rent check.

But last month’s quiet Friday announcement that Apple will pay Google roughly $1 billion annually to power Siri with Gemini isn’t just a “partnership.” It is a capitulation. The landlord just started paying rent to the tenant.

For the first time since the BlackBerry died, Apple isn’t selling us the future. It’s reselling to us Google’s.

The News Peg: The January Pivot

We all saw the press release in January 2026. “A multi-year collaboration.” “Privacy-first integration.” “Apple Foundation Models powered by Gemini.” The corporate euphemisms were working overtime. But strip away the marketing gloss, and the reality is stark: Apple’s internal AI efforts—Project Ajax, the “Apple GPT” rumors, the frantic hiring sprees—have failed to produce a consumer-ready foundation model that can compete with Gemini 3 or GPT-5.

By licensing Gemini to do the heavy lifting for Siri—specifically the complex “planner” and “summarizer” agents—Apple has effectively admitted that it cannot build the engine for the most important computing shift of the century. They are now just the chassis. The implications of this pivot will ripple through the tech ecosystem for the next decade, fundamentally altering the balance of power in Silicon Valley.

The Privacy Facade is Cracking

Apple will tell you this is about privacy. They’ll say that by using Gemini only for “world knowledge” while keeping personal context on-device, they are protecting you. That’s a comforting bedtime story, but it masks a critical technical deficiency.

The reality is technical, not moral. Large Language Models (LLMs) scale with data and compute. Apple’s privacy-absolutist stance, while noble, starved their models of the very data needed to make them smart. While Google was training Gemini on the entire open web and YouTube’s transcript library, Apple was handicapped by its own marketing.

Now, to give you a Siri that actually works, they have to pipe your complex queries to Google’s cloud. The “Private Cloud Compute” relay is a clever architectural hack, but it’s still an admission that the iPhone’s silicon alone isn’t enough anymore. When you ask Siri to “plan an itinerary for Tokyo based on my emails,” that request isn’t staying in Cupertino. It’s taking a trip to a Google data center.

The Economic Flip: A Dangerous Precedent

Let’s look at the money. For a decade, the “Google Tax” (the $20B search deal) was pure profit for Apple—essentially free money that padded the Services revenue line. Now, the flow has started to reverse.

Sure, $1 billion seems small compared to the $20 billion coming in. But in technology, trend lines matter more than absolute numbers. The cost of inference (running AI models) is skyrocketing. As Siri becomes more dependent on Gemini for agentic tasks—booking flights, editing video, coding apps—that $1 billion bill will grow. Apple has voluntarily hooked its ecosystem into a utility meter controlled by its biggest rival.

Moreover, the Department of Justice’s ongoing antitrust appeal regarding the search monopoly threatens that $20 billion revenue stream. If that deal is struck down, Apple will be left with the bill for Gemini but without the income from Search.

The Balance of Power (Financial Flows 2026)

A look at how the cash flow and infrastructure spending between the two giants has shifted.

| Metric | The “Search Era” (2010-2024) | The “AI Era” (2026-Present) | The Warning Sign |

| Google Pays Apple | ~$20 Billion / year | ~$20 Billion / year | This revenue is under active antitrust threat (DOJ Appeal). |

| Apple Pays Google | $0 | ~$1 Billion – $5 Billion (Est.) | Apple is now paying for intelligence, not just cloud storage. |

| AI Infrastructure Spend (2025) | Minimal (Focus on device silicon) | $12.7 Billion (Apple) vs $91.4 Billion (Google) | Google is outspending Apple 7-to-1 on the “factories” of the future. |

| Leverage | Apple could threaten to switch to Bing. | Google holds the keys to Siri’s competence. | Switching AI models is harder than switching default search engines due to prompt engineering dependencies. |

The Innovation Rot: Just a “Wrapper”?

The most damning aspect isn’t the money; it’s the culture. Apple used to control the “whole widget”—hardware, software, services. This integration was their moat. By outsourcing the brain of the operating system, they are commoditizing their own hardware.

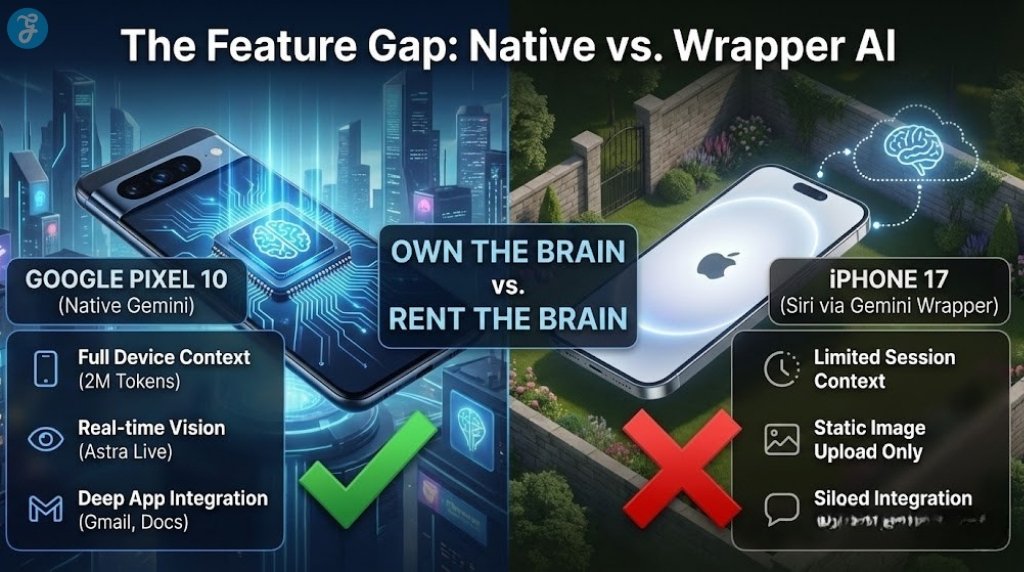

If Siri is just a wrapper for Gemini, and the Pixel 10 runs Gemini natively with deeper hardware integration, what is the iPhone’s unique value proposition? Blue bubbles? The camera? Those advantages are eroding. Apple is risking becoming the premium skin for Google’s intelligence.

We are seeing a divergence in capability. Google’s Pixel devices, running “Gemini Nano” locally with full access to the OS, can “see” what you are doing in real-time. Siri, tethered to a cloud relay, is always a step behind.

The Feature Gap (iPhone 17 vs. Pixel 10)

What you get when you own the model vs. when you rent it.

| Feature | Google Pixel 10 (Native Gemini) | iPhone 17 (Gemini via Siri) | Why It Matters |

| Context Window | 2 Million Tokens (Full device history) | Limited (Session-based only) | Pixel “remembers” your life; iPhone only remembers the last 5 minutes. |

| Video Understanding | Real-time “Astra” vision (Live camera analysis) | Static image upload only | Google can “see” the world live; Siri can only look at photos. |

| Personalization | Deep integration with Gmail, Docs, Drive | Limited to iMessage/Calendar (Privacy sandbox) | Google’s assistant knows your work life; Apple’s is walled off. |

| Latency | Near-instant (On-device Nano models) | Variable (Cloud relay lag) | Speed creates trust. A slow assistant feels “dumb.” |

The Counter-Punch: “It’s Just Smart Outsourcing”

The strongest defense of Tim Cook’s strategy is that this is classic Apple: wait, watch, and then perfect. Supporters argue that building LLMs is a capital-intensive, low-margin utility business (like electricity) and that Apple is smart to let Google burn cash on data centers while Apple focuses on the experience. They point to Samsung, which uses Gemini without losing its identity. They argue that the $1 billion cost is a “rounding error” for a company with Apple’s cash pile.

Why It Fails in 2026:

This analogy breaks down because AI isn’t electricity; it’s the operating system. In the AI era, the model is the product. If you don’t own the weights, you don’t own the user intent. By letting Google handle the logic, Apple loses the feedback loop. Every time Siri fails and hands off to Gemini, Google learns what iPhone users want, and Apple doesn’t.

Samsung is a hardware manufacturer; Apple sells a lifestyle. If that lifestyle is “powered by Google,” the brand premium evaporates. Furthermore, reliance on a competitor for a core feature creates an existential risk. If Google decides to prioritize its own hardware or degrade the API performance for competitors, Apple is left vulnerable.

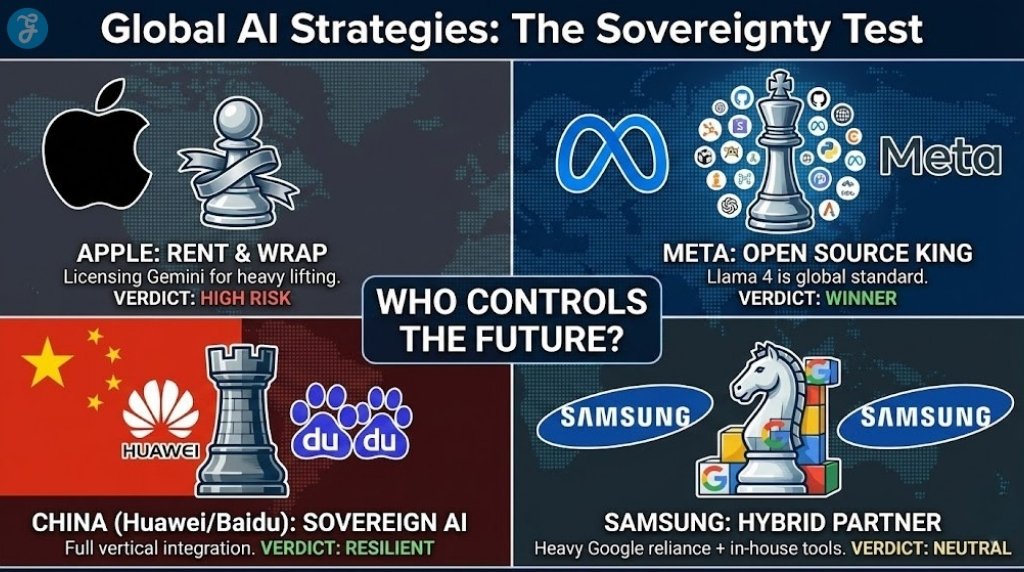

Global AI Strategies (The Sovereignty Test)

How other major players are handling the “AI Brain” problem.

| Entity | Strategy | Status in 2026 | Verdict |

| Apple | Rent & Wrap | Licensing Gemini for heavy lifting. | High Risk: Dependent on rival for core innovation. |

| Meta (Facebook) | Open Source King | Llama 4 is the global standard for open AI. | Winner: Owning the ecosystem developers build on. |

| China (Huawei/Baidu) | Sovereign AI | Full vertical integration (Chip to Model). | Resilient: Immune to Western tech sanctions/reliance. |

| Samsung | Hybrid Partner | Heavy Google reliance + minor in-house tools. | Neutral: Accepts commoditization to sell hardware volume. |

The Human Impact: Privacy and Trust

The shift to cloud-based AI for Siri fundamentally alters the privacy contract Apple has with its users. For years, “What happens on your iPhone, stays on your iPhone” was a marketing slogan backed by technical reality. Now, it’s a slogan backed by a complex legal agreement with an advertising company.

Even with “Private Cloud Compute,” the metadata of what you are asking—the intent, the timing, the complexity—is valuable signal. By inviting Google inside the walled garden, Apple is normalizing the idea that our personal assistants must be tethered to the surveillance capitalism machine. It erodes the one true alternative we had to the data-mining giants.

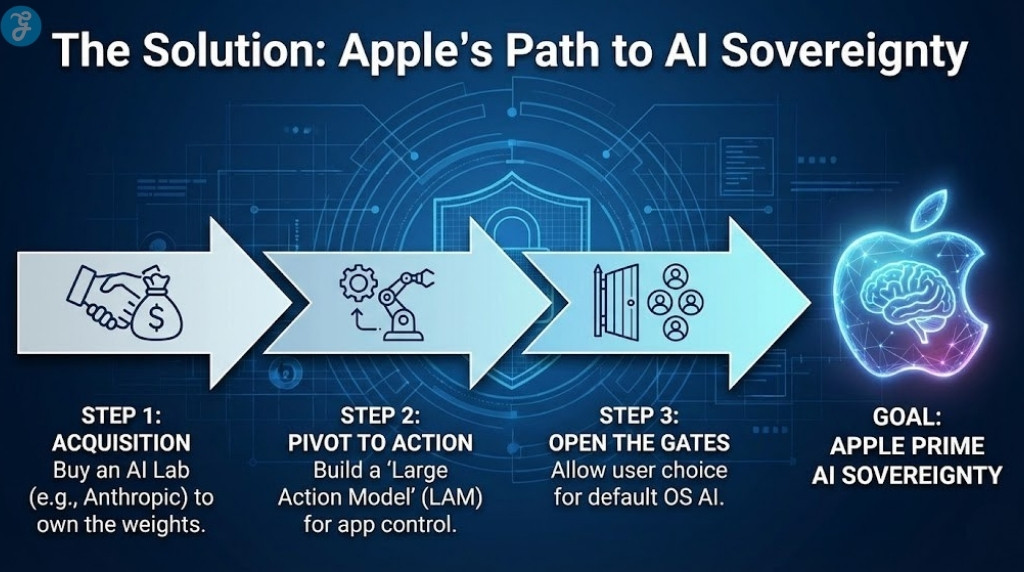

The Solution: Buy or Die

Apple needs to stop acting like a bank and start acting like a tech company again. With $160 billion in cash, renting technology is inexcusable.

-

Acquisition: Apple should have bought Anthropic or a major chunk of the open-source ecosystem two years ago. It’s not too late to acquire a specialized lab to build a proprietary “Apple Prime” model that runs locally. They need to own the weights.

-

The Pivot: Stop trying to make Siri a chatty generalist. Lean into action. Build a “Large Action Model” (LAM) that controls apps better than anyone else. Let Google handle the poetry; Apple should own the doing.

-

Open the Gates: If they can’t build the best model, allow users to choose their default AI system at the OS level—not just as a plugin, but as the core brain. If I pay $1,500 for an iPhone 17, I should be able to swap Siri for a deeply integrated ChatGPT or Claude without Apple acting as the middleman.

2026 Fact Sheet: The State of Play

Here’s a quick overview:

-

60.7%: ChatGPT’s global market share, despite Apple’s entry—proving Apple didn’t “kill” the incumbent.

-

750 Million: Monthly active users for Google Gemini (up 100M since the Apple deal rumors began).

-

$12.7 Billion: Apple’s infrastructure spending in 2025.

-

$185 Billion: Google’s projected infrastructure spending for 2026 (The “Compute Gap”).

-

33%: The reported failure rate of Apple’s internal Siri tests before they decided to outsource to Gemini.

-

15%: The estimated percentage of Apple’s Operating Earnings that come from the Google Search deal—now at risk if regulators view the AI deal as further collusion.

The Takeaway

Apple has bought itself time, but it has sold its soul in the process. We are now watching a slow-motion merger of the two mobile giants, with Google providing the brain and Apple providing the body. The question for 2027 isn’t whether Siri will get better. It’s whether Apple will remember how to think for itself before it forgets how to innovate altogether.