It’s the classic financial “Catch-22”: You need a credit history to get a credit card, but you can’t get a credit history without one. If you are a college student or a young adult looking for your first card, this barrier can feel impossible. But here is the good news: It isn’t.

In 2026, the credit landscape has shifted. Major issuers like Discover, Capital One, and Chase are now aggressively competing for your business. They understand that if they treat you well now, you’ll stick with them when you’re looking for a mortgage in ten years. This means you now have access to cards with $0 annual fees, generous cash back rewards, and no credit score requirements.

However, credit cards are a double-edged sword. Used correctly, they are the fastest way to build an 800 credit score and travel for free. Used poorly, they can lead to a spiral of high-interest debt.

This guide is your roadmap. We have analyzed dozens of offers to bring you the 7 best credit cards for students and beginners that prioritize safety, low costs, and high approval odds.

What to Look for in Your First Credit Card

Before we dive into the top picks, you need to understand the criteria we used to select them. As a beginner, your priorities are different from someone with a decade of credit history.

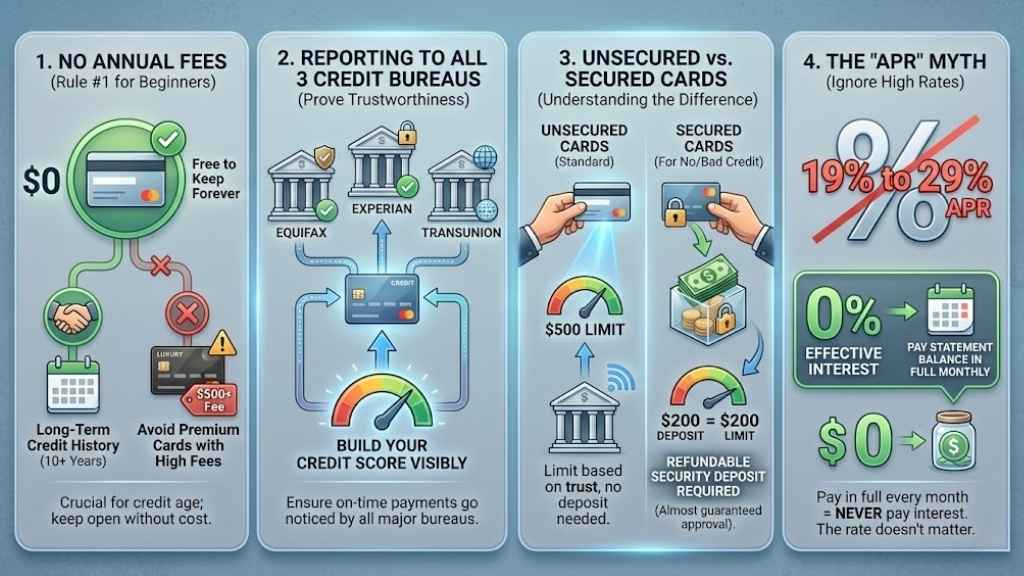

1. No Annual Fees

Rule #1: Never pay money just to hold a credit card, especially as a student.

There are premium cards out there with $500+ annual fees that offer airport lounge access, but you don’t need those yet. All the cards on this list have a $0 annual fee, meaning they are free to keep in your wallet forever. This is crucial because the “age” of your oldest credit card is a major factor in your credit score. You want a card you can keep open for 10+ years without it costing you a dime.

2. Reporting to All 3 Credit Bureaus

The entire point of a starter card is to prove to the world that you are trustworthy. To do that, your card issuer must report your payments to the “Big Three” credit bureaus:

- Equifax

- Experian

- TransUnion

If an issuer doesn’t report to all three, your on-time payments might go unnoticed. All cards on our list report to all three.

3. Unsecured vs. Secured

- Unsecured Cards: The standard credit card. You apply, and the bank gives you a credit limit (e.g., $500) based on their trust in you. You don’t have to put down any cash.

- Secured Cards: Designed for those with no credit or bad credit. You must put down a refundable security deposit (usually equal to your credit limit, e.g., $200). It’s safer for the bank, which makes approval almost guaranteed.

4. The “APR” Myth

You will see interest rates (APR) ranging from 19% to 29% on these cards. Ignore them.

If you pay your statement balance in full every single month—which is the only way you should use a credit card—the APR is effectively 0%. You will never pay a penny in interest.

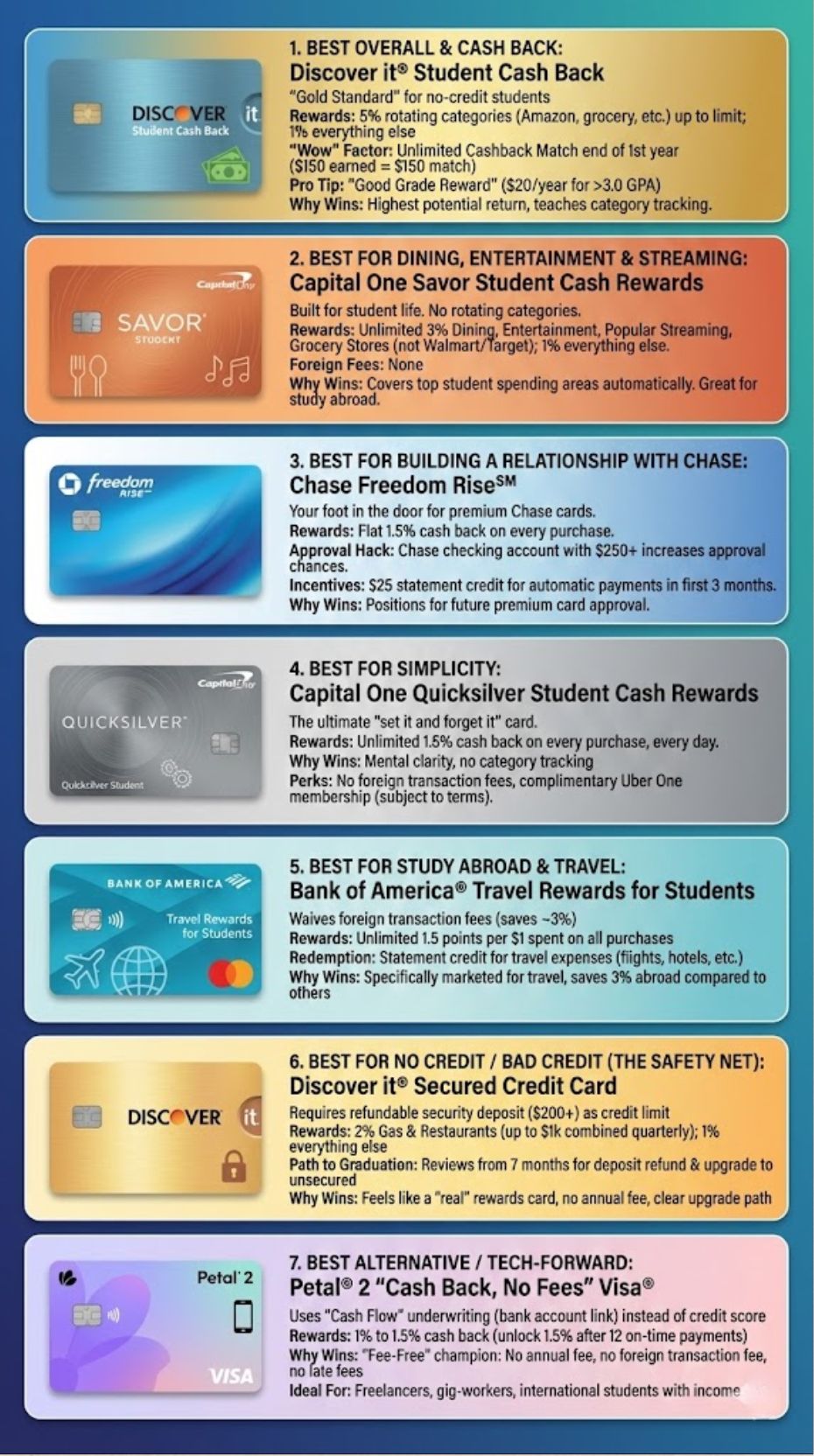

7 Best Credit Cards for Students and Beginners

Here is the definitive ranking for 2026, categorized by what they do best.

1. Discover it® Student Cash Back

Best Overall & Best for Cash Back

The Discover it® Student Cash Back continues to be the “Gold Standard” for students in 2026. Discover is famous for being friendly to those with no credit history, often approving students with nothing more than a verifiable college enrollment.

- The Rewards: You earn 5% cash back on everyday purchases at different places each quarter (like Amazon.com, grocery stores, restaurants, and gas stations) when you activate, up to the quarterly maximum. All other purchases earn 1%.

- The “Wow” Factor: Unlimited Cashback Match. At the end of your first year, Discover automatically matches all the cash back you’ve earned. If you earned $150, they give you another $150.

- Why It Wins: It teaches you to pay attention to spending categories while offering the highest potential return on spend.

Pro Tip: Discover offers a “Good Grade Reward.” If your GPA is 3.0 or higher, you can get a statement credit statement credit (usually $20) each school year for up to 5 years.

2. Capital One Savor Student Cash Rewards

Best for Dining, Entertainment & Streaming

If you are a student, your budget likely revolves around food, movies, and music. The Capital One Savor Student is custom-built for this lifestyle. unlike Discover, there are no rotating categories to track—the rewards are automatic.

- The Rewards:

- Unlimited 3% Cash Back on dining, entertainment, popular streaming services, and at grocery stores (excluding superstores like Walmart/Target).

- 1% Cash Back on all other purchases.

- Why It Wins: It covers the exact categories where students spend the most money. Whether you’re grabbing Chipotle, paying for Netflix, or buying concert tickets, you are getting 3% back.

- Foreign Fees: None. This is a great backup card for study abroad programs.

3. Chase Freedom Rise℠

Best for Building a Relationship with Chase

Chase is known for having some of the best travel cards in the world (like the Sapphire Preferred), but they are notoriously hard to get. The Chase Freedom Rise℠ is your foot in the door.

- The Rewards: A flat 1.5% cash back on every purchase. Simple and effective.

- Approval Hack: Chase explicitly states that having a Chase checking account with a balance of $250+ increases your chances of approval.

- Why It Wins: It positions you perfectly for the future. After a year of responsible use with the Freedom Rise, you will be much more likely to be approved for Chase’s premium cards.

- Incentives: You earn a $25 statement credit for signing up for automatic payments in the first 3 months.

4. Capital One Quicksilver Student Cash Rewards

Best for Simplicity

If the idea of tracking “categories” sounds exhausting, the Capital One Quicksilver Student is your answer. It is the ultimate “set it and forget it” card.

- The Rewards: Unlimited 1.5% cash back on every purchase, every day.

- Why It Wins: Mental clarity. You don’t have to wonder if your coffee shop counts as “dining” or if your textbook rental counts as “online shopping.” You just swipe and earn 1.5% back.

- Perks: Like the Savor, it has no foreign transaction fees and includes complimentary Uber One membership (subject to current offer terms).

5. Bank of America® Travel Rewards for Students

Best for Study Abroad & Travel

Most student cards charge a “Foreign Transaction Fee” (usually 3%) every time you swipe the card outside the U.S. If you are studying abroad, this adds up fast. The Bank of America® Travel Rewards card waives this fee.

- The Rewards: Unlimited 1.5 points per $1 spent on all purchases.

- Redemption: Points can be used as a statement credit to pay for travel expenses (flights, hotels, baggage fees, etc.).

- Why It Wins: It is one of the few student cards specifically marketed as a “Travel” card. If you are planning a semester in Europe or Asia, this card will save you 3% on every purchase compared to most competitors.

6. Discover it® Secured Credit Card

Best for No Credit / Bad Credit (The Safety Net)

If you apply for the cards above and get rejected, do not panic. The Discover it® Secured is your safety net. It requires a refundable security deposit (usually starting at $200), which acts as your credit limit.

- The Rewards: Surprisingly, it earns rewards! 2% cash back at gas stations and restaurants (up to $1,000 in combined purchases each quarter) and 1% on everything else.

- The Path to Graduation: Discover reviews your account starting at 7 months. If you pay on time, they may refund your deposit and upgrade you to an “unsecured” card.

- Why It Wins: It is the only secured card that feels like a “real” rewards card. It has no annual fee, earns cash back, and offers a clear path to getting your deposit back.

7. Petal® 2 “Cash Back, No Fees” Visa®

Best Alternative / Tech-Forward

Petal (now part of the Empower family) disrupted the industry by using “Cash Flow” underwriting. Instead of just looking at your non-existent credit score, Petal asks to link to your bank account to see that you pay your bills and earn income.

- The Rewards: 1% to 1.5% cash back. You start at 1%, and after 12 on-time monthly payments, you unlock 1.5%.

- Why It Wins: It is the “Fee-Free” champion. No annual fee, no foreign transaction fee, and shockingly, no late fees. (Note: You should still never pay late, as it hurts your credit score, but Petal won’t charge you a penalty fee for it).

- Ideal For: Freelancers, gig-workers, or international students who have money in the bank but no US credit history.

Student Credit Cards at a Glance

| Card Name | Best For… | Rewards Rate | Annual Fee | Foreign Txn Fee |

| Discover it® Student | Overall Value | 5% Rotating | $0 | None |

| CapOne Savor Student | Food & Fun | 3% Dining/Ent. | $0 | None |

| Chase Freedom Rise | Future Growth | 1.5% Flat | $0 | 3% |

| CapOne Quicksilver | Simplicity | 1.5% Flat | $0 | None |

| BofA Travel Rewards | Study Abroad | 1.5X Points | $0 | None |

| Discover it® Secured | Building Credit | 2% Gas/Dining | $0 | None |

| Petal® 2 Visa® | Alternative Data | 1% – 1.5% | $0 | None |

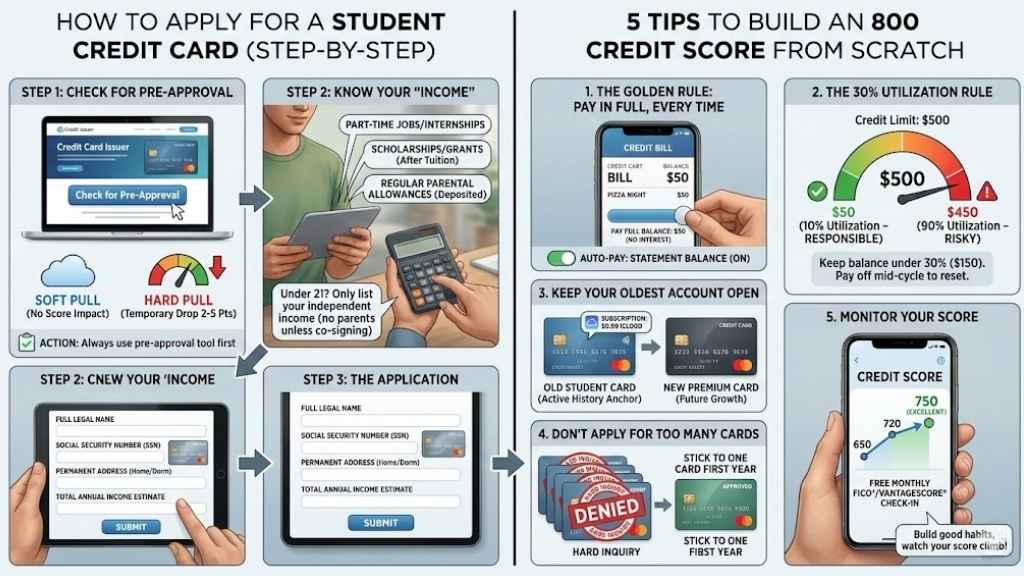

How to Apply for a Student Credit Card (Step-by-Step)

Applying for a credit card is a legal financial agreement. Here is how to do it correctly.

Step 1: Check for Pre-Approval

Most issuers (Capital One, Discover, Chase) have a “Check for Pre-Approval” tool on their website.

- Soft Pull: This checks your eligibility without hurting your credit score.

- Hard Pull: This happens only when you submit the final application. It may temporarily drop your score by 2-5 points.

- Action: Always use the pre-approval tool first to see which cards you are likely to get.

Step 2: Know Your “Income”

Students often ask, “Can I get a card without a job?”

The CARD Act of 2009 requires you to have an independent ability to pay, but “Income” is broader than just a salary. You can legally include:

- Money from part-time jobs or internships.

- Scholarships and grants (after tuition is paid).

- Regular allowances from parents deposited into your account.

- Note: If you are under 21, you cannot list your parents’ income unless they are co-signing (which is rare these days).

Step 3: The Application

You will need your:

- Full Legal Name

- Social Security Number (SSN)

- Permanent Address (Use your parents’ home address if you live in a dorm)

- Total Annual Income estimate

5 Tips to Build an 800 Credit Score from Scratch

Getting the card is just the start. How you use it determines your financial future.

1. The Golden Rule: Pay in Full, Every Time

If you spend $50 on pizza, pay the bank $50 when the bill comes. If you only pay the “Minimum Payment” (e.g., $25), the remaining $25 will accrue interest. Over time, this destroys your finances. Set up Auto-Pay for the “Statement Balance” immediately.

2. The 30% Utilization Rule

Your credit score is heavily influenced by how much of your limit you use.

- Scenario: You have a $500 limit.

- Bad: Spending $450 (90% utilization). This looks risky to banks.

- Good: Spending $50 (10% utilization). This looks responsible.

Try to keep your balance below 30% ($150 on a $500 limit). If you need to spend more, pay it off immediately (even before the statement closes) to reset your balance.

3. Keep Your Oldest Account Open

Length of credit history matters. Even if you graduate and get a fancy high-end card, do not close your student card. Put a small recurring subscription on it (like iCloud or Spotify) and set it to auto-pay. This keeps the account “active” and anchoring your credit history age.

4. Don’t Apply for Too Many Cards

Every time you apply, it places a “Hard Inquiry” on your report. One or two a year is fine. Five in one month looks desperate. Stick to one card for your first year.

5. Monitor Your Score

All the cards listed above provide a free FICO® or VantageScore® credit score in their mobile app. Check it monthly. Watching that number climb from 650 to 720 to 750 is incredibly satisfying and motivates good habits.

Final Thoughts

Selecting your first credit card is more than just picking a piece of plastic; it is your first real step toward financial independence. In 2026, the barriers to entry are lower than ever, with excellent no-fee options from Discover, Capital One, and Chase designed specifically to help you succeed.

Remember, the specific card you choose matters less than how you use it. Whether you opt for the high rewards of the Discover it® Student or the dining perks of the Capital One Savor, the golden rule remains the same: treat your credit limit like debit, not extra income.

If you pay your balance in full every month, you are effectively hacking the system—earning free rewards while building a credit score that will save you thousands of dollars on future apartment rentals, car loans, and mortgages. Don’t let the fear of debt keep you on the sidelines. Start small, set up autopay immediately, and use this tool to build a reputation of trust. Your future self will thank you for starting today.