Do you ever feel a rush of pure excitement when you click “buy,” only to feel a wave of regret the moment the package arrives? You aren’t the only one. You might tell yourself you need that extra pair of shoes or the latest gadget, but your wallet keeps shrinking, and your closet grows crowded. Many people get stuck in this cycle and start searching for answers on How To Stop Shopping Addiction.

Studies show that compulsive shopping can harm mental health and cause stress at home. This behavior is more common than many think, with millions struggling to manage emotional spending each year.

In this post, we’ll explore what drives shopping addiction, spot the specific warning signs, and walk through simple, proven steps to take back control. Ready to break free? Let’s get started.

What Is Shopping Addiction?

Shopping addiction is a strong urge to buy, even without need or reason. It can take over your thoughts and feelings, making wallets much lighter and hearts heavier.

It is often more than just “retail therapy” gone wrong; for many, it becomes a compulsive behavior that feels impossible to stop.

Definition of Compulsive Buying Disorder (CBD)

Compulsive Buying Disorder, or CBD, means a person cannot control their urge to shop. This condition goes beyond loving sales or the thrill of new things. People with CBD feel strong cravings to buy, even if they do not need anything.

Often, shopping brings a rush of excitement and relief from stress or sadness. Doctors classify it as a mental health issue because it fundamentally changes how people interact with money and possessions. According to 2025 data from the Addiction Group, approximately 5.8% of adults in the United States will experience compulsive buying in their lifetime. That is roughly 1 in every 20 people you know.

This pattern often leads to debt, cluttered homes, and guilt after spending sprees. Emotional spending can harm both your bank account and your self-esteem if left unchecked.

Behavioral and psychological aspects

People often shop to escape negative emotions, like stress or sadness. This cycle gives a quick boost of happiness, sometimes called a sensation of euphoria. However, this feeling is fleeting.

Soon after buying, guilt and shame can sneak in. Emotional spending takes over logic, making it hard to stop even when money runs low. Stores and ads use bright colors, sales signs, and catchy phrases to trigger impulsive purchases.

To measure this, psychologists often use the Bergen Shopping Addiction Scale, which looks for key signs like using shopping to change your mood or feeling intense conflict after a purchase.

“The problem isn’t the stuff. The problem is that we are using the stuff to try to fill an emotional void.” – Dr. April Lane Benson, Author of To Buy or Not to Buy.

Materialism feeds this urge as people start believing that things bring joy or status. Some shoppers crave the thrill more than the stuff itself. The brain links pleasure with shopping through dopamine spikes, just like sugar rewards kids for eating candy bars.

Breaking these habits feels tough because consumer capitalism surrounds daily life with constant pressure to buy more stuff just to fit in or feel better for a short while.

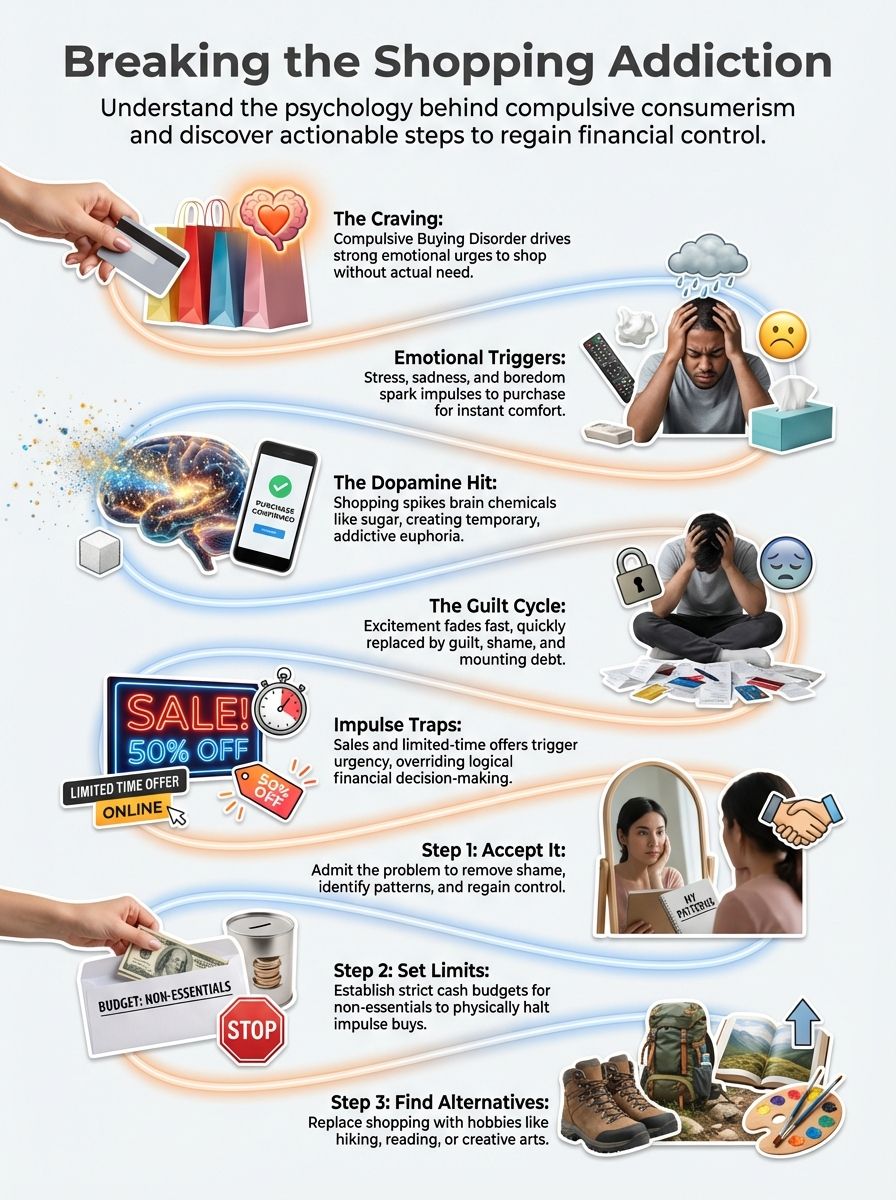

The Cycle of Shopping Addiction

Shopping can feel like an escape from stress, but the high fades fast. People often get caught in a loop, buying to chase that thrill again and again. Understanding this biological loop is the first step to stopping it.

Impulse triggers and emotional responses

Impulse triggers spark the urge to buy. Emotional responses often follow right behind, fueling the cycle of buying addiction.

- The “Flash Sale” Panic: Brands use “limited time” deals to create urgency. It tricks your mind into thinking you will miss out if you wait.

- Visual Cues: Advertisements use colors, sounds, and happy faces to lure you in. They make spending feel fun and easy.

- Stress Relief: Stress at work or home can push you toward impulse purchases. Buying something new gives quick comfort.

- The “Doom Scrolling” Trap: Feeling lonely or sad may send you scrolling through online stores. Shopping fills empty minutes with hope for happiness.

- Social Comparison: Peer pressure matters too. Seeing friends show off new things on social media adds fuel to the fire.

- The Dopamine Chase: Some people crave the thrill itself. The act of spending creates a sensation of euphoria that dulls negative emotions for a while.

- Boredom: Boredom opens the door wide for emotional spending. Time passes slowly, so clicking “add to cart” becomes a pastime.

Up next are some warning signs and types of shopping addiction that keep people stuck in these habits.

Temporary satisfaction versus long-term consequences

Buying something new can spark a quick thrill, like opening a present. This sensation of euphoria may last minutes or maybe hours. Soon after, negative emotions often creep in.

Guilt and regret start to weigh heavily, especially if the item costs more than you could afford. Impulse purchasing feels good in the moment, but it harms financial health over time. Credit card bills pile up faster than dust on forgotten gadgets.

A 2024 report by Gartner found that financial stress is one of the top triggers for anxiety in the US, creating a vicious cycle where people shop to relieve the stress caused by… shopping.

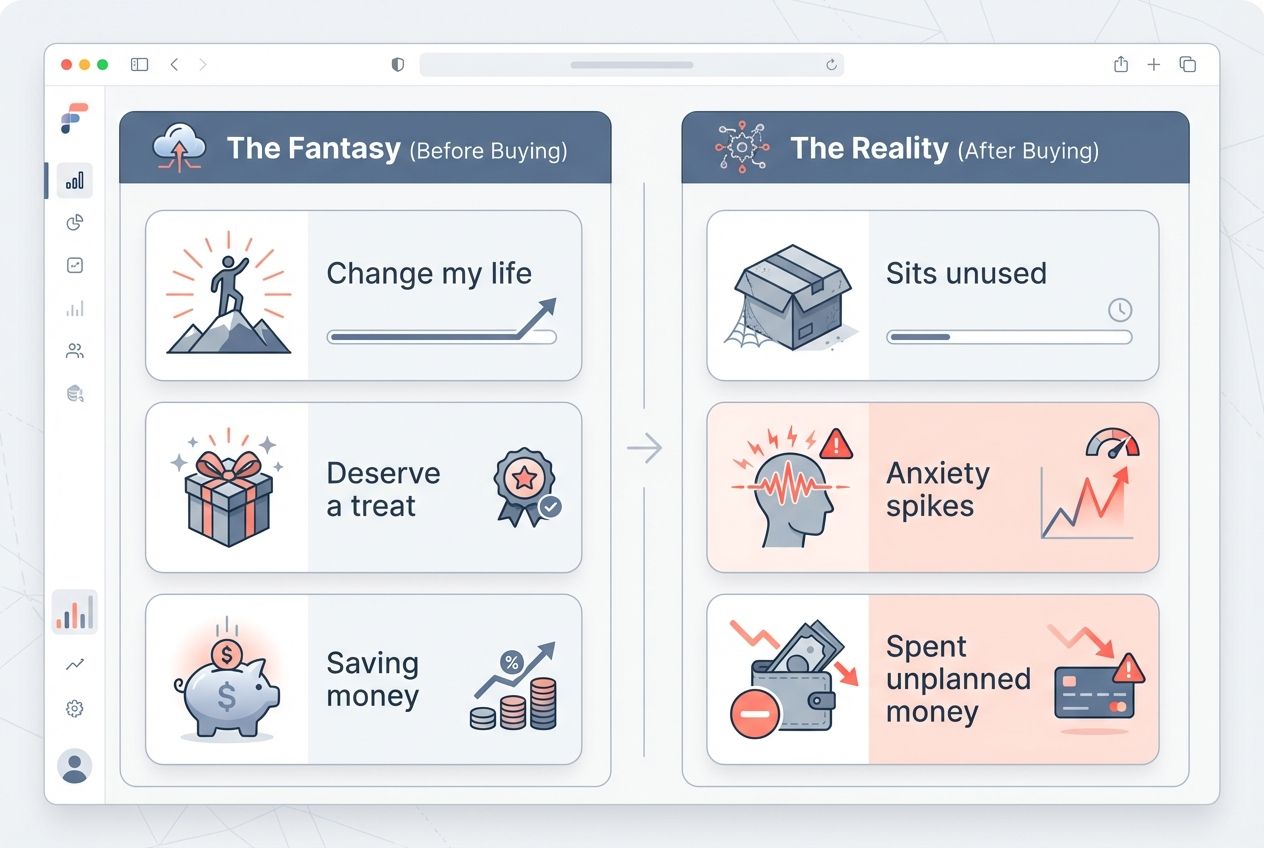

| The Fantasy (Before Buying) | The Reality (After Buying) |

| “This item will change my life/look.” | The item sits unused in a closet. |

| “I deserve a treat for my hard work.” | Anxiety spikes when the bill arrives. |

| “It’s on sale, I’m saving money!” | You spent money you didn’t plan to spend. |

Shopping seems like an easy fix, but it digs deeper holes for tomorrow’s problems. Materialism promises happiness yet leaves emptiness behind once the tag comes off and reality sets in.

Signs and Types of Shopping Addiction

Not all shopping cravings look the same; some sneak up while others hit like a storm. Each kind comes with its own set of habits and pitfalls waiting to trip you up.

Impulse buying

Impulse buying grabs you fast. Bright signs, catchy ads, or your own rushing feelings can push you to pull out your wallet in seconds. Big stores use tricks like flashy colors and sales tags to stir excitement and drive up impulse purchasing. This is extremely common. A 2025 Capital One Shopping report noted that 36% of Americans say most of their purchases are unplanned.

This kind of consumer behavior often starts with emotions, stress, sadness, or even simple boredom spark the urge for instant rewards. Shoppers chase that quick sensation of euphoria from snagging something new, but regret often follows soon after.

You might walk away feeling guilty as bills pile up, while what you bought gathers dust at home. Impulse buying is not always about wanting things; sometimes it’s an attempt to fill empty feelings or distract from negative emotions.

Bargain hunting

Chasing deals can spark a rush, like finding buried treasure. Some people love the thrill of saving money. Sales, coupons, and “limited-time offers” draw them in.

Retailers often use a psychological trick called “Anchoring.” This is where they show a high “original” price (the anchor) next to a sale price. Your brain latches onto the high price, making the sale price look like a steal, even if it’s still expensive. A $100 jacket marked down to $25 looks hard to resist. But constant bargain hunting often leads to buying things you do not need.

Over time, savings from deals may disappear as shoppers buy more than planned. Collecting discounts becomes its own habit; it feels smart at first, but chips away at financial health over months or years.

Binge shopping and “Doom Spending”

Binge shopping feels like a rush. People fill carts, both real and digital, during stressful or lonely times. They crave that hit of excitement from buying many things at once. One click leads to another, and soon, packages line the doorstep.

A newer version of this is called “Doom Spending.” This trend, popular among Millennials and Gen Z in 2024 and 2025, involves spending money to cope with anxiety about the economy or world events. It’s a way of saying, “The world is chaotic, so I might as well enjoy this nice thing now.”

People sometimes binge shop after seeing ads online or hearing about sales from friends. Social media makes this urge stronger, making it hard to stop even when wallets scream for mercy.

This kind of emotional spending grows fast but empties bank accounts even faster. Watching out for other types of shopping addiction can help spot trouble before wallets take the real punch.

The collector mindset

After binge shopping, the collector mindset often shows up. Here, people chase after certain items just to fill a gap or “complete” a set. This pattern feels different from random impulse buying.

Many feel excitement with each new item, a rush called the sensation of euphoria. Stamps, rare sneakers, comic books, or expensive handbags can all become targets. Some collectors tell themselves these things may gain value over time.

Shoppers with this mindset sometimes spend hours searching for their next addition online or at stores. Emotional spending gets tangled up with consumer behavior and materialism.

The urge to buy becomes stronger than the joy of owning what’s already there, trapping some in a cycle of compulsive buying and constant wanting that is hard to break free from alone.

Causes of Compulsive Shopping

Many things can spark the urge to shop, and you might be surprised by what drives this habit, curious yet? Read on to see what’s happening beneath the surface.

Psychological factors

Feelings play a big role in shopping habits. Stress, sadness, and boredom can push people to buy things they do not need. Some shoppers chase the sensation of euphoria that comes with a new purchase.

This happy rush fades fast, leaving emptiness or regret behind. People often tie their self-worth to what they own. Advertisements prey on this idea daily, telling us “more is better.”

Emotional spending rises during rough patches in life or after tough days at work. Seeking comfort through buying becomes an easy habit for those struggling with negative emotions or low self-esteem.

Societal and cultural influences

Shops, ads, and social media shape what people want. Companies use bright colors, catchy slogans, and special deals to grab attention fast. Many people see others post new clothes or gadgets online and feel pressure to keep up.

We are constantly bombarded. Some estimates suggest the average person is exposed to thousands of ads each day. These messages whisper that buying more means living better.

A major modern driver is the rise of “Buy Now, Pay Later” (BNPL) apps like Klarna or Affirm. A 2025 study on consumer habits found that using BNPL services can increase total spending by up to 20% per transaction because it reduces the immediate “pain of paying.”

Special days like Black Friday make spending seem normal or even fun. Stores often put items on sale for just a short time, so you feel rushed to spend money now. Popular TV shows also show big houses and fancy cars as if everyone should have them, too.

Biological contributors

Brain chemicals play a big part in shopping addiction. Dopamine, often called the “feel-good” chemical, lights up when you shop or find something new.

This burst gives a sensation of euphoria and makes you want to chase that feeling again. It’s important to know that the brain releases dopamine during the anticipation of the reward, not just the getting of it. That is why the tracking number is often more exciting than the package itself.

Genes can also influence shopping habits. Studies show that if family members have impulse problems, like gambling or substance abuse, others may struggle too.

How to Break the Buying Addiction

Breaking free from shopping urges feels tough, but it’s not magic; it takes honest work and fresh habits. Take small steps each day, and you’ll soon notice your wallet (and mind) breathing easier.

Recognize and accept the problem

Spotting a shopping addiction takes honesty. Many people blame bad luck or sales, but it goes deeper. Think about your consumer behavior for a moment. Ask yourself these questions based on common diagnostic criteria:

- Do you shop to change your mood?

- Do you feel a rush, like euphoria, after buying something?

- Does emotional spending fill empty spaces inside, only to leave guilt soon after?

- Have you hidden purchases from family or friends?

If you answered yes, these may be signs of compulsive buying. Admitting the problem is not easy. It hurts the pride and can make anyone feel small in this big world where materialism rules loud and clear.

Owning up means you take back control from impulse purchases; you see what harm they cause to mental health and financial stability instead of ignoring them.

Seek professional help or therapy

Talking to a therapist can help you break the cycle of compulsive buying. Therapists know about addiction psychology and offer tools that work. They can spot patterns in your consumer behavior fast, helping you change habits step by step.

Cognitive Behavioral Therapy (CBT) is particularly effective. It helps you identify the specific thought (“I’m sad, I need this”) and interrupt it before you click buy.

Some people need support groups for shopping addiction. These meetings feel safe and private, giving space to share stories, victories, or slip-ups without shame. If emotional spending affects mental health or leads to debt, professionals give guidance on better choices.

Set financial boundaries and goals

Therapists and counselors can guide your mind, but your wallet needs its own guardrails. Start by drawing a line in the sand for spending. Decide how much cash you will allow yourself to use each week on non-essentials, then stick to it like glue. You can use modern tools to help you:

- Delete Stored Cards: Remove your credit card details from your browser autofill. Forcing yourself to get up and find your wallet creates a “cooling off” period.

- Unsubscribe: Use a tool like Unroll.me to mass-unsubscribe from marketing emails that trigger your urges.

- Use a Budgeting App: Apps like Rocket Money or YNAB (You Need A Budget) can help you see exactly where your money is going.

Use clear numbers, not guesses. For example, set a rule such as “only $20 per week for fun shopping.” Write this down or keep a note on your phone.

Make goals that spark joy beyond buying things. Save up for something meaningful—a class, travel with friends, or paying off debt bit by bit. Watching your saved dollars grow feels better than impulse purchases ever could.

Find alternative activities to replace shopping

After you set strong financial limits, it becomes easier to see shopping differently. Shifting your focus away from constant buying can actually lift your mood more than a full cart ever could.

Try the “72-Hour Rule”: If you see something you want, wait 72 hours before buying it. 90% of the time, the urge will pass.

- Take a walk or hike outdoors to clear your head and boost energy with fresh air.

- Choose to read books or listen to podcasts that spark your curiosity.

- Pick up drawing, painting, or crafting for creative satisfaction without spending much.

- Start cooking new recipes at home, mixing fun with learning healthy habits.

- Join a local club or class like yoga, dance, or gardening for social connection.

- Volunteer in your community; helping others feeds the soul and grows self-worth.

- Practice mindfulness through meditation to lower stress and calm cravings.

- Invite friends over for board games or movie nights instead of mall trips.

- Grow plants indoors to add color and joy without racking up credit card bills.

- Set personal goals such as training for a charity run; achievements build confidence.

Trying new things can fill the gaps that shopping once filled, while strengthening mental health and trimming down emotional spending.

The Role of Support Networks

Sometimes, it takes a village, or at least a small circle of folks, to help break free from shopping’s tight grip.

Building connections with others facing similar challenges

Meeting people with the same struggles can help break shopping addiction. Support groups let you share honest feelings and slip-ups without fear. You may spot that impulse buying is not just your problem, but is common in many people’s lives.

Organizations like Debtors Anonymous or Spenders Anonymous offer free meetings (both online and in-person) where you can follow a structured recovery program.

Online communities are also powerful. The r/shoppingaddiction community on Reddit is a massive, active group where people share daily tips and encouragement. Finding others helps keep guilt away, too.

Some folks text peers before they shop as a safety net for emotional spending urges. If money matters feel heavy, talking to those fighting materialism loosens shame’s grip.

Involving family and friends in the recovery process

Sharing your struggle with shopping addiction can help you feel less alone. Talk openly to your family about why you want to change these habits. Ask them for support, not judgment. Sometimes, a simple text from a friend, asking how your day is going, fights the urge to buy something out of boredom or sadness.

Let close friends know when you set new financial goals or make rules about spending. They can cheer on small wins and give gentle reminders during tough moments. Game nights, movie marathons at home, or cooking together break the habit of using shopping as entertainment.

A strong support network makes it easier to work on healthy consumer behavior and avoid falling back into old patterns.

Final Words: Redefining Your Worth Beyond the Price Tag

Breaking the buying addiction starts with knowing your triggers and feelings. Small steps like setting a budget, deleting shopping apps, and asking friends for help can make a huge difference in your financial health. These actions are simple, clear, and work well in real life. Trust that you can do it!

Choosing mindful habits over quick shopping highs brings more peace, savings, and self-worth than any sale ever could. I urge you to find worth far beyond things money buys.