Trade negotiations are usually crowded rooms. Every interest has a seat. Governments exporters regulators industry lobbies. In the recent India European Union (EU) trade talks one chair stood conspicuously empty. China was not part of the negotiations. Yet few forces shaped the conversation as strongly as its absence. The India-EU Trade Deal and China’s influence were never explicitly on the table, yet shaped every strategic choice in the room.

For nearly two decades global trade rested on a single assumption. China would remain the world’s most efficient factory. Fast, cheap and deeply integrated into every major supply chain. That assumption powered an era of cost driven globalisation and unprecedented interdependence. It also created a concentration risk few were willing to acknowledge until recent shocks made it impossible to ignore.

Covid-19 pandemic in 2020 and 2021 disrupted production lines almost overnight, though the impact varied by sector, with pharmaceuticals and technology faring better than consumer goods initially. Geopolitical tensions complicated technology flows. Trade sanctions and export controls exposed how vulnerable economies had become to a single dominant hub. China continued production, but global systems realized their vulnerability. The system simply realised how exposed it had become.

This shift in thinking explains why the India EU trade deal matters beyond its economic details. It is not just about tariff reductions or market access. It is about how major economies are quietly rewriting the rules of engagement in a more uncertain world.

The agreement reflects a deeper recalibration in global trade. Efficiency alone is no longer the guiding principle. Reliability, trust and diversification now carry equal weight. Seen through this lens the India EU deal is more than a bilateral pact. It is a case study in how global trade is being reshaped in China’s long shadow.

Europe’s Search for Trade Without Overdependence

Europe’s approach to trade has entered a careful balancing phase. The language used in Brussels is revealing. Officials speak of strategic autonomy rather than protectionism. They emphasise de-risking rather than decoupling. The goal is not to dismantle global trade but to make it less fragile.

China sits at the centre of this dilemma. For the EU it remains an indispensable economic partner. The scale of the Chinese market is unmatched. European industries from automobiles to pharmaceuticals remain deeply integrated into Chinese supply chains. Manufacturing networks built over decades cannot be unwound without significant cost. Any attempt at a clean break would be economically self-defeating.

Yet the status quo has become increasingly uncomfortable. Political tensions have intensified scrutiny of trade dependencies. Public opinion across Europe has grown more sceptical of concentrated exposure to a single external power. Differences over data governance, industrial subsidies and market access have added to unease. The question for European policymakers is no longer whether trade with China should continue but how much risk is acceptable.

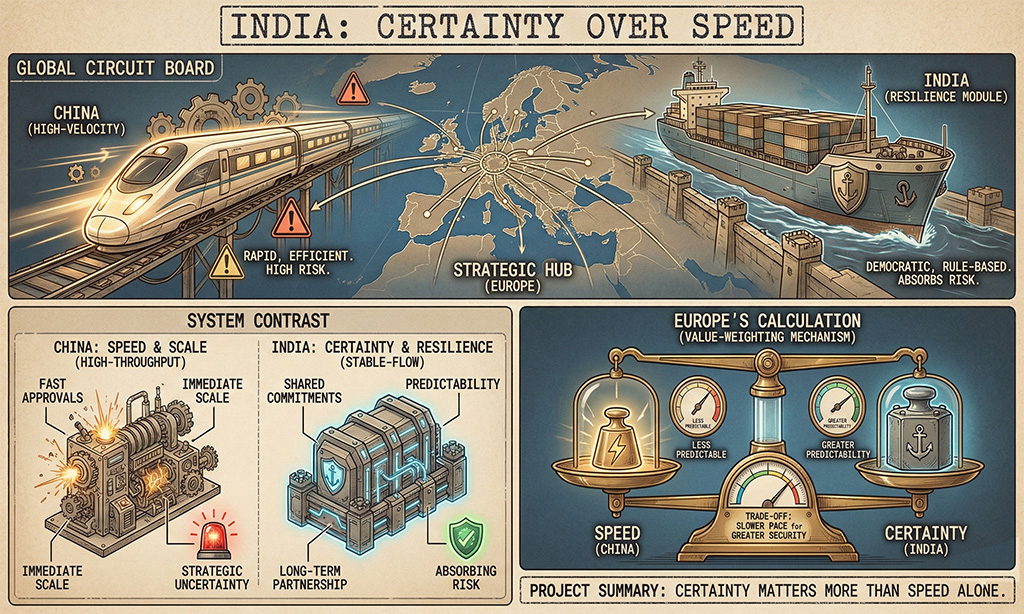

This tension explains the EU’s search for alternatives that do not demand absolute choices. India fits this logic. It offers scale without the same level of political friction. It promises growth while aligning more closely with Europe’s regulatory and institutional preferences. The attraction is not that India replaces China but that it reduces over reliance on any one partner.

At its core Europe’s trade strategy today is shaped by caution rather than confrontation. It is an attempt to preserve openness while insulating itself from future shocks. The India EU trade deal emerges from this mindset. It is not a rejection of China but a recognition that resilience now matters as much as efficiency in a changing global economy.

Why India Works When Certainty Matters More Than Speed

India fits this moment in global trade not because it mirrors China’s efficiency but because it answers a different need. As Europe looks to reduce concentration risk without retreating from openness, India offers something rare at this scale: a large democratic economy willing to integrate more deeply into global supply chains.

The appeal begins with size. India’s domestic market rivals the largest in the world, its workforce is young and expanding, and its manufacturing ambitions are no longer rhetorical. For European firms seeking to diversify production, India presents the possibility of long term capacity rather than short term fixes. Political alignment also matters. Shared commitments to democratic institutions, rule based commerce and regulatory dialogue create a degree of predictability that has become increasingly valuable in trade decisions.

Yet this opportunity comes with complications that neither side underestimates. India’s infrastructure remains uneven, especially beyond major industrial corridors. Regulatory processes can be slow and fragmented across states. Skill availability, while improving, does not always match the immediate needs of advanced manufacturing. These frictions explain why India has not moved at the pace once seen in China’s rapid industrial ascent.

That contrast is central to Europe’s calculation. India is slower than China. Supply chains take longer to stabilise, approvals take time, and scale is built incrementally rather than imposed. But India is also politically safer. It carries fewer strategic uncertainties and offers a partnership that aligns more comfortably with Europe’s economic and institutional values.

This is the trade off Europe appears willing to make. The India EU deal is not an attempt to recreate China elsewhere. India is not replacing China’s scale. It is absorbing China’s risk. In a world where overdependence has become a liability, that distinction may prove more important than speed alone.

Opportunity With Conditions

The India EU trade deal is expected to be a breakthrough if concluded. From India’s perspective it is also a test. Access to one of the world’s largest and wealthiest markets comes with expectations that go far beyond tariff schedules and export volumes.

European trade agreements are built around standards as much as commerce. Indian manufacturers and service providers will face strict requirements on labour practices, environmental safeguards and product quality. Data protection rules will demand stronger compliance frameworks especially for technology driven sectors. These are not symbolic clauses. They are enforced through audits, certifications and regulatory oversight that leave little room for informal adjustments.

For India this creates both pressure and possibility. Meeting European standards can raise competitiveness and credibility across global markets. Firms that adapt successfully often find it easier to access other developed economies. At the same time compliance requires investment in skills, infrastructure and governance that many smaller enterprises are not yet equipped to absorb quickly. The gap between ambition and readiness remains uneven across regions and industries.

This is where the true significance of the deal will be decided. Signing an agreement signals intent. Implementing it requires sustained political will, administrative coordination and private sector readiness. State governments will play a critical role as will regulators tasked with harmonising domestic rules with European expectations.

The opportunity is real but conditional. The India EU trade deal rewards consistency more than announcements. Its success will depend less on headline numbers and more on whether India can translate access into adherence. In that sense the agreement is not just an external opening. It is an internal challenge that will shape the credibility of India’s next phase of global integration.

Globalisation After China Dominance

The India EU trade deal points to a broader shift in how global commerce is being organised. It does not signal the collapse of China-centered trade. China remains deeply embedded in manufacturing networks and will continue to be a central player in global production. What is ending instead is the assumption that efficiency requires dependence on a single hub.

A more distributed model is taking shape. Manufacturing is being spread across multiple geographies rather than concentrated in one country. Supply chains are becoming layered rather than linear, designed to absorb disruption rather than maximise speed alone. This recalibration reflects lessons drawn from recent shocks, where scale without redundancy proved costly.

Trade now factors in political trust, regulatory reliability, and risk management alongside cost and logistics… values are priced in, not replacing economics.

The India EU agreement fits this emerging pattern. It represents a deliberate effort to anchor trade relationships in diversification rather than dependence. Similar strategies are visible in partnerships across Southeast Asia, Latin America and parts of Africa, where governments and firms are building alternatives alongside existing ties rather than abandoning them.

Seen this way, the India EU deal is not an exception created by unique circumstances. It is an early illustration of a new phase of globalisation. One that retains openness while accepting that resilience and trust now shape trade as much as efficiency once did.

What the India-EU Trade Deal Signals for Global Strategy

The India-EU Trade Deal and China are linked even when China is not at the table. Policymakers in Europe and India are both aware that past reliance on a single hub carries hidden costs. The deal is not just about market access. It is a deliberate attempt to diversify and build resilience.

European officials describe it as strategic autonomy in practice. The EU is not leaving China. Trade volumes with Beijing remain massive. But exposure is now being balanced. Supply chains, investment plans, and regulations are all being structured to reduce concentrated risk. In this sense, India emerges as a partner who can absorb uncertainty, rather than replace China’s scale.

For India, the deal is an opportunity to modernize manufacturing and align with global standards. European markets demand compliance with labour laws, environmental safeguards, and data security rules. Meeting these expectations will not be easy, but the reward is credibility and integration into a wider network of trade partners.

The timing is important. Global supply chains are shifting after pandemic disruptions, geopolitical tensions, and trade sanctions. Companies no longer make decisions based purely on cost. Reliability and trust matter as much as efficiency. The India-EU Trade Deal embodies this approach.

This is why the agreement is more than economic calculus. It reflects a strategic mindset that anticipates future shocks. By linking trade, politics, and risk management, it positions both India and the EU to navigate a world where dependence on a single partner is no longer viable.

The deal is an early example of how global trade is being reshaped quietly but deliberately, with long-term implications for businesses, governments, and economies worldwide.

The Deal China Never Signed

Trade rooms are remembered for who signs the papers, not for who is absent. Yet in the India EU negotiations the most influential presence never took a seat. China was not in the room, but the deal would not exist without it. The choices made on both sides were shaped by years of dependence, disruption and recalibration that followed China’s rise as the world’s dominant manufacturing hub.

This agreement is not an act of rejection. It is an adjustment to a world that feels less predictable than it once did. The rules of trade are being rewritten quietly, not in opposition to any one country but in response to accumulated risk. Scale still matters. Cost still matters. But they no longer stand alone.

Dependability has entered the equation. So has trust. So has the ability to absorb shocks without bringing entire supply chains to a halt. In that context the India EU trade deal signals more than closer economic ties. It reflects a shared recognition that resilience now carries its own value.

India now has a seat at that table. Not as a replacement for China’s scale, but as a partner in a more distributed and cautious global economy. What India does with this opportunity, how it implements commitments and builds credibility, will shape not just this partnership but its place in global trade for the decade ahead.