Freelancing in the UAE offers an incredible opportunity to work independently while enjoying the country’s business-friendly policies. With no personal income tax, the UAE is an attractive destination for freelancers.

However, managing finances and taxes efficiently is crucial to maximizing income and ensuring compliance with regulations. Many freelancers struggle with understanding VAT obligations, deductible expenses, and business structures that provide tax benefits.

Understanding and implementing simple tax-saving strategies for freelancers in UAE can help you reduce tax burdens, optimize your financial health, and avoid unnecessary penalties.

In this comprehensive guide, we will explore the tax regulations freelancers need to know and provide 10 effective ways to legally reduce tax liabilities and enhance profitability.

Additionally, we will include practical examples, tables, and insights that can help freelancers make informed financial decisions and improve their overall financial well-being.

Understanding Taxation for Freelancers in UAE

The UAE is known for its tax-friendly environment, with zero personal income tax. However, freelancers operating within the country must be aware of Value-Added Tax (VAT) regulations, especially if their earnings exceed certain thresholds.

Since 2018, the UAE has implemented VAT, impacting businesses and self-employed professionals. Many freelancers mistakenly assume they are completely exempt from taxation, which can lead to penalties if they fail to register for VAT when required.

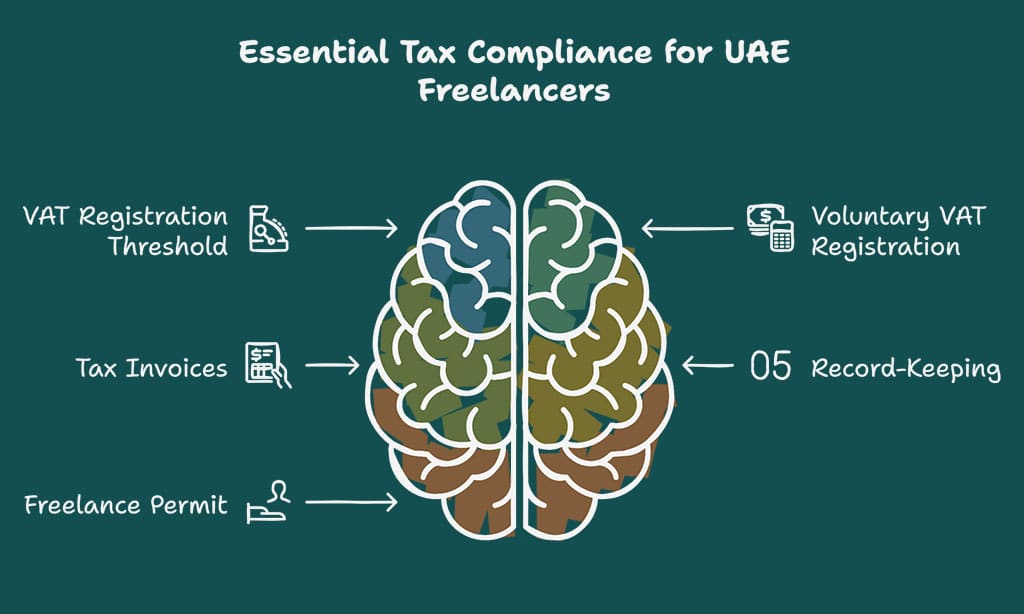

Key Tax Regulations That Freelancers Should Know

| Regulation | Requirement |

| VAT Registration Threshold | AED 375,000 per year (Mandatory) |

| Voluntary VAT Registration | AED 187,500 per year (Optional) |

| Tax Invoices | Must include VAT details (if applicable) |

| Record-Keeping | Maintain records for at least five years |

| Freelance Permit | Required for legal operation |

By understanding these laws, freelancers can legally save on taxes while ensuring compliance. Keeping proper documentation and seeking professional tax guidance can further help in optimizing tax liabilities.

10 Simple Tax-Saving Strategies for Freelancers in UAE

Freelancers in the UAE need to be aware of tax-saving strategies that help them stay compliant while optimizing their earnings.

The country offers numerous tax benefits, but understanding VAT registration, deductible expenses, and structuring your business correctly can significantly impact your financial efficiency.

This section will outline key tax-saving strategies tailored to freelancers operating in the UAE.

1. Register for VAT Only When Necessary

Freelancers should only register for VAT if they meet the required income threshold. Registering too early may lead to unnecessary tax obligations, while delaying it can result in penalties. Understanding when to register ensures compliance and potential tax savings.

| Revenue Range | VAT Registration Requirement |

| Above AED 375,000 | Mandatory registration |

| Between AED 187,500 – 375,000 | Voluntary registration |

| Below AED 187,500 | No VAT registration required |

Benefits of Voluntary VAT Registration:

- Claim VAT refunds on business expenses.

- Enhance business credibility.

- Improve financial planning.

2. Track and Deduct Business Expenses Effectively

Properly tracking expenses helps freelancers reduce taxable income and optimize financial management. Every business-related cost should be documented and categorized for efficient tax deductions.

| Expense Category | Examples |

| Office Space & Utilities | Rent, electricity, water, internet |

| Marketing Costs | Advertising, promotions, website development |

| Business Travel | Flights, hotels, transportation |

| Professional Development | Online courses, workshops, training |

| Software & Tools | QuickBooks, Zoom, Adobe Suite |

Use Accounting Software for Tracking:

- Zoho Books

- QuickBooks

- Wave Accounting

3. Choose the Right Business Structure

Selecting the right business structure impacts tax obligations and financial benefits. Freelancers can opt for a freelance permit or a free zone company, each with distinct advantages.

| Option | Tax Benefits |

| Freelance Permit | No corporate tax, simple registration process |

| Free Zone Company | 100% foreign ownership, VAT benefits |

Key Considerations:

- Assess business goals and scalability.

- Evaluate costs associated with each structure.

- Choose a setup that aligns with tax-saving opportunities.

4. Open a Separate Business Bank Account

Keeping personal and business finances separate ensures smooth tax compliance and financial tracking. A business bank account simplifies VAT calculations, audit processes, and bookkeeping. Having a dedicated account also enhances financial credibility, making it easier to secure loans or investments.

Furthermore, it allows freelancers to maintain clear financial records, reducing the risk of errors in tax filings. Banks in the UAE often offer specialized business accounts tailored for freelancers, providing added benefits such as lower transaction fees and online banking support.

| Benefit | Why It’s Important |

| Easier VAT calculations | Avoids confusion between business and personal expenses |

| Better financial tracking | Helps monitor revenue and expenses efficiently |

| Simplifies audit processes | Ensures compliance with UAE tax laws |

Steps to Open a Business Bank Account:

- Choose a reputable UAE bank with freelancer-friendly policies.

- Provide valid documentation, including trade license and financial records.

- Maintain clear records of business transactions.

5. Issue Proper Tax Invoices to Clients

Freelancers must ensure invoices meet UAE VAT compliance standards to prevent tax issues. Invoices should be detailed, containing essential information such as the VAT number, description of services, invoice date, and the applicable tax rate.

Proper invoicing not only ensures compliance but also builds credibility with clients. Keeping organized financial records and maintaining digital copies of all invoices will help freelancers avoid potential disputes and simplify tax filing processes.

| Invoice Component | Requirement |

| VAT Number | Must be included if registered |

| 5% VAT Charge | Clearly mentioned (if applicable) |

| Record Keeping | Retain invoices for at least five years |

Tips for Compliance:

- Use invoicing software to generate accurate tax invoices.

- Clearly state VAT amounts and registration details.

- Keep all invoices properly stored for tax audits.

6. Utilize Tax-Exempt Offshore Income

Freelancers earning from non-UAE clients can benefit from tax-exempt offshore income, provided that transactions are structured correctly. By maintaining offshore accounts, freelancers can legally reduce tax liabilities while ensuring compliance with financial regulations.

It is important to document all cross-border transactions properly, using professional invoicing tools to track payments. Leveraging international banking services and consulting tax experts can further optimize the benefits of offshore income.

How to Leverage Offshore Income:

- Maintain separate accounts for offshore transactions.

- Use international invoicing to document income sources.

- Seek tax advisory services for legal compliance.

7. Leverage Insurance for Tax Deductions

Insurance plays a crucial role in financial planning for freelancers, offering protection against unforeseen circumstances while providing tax benefits. Policies such as professional indemnity insurance, business liability coverage, and even health insurance may be considered deductible expenses under UAE tax laws.

Investing in comprehensive coverage not only safeguards business operations but also helps freelancers lower their taxable income. Maintaining proper documentation of premiums paid will make it easier to claim deductions during tax filings.

| Insurance Type | Tax Benefit |

| Professional Indemnity Insurance | Protects against legal claims, deductible |

| Health Insurance | Essential for visa renewals, deductible |

| Business Liability Insurance | Covers business risks, deductible |

Maximizing Benefits:

- Choose insurance plans tailored for freelancers.

- Ensure policy expenses are well-documented.

- Include necessary coverage to safeguard financial stability.

8. Plan Income Distribution Strategically

Income distribution plays a crucial role in tax planning. Structuring earnings to minimize tax liabilities can improve financial flexibility. By carefully timing and allocating income, freelancers can legally lower their tax obligations while maintaining steady cash flow.

Various methods, such as deferring income to lower tax brackets, investing in tax-exempt plans, and ensuring an even distribution of payments, can help in reducing taxable income.

| Strategy | Benefit |

| Structuring payments | Helps stay within lower tax brackets |

| Deferring income | Minimizes taxable amounts in high-income years |

| Investing in retirement plans | Provides tax-exempt savings for the future |

Key Points:

- Carefully plan when and how to receive payments.

- Leverage tax-exempt savings opportunities.

- Consult a tax advisor for the best strategies.

9. Take Advantage of Business-Related Allowances

Freelancers can reduce taxable income by claiming business-related expenses as deductions. These deductions can significantly lower overall tax obligations, making it crucial to keep accurate records and ensure all eligible expenses are accounted for.

UAE tax laws allow for the deduction of costs related to running a freelance business, including operational costs, professional services, and learning expenses.

| Deductible Expense | Examples |

| Rent and utilities | Coworking spaces, home office costs |

| Equipment and software | Laptops, accounting software, design tools |

| Professional development | Online courses, certifications, workshops |

Maximizing Allowances:

- Keep accurate records of all expenses.

- Separate personal and business expenses.

- Use professional accounting software for tracking.

10. Work with a Professional Tax Consultant

Navigating tax laws can be complex, and professional guidance ensures freelancers take full advantage of deductions and remain compliant. Tax consultants specialize in optimizing financial structures and ensuring adherence to legal tax requirements.

They provide crucial insights into tax-saving opportunities, VAT compliance, and financial planning strategies.

| Benefit of Tax Consultants | Why It Matters |

| Expert guidance | Avoid penalties and stay tax compliant |

| Maximized deductions | Reduce overall tax liability |

| Regulatory updates | Stay informed about changing tax laws |

Why You Should Hire a Tax Expert:

- Identify and apply all possible deductions.

- Ensure VAT compliance and avoid legal risks.

- Plan long-term strategies for financial success.

Final Words: Smart Tax Planning for Freelancers in UAE

Implementing these simple tax-saving strategies for freelancers in UAE can help reduce financial burdens, stay compliant, and maximize earnings.

By tracking expenses, optimizing business structures, leveraging tax exemptions, and seeking professional guidance, freelancers can ensure long-term financial stability while operating in one of the most tax-friendly environments in the world.

For freelancers looking to take control of their tax obligations, the key is proactive planning, proper record-keeping, and strategic decision-making. Apply these strategies today and enjoy greater financial freedom!