The global financial landscape has undergone a significant transformation in recent years, with fintech companies revolutionizing cross-border transactions. Traditionally, international payments were expensive, slow, and riddled with hidden fees.

However, fintech innovations have paved the way for seamless, cost-effective, and efficient transactions. This article explores how fintech is slashing costs in cross-border payments, the key technologies behind this shift, and what the future holds for the global payments industry.

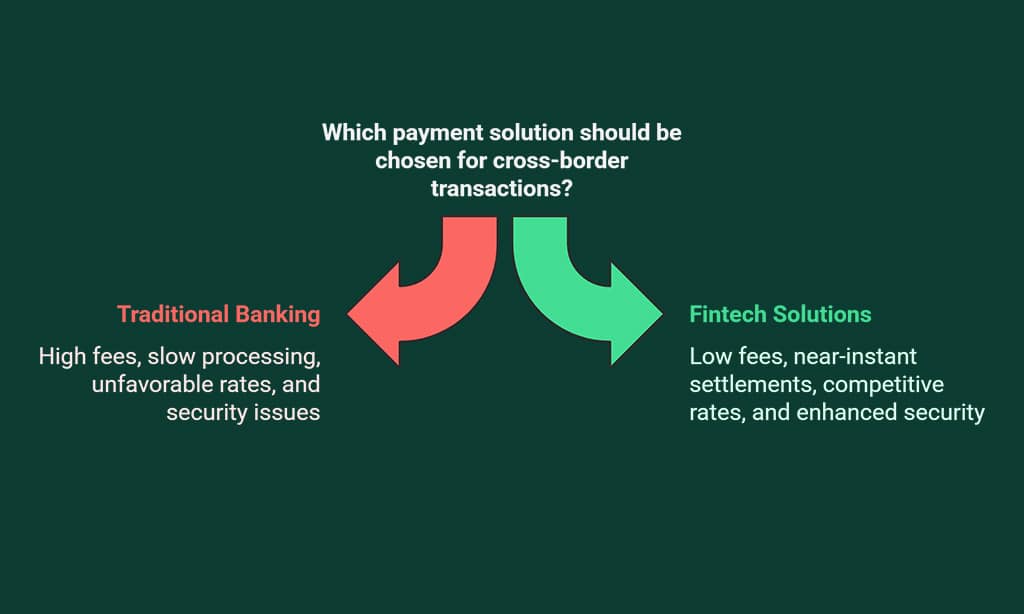

Key Benefits of Fintech in Cross-Border Payments

Fintech has fundamentally reshaped the cross-border payments industry, introducing cost-effective, secure, and efficient solutions. By leveraging cutting-edge technologies like blockchain, artificial intelligence, and real-time payment networks, fintech companies are driving financial inclusion and making international transactions more accessible.

Below is a comparison of key benefits fintech brings to global payments.

| Benefit | Traditional Banking | Fintech Solutions |

| Transaction Fees | High fees with hidden charges | Low, transparent pricing |

| Processing Time | 3-5 business days | Near-instant settlements |

| Currency Exchange Rates | Unfavorable, with markups | Competitive, AI-optimized rates |

| Security | Prone to fraud and delays | Blockchain and AI-driven security |

| Accessibility | Limited by geography and regulations | Global, inclusive financial solutions |

The Evolution of Cross-Border Payments

Cross-border payments have historically been a challenge due to high costs, slow processing times, and complex regulations. Businesses and individuals have long sought more efficient ways to transfer money internationally, leading to the rise of innovative fintech solutions.

As technology advances, fintech companies are stepping in to bridge the gaps, providing faster and more affordable alternatives to traditional banking systems.

Traditional Payment Methods and Their Limitations

For decades, cross-border payments have relied on traditional banking systems such as SWIFT, wire transfers, and money remittance services. While these methods facilitated international transactions, they came with significant drawbacks:

- High Transaction Fees: Banks and financial intermediaries charge hefty fees for international transfers, often including hidden charges, increasing costs for businesses and consumers.

- Slow Processing Times: Traditional cross-border payments take days, sometimes even a week, due to intermediary banks and compliance checks, creating delays in global commerce.

- Currency Conversion Complexities: Exchange rate fluctuations and unfavorable conversion rates often result in additional costs, reducing profitability for international businesses.

The Rise of Fintech in Global Transactions

Fintech companies have disrupted this inefficient system by leveraging technology to create faster, cheaper, and more transparent payment solutions. The rise of blockchain, decentralized finance (DeFi), artificial intelligence (AI), and mobile wallets has dramatically improved the efficiency of international transactions, empowering businesses and individuals worldwide.

How Fintech Is Slashing Costs in Cross-Border Payments?

Traditional banking systems rely on a network of intermediary banks that increase transaction costs. Fintech eliminates or minimizes these intermediaries by enabling:

- Direct Peer-to-Peer Transactions: Decentralized payment platforms facilitate direct payments between sender and receiver, eliminating middlemen and lowering transaction fees.

- Blockchain and Cryptocurrencies: Blockchain technology provides a transparent, decentralized ledger, significantly reducing transaction costs and fraud risks.

- Lower Overhead Costs for Businesses and Individuals: With fewer fees and faster processing, businesses save substantial amounts on cross-border payments, improving profit margins.

| Factor | Traditional Payments | Fintech Solutions |

| Intermediaries | Multiple banks involved | Direct transactions |

| Fees | High hidden charges | Low or no extra fees |

| Transparency | Opaque cost structure | Full transparency |

Competitive Exchange Rates and Lower Fees

Unlike banks that often charge hidden fees, fintech companies provide more competitive exchange rates. Fintech-driven platforms offer:

- Transparent Pricing Models: Users can see exact fees before initiating a transaction, allowing better financial planning.

- Better Conversion Rates: AI-powered fintech services optimize currency conversions in real-time, offering better rates than banks.

- Real-World Case Studies: Platforms like Wise (formerly TransferWise) and Revolut have saved businesses millions in foreign exchange fees.

Faster Processing and Instant Settlements

Fintech solutions drastically reduce settlement times, offering near-instant transactions compared to traditional banks. Some improvements include:

- Real-Time Payment Networks: Fintech leverages blockchain and digital payment rails like RippleNet, enabling instant global payments.

- Automated Transaction Processing: AI and machine learning help streamline payment verification, reducing human error and processing delays.

- Speed Comparison: While traditional bank transfers take 3-5 business days, fintech-powered payments often settle within minutes, boosting efficiency for businesses.

Key Fintech Innovations Transforming Cross-Border Payments

Fintech continues to push the boundaries of innovation, driving significant cost reductions and efficiency improvements in cross-border transactions. By leveraging advanced technologies, fintech companies are reshaping the global financial ecosystem and making international payments more accessible, transparent, and affordable for businesses and consumers alike. Here are some of the most transformative innovations in the fintech space.

Blockchain and Cryptocurrencies

Blockchain has become a game-changer in international transactions due to:

- Decentralized Ledger Technology (DLT): Transactions are secure, transparent, and immutable, reducing fraud risks.

- Smart Contracts: These automate payment processing, reducing human errors and administrative costs.

- Real-World Adoption: Companies like Ripple and Stellar enable cost-effective cross-border transactions for businesses and financial institutions.

AI and Machine Learning in Payment Optimization

AI enhances fintech payment solutions by:

- Fraud Detection and Risk Management: Machine learning algorithms identify suspicious activities in real-time, preventing fraudulent transactions.

- Exchange Rate Predictions: AI-driven tools help users optimize currency conversions, ensuring cost-effective transactions.

- Reducing Manual Processing Costs: Automating compliance and verification reduces operational expenses, making fintech solutions more affordable.

Digital Wallets and Mobile Payment Solutions

Digital wallets have gained massive popularity due to:

- Seamless User Experience: Apps like PayPal, Wise, and Alipay allow instant global transfers, reducing the complexity of international payments. Their user-friendly interfaces and mobile-first approach enable customers to send money with just a few clicks, enhancing convenience and accessibility.

- Financial Inclusion: Mobile wallets provide unbanked populations with access to international transactions, bridging economic gaps. Many developing regions benefit from mobile-based financial solutions, allowing individuals and small businesses to participate in the global economy without needing a traditional bank account.

- Reduced Transfer Costs: These platforms offer lower fees compared to traditional banks, making them a cost-effective choice. By leveraging decentralized payment networks and avoiding intermediary banks, digital wallets reduce transaction costs while offering faster settlements. Many fintech providers also use competitive exchange rates, providing further savings to users.

Challenges and Future Outlook for Fintech in Cross-Border Payments

As fintech continues to transform the financial industry, it also faces several challenges that could impact its growth and effectiveness. While fintech has successfully lowered costs and improved efficiency in cross-border transactions, issues such as regulatory compliance, cybersecurity threats, and financial stability remain key concerns. Addressing these challenges is essential to ensuring the long-term success of fintech in global payments.

Regulatory and Compliance Issues

Despite fintech’s advancements, regulatory hurdles remain a challenge:

- KYC (Know Your Customer) and AML (Anti-Money Laundering) Regulations: Compliance costs can be high, requiring fintech firms to invest in security and legal frameworks. Meeting these requirements often involves extensive documentation, user verification processes, and periodic audits to ensure regulatory adherence. While these measures enhance security and prevent financial crimes, they can also slow down fintech expansion and increase operational costs.

- Jurisdictional Challenges: Different countries have varying financial regulations, affecting fintech adoption and scalability. Some regions impose strict capital controls, transaction limits, or licensing requirements, making it difficult for fintech firms to operate seamlessly across borders. Navigating these regulatory landscapes requires partnerships with local financial institutions and adherence to diverse legal frameworks, which can be resource-intensive and time-consuming.

Cybersecurity and Fraud Prevention

With increasing digital transactions, fintech firms must address:

- Rising Threat of Cyber Attacks: Hackers target digital financial systems, making cybersecurity a top priority. As fintech adoption grows, so does the risk of sophisticated cyber threats, requiring companies to invest heavily in protective measures.

- Advanced Security Protocols: Fintech companies invest in encryption, multi-factor authentication, and AI-driven fraud detection to protect users. These measures help prevent data breaches, unauthorized transactions, and identity theft. Additionally, biometric authentication and blockchain technology are emerging as robust solutions to enhance security in digital financial ecosystems.

Future Trends in Cross-Border Fintech Payments

The fintech industry continues to evolve, with promising trends such as:

- Expansion of Central Bank Digital Currencies (CBDCs): Governments are actively exploring the implementation of digital currencies to enhance efficiency in cross-border transactions. These digital assets promise faster settlements, reduced reliance on traditional banks, and increased transparency in international payments.

- Greater Blockchain Adoption: More businesses and financial institutions are integrating blockchain technology to ensure secure, transparent, and cost-effective cross-border payments. Blockchain-based payment networks like Ripple and Stellar are revolutionizing global transactions by minimizing intermediaries and reducing fees.

- Growth in AI and Automation: AI-driven tools are playing a crucial role in optimizing cross-border transactions, enabling fraud detection, automated compliance, and real-time currency exchange rate predictions. Automation in fintech reduces operational costs and significantly improves processing speeds, making international payments more seamless than ever before.

Wrap Up

Fintech has revolutionized cross-border payments, offering faster, cheaper, and more transparent solutions compared to traditional banking systems. By reducing intermediaries, leveraging blockchain technology, and utilizing AI-driven optimizations, fintech is slashing costs in cross-border payments.

As regulatory challenges are addressed and new technologies emerge, the future of global transactions looks increasingly efficient and cost-effective. Businesses and individuals should explore fintech solutions to take advantage of these transformative benefits.