The financial landscape is undergoing a massive transformation, thanks to the rapid advancements in fintech. Among the most significant impacts of fintech innovation is its role in accelerating cryptocurrency adoption.

As digital assets continue to gain traction, fintech solutions are making it easier, safer, and more efficient for individuals and businesses to integrate cryptocurrencies into everyday transactions.

From crypto payment solutions to decentralized finance (DeFi), fintech is at the heart of the global shift toward digital assets. This article explores 7 ways fintech is accelerating cryptocurrency adoption and how these advancements are shaping the future of financial systems.

The Synergy Between Fintech and Cryptocurrency

Cryptocurrency and fintech go hand in hand. Fintech, short for financial technology, encompasses a broad range of innovations that enhance financial services through digital means. Meanwhile, cryptocurrency is a decentralized form of digital currency built on blockchain technology.

How Fintech and Cryptocurrency Work Together:

- Innovation in Payments: Fintech companies are enabling seamless crypto payments, making it easier to use digital currencies for everyday transactions.

- Improved Security: Fintech advancements, including biometric verification and AI-driven fraud detection, are enhancing crypto security.

- Mainstream Adoption: Fintech platforms such as PayPal and Square are integrating crypto services, making digital currencies more accessible.

- Regulatory Compliance: Fintech firms are developing tools to ensure compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, fostering trust in crypto.

As these sectors continue to intertwine, 7 ways fintech is accelerating cryptocurrency adoption become evident.

7 Ways Fintech Is Accelerating Cryptocurrency Adoption

Fintech is revolutionizing the way we interact with digital assets, making cryptocurrencies more accessible and practical for mainstream use. By integrating cutting-edge financial technology solutions, fintech companies are breaking down barriers and fostering widespread cryptocurrency adoption across the globe.

From facilitating transactions to enhancing security and compliance, fintech plays a crucial role in the evolution of digital finance.

1. Seamless Crypto Payment Solutions

One of the biggest hurdles for cryptocurrency adoption has been its usability in daily transactions. Fintech is bridging this gap by enabling seamless crypto payments. The rise of fintech-driven payment solutions has allowed businesses and individuals to transact in cryptocurrencies as easily as traditional fiat currencies. Payment platforms now support multiple digital currencies, making them widely acceptable.

How Fintech Is Making Crypto Payments Easier:

- Crypto Payment Gateways: Fintech firms like BitPay, Coinbase Commerce, and CoinGate allow businesses to accept crypto payments effortlessly.

- Integration With Traditional Finance: Companies like PayPal and Mastercard now support crypto transactions, allowing users to buy, sell, and pay using digital currencies.

- Point-of-Sale (POS) Crypto Transactions: Businesses can now accept crypto payments using fintech-powered POS systems.

Example: PayPal’s cryptocurrency integration allows over 400 million users to buy and spend crypto within its ecosystem, directly impacting mainstream adoption.

Leading Fintech Crypto Payment Solutions

| Fintech Company | Supported Cryptos | Key Features |

| PayPal | Bitcoin, Ethereum, Litecoin | Direct crypto transactions |

| BitPay | Multiple Cryptos | Payment gateway integration |

| CoinGate | Bitcoin & Altcoins | POS and merchant services |

2. Expansion of Crypto-Friendly Banking Services

Traditional banks have been slow to adopt cryptocurrencies, but fintech-driven neobanks and digital-first financial services are changing the game. Fintech startups are introducing innovative banking solutions that make it easier for customers to hold and use digital currencies. These services bridge the gap between traditional financial institutions and the decentralized crypto economy.

Key Innovations in Crypto Banking:

- Crypto-Friendly Bank Accounts: Neobanks like Revolut and N26 allow users to hold, trade, and spend crypto seamlessly.

- Crypto Debit and Credit Cards: Companies like Crypto.com and Binance offer crypto-backed cards that function like traditional debit/credit cards.

- Yield-Generating Accounts: Fintech firms provide high-yield interest accounts for users who store crypto assets, making it an attractive investment option.

Fintech Companies Offering Crypto Banking Services

| Fintech Bank | Crypto Services | Unique Feature |

| Revolut | Buy, sell, and hold crypto | Instant currency exchange |

| Crypto.com | Crypto debit cards | Cashback in crypto rewards |

| Nexo | Crypto savings accounts | High-yield interest on deposits |

3. Enhanced Security and Fraud Prevention in Crypto Transactions

Security concerns have been a major barrier to mass cryptocurrency adoption. Fintech is tackling this challenge head-on by implementing sophisticated fraud prevention techniques. Blockchain transactions are irreversible, making security paramount. Fintech companies are integrating AI-driven monitoring tools and multi-layer authentication processes to protect crypto users from fraud and cyber threats.

How Fintech Boosts Crypto Security:

- AI-Powered Fraud Detection: Machine learning algorithms detect suspicious activities and prevent fraud in crypto transactions.

- Biometric Authentication: Fintech companies implement fingerprint and facial recognition to secure digital wallets.

- Multi-Signature Wallets: These require multiple approvals before processing transactions, reducing fraud risks.

Fintech Security Features in Cryptocurrency

| Security Feature | Description |

| AI Fraud Detection | Detects suspicious activity and prevents unauthorized access |

| Biometric Verification | Uses fingerprints or facial recognition for secure access |

| Multi-Signature Wallets | Requires multiple approvals for transactions |

4. DeFi Innovations and Financial Inclusion

Decentralized Finance (DeFi) is transforming traditional financial services by eliminating intermediaries and offering greater accessibility. Fintech plays a crucial role in this transformation by providing platforms that allow users to lend, borrow, and earn interest on cryptocurrencies. DeFi applications are making financial services more inclusive, especially for the unbanked population.

How Fintech Drives DeFi Growth:

- Decentralized Lending and Borrowing: Platforms like Aave and Compound offer lending and borrowing services without banks.

- Staking and Yield Farming: Fintech applications provide opportunities for users to earn passive income through staking rewards.

- Cross-Border Transactions: DeFi platforms enable low-cost international payments, benefiting users in regions with high remittance fees.

Leading DeFi Platforms Powered by Fintech

| Platform | Key Feature | Supported Cryptos |

| Aave | Decentralized lending and borrowing | Ethereum, Polygon |

| Compound | Crypto interest accounts | Various ERC-20 tokens |

| Uniswap | Decentralized trading | Ethereum, Altcoins |

5. Regulatory Compliance and Legal Framework Improvements

As cryptocurrency adoption increases, governments and financial regulators are working to establish clearer guidelines. Fintech companies are developing compliance solutions that help crypto businesses adhere to regulations. These advancements promote trust and security within the crypto industry.

Fintech’s Role in Crypto Compliance:

- Automated KYC and AML Verification: Fintech solutions streamline identity verification and fraud prevention.

- Smart Contracts for Regulatory Adherence: Blockchain-based contracts ensure regulatory compliance.

- AI-Powered Risk Assessment: Advanced AI tools analyze transactions to detect suspicious activity.

Fintech Solutions for Regulatory Compliance

| Solution | Function | Benefit |

| Chainalysis | Blockchain analysis | Identifies illicit transactions |

| CipherTrace | AML compliance | Ensures adherence to financial regulations |

| Onfido | AI identity verification | Enhances security in crypto transactions |

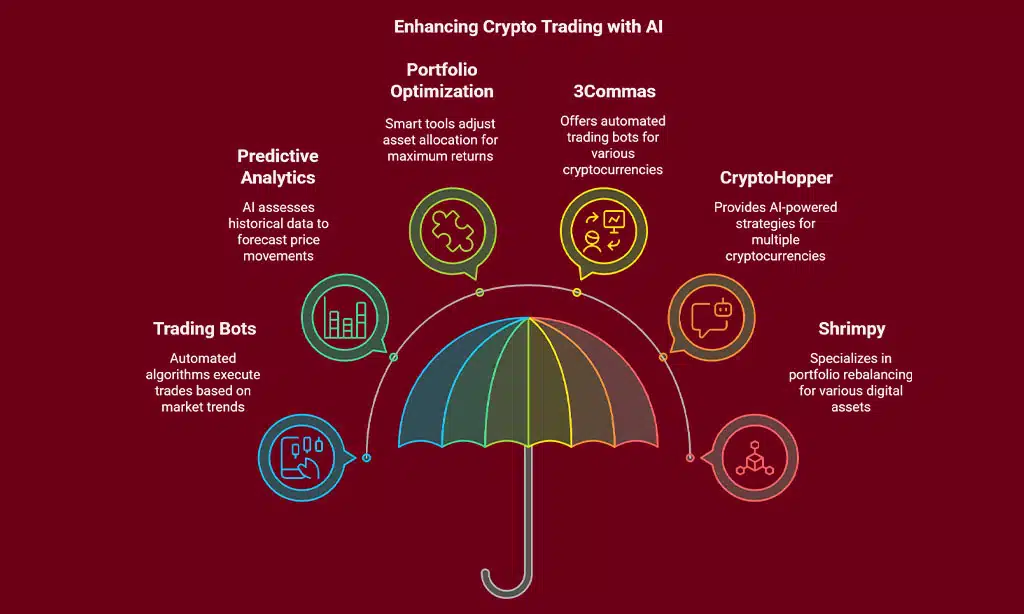

6. AI and Machine Learning for Crypto Trading and Investment

Artificial Intelligence (AI) and Machine Learning (ML) are enhancing cryptocurrency trading by providing data-driven insights and automated investment strategies. Fintech platforms leverage AI to help traders make informed decisions and reduce risks.

AI in Crypto Trading:

- Trading Bots: Automated algorithms execute trades based on market trends.

- Predictive Analytics: AI assesses historical data to forecast price movements.

- Portfolio Optimization: Smart fintech tools adjust asset allocation for maximum returns.

AI-Powered Crypto Trading Platforms

| Platform | AI Feature | Supported Assets |

| 3Commas | Automated trading bots | Bitcoin, Ethereum, Altcoins |

| CryptoHopper | AI-powered strategies | Multiple cryptocurrencies |

| Shrimpy | Portfolio rebalancing | Various digital assets |

7. NFT and Metaverse Integration in Fintech Solutions

The rise of Non-Fungible Tokens (NFTs) and the Metaverse has opened new opportunities for fintech innovation. Digital asset ownership, gaming, and virtual economies are growing rapidly, and fintech is driving their mainstream adoption.

How Fintech Supports NFTs and the Metaverse:

- NFT Marketplaces: Platforms like OpenSea facilitate seamless NFT trading.

- Crypto Payment Integration in Virtual Worlds: Metaverse environments use fintech solutions to process crypto transactions.

- Tokenized Digital Assets: Fintech innovations enable fractional ownership of high-value NFTs.

Top NFT and Metaverse Platforms

| Platform | Key Feature | Crypto Support |

| OpenSea | NFT marketplace | Ethereum, Polygon |

| Decentraland | Virtual real estate | MANA, Ethereum |

| Axie Infinity | Play-to-earn gaming | AXS, SLP |

Final Thoughts

The synergy between fintech and cryptocurrency is reshaping the global financial ecosystem. 7 ways fintech is accelerating cryptocurrency adoption showcase how digital finance is becoming more secure, accessible, and user-friendly.

With continuous advancements, fintech will play an even bigger role in mainstreaming cryptocurrencies, making them an integral part of our daily financial interactions.

Whether through seamless payment solutions, enhanced security, or AI-powered investments, fintech is at the forefront of making cryptocurrency adoption a reality for everyone. Now is the time for businesses and individuals to embrace this digital revolution.