The cryptocurrency world has significantly transformed since Satoshi Nakamoto introduced Bitcoin in 2009. Over the years, various cryptocurrency exchanges have emerged, enabling people to trade Bitcoin and other virtual currencies.

Decentralized crypto exchanges are particularly the game-changer in the crypto trading world. They differ from centralized crypto exchanges that require users to deposit money into centralized platforms that function as trusted third parties. Decentral crypto exchanges use a decentralized network to eliminate intermediaries while enhancing security. This blog post compares centralized vs. decentralized crypto exchanges to determine their future.

Centralized Crypto Exchanges

A centralized crypto exchange is an intermediary between cryptocurrency buyers and sellers. Most people conduct crypto transactions via centralized exchanges because they consider them more trustworthy.

These platforms allow users to purchase and sell Bitcoin or other cryptocurrencies using fiat money. Most people consider them trustworthy, and they may also function as custodians that keep or safeguard their cash. Many traders prefer these platforms because of their user-friendly and straightforward interface. Also, they provide a security layer to the users.

However, these platforms are vulnerable to cybersecurity threats, including hacking. Also, they charge service fees, and centralized entities control them.

Decentralized Crypto Exchanges

A decentralized crypto exchange is a non-centralized alternative. That means no single or central entity controls the platform. Instead, the platform uses decentralized apps and smart contracts to automate trades and transactions. And this makes decentralized crypto exchanges safer because breaches are almost impossible.

Centralized vs. Decentralized Crypto Exchanges

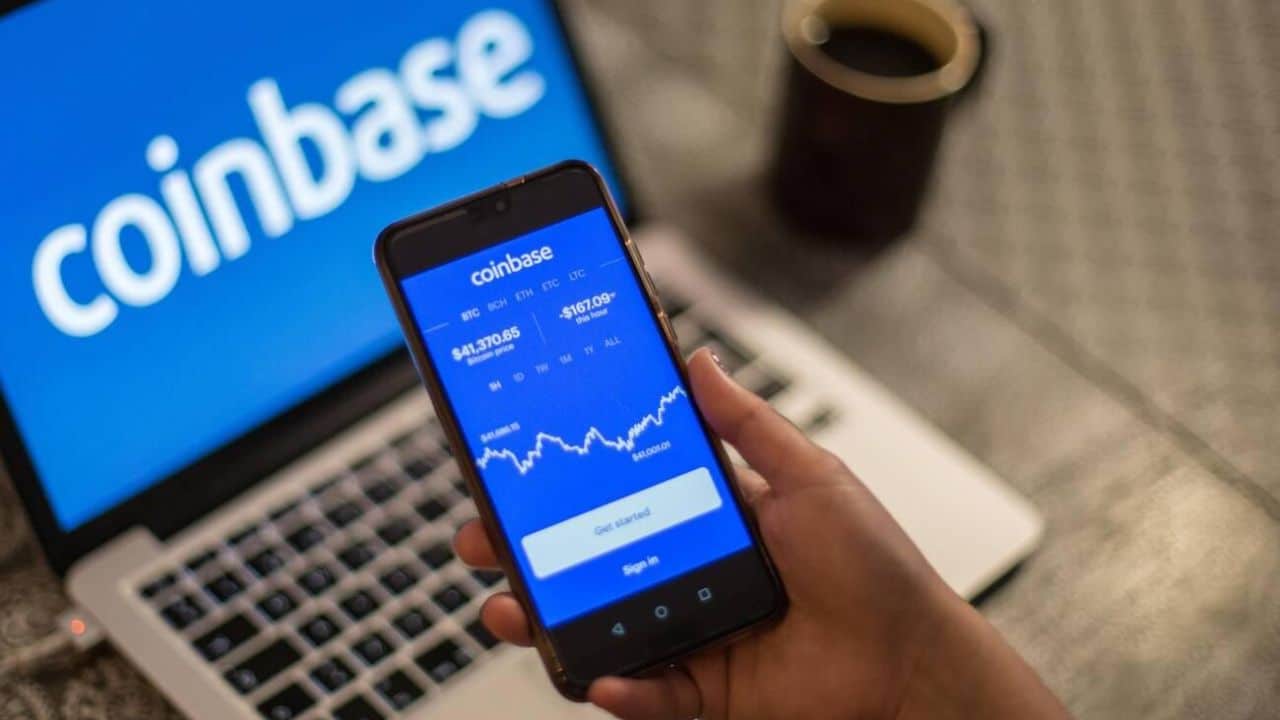

Once you decide to trade cryptocurrency, you may sign up with a platform like bitcoin billionaire without considering whether it’s centralized or decentralized. However, knowing the differences between centralized and decentralized platforms is vital. It helps you make a more informed decision. Here’s how centralized crypto exchanges differ from decentralized exchanges.

Control

Centralized platforms have a single entity controlling them, while decentralized exchanges use smart contracts to govern operations.

Security

People consider centralized exchanges secure because they may invest more resources in security measures. However, decentralized exchanges can be less safe as they depend on smart contracts and individual wallets for security.

Privacy

Centralized crypto exchanges may require the user’s personal information for verification purposes. Thus, they may compromise the user’s privacy. Decentralized platforms allow users to trade anonymously, safeguarding their privacy.

Liquidity

Centralized platforms have higher liquidity because of centralized order books and funds control. Decentralized exchanges may have low liquidity because they fragment order books.

Censorship

Centralized exchange platforms may be subject to regulations or censorship from government agencies. However, decentralized platforms are almost immune to shutdowns or censorship since smart contracts govern them and they are decentralized.

Usability

Centralized crypto exchanges are more user-friendly, with an easy-to-use interface and customer support. Decentralized platforms often require experience and technical knowledge to use effectively.

Fees

Centralized crypto exchanges require higher charges due to infrastructure costs and centralized control. Decentralized platforms charge lower amounts because they have low overhead costs for their maintenance.

The Future

Crypto exchanges have a bright future due to their immense potential. These platforms will likely undergo significant improvement due to the crypto landscape’s increasing cryptocurrency adoption and evolution. Global regulatory agencies and governments are also looking for ways to establish regulations that will govern digital currencies and their exchange platforms. Such moves will influence how Bitcoin and other virtual currencies work. Also, these regulations will likely enhance investor confidence and boost cryptocurrency integration with conventional financial systems and institutions. Additionally, it will establish a conducive environment for people to trade Bitcoin and other cryptocurrencies on crypto exchanges. Thus, these platforms will likely get more users as crypto adoption increases.