Buying property in Belgium can be an exciting and rewarding investment, whether you’re looking for a family home, a rental property, or a long-term investment. However, the process can be complex, with various legal, financial, and practical considerations to keep in mind.

Understanding the key things to know before buying property in Belgium will help you navigate the market smoothly and avoid costly mistakes.

In this guide, we’ll explore everything from legal regulations and mortgage options to taxation, best locations, and potential pitfalls.

Whether you’re an investor, an expat, or a local buyer, these insights will ensure you make informed decisions. Let’s dive into the things to know before buying property in Belgium to ensure you make the best choices.

10 Things to Know Before Buying Property in Belgium

Buying property in Belgium involves understanding the real estate market, legal requirements, financing options, and potential challenges. Whether you’re purchasing a home for personal use or as an investment, knowing the key factors will help you make informed decisions. Below, we explore the most important aspects to consider before making a purchase.

1. Understanding the Belgian Real Estate Market

Buying property in Belgium is an appealing prospect for many investors, expatriates, and locals. However, understanding market trends, pricing dynamics, and the best locations to invest in is crucial before making a purchase.

Current Market Trends in Belgium

Belgium’s real estate market has remained resilient, with steady price growth in urban centers. While property prices in Brussels, Antwerp, and Ghent have increased annually by 5-7%, some smaller towns and rural areas have seen slower appreciation rates.

Key factors influencing the market include:

- Population Growth: The demand for housing has risen due to increased urbanization and migration.

- Economic Stability: Belgium’s strong economy and steady job market contribute to sustainable property demand.

- Interest Rates: Mortgage interest rates have fluctuated, impacting affordability for homebuyers and investors.

- Energy Efficiency Regulations : New laws regarding energy-efficient buildings affect property valuations and rental demand.

Average Property Prices and Growth Rates

The price of property in Belgium varies significantly by location. Below is a table showing the average cost per square meter and annual growth trends in major cities:

| City | Average Property Price per m² | Yearly Price Growth | Rental Yield (%) |

| Brussels | €3,500 – €5,000 | 6% | 5-7% |

| Antwerp | €3,000 – €4,500 | 5.5% | 4.5-6% |

| Ghent | €2,800 – €4,200 | 5% | 4-5.5% |

| Bruges | €2,500 – €3,800 | 4.5% | 4-5% |

| Liège | €1,800 – €2,800 | 3.5% | 3.5-5% |

How to Analyze Market Trends Before Investing?

If you’re considering buying a property in Belgium, it’s important to analyze key factors before making a decision:

- Research recent sales prices in your preferred location.

- Compare rental yields and vacancy rates.

- Monitor upcoming infrastructure projects that may impact property value.

- Understand government policies affecting foreign buyers and investors.

Best Cities to Buy Property in Belgium

Each city in Belgium has its unique advantages for homebuyers and investors. Depending on your goals, you may prefer one over another:

- Brussels: As Belgium’s capital and a hub for international business, Brussels offers strong appreciation potential and high rental yields. It is ideal for expats, professionals, and corporate rental properties.

- Antwerp: Known for its vibrant port economy, Antwerp has a growing real estate market with a mix of modern apartments and historic homes. It is a great option for commercial and residential investments.

- Ghent: A university city with a youthful population, Ghent offers high demand for student rentals, making it a great choice for buy-to-let investors.

- Bruges: A picturesque, tourist-heavy city that provides strong short-term rental opportunities, especially for Airbnb-style accommodations.

- Liège: One of the most affordable major cities in Belgium, Liège is experiencing growing demand due to new transportation and infrastructure projects.

2. Property Demand and Investment Opportunities

Belgium has an active real estate market with opportunities for local and foreign investors. Due to its strategic location in Europe, relatively affordable prices, and high rental demand, the country attracts buyers looking for stable, long-term investments.

Types of Investment Properties in Belgium

- Long-Term Rentals: Renting to families, professionals, and expatriates is a profitable strategy in cities like Brussels, Antwerp, and Ghent.

- Short-Term Rentals: Platforms like Airbnb have made it easier to generate high returns from short-term vacation rentals, particularly in tourist hubs like Bruges and Brussels.

- Student Housing: Belgium has a large student population, creating strong demand for affordable rental accommodations near universities.

- Commercial Real Estate: Office spaces and retail properties are attractive options in business districts.

Key Factors to Consider Before Investing

When evaluating an investment property, keep the following factors in mind:

- Location: Proximity to transportation, schools, and commercial hubs influences rental demand and property value.

- Property Condition: Older properties may require costly renovations, impacting profitability.

- Market Trends: Understanding economic factors and policy changes helps anticipate future price fluctuations.

3. Legal Documents Needed for Property Purchase

The property-buying process in Belgium requires several legal documents to ensure a smooth transaction:

- Title Deed (Acte de Vente/Notariële akte): Confirms ownership and records the property’s history.

- Compromise de Vente (Preliminary Sale Agreement): Outlines the terms and conditions before the final transaction.

- Notarial Deed: The final agreement, officially signed before a notary, transferring ownership.

- Energy Performance Certificate (EPC): A mandatory document rating the property’s energy efficiency.

- Building Permits and Surveys: These documents confirm compliance with local zoning laws and construction regulations.

4. Common Legal Pitfalls to Avoid

Many buyers face legal complications due to misunderstandings of Belgian property laws. To avoid costly mistakes, be mindful of these risks:

| Issue | Risk Factor | How to Avoid It |

| Incomplete Paperwork | Legal disputes over ownership | Work with a licensed notary |

| Zoning Restrictions | Limited property use | Check municipal regulations |

| Hidden Debts | Unexpected financial liabilities | Conduct due diligence |

| Undisclosed Structural Issues | Expensive repairs | Get a professional inspection |

Hiring a qualified real estate lawyer can help you navigate these legal complexities.

5. Residency and Ownership Rules for Foreign Buyers

Belgium has an open property market, meaning both EU and non-EU citizens can purchase real estate. However, property ownership does not automatically grant residency.

- EU Citizens: Can buy and reside in Belgium without restrictions.

- Non-EU Citizens: Can buy property but need to apply for residency separately if they wish to live in Belgium.

Residency Options for Property Buyers

- Temporary Residency: Non-EU citizens can apply for a residence permit if they plan to live in Belgium for an extended period.

- Investor Visa: In some cases, high-value property investments may help in obtaining a long-term visa.

- Golden Visa Alternatives: Belgium does not have a direct Golden Visa program, but investment and entrepreneurship can lead to residency.

6. Mortgage Options in Belgium

Belgian banks offer various mortgage options for residents and non-residents.

Types of Mortgages Available

- Fixed-Rate Mortgages: Provides stability with consistent interest rates.

- Variable-Rate Mortgages: Lower initial rates but subject to market fluctuations.

- Interest-Only Loans: Useful for investors looking to minimize short-term payments.

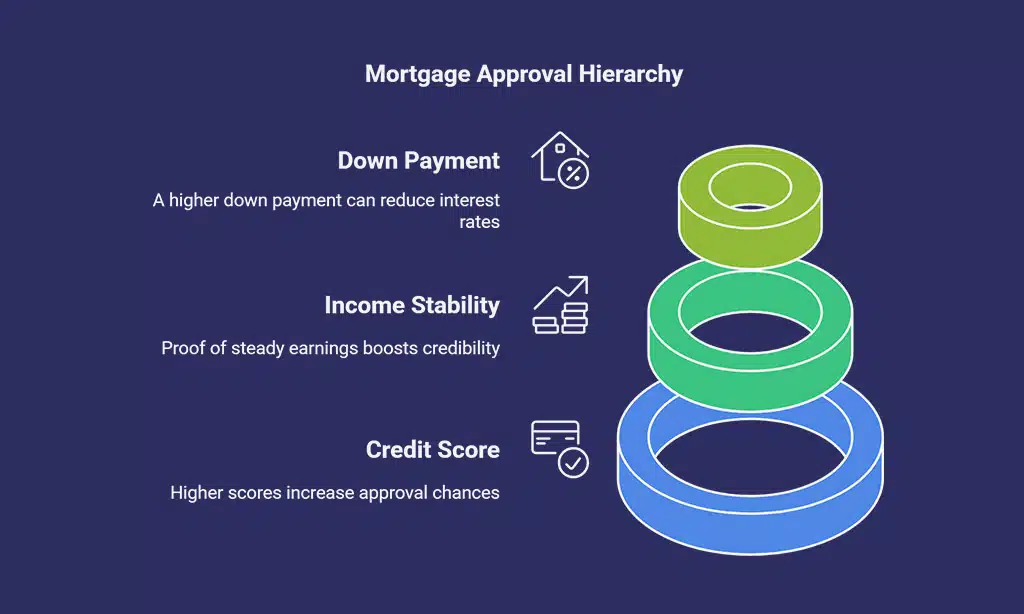

Eligibility Factors for a Mortgage

| Factor | Impact on Loan Approval |

| Credit Score | Higher scores increase approval chances |

| Income Stability | Proof of earnings boosts credibility |

| Down Payment | Larger down payment lowers interest rates |

7. Taxation on Property Purchase in Belgium

Understanding property taxes in Belgium is crucial, as they can significantly impact the total cost of your investment. Taxes vary depending on the type of property, its location, and whether it is newly built or second-hand.

Key Taxes When Buying Property in Belgium

- Registration Tax: Also known as “transfer tax,” this fee applies when purchasing an existing (second-hand) property. It varies by region:

- Brussels-Capital Region: 12.5%

- Flanders: 12% (Reduced to 3% for primary residences)

- Wallonia: 12.5%

- Value-Added Tax (VAT): If purchasing a newly built property (less than two years old), you will pay 21% VAT instead of registration tax.

- Notary Fees: Typically range between 0.5% and 1.5% of the purchase price, plus 21% VAT. Notaries handle all legal documentation and verify property ownership.

- Municipal and Regional Taxes: Property owners pay additional taxes depending on the municipality where the property is located.

- Capital Gains Tax: If you sell your property within five years of purchasing it, you may be subject to 16.5% capital gains tax on the profit. If you hold the property longer than five years, no capital gains tax applies.

8. Utility and Maintenance Costs

Belgium has relatively high utility and maintenance costs, which should be factored into your budget when buying a home.

Typical Utility Expenses

- Electricity and Gas: The average cost for a three-bedroom home is €150-€250 per month, depending on usage and provider.

- Water Supply: Water bills average €30-€50 per month per household.

- Internet and TV: Internet services cost between €40-€80 per month, with premium packages including TV and mobile services.

- Waste Collection Fees: Municipalities charge annual waste management fees, ranging from €50-€150 per household.

Maintenance and Repair Costs

Owning a property requires ongoing maintenance. Here’s what you should expect:

- Property Insurance: Typically costs €250-€600 per year, covering fire, theft, and natural disasters.

- Homeowners’ Association Fees: If you buy an apartment, you may have to pay monthly fees for building maintenance, ranging from €50-€300 per month.

- Annual Property Tax (Précompte Immobilier): Property taxes depend on the cadastral income of the property. The tax rate is approximately 20%-50% of the cadastral income per year.

Tip: When purchasing a property, request a breakdown of annual costs from the previous owner to estimate your future expenses.

9. Local Infrastructure and Connectivity

The value and convenience of your property investment depend heavily on nearby infrastructure and connectivity.

Transportation & Accessibility

Belgium has an excellent public transport system that enhances the attractiveness of properties in well-connected areas:

- Trains: The SNCB (National Railway Company of Belgium) connects all major cities, with Brussels being a central hub.

- Trams & Buses: Major cities like Brussels, Antwerp, and Ghent have extensive tram and bus networks.

- Highways: Belgium has one of the densest road networks in Europe, making commuting by car easy.

- Airports: Brussels Airport (Zaventem) is the main international gateway, with Charleroi and Antwerp airports serving as secondary options.

Essential Amenities Nearby

When choosing a property, consider its proximity to:

- Schools & Universities: Belgium has top-rated international and public schools, as well as renowned universities like KU Leuven, Ghent University, and the Université Libre de Bruxelles.

- Healthcare Facilities: Belgium’s healthcare system is among the best in Europe, with many hospitals and private clinics offering world-class medical services.

- Supermarkets & Shopping Centers: Access to grocery stores, malls, and weekly markets can enhance the convenience of your location.

10. Renting vs. Buying: Which is the Better Option?

If you are moving to Belgium or considering an investment, you may wonder whether to buy a home or rent instead. Both options have pros and cons depending on your financial situation and long-term goals.

Advantages of Buying a Home in Belgium

- Long-Term Financial Benefits: Buying allows you to build equity over time instead of paying rent.

- Rental Income Potential: If you purchase a property in a high-demand area, you can generate 5-7% rental yield per year.

- Capital Appreciation: Properties in prime locations appreciate in value over time, offering profitable resale opportunities.

- No Rent Increases: As a homeowner, you are protected from annual rent hikes by landlords.

Advantages of Renting in Belgium

- Flexibility: Renting is ideal if you are unsure how long you will stay in Belgium.

- Lower Upfront Costs: No need to pay high registration taxes, notary fees, or property maintenance costs.

- No Risk of Market Fluctuations: Homeowners may face price declines or rising interest rates, while renters are shielded from such risks.

| Factor | Buying | Renting |

| Initial Cost | High (registration tax, notary fees) | Low (1-3 months deposit) |

| Monthly Cost | Mortgage + utilities | Rent + utilities |

| Long-Term Savings | Builds equity | No capital growth |

| Flexibility | Low | High |

| Property Maintenance | Owner’s responsibility | Landlord’s responsibility |

Tip: If you plan to stay in Belgium for more than five years, buying is often a better financial decision. However, if you are uncertain about your future plans, renting may be the smarter choice.

Final Thoughts: Is Buying Property in Belgium the Right Move for You?

Purchasing property in Belgium is a significant financial decision that requires careful planning and research. Whether you’re a first-time buyer, an investor, or an expat relocating to Belgium, understanding the legal, financial, and market conditions is essential for making a sound investment.

Key Takeaways

- Research the real estate market to understand pricing trends and growth potential in different cities.

- Understand all taxes and fees to avoid unexpected costs.

- Consult legal professionals to ensure a smooth transaction.

- Analyze financing options to determine the best mortgage for your needs.

- Evaluate infrastructure and amenities to choose the right location.

- Weigh the pros and cons of buying vs. renting based on your long-term goals.

Belgium’s property market offers plenty of opportunities, but success depends on proper due diligence and smart decision-making. Whether you’re looking for a family home or a profitable investment, the Belgian real estate market has something for everyone!

Now is the time to explore your options and start your journey to property ownership in Belgium!