India and Southeast Asia are no longer just “cheap manufacturing hubs.” Together, they form a 2-billion-plus market, a critical node in global supply chains, and a testing ground for digital and green transformation. As geopolitics and technology reshape trade, 2026 is emerging as a hinge year for many growth sectors in India and Southeast Asia.

New regional plans of action, supply-chain shifts away from over-dependence on China, and ambitious climate and digital goals are converging. India is pushing towards its 2030 renewable energy and electric vehicle targets. ASEAN governments are rolling out blueprints for the green economy and the digital economy. Businesses and investors are watching closely to see which sectors will actually convert policy into profits.

The Big Picture: From “China+1” to “India+ASEAN”

Governments across India and Southeast Asia are redesigning economic strategies to align with digital transformation, green energy goals, and new trade dynamics. In 2026, policy reforms, regional cooperation, and shifting supply chains will create the foundation for long-term growth across both regions.

Supply Chains Are Being Re-Drawn

For the last decade, many global firms have talked about diversifying beyond China. That conversation has now moved from boardroom slides to factory floors, warehouses, and data centers. India’s Make in India and Production-Linked Incentive (PLI) schemes are pulling in manufacturing and electronics investments. At the same time, ASEAN economies are deepening their role as flexible, export-oriented manufacturing bases.

This is transforming the old “China+1” mindset into something broader: “India+ASEAN” as a composite strategy. Companies are no longer choosing between India and Southeast Asia. They are designing regional footprints that use India’s scale and tech talent alongside ASEAN’s manufacturing depth and trade agreements.

Twin Transformation: Digital + Green

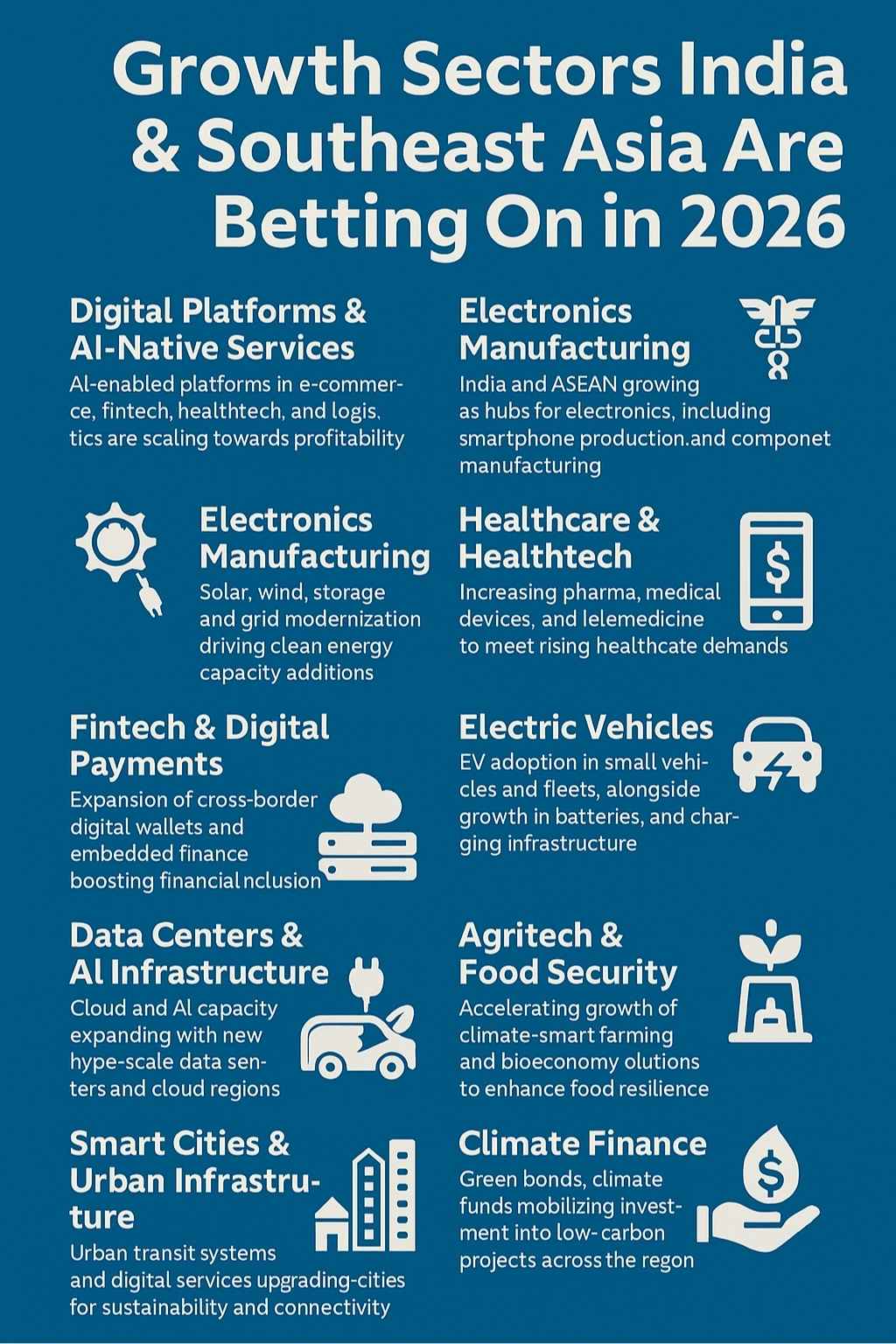

Two themes cut across almost every growth sector in 2026:

- Digital transformation – digital public infrastructure, e-commerce, fintech, AI, Industry 4.0, and data-rich services.

- Green transformation – renewable power, green hydrogen, low-carbon manufacturing, sustainable logistics, and climate finance.

This twin transformation is why terms like “digital economy in ASEAN 2026” and “green economy in Southeast Asia” matter. They are not buzzwords. They are now central to industrial policy, trade deals, and investment mandates.

Why 2026 Is a Tipping Point

Several timelines converge around 2026:

- New ASEAN–India cooperation plans in the maritime, digital, and energy domains.

- Mid-point progress towards India’s 2030 goals on clean energy, electric mobility, and emissions intensity.

- Rollout of ASEAN energy and digital masterplans that set targets for renewables, cross-border power trade, and digital connectivity.

In short, 2026 is when policies announced over the last few years must start delivering scale. That is what makes the following 15 sectors so important.

Digital & AI Economy: Platforms, Clouds and Cyber Defences

The digital economy is accelerating rapidly as India and ASEAN adopt AI-powered platforms, expand e-commerce, and build cloud and data infrastructure. In 2026, digital public infrastructure, AI adoption, and cybersecurity will define the next phase of growth and innovation.

1. Digital Platforms, E-Commerce, and AI-Native Services

The first obvious growth engine is the digital economy in ASEAN and India’s booming digital services market.

- In India, UPI has turned real-time digital payments into a daily habit. Start-ups build on top of digital public infrastructure to launch fintech, healthtech, and retail platforms.

- In Southeast Asia, super apps and e-commerce giants continue to expand into logistics, food delivery, buy-now-pay-later, and other embedded services.

In 2026, platforms are shifting from pure growth to profitable, AI-enabled operations.

Expect:

- smarter recommendation engines and logistics routing

- dynamic pricing in retail and transport

- AI-driven customer support at scale

For SEO, this space ties directly to emerging industries in India 2026 and ASEAN growth sectors 2026, as digital services are becoming the operating layer for many other industries.

2. Data Centers, Cloud, and AI Infrastructure

Behind every digital service is a growing need for storage, computing, and connectivity. This is why data centers and AI infrastructure in Southeast Asia and India are expanding so fast.

Singapore remains a key hub, but capacity is spilling over into Malaysia, Indonesia, Thailand, and India. Hyperscalers, telecom operators, and local conglomerates are investing in:

- Large-scale data center campuses

- Cloud regions closer to users and enterprises

- AI-ready infrastructure with high-performance chips and specialised cooling

This sector is tightly linked to energy policy. Governments are now asking: if data centers are the new industrial parks, how do we power them with renewable energy and keep emissions in check? That question pushes us towards the next cluster of growth sectors.

3. Cybersecurity and Digital Trust

As more services move online, cybersecurity 2.0 becomes a standalone growth sector. For both India and ASEAN, cyber threats are no longer abstract. Attacks on critical infrastructure, financial institutions, and government agencies have elevated cybersecurity to the level of national resilience.

Growth in this space shows up in:

- security operations centres (SOCs)

- managed security services for SMEs and mid-market firms

- identity, privacy, and data protection tools

- regulatory frameworks for data governance and AI safety

For readers focused on generative AI and post-quantum crypto, this is the defensive side of the arms race: governments and firms need to protect critical infrastructure that is now deeply digital.

Green Energy and Climate Tech: Building a Low-Carbon Backbone

Clean energy ambitions are driving heavy investment in solar, wind, storage, and climate technologies. India and Southeast Asia see 2026 as a pivotal year to scale renewable capacity, cut emissions, and transition industries toward sustainable, low-carbon pathways.

4. Renewable Energy: Solar, Wind, Storage, and Grid Upgrades

If there is one unifying growth story across the region, it is the green economy in Southeast Asia and India’s large-scale renewable expansion.

India is pushing aggressively on:

- utility-scale solar

- wind (onshore and emerging offshore)

- battery storage and pumped hydro

- grid modernisation to manage variable renewables

Southeast Asian economies are accelerating renewable targets and exploring regional power grids. The focus for 2026 is not just adding capacity, but making grids smarter and more flexible so they can host intermittent wind and solar at scale.

For investors, this sector is where industrial policy, climate goals, and infrastructure returns meet.

5. Green Hydrogen and Low-Carbon Fuels

India’s green hydrogen mission positions it as a potential exporter of low-carbon fuels to Asia, Europe, and beyond. Meanwhile, Southeast Asian economies are exploring hydrogen and ammonia for industry, shipping, and power.

The opportunity is clearest in:

- steel and cement decarbonisation

- shipping fuel transitions

- chemical industries looking for low-carbon feedstocks

By 2026, the picture will become clearer: which pilots have moved beyond announcements, which supply chains are commercially viable, and where India–ASEAN cooperation can shorten the learning curve.

6. Electric Vehicles and Battery Ecosystems

The electric vehicles market in India and ASEAN is another central pillar among the growth sectors in India and Southeast Asia in 2026.

India is targeting a rapidly rising share of EVs in new vehicle sales, especially for two-wheelers, three-wheelers, and commercial fleets.

Southeast Asian cities are following a similar path, driven by:

- Air pollution concerns

- High fuel import bills

- Urban congestion

Growth will not only come from vehicle sales. Batteries, charging infrastructure, software for fleet management, and second-life or recycling solutions are all emerging opportunities.

Manufacturing and Supply Chains: From Chips to Ships

Manufacturing revival and supply-chain diversification are positioning India and ASEAN as key global production hubs. Electronics, semiconductors, and maritime logistics are strengthening regional competitiveness and reducing over-reliance on traditional global supply nodes.

7. Electronics and Semiconductor Manufacturing

Electronics manufacturing is where industrial policy is most visible. India’s ambitions in smartphones, consumer electronics, and eventually semiconductors are backed by PLI incentives and infrastructure investments. This sits at the heart of electronics and semiconductor manufacturing in India.

Southeast Asian economies, meanwhile, have decades of experience in:

- electronics assembly

- components manufacturing

- export-oriented industrial zones

In 2026, expect tighter integration: component manufacturing in ASEAN feeding device assembly in India, or vice versa, as firms optimise for tariffs, skills, and logistics.

8. Advanced Manufacturing and Industry 4.0

Beyond electronics, advanced manufacturing is rising as a growth engine.

This includes:

- robotics and automation

- precision engineering

- 3D printing and additive manufacturing

- smart factories with sensor-rich production lines

Both India and ASEAN are trying to move from low-cost labour to high-value manufacturing. Industry 4.0 adoption is a crucial bridge. For companies, it is not just a technology upgrade. It is about integrating design, production, supply chain, and after-sales in a data-driven loop.

9. Maritime Economy, Ports, Logistics, and Shipping

The region’s geography is its destiny. The Indian Ocean, the Bay of Bengal, and the South China Sea are the arteries of global trade.

In 2026, India–ASEAN maritime cooperation is set to deepen around:

- port modernisation and logistics corridors

- shipbuilding and repair

- blue economy sectors like fisheries, offshore renewables, and marine services

Better port connectivity and logistics efficiency directly support many other sectors on this list—manufacturing, agrifood exports, e-commerce logistics, and even data center equipment flows.

Human Development Sectors: Health, Food, and Skills

Human development is becoming a strategic priority for India and Southeast Asia as healthcare demand rises, food systems face climate pressure, and millions require new skills for a digital-green economy. In 2026, investment in healthtech, agritech, and future-ready skilling will strengthen resilience, improve well-being, and ensure the workforce can support fast-growing industries across the region.

10. Healthcare, Pharmaceuticals, and Healthtech

India is already known as the “pharmacy of the world,” and its pharmaceutical exports continue to grow. At the same time, Southeast Asia’s healthcare demand is rising with ageing populations, urbanisation, and lifestyle diseases.

Three dynamics define this growth sector:

- Pharma and generics – India supplies affordable medicines to both ASEAN and global markets.

- Medical devices and diagnostics – new manufacturing clusters reduce dependence on imports.

- Healthtech – telemedicine, remote diagnostics, AI-based imaging, and digital health records streamline care delivery.

For investors and policymakers, healthtech and pharma in India and Southeast Asia are not just business stories. They are also about resilience after the pandemic and preparedness for future health shocks.

11. Agritech, Food Security, and the Bioeconomy

Food security is back at the top of policy agendas. Climate volatility, supply chain disruptions, and price spikes have made governments much more focused on:

- Climate-smart agriculture

- Resilient seed and input systems

- Cold chains and storage

- Transparent, traceable supply chains

At the same time, start-ups are bringing digital tools to smallholders—soil sensors, satellite imagery, market information, and digital payments. This is where agritech and food security in Asia become an important growth sector.

Add in the bioeconomy—biofuels, bioplastics, and biotech applications in agriculture—and the picture becomes even richer. India and ASEAN both view this as a way to create rural jobs while meeting climate and energy goals.

12. Edtech, Skills and Digital Learning

None of these sectors will scale without people who can actually run them. That is why edtech and skilling are emerging as strategic sectors, not just adjuncts.

India has launched large-scale skilling missions, while ASEAN governments are pushing digital literacy, STEM education, and vocational training.

Platforms now offer:

- Micro-credentials in AI, cloud, cybersecurity, and data analytics

- Blended models combining online learning with practical labs

- Cross-border courses and certifications

In 2026, the focus is shifting from “more content” to measurable job outcomes. For businesses, the question is simple: can they find enough skilled workers to execute ambitious investment plans in digital and green industries?

Finance and Inclusion: Wiring the Money Flows

Financial systems across India and Southeast Asia are modernising through fintech, digital payments, and green finance. In 2026, inclusive financial infrastructure and climate-aligned capital will support SMEs, consumers, and large-scale sustainability projects.

13. Fintech, Digital Payments, and Inclusive Finance

Fintech is where India and Southeast Asia have some of the most compelling stories in the Global South.

India’s digital public infrastructure—UPI, Aadhaar, and related platforms—has transformed everyday transactions. In Southeast Asia, digital wallets, buy-now-pay-later, and lending platforms are extending services to the underbanked.

In 2026, expect more:

- cross-border QR payment trials

- regional fintech partnerships

- embedded finance woven into e-commerce, ride-hailing, and gig platforms

This sector directly supports financial inclusion and SME growth. It is also a key part of India’s ASEAN economic cooperation, as interoperability and regulatory alignment become more important.

14. Climate and Transition Finance, Green Capital Markets

All the green ambitions in energy, mobility, and infrastructure require serious capital. That is where climate and transition finance enter the picture.

Key trends include:

- Sovereign and corporate green bonds

- Blended finance structures for renewable projects

- Climate funds targeting industrial decarbonisation and resilience

Singapore is positioning itself as a regional hub for green finance. India is experimenting with sovereign green bonds and ESG reforms in its financial system. By 2026, the volume and quality of climate finance will be a key indicator of how real the green transition is.

Cities, Culture and the Experience Economy

Urban transformation is accelerating as governments invest in smart cities, public transport, clean mobility, and cultural infrastructure. In 2026, these developments will boost tourism, enhance liveability, and power the growing experience-driven economy across the region.

15. Smart Cities, Urban Infrastructure and the Experience Economy

Urbanisation continues to shape the region’s economic geography. Large infrastructure programmes in India and ASEAN are focusing on:

- Mass transit systems

- Smart grids and utilities

- Digital public services and urban data platforms

- Public spaces that blend culture, retail, and tourism

Smart cities are no longer limited to “sensor projects.” They sit at the intersection of many other growth sectors in India and Southeast Asia 2026:

- EV adoption depends on urban charging networks.

- Data centers and AI services need reliable power and connectivity.

- Tourism and creative industries thrive when transport and public spaces are upgraded.

The experience economy—travel, culture, sports, and entertainment—benefits directly from better urban infrastructure and digital services. For many citizens, this is where the macro stories of green and digital transformation become visible in daily life.

Cross-Cutting Risks: What Could Slow These Sectors?

No growth story is guaranteed. Several risks could slow or distort these sectors in 2026:

- Regulatory uncertainty – abrupt policy shifts in renewables, data protection, AI governance, or foreign investment can unsettle long-term capital.

- Funding cycles – digital, healthtech, and agritech start-ups remain vulnerable to global interest rate changes and investor sentiment.

- Geopolitical tensions – trade disputes, sanctions, or conflicts can reroute supply chains yet again and complicate India–ASEAN cooperation.

- Infrastructure gaps – slow grid upgrades, port congestion, or weak last-mile connectivity can erode the benefits of large headline investments.

Investors and policymakers need to watch these risk factors as much as headline sector growth numbers.

What to Watch in 2026: Signals Behind the Headlines

For businesses tracking the key growth sectors in India and Southeast Asia in 2026, five signals are worth watching.

- Concrete India–ASEAN projects– Look beyond announcements: which maritime, digital, and energy projects actually break ground or go live?

- Renewable and grid integration progress– Capacity additions matter, but so do grid upgrades, cross-border interconnections, and energy storage adoption.

- EV adoption versus infrastructure roll-out– The pace of public and private charging infrastructure will show whether EV targets are realistic.

- Data center and AI infrastructure deals– New hyperscale data centers, cloud regions, and AI clusters are strong indicators of digital economy confidence.

- Funding flows into healthtech, agritech, and climate tech– These “mission-critical” sectors will show whether investors are willing to move beyond pure consumer apps into deeper, longer-term plays.

Bottom Line: From “Back Office” to Co-Architect of Globalisation

India and Southeast Asia are moving past the old narrative of being the world’s back office or factory.

The 15 sectors highlighted here show a more complex reality:

- Tech-driven services and AI platforms

- Deep infrastructure in energy, data, and logistics

- Strategic industries in health, food, and mobility

- Financial and urban systems built for inclusion and resilience

For businesses, this is both an opportunity and a test. Winning in these markets will require more than low-cost strategies. It demands long-term commitments, local partnerships, and a serious understanding of policy, politics, and people.

For policymakers, the challenge is to keep the momentum. That means stable regulation, patient investment in institutions, and openness to collaboration across the region.

For decision-makers, the key takeaway is simple: the growth sectors in India and Southeast Asia 2026 are not isolated. They form a network. The most durable gains will come from those who understand how digital, green, and inclusive agendas reinforce one another across this emerging India–ASEAN growth corridor.