Buying a property is one of the most important financial decisions you’ll make in your life. Whether you’re a first-time homebuyer or a seasoned investor, the price you pay can significantly impact your finances for years to come. That’s why learning how to negotiate the best price on your next property is crucial.

Negotiation is a skill that can help you save thousands of dollars, avoid common pitfalls, and secure the best possible deal. In this guide, we’ll walk you through eight proven strategies to help you become a smarter buyer and a stronger negotiator.

Why Negotiation Matters in Real Estate Deals?

Negotiating is more than just haggling over numbers. It’s about understanding market trends, identifying seller motivations, and knowing what you want. Effective negotiation can:

- Help you lower the final sale price

- Win you favorable terms (like closing cost contributions)

- Reveal important details about the property

According to the National Association of Realtors (NAR), buyers who negotiated with strong strategies were able to save an average of 5-10% on the listing price.

1. Do Your Market Research First

Before you make an offer, it’s essential to understand the market. Look into:

- Recent sales in the neighborhood

- Price trends over the last 6–12 months

- Days on market (DOM) for similar properties

This information gives you a realistic price range and helps you avoid overpaying.

Quick Tools for Research:

| Tool | Use Case |

| Zillow | Check home values and trends |

| Redfin | Analyze comparable sales |

| Realtor.com | Access detailed market insights |

| Local MLS | See up-to-date listings and sales data |

Tip: If a property has been sitting for over 60 days, the seller may be more open to price negotiation.

2. Get Pre-Approved for a Mortgage

Getting pre-approved shows sellers that you’re a serious buyer. It also gives you a clear idea of your budget.

Benefits of pre-approval:

- Speeds up the buying process

- Gives you negotiation leverage

- Can make your offer more attractive in a bidding war

Mortgage Pre-Approval Checklist:

| Document Needed | Why It Matters |

| Proof of income | Shows your ability to repay loan |

| Credit score report | Affects your loan terms |

| Bank statements | Proves available funds |

| Tax returns (2 years) | Demonstrates income stability |

Tip: A pre-approval letter can be the edge you need when a seller is considering multiple offers.

3. Understand the Seller’s Motivation

Knowing why a seller is putting the property on the market can help you tailor your offer.

Possible motivations:

- Job relocation

- Financial distress

- Divorce or personal reasons

If the seller is under pressure to sell quickly, they may be more open to price negotiations.

Seller Motivation and Strategy Table:

| Motivation | Strategy to Use |

| Job relocation | Offer fast closing at a lower price |

| Financial hardship | Emphasize your secure financing |

| Divorce settlement | Be flexible and ready to move fast |

Tip: Ask the listing agent about the seller’s timeline and motivation. This insight can shape your negotiation strategy.

4. Always Start with a Lower Offer

Starting with a lower offer sets the stage for negotiation. It creates room to meet somewhere in the middle.

Why it works:

- Anchors the price lower

- Shows you’re a cautious, thoughtful buyer

- Opens up space for concessions

Offer Strategy Guide:

| Asking Price | Suggested Initial Offer | Negotiation Target |

| $300,000 | $280,000 | $290,000 |

| $500,000 | $470,000 | $485,000 |

| $700,000 | $660,000 | $680,000 |

Tip: Keep your tone respectful and your offer supported by market data.

5. Highlight Flaws to Strengthen Your Position

Pointing out necessary repairs or outdated features gives you leverage to ask for a lower price or request upgrades.

What to look for:

- Plumbing or electrical issues

- Roof age and condition

- HVAC system functionality

- Old appliances or worn flooring

Common Issues That Lower Home Value:

| Issue | Potential Price Impact |

| Roof replacement needed | -$8,000 to -$12,000 |

| HVAC system outdated | -$4,000 to -$7,000 |

| Plumbing leaks | -$1,000 to -$5,000 |

| Termite damage | Varies by severity |

Tip: Use your home inspection report as a tool during renegotiation.

6. Be Ready to Walk Away

This is one of the most powerful negotiation tools. If you’re not emotionally attached to the property, you’re in a better position to push for your terms.

Why this works:

- Signals that you’re not desperate

- Pressures the seller to reconsider your offer

When to Walk Away:

| Red Flag | Reason to Leave |

| Seller won’t budge on price | You exceed your budget |

| Major undisclosed issues | Future repair costs too high |

| Title complications | Legal delays or ownership risks |

Tip: There will always be another house. Don’t let emotions override logic.

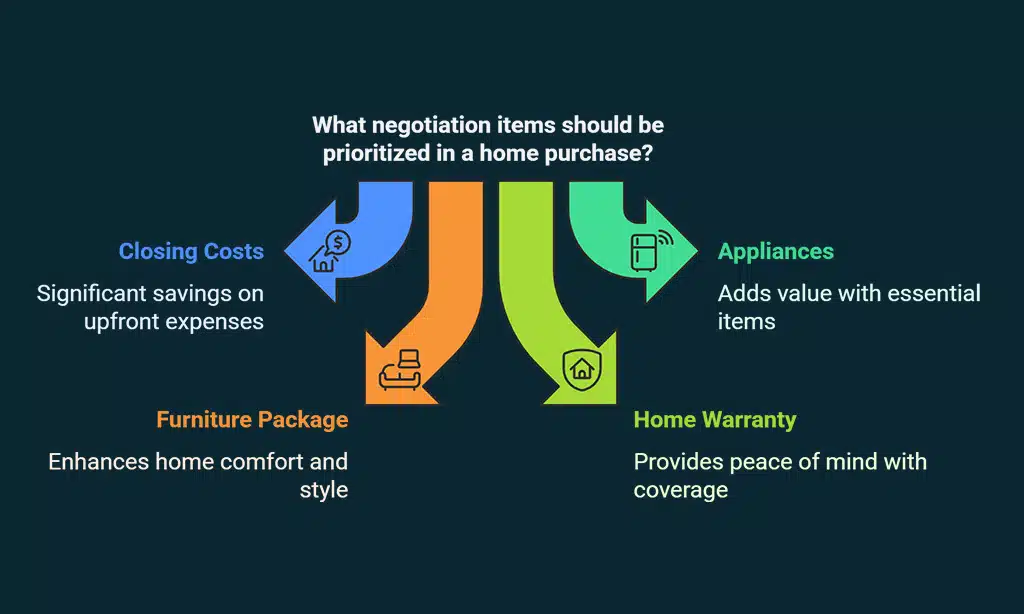

7. Negotiate More Than Just the Price

Price isn’t the only thing up for negotiation. You can also ask for:

- Closing cost contributions

- Appliances and furniture

- Home warranty coverage

- Repairs or credits

Negotiation Alternatives:

| Item to Negotiate | Estimated Value |

| Closing costs covered | $3,000 – $10,000 |

| Appliances included | $1,500 – $5,000 |

| Furniture package | Varies widely |

| Home warranty (1 year) | $400 – $600 |

Tip: Sellers are often more willing to agree to perks than price cuts.

8. Work with an Experienced Real Estate Agent

An expert agent can make all the difference in securing the best deal. They know the market, the paperwork, and how to negotiate.

Benefits of working with a seasoned agent:

- Access to insider data

- Skilled in back-and-forth bargaining

- Can handle emotional conversations professionally

Choosing the Right Agent:

| Factor | What to Look For |

| Years of experience | 3+ years minimum |

| Local market knowledge | Specializes in your target area |

| Client reviews | Look for 4.5+ stars or testimonials |

| Negotiation success | Ask about recent closed deals |

Tip:style=”font-weight: 400;”> Ask your agent about their negotiation style and past wins.

Common Mistakes to Avoid During Property Negotiation

Avoid these common errors that can cost you money or kill the deal:

| Mistake | Why It’s a Problem |

| Getting emotionally attached | Leads to overpaying |

| Failing to research comparable sales | Reduces your negotiation credibility |

| Being too aggressive or rude | Can turn off the seller |

| Ignoring repair needs | Can result in surprise costs later |

Real-Life Example of a Successful Property Negotiation

Case Study: John and Maria were looking for a house in Austin, TX. They found a property listed at $550,000. By applying the negotiation strategies in this article:

- They researched similar homes and found the price was 5% above average

- They got pre-approved and offered $515,000

- After inspection revealed HVAC issues, they requested a $7,000 credit

- They closed at $520,000 with seller-paid closing costs

Total Savings: Over $20,000

Tools and Resources to Help You Negotiate Smarter

These platforms and services can give you the edge in negotiations:

| Tool/Resource | Purpose |

| Zillow / Redfin | Market research & comps |

| NAR (Realtor.org) | Industry trends & tips |

| Bankrate / NerdWallet | Mortgage calculators and advice |

| Home inspection firms | Property assessment and reports |

If you want to negotiate the best price on your next property, you must be prepared, informed, and patient. Start with research, back your offer with data, and work with a skilled agent. Use each of the eight strategies outlined here to build a negotiation plan that works for you.

Saving $5,000 to $25,000 is not only possible—it’s likely when you apply these methods. So go out there, be confident, and secure the deal that fits your needs and your budget.