Oil markets are treating the Venezuela strike impact as a manageable risk after U.S. strikes and political turmoil, with early signs showing key oil facilities still running and global supply forecasts pointing to a sizeable 2026 surplus.

Strikes and operations

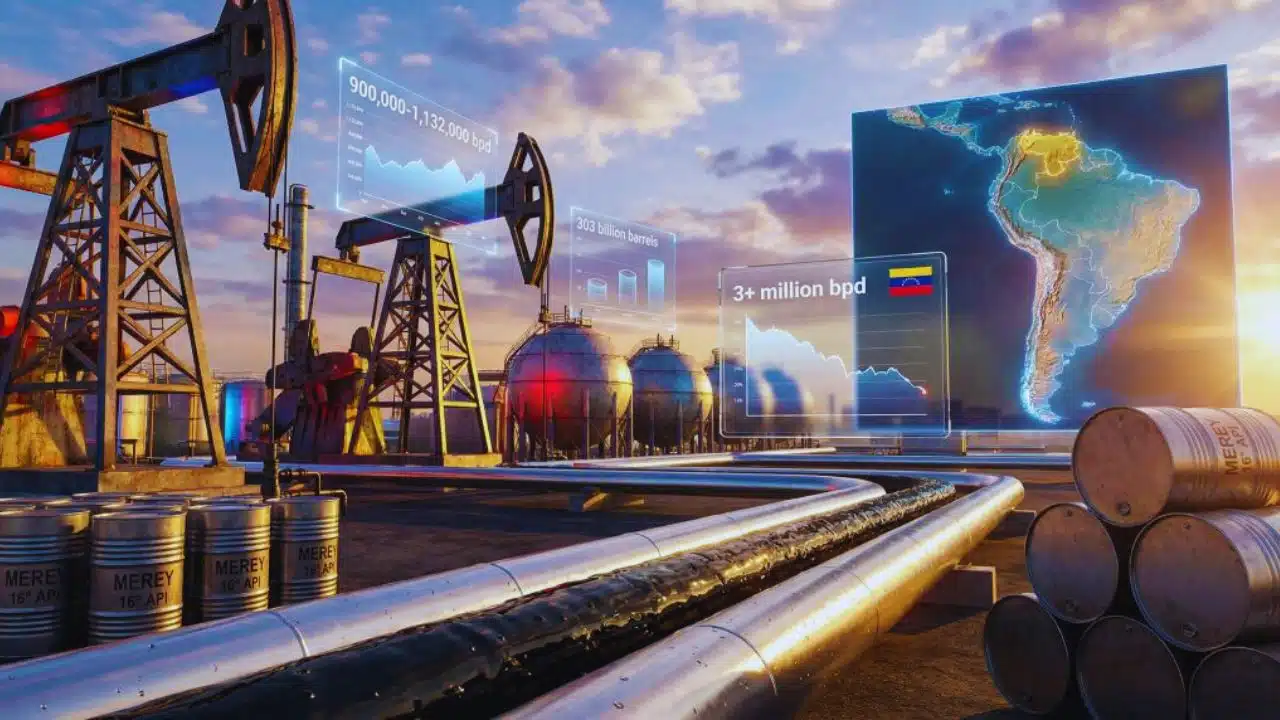

U.S. strikes in Venezuela and the reported capture of President Nicolás Maduro triggered immediate scrutiny of the country’s ports, refineries, and Orinoco Belt production systems because Venezuela remains an OPEC member and an exporter of heavy crude.

Early assessments indicated no confirmed damage to core oil infrastructure, with major facilities and export hubs described as still operational by people familiar with operations.

At the same time, shipping and logistics around Venezuela have been under stress even before the latest strikes, as enforcement actions and tanker-related restrictions pushed some vessel owners to avoid Venezuelan waters and complicated crude movements.

That means the “strike impact” risk to barrels is not only about physical damage—it also includes whether PDVSA can reliably move cargoes and manage inventories during political instability.

Market reaction and supply cushion

Traders initially marked prices higher in thin weekend conditions, but the broader view in market commentary has been that any near-term disruption is likely to be absorbed unless exports are halted for an extended period.

One reason is scale: Venezuela’s output has fallen dramatically from historic peaks and is now described as less than 1% of global supply in recent market discussions.

Another key reason is the wider balance for 2026, where the International Energy Agency (IEA) has projected a large surplus—about 3.84 million barrels per day—despite trimming the estimate from earlier projections.

That projected oversupply, along with seasonally weaker first-quarter demand, is why traders have been focused as much on OPEC+ policy settings as on Venezuela headlines.

Sanctions, shipping, and exports

Even if production sites keep running, Venezuela’s ability to export can be constrained by shipping bottlenecks, diversions, and growing floating storage when tankers hesitate to load or deliver.

Recent shipping disruptions have included vessels halting or reversing course, adding to delays and uncertainty for crude already produced.

Before the latest round of turmoil, November export data showed Venezuela shipped about 921,000 barrels per day of crude and fuel, with China taking about 80% (around 746,000 barrels per day).

Those flows matter most to refiners configured for heavy grades, because substituting heavy crude is often harder than replacing lighter barrels on short notice.

Key data points (recent)

| Metric | What it indicates | Latest reported figure |

| Venezuela crude & fuel exports | Baseline export level before the latest shock | ~921,000 bpd (Nov. 2025) |

| China share of Venezuela exports | Concentration risk if shipments are disrupted | ~80% (~746,000 bpd) |

| IEA 2026 market balance | Global buffer that can offset temporary disruptions | Surplus ~3.84 million bpd |

| Infrastructure status after strikes | Whether barrels can still be produced/loaded | Key facilities reported operational |

| Storage constraint risk | Whether PDVSA may have to slow/shut production | Storage tightness and tanker limits flagged |

What this means for prices

In the near term, the central question for oil prices is whether the Venezuela strike impact turns into a sustained export stoppage rather than a brief risk premium.

If exports continue moving—despite delays—the projected 2026 surplus highlighted by the IEA could keep price gains limited, particularly during the seasonally weaker first quarter.

OPEC+ policy remains another immediate variable because the group is expected to review its stance in early January, and earlier reporting indicated the alliance planned a pause in production hikes during the first quarter amid oversupply signals.

That backdrop makes Venezuela’s near-term disruptions easier for the market to “absorb,” but it does not remove longer-term uncertainty around investment, field performance, and export reliability.

Timeline to watch

| Date | Event | Why it matters |

| Nov. 2025 | Exports averaged ~921,000 bpd | Shows baseline flows into Asia before the shock |

| Mid-Dec. 2025 | Storage/tanker constraints highlighted | Raises risk of forced production shut-ins if exports stall |

| Late Dec. 2025 | Venezuelan production/exports reported falling in December | Indicates pressure on barrels ahead of January events |

| Early Jan. 2026 | U.S. strikes reported; facilities described as operational | Reduces immediate fear of physical supply loss |

| Jan. 4, 2026 | OPEC+ video meeting scheduled | Policy signal into a potentially oversupplied Q1 |

Final thoughts

The Venezuela strike impact is being priced more as a logistics-and-policy risk than as an immediate loss of facilities, based on early indications of continued operations.

Global supply expectations—especially the IEA’s forecast surplus for 2026—are a major reason the market is signaling resilience unless outages escalate or exports stop for weeks rather than days.

The next market-moving updates are likely to center on confirmed export volumes, tanker movements, and any policy shifts from major producers meeting in early January.