Trump’s hint that a “military operation” in Colombia could follow the U.S. raid that seized Venezuela’s Nicolás Maduro is significant because it tests a new intervention template in 2026, pressures a key U.S. partner, and injects uncertainty into migration, counter-drug strategy, and oil markets at once.

If the phrase Trump Colombia Military Operation sounds like a headline-grabber, that is partly the point. But it is also a strategic signal. After U.S. forces captured Maduro in Caracas and transported him to New York to face drug-related charges, Trump publicly entertained the idea of taking similar action in Colombia, while attacking President Gustavo Petro personally.

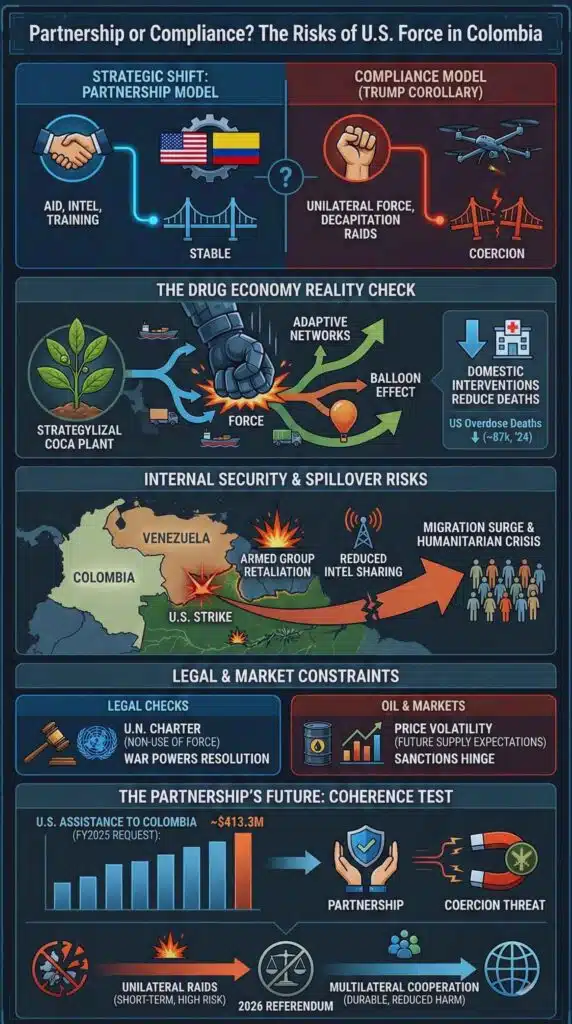

This matters because Colombia is not Venezuela. Venezuela is framed in Washington as an authoritarian adversary and a sanctions target. Colombia is Washington’s longest-running security partner in South America, designated a major non-NATO ally in 2022. Threatening a partner with military action is not just escalation, it is doctrine, and it forces every government in the region to ask a hard question: is “cooperation” still the model, or is “compliance” the new test.

The deeper issue is whether the United States is drifting from a law-enforcement and capacity-building approach to a counterterror-style template for drugs and migration, with unilateral strikes, decapitation raids, and a wider military footprint. The administration’s own strategy language about a “Trump Corollary” to the Monroe Doctrine, plus a visibly expanded Caribbean posture, gives that concern real ballast.

How We Got Here?

Two trends collided in early January 2026.

First, Washington moved from pressure to force in Venezuela. The Maduro capture triggered immediate scrutiny at the United Nations, where legal experts raised questions about the absence of U.N. authorization, Venezuelan consent, or a clear self-defense rationale under Article 51 of the U.N. Charter. The U.N. Secretary-General warned of a “dangerous precedent,” and U.S. allies largely chose cautious wording rather than open endorsement. Spain’s prime minister went further, condemning the intervention as a violation of international law.

Second, U.S.-Colombia relations were already strained by drug metrics and policy disagreement. The latest UNODC survey found coca cultivation in Colombia rose to about 253,000 hectares in 2023, while potential cocaine production climbed to roughly 2,664 metric tons. The Petro government argues for a shift toward rural investment and public-health approaches, while many in Washington read the numbers as proof that a partner is failing.

When Trump says a military operation in Colombia “sounds good,” he is not only reacting to data. He is repositioning Colombia inside the same threat frame used for Venezuela: drugs, sovereignty, and security all merged into one.

A Timeline That Shows How Escalation Became Thinkable

| Date | What Happened | Why It Matters |

| Nov 10–11, 2025 | CSIS documented an expanded Caribbean campaign posture and naval build-up tied to counter-drug strikes | Suggests the operational runway for escalation existed before Venezuela’s raid |

| Nov 26, 2024 | CRS outlined intensifying U.S. congressional conditions on Colombia aid tied to coca levels and Petro’s policies | Shows U.S.-Colombia friction was already institutional, not just rhetorical |

| Jan 3, 2026 | U.S. operation captures Maduro and moves him to New York | Crosses a major sovereignty threshold and resets regional risk perceptions |

| Jan 4, 2026 | U.N. legal and allied scrutiny intensifies, with “dangerous precedent” warnings | Legitimacy becomes a live operational constraint, not a theory debate |

| Jan 5, 2026 | Trump says Colombia operation “sounds good,” attacks Petro | Moves the threat envelope from adversaries to partners, raising spillover risk |

Trump Colombia Military Operation And The Return Of “Compliance Politics”

The most important analytical point is this: the Colombia remark is less about Colombia itself, and more about a model of leverage.

For decades, U.S. influence in Colombia ran through partnership structures: aid, intelligence sharing, training, extradition cooperation, and joint targeting. Colombia has been among the top recipients of U.S. foreign assistance worldwide since the launch of Plan Colombia around FY2000, even as the emphasis evolved over time.

A threat of unilateral force changes the relationship’s grammar. It implies Washington no longer trusts the partner’s political process to deliver outcomes on a U.S. timetable. It also turns domestic Colombian debates into U.S. security debates. That is combustible because Colombia’s drug policy is not simply a “choice” that can be flipped. It is entangled with armed groups, rural governance, land rights, and a peace process that remains fragile.

This is why the rhetoric can be destabilizing even if no strike happens. The threat itself can:

- harden nationalist politics in Bogotá,

- incentivize Colombia to diversify security partners,

- reduce intelligence collaboration in sensitive border regions,

- and give armed groups propaganda material that reframes them as “anti-imperialist resistance.”

Those effects are strategic, not cosmetic. They can make the drug problem harder even if a military raid looks “successful” on television.

The Drug Economy Reality Check: Why Force Rarely Solves Supply

U.S. frustration is anchored in numbers. UNODC’s 2023 estimates show record levels of cultivation and potential production. Yet the numbers also reveal why military shortcuts disappoint. Coca cultivation is geographically dispersed and socially embedded, and trafficking networks are adaptive. When pressure hits one corridor, routes shift, and violence often migrates, not disappears.

WOLA’s field reporting has described localized coca market collapses in parts of Colombia since 2022, a reminder that “the cocaine economy” is not a single stable machine. It has cycles, regional variation, and multiple armed actors extracting rents. That complexity matters because it undermines the premise that a single decapitation or a handful of strikes can reliably reduce supply.

A second complication is that cocaine is no longer the only driver of U.S. political urgency. The fentanyl era changed the emotional register of the drug debate. But fentanyl supply chains are primarily linked to synthetic opioid precursors and transnational manufacturing and distribution, not coca fields. That creates a mismatch between the “enemy” in the rhetoric and the actual drivers of overdose mortality.

CDC’s most recent national provisional data showed a steep decline in U.S. overdose deaths for the 12 months ending September 2024, down to about 87,000 from roughly 114,000 the year before. That decline suggests domestic interventions can materially change outcomes, which weakens the argument that foreign military force is the primary lever.

Key Drug And Public Health Metrics

| Metric | Latest Widely Cited Estimate | What It Suggests |

| Colombia coca cultivation | ~253,000 hectares (2023) | Scale is expanding despite decades of enforcement |

| Potential cocaine production | ~2,664 metric tons (2023) | Production capacity is high and adaptable |

| U.S. drug overdose deaths | ~87,000 (12 months ending Sep 2024, provisional) | Domestic policy and supply shifts can reduce fatalities |

The implication is not that Colombia is irrelevant. It is that militarizing Colombia risks treating the wrong problem with the wrong tool, especially when the U.S. overdose trajectory is already changing through internal dynamics.

Colombia’s Internal Security Map: Peace, Armed Groups, And Border Spillover

To understand why a U.S. “operation” in Colombia would be unusually risky, you have to understand Colombia’s security landscape as a patchwork, not a single battlefield.

Petro’s “Total Peace” strategy aimed to negotiate with multiple armed actors, but the process has faced repeated shocks, including violence between factions and strained talks with groups like the ELN. The result is a contested environment in which armed groups compete for territory, extortion markets, and drug corridors, particularly in border regions.

That border dimension links directly to Venezuela. The Venezuela-Colombia frontier has long been a zone where armed groups operate, launder money, and exploit weak governance. The Maduro raid increased uncertainty at the border, and reporting described Colombian concerns about possible refugee flows and security threats from cross-border criminal actors.

A U.S. strike inside Colombia could therefore trigger second-order effects that are easy to underestimate:

- Armed groups can retaliate asymmetrically through kidnappings, sabotage, or attacks on police stations.

- Cooperation between Colombian agencies and U.S. counterparts could shrink if sovereignty politics becomes toxic.

- Violence can shift into areas where the state has less capacity, creating localized humanitarian emergencies.

In other words, Colombia is not a clean target. It is a complex partner state with layered conflicts. Treating it as a “narco-terror theater” may simplify U.S. messaging, but it complicates everything on the ground.

The Legal And Institutional Checks: What Stops A Template From Spreading

If Venezuela is the precedent, Colombia is the test of constraints.

International Law: The Use-Of-Force Problem

Under the U.N. Charter system, the baseline rule is non-use of force, with narrow exceptions such as Security Council authorization or self-defense after an armed attack. Article 51 is the central reference point for the self-defense claim.

In the Maduro case, legal experts cited by Reuters argued the operation lacked clear legal justification under the Charter framework, and the U.N. Secretary-General warned it sets a dangerous precedent. If that is the legal atmosphere around an “adversary” like Venezuela, the legal and diplomatic resistance would likely intensify for any unilateral action in Colombia, a partner state that has not attacked the United States.

U.S. Domestic Law: The War Powers Constraint

At home, the key brake is political and institutional, not just legal. The War Powers Resolution requires reporting when U.S. forces enter hostilities or imminent hostilities, and it sets timelines for congressional authorization.

The more enduring question is whether Congress treats this as a one-off “raid” or a new category of war. If continued operations occur, lawmakers will face a familiar dilemma: accept expansion by inertia, or force a vote that creates accountability. That debate becomes even sharper if operations shift from Venezuela to other countries.

This is not academic. Reuters reporting shows U.S. political leaders already questioned scope and duration after the Maduro operation.

Oil And Markets: Why Venezuela Moves Prices Even When Output Is Limited

Venezuela’s role in markets is a paradox: it produces a relatively small share of global supply today, yet it holds enormous reserves and therefore huge option value.

EIA’s global oil outlook projected Brent averaging around the mid-$50s in early 2026 amid inventory builds, framing a market already sensitive to expectations of future supply. That context matters because the Maduro capture immediately triggered talk of Venezuelan production returning over time if sanctions and investment constraints ease.

Reuters reported analysts suggesting a post-crisis transition could raise Venezuela’s production into the 1.3–1.4 million bpd range within a couple of years, with much larger potential over a decade if investment flows. The Financial Times captured the immediate market reflex: prices fell after the operation, not because supply surged, but because traders priced the possibility that more oil could eventually come to market.

Sanctions policy is the hinge. OFAC actions in 2025 amended licenses tied to Chevron’s Venezuela joint ventures, illustrating how quickly permissions can tighten or loosen. A political transition could accelerate license changes, but a messy transition could just as easily delay investment.

Oil And Sanctions Signals To Watch

| Signal | Why It Matters | What It Could Indicate |

| U.S. statements about “running” Venezuela or controlling oil | Raises fears of resource-driven policy and legitimacy backlash | Higher political risk premium even if output stays flat |

| OFAC license updates and wind-down authorizations | Determines whether firms can legally operate and export | Speed or slowdown of recovery investment |

| Analyst production pathways (800k to 1.3m bpd, longer-term higher) | Shapes the “future supply” expectation that moves prices | Downward pressure on long-run price expectations |

The oil angle also connects back to Colombia. If Washington links military pressure to drug claims while publicly emphasizing oil, critics will read the posture as opportunistic. That can erode coalition support, even among governments that oppose Maduro.

PBS fact-checking highlighted that some of Trump’s public claims around the operation were false or misleading, which matters because credibility is part of market and alliance stability.

U.S.-Colombia Assistance: The Partnership Is Real, And That Raises The Cost Of Threats

Colombia is not only a partner in rhetoric. It is a partner in budgets.

The CRS report notes Congress designated at least about $377.5 million for Colombia in FY2024, and the administration requested about $413.3 million for FY2025, with recurring debates about conditions tied to counternarcotics performance and human rights. Those figures are not merely accounting. They are policy architecture.

When a U.S. president threatens unilateral action, it collides with that architecture in three ways:

- It undermines the logic of capacity-building, since capacity assumes sovereignty and consent.

- It changes incentives for Colombian agencies, which may become more cautious in sharing intelligence if they fear it will be used for unilateral strikes.

- It pulls Colombian domestic politics into a compliance frame, which can weaken the legitimacy of cooperation.

U.S. Foreign Assistance To Colombia, Recent Levels

| Fiscal Year | Total (Approx.) | What It Tells You |

| FY2023 (estimate) | ~$453.1 million | High baseline partnership spending |

| FY2024 (request level discussed) | ~$444.0 million requested, with at least ~$377.5 million designated by Congress | Support continues, but with sharper conditions and skepticism |

| FY2025 (request) | ~$413.3 million | Partnership remains substantial, but trending downward amid political friction |

This is why a “Trump Colombia Military Operation” is not only a foreign policy decision. It is an internal coherence test: can the U.S. simultaneously fund partnership and threaten coercion without breaking the very cooperation the funding is meant to buy.

Regional Politics And Migration: The Spillover That Can Outlast Any Raid

Even if operations remain limited, spillover effects can be durable because migration and humanitarian systems respond to instability quickly.

R4V’s regional figures put Venezuelan refugees and migrants in Latin America and the Caribbean at about 6.9 million. Any turbulence in Venezuela’s transition can increase displacement, and Colombia is the primary host country and transit corridor. That means Colombia bears immediate risk if Venezuela destabilizes, even if Colombia is not the target of a strike.

This is where Trump’s Colombia rhetoric becomes particularly combustible. Colombia is simultaneously:

- a key counter-drug partner,

- a major migrant host,

- and a state managing internal armed conflict dynamics.

Pressure that weakens Colombian governance capacity, or forces political hardening against migrants, can rebound on U.S. interests through renewed northbound movement.

AP reporting on the aftermath of the Maduro capture described regional tension, casualties, and uncertainty about governance and the limits of U.S. involvement, even as U.S. officials signaled they would not run Venezuela day to day. That ambiguity is itself destabilizing because it encourages worst-case planning in neighboring capitals.

Expert Perspectives: Two Competing Readings, And The Most Likely Reality

A credible analysis should hold two truths at once: governments can be complicit in transnational crime, and unilateral force can produce strategic damage that outweighs tactical gains.

Argument for escalation: Proponents see deterrence and disruption. The CSIS analysis of the Caribbean campaign described an expanded posture and an already militarized counter-drug approach, with strikes and visible build-up. In that view, the Maduro raid is a decisive extension of a broader campaign logic.

Argument against escalation: Critics emphasize legitimacy, blowback, and the risk of creating a norm that powerful states can seize leaders in weaker states without broad multilateral support. Reuters reporting on the U.N. debate highlighted legal skepticism, allied caution, and the Secretary-General’s warning about precedent.

A pragmatic middle reading: CFR experts stressed that removing a leader is only the beginning, and that governance, security, humanitarian needs, and regional politics define whether outcomes stabilize or unravel.

In practice, the most likely path is neither a full invasion of Colombia nor a return to pre-raid restraint. The more plausible trajectory is a widening toolkit: more maritime interdiction, expanded intelligence operations, selective raids framed as “counter-narco-terror,” and rising pressure on governments to align with U.S. priorities, even when those governments are allies.

What Comes Next: The Milestones That Will Signal Which Path Wins

Here is what to watch in 2026 if you want to understand whether this becomes a one-off shock or a durable doctrine.

| Milestone | What To Look For | Why It Changes The Game |

| War Powers and congressional posture | Formal authorization debates, hearings, reporting, funding conditions | Determines whether the template is politically constrained |

| Rules for partner consent | Whether any future operations are explicitly requested by host governments | Consent is the dividing line between partnership and coercion |

| OFAC licensing direction | New general licenses, wind-down extensions, or tighter restrictions | Signals whether “oil leverage” becomes policy center |

| Colombia cooperation signals | Extradition tempo, intelligence sharing, border security posture | Reveals whether the partnership is fraying or adapting |

| Migration numbers and humanitarian planning | R4V updates, host-country capacity strain | Spillover can force policy shifts regardless of ideology |

A final indicator is rhetoric discipline. If U.S. claims become visibly inconsistent, fact-checking becomes part of geopolitics. PBS’s review of Trump’s post-raid claims matters because credibility affects allied support and regional compliance.

The phrase Trump Colombia Military Operation is not just a threat, it is a referendum on how the United States intends to manage hemispheric challenges in 2026. If Washington treats drugs, migration, and geopolitics as one fused security problem, military tools will creep into places where partnership once defined the relationship. Colombia is the most consequential test case because it sits at the center of drug supply dynamics, hosts millions impacted by the Venezuela crisis, and remains a cornerstone of U.S. regional strategy.

A limited strike might look decisive in the short run, but it risks degrading the very cooperation required for sustained results, while escalating legal and legitimacy disputes that allies have already signaled they do not want to normalize. The more durable path, if the goal is reduced harm, likely depends less on unilateral raids and more on tighter financial targeting of trafficking networks, stronger rural governance and legal economies in Colombia, and domestic public-health gains that are already moving U.S. overdose numbers in the right direction.