Many traders feel stress with every market move. They watch losses pile up and lose sleep. They wish they had a solid trading plan. Studies show traders with a plan, plus stop-loss orders and risk management, can cut losses by half. You will learn to use paper trading to practice without risk. You will see how to diversify your portfolio and calm your trading psychology. This guide will make trading less painful and more profitable.

Keep reading.

Key Takeaways

- Define a profit goal and risk no more than 1 percent per trade. Place stop-loss orders before any buy or sell. Test your plan in a paper-trading demo and review about 200 charts per entry. Studies show this can cut losses by half.

- Use stop-loss orders in all trades (for example, 10 points in corn or 20 points in crude oil). Move your stop to break-even after new support forms. Risk no more than 1 percent of capital per trade so you can survive 100 losing trades.

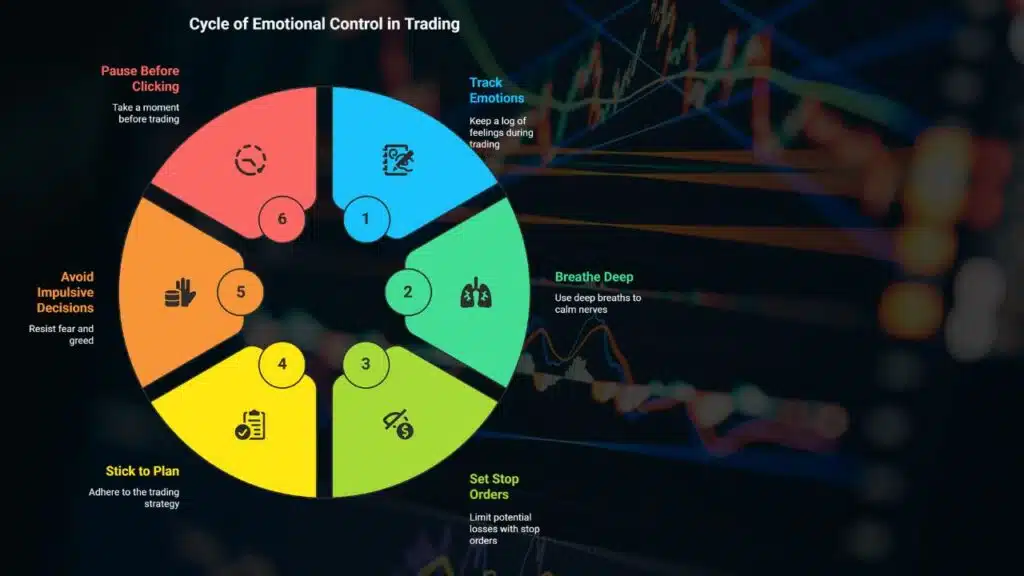

- Keep a log of each trade and your feelings. Pause and take deep breaths before you click. Follow Warren Buffett’s rule that risk is what you do not know. Stick to your plan to curb panic and greed.

- Study candlestick patterns, RSI, and Commitment of Traders (COT) data. Read Trade Stocks and Commodities with the Insiders ($40). Test new ideas in a demo account before real trades. Monitor COT reports for large-producer moves.

- Spread funds across a Vanguard Total Stock Market ETF, a 10-year Treasury note, and gold futures. Use Excel or Morningstar’s Portfolio Manager to rebalance monthly. Avoid single-stock bets—a trader once lost $2 million on one tech stock.

Develop a Solid Trading Plan

Map your goals on a clear roadmap, and let that plan guide you through financial markets, from stocks to commodities. Try a demo account to sharpen your strategy, and set strict risk limits with stop-loss orders in your graphing tool.

Define your goals and risk tolerance

Set a profit goal for each trade and define your risk tolerance. Only risk 1 percent of your capital per trade so you can face 100 losing trades. Decide loss limits before you buy or sell.

Use stop loss orders to cap your risk.

You can apply this to commodity futures trading or other assets. Use paper trading to build discipline and test your trading plan before you risk money. You might need to review 200 charts for one good entry.

This process uses technical analysis and builds solid trading psychology.

Set clear entry and exit strategies

Traders spot a hammer, morning doji star, or abandoned baby on a chart. They watch for price gaps that back up these candlesticks. They set a stop-loss at a level that caps losses per trade.

They note a price target, loss limit, and risk trigger before they buy or sell. Any trader can use paper trading to test these rules before live day trading. Warren Buffett calls risk what you do not know.

A clear trading plan cuts stress and curbs bad choices.

Soybean futures trades either hit a stop-loss or make a gain. Traders add to winners after a strong move and pullback. They slide a stop-loss to the entry level once support holds.

They lock in 50 percent or 30 percent of their position to grab profit. They let the rest run until they spot a reversal pattern. This risk management plan lets winners run and ends losers fast.

Manage Risk Effectively

Slip on your seatbelt and let risk cut-offs guard your capital. Track your stake sizing in a logbook, catch leaks before they sink your ship.

Use stop-loss orders to limit losses

Set a stop-loss order after you enter any trade in your trading plan. Pick a level before you click buy or sell. Adjust it for market swings, for instance 10 points in corn futures or 20 points in crude oil futures.

Stop-loss orders defend your investments during bear markets and volatile futures markets.

Move your stop-loss to break-even after new support forms. That locks in a no risk trade and limits losses in the trading system. This tactic eases trading psychology stress and stops unproductive panic selling.

A day trader can use paper trading in a demo account to sharpen risk management skills.

Only risk a small percentage of your capital per trade

A trader can survive 100 losing trades by capping loss at 1 percent of the account. This rule acts like a life raft in rough markets. It ties to sound trading psychology and risk management.

It shields you in fast moves in financial markets. Many day trading methods crash under overleveraging. Warren Buffett calls it a margin of safety. A charting platform can test a trading system.

A broker terminal shows asset prices without delay.

I made five thousand dollars in a class setup, then wiped out ten thousand on real trades. That loss stuck like chewing gum on a shoe. I switched to paper trading and ran it for thirty days.

I grew my simulated account month after month. Only then did I risk a small portion of capital. This move fits sustainable investing and dollar cost averaging.

Control Emotions During Trading

Charts can stir wild feelings, so I keep a trading log to track each emotion, and I breathe deep before I click. I set a stop order in my day-trading system to cap pain fast, and I stick to that plan no matter how loud my heart beats.

Avoid impulsive decisions driven by fear or greed

Traders must tame their trading psychology in the heat of a drop. Greed can lure you into a risky option or a pump and dump. Warren Buffett held through the 2008 slide and rode a bull market rebound, as the stock market moves up over time.

Stick to your trading plan that uses stop-loss orders and tested in paper trading sessions. Deep breaths can calm your parasympathetic nerve, to keep greed and fear from driving your daytrading.

Most mistakes come from panic, not lack of skill. Pre-set rules like risking 1 percent per trade protect your funds. That risk management concept sits at the core of many trading systems across financial markets.

You must learn to pause before you click buy or sell. Wise patience can spare you poor choices and curb emotional strain.

Continuously Educate Yourself

Watch tutorials on candlestick patterns, RSI and volume profiles then test each idea in a demo account or paper trading setup. Use a charting platform, keep a trade journal and poke around forums and blogs to feed your curiosity and fuel your skill.

Stay updated on market trends and trading strategies

Traders track the Wilshire 5000 and Russell 3000 to gauge financial markets. Markets shift through four bear market phases like the tide and offer buying or selling clues. Many use market indicators as barometers for stock market moves.

Commitment of Traders Reports reveal how large producers position their bets.

Study candlestick charts and technical patterns to spot entry and exit signals. Look for cleaner setups when all criteria align. Use paper trading to test new methods without real loss.

Read Trade Stocks and Commodities with the Insiders: Secrets of the COT Report ($40) to grasp COT data. Train trading psychology by staying calm and letting your parasympathtic response curb panic.

Build a day trading system that blends risk management with a solid trading plan.

Learn from both successes and failures

His partner flipped $30,000 into $2,000,000 in three months with day trading moves. Overconfidence wiped out all his profit in one week. Trading odds often beat a casino gambler. The author began at age fifteen and quit by twenty-two.

He used paper trading to test moves before risking cash. He scanned 200 stock market charts per setup to sharpen his skill.

Warren Buffett tells rookies to treat losses like a lesson. Use a simple moving average indicator and set stop-loss orders to guard capital. Trading psychology works with risk management to curb fear and greed.

A solid trading plan grows in bull markets but falls apart without practice.

Diversify Your Portfolio

Spread your cash across Vanguard Total Stock Market ETF, a 10-year Treasury note, and gold futures. Then plug those figures into an Excel workbook or Morningstar’s Portfolio Manager, set target weights with simple asset allocation and portfolio optimization, and watch your eggs find safer nests.

Avoid putting all your capital into one asset or trade

Many traders risk too much on a single stock. My partner once lost 2,000,000 dollars after riding one tech stock. He thought the stock market would keep rising. A single trade wiped out his win.

Diversification cuts that risk. You can use day trading methods on several symbols. You can check a charting program or use a paper trading app to test ideas. Warren Buffett holds dozens of shares at once, not just one.

This tactic saves you from sector sell-offs.

Split funds across stocks, bonds, and commodities. Balance high-risk plays with safer bets. Use a trading system and stop-loss rules in your trading plan. Check your asset mix each month with a portfolio rebalancing tool or a spreadsheet.

This simple review keeps your holdings strong in bear phases. It also calms your trading psychology and stops panic sales.

Balance high-risk and low-risk investments

Traders split capital between commodity futures, a high-risk trade class, and Vanguard S&P 500 index fund shares. This mix uses market indicators to guide asset moves. They risk one or two percent of capital per trade, a key risk management rule.

It suits day trading in fast financial markets and limits deep losses. This mix also taps trading psychology insights to calm fear and greed.

Practice with paper trading accounts to test your trading system without real dollar risk. Troy uses dollar cost averaging to spread purchases across weeks. He cuts or closes high-risk trades in a slump, to shield his stock market bets.

Warren Buffett praised low-cost index funds over risky speculations. Traders reassess their risk profile each quarter, to meet new goals and market shifts.

Takeaways

These five steps can cut your losses, and boost your gains. A solid plan, smart risk management, and a clear exit rule form a sturdy bridge over rough financial market waters. Simulated trades sharpen your skills with a trading system, before you put real cash on the line.

Stop-loss orders guard your funds, when the stock market turns wild. Keeping emotions in check feels like wearing a seatbelt on a roller coaster, but it saves you from nasty drops.

New knowledge, stock market insights, and varied assets act like a safety net beneath a tightrope. You can win big, one smart move at a time.

FAQs

1. What role does trading psychology play in day trading?

Good trading psychology helps you stay calm under stress. It can boost your day trading wins, cut losses, and keep you focused on your plan.

2. Why should I start with paper trading before the stock market?

Paper trading is like training wheels on a bike. You learn risk, test your moves, and build confidence without using real cash.

3. How do I pick the right trading system for financial markets?

A trading system is your rule book. It should be simple and clear, with buy and sell signals, a stop rule, and a style that fits you.

4. Can I use one strategy across different financial markets?

Yes, you can surf stocks, forex, and bonds if you adapt. Use a sturdy system, strong trading psychology, and you can ride the waves without wipeouts.