Groceries and gas are two categories where cash back can add up fast, because you keep spending in them every month. The best card is the one that matches where you buy groceries, where you fuel up, and whether you’re okay with caps, rotating categories, or an annual fee.

This list focuses on cards that earn strong rewards specifically on groceries and gas in Feb 2026, with the fine print that usually changes your real return.

How We Picked The Top 5 Cash Back Cards

We prioritized cards that are strong in both categories or excellent in one while still being useful in the other. These are our filtering criteria

-

Earning power: Strong grocery and/or gas cash back rates that are easy to use

-

Caps and rules: Whether high rates are limited by annual/quarterly caps

-

Fees vs value: Cards with annual fees only if the rewards can outweigh it

-

Redemption: Straightforward cash back (statement credit, deposit, etc.)

-

Real-world fit: Grocery coding rules, gas station definition, and common exclusions

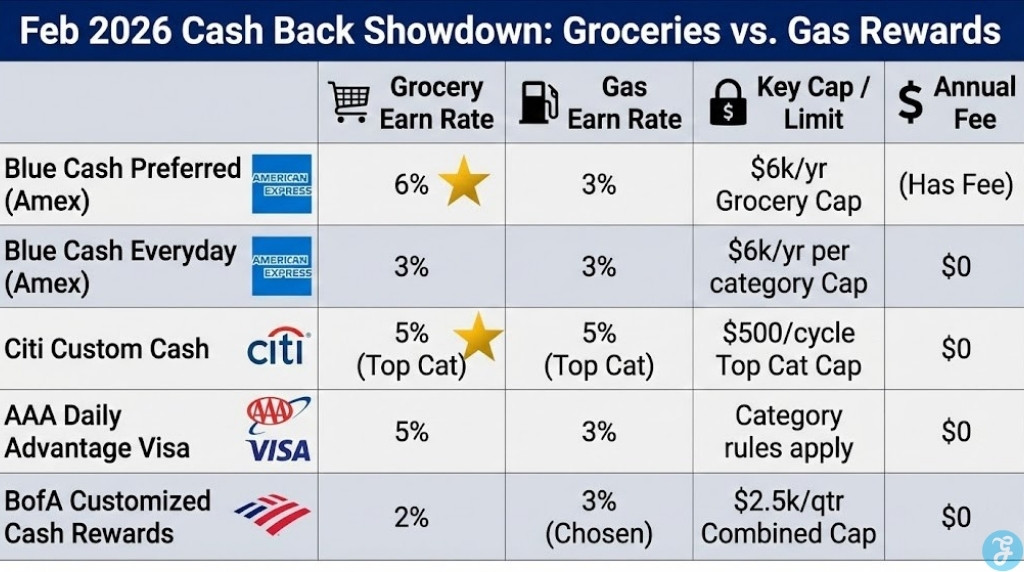

Comparison Table

| Card | Grocery Rewards | Gas Rewards | Caps You Should Know | Annual Fee |

|---|---|---|---|---|

| Blue Cash Preferred (Amex) | 6% at U.S. supermarkets | 3% at U.S. gas stations | 6% on up to $6,000/yr at U.S. supermarkets, then 1% | (Has annual fee) |

| Blue Cash Everyday (Amex) | 3% at U.S. supermarkets | 3% at U.S. gas stations | 3% on up to $6,000/yr in each category (supermarkets, gas, online retail), then 1% | $0 |

| Citi Custom Cash | 5% on top eligible category | 5% on top eligible category | 5% on top category each billing cycle up to $500, then 1% | $0 (commonly) |

| AAA Daily Advantage Visa | 5% on groceries | 3% on gas/EV charging | Category rules apply (issuer/AAA program terms) | $0 |

| Bank of America Customized Cash Rewards | 2% grocery (auto) | 3% gas (when chosen) | 3% + 2% on up to $2,500 combined per quarter, then 1% | $0 |

Top 5 Cash Back Cards for Groceries and Gas (Jan 2026)

Here are the 5 Best Cash Back Cards for Groceries and Gas that can maximize everyday spend without making things complicated:

1) Blue Cash Preferred Card from American Express

If your grocery spending is consistently high, this is one of the strongest “set-and-forget” options because it earns 6% cash back at U.S. supermarkets (up to $6,000 per year) and 3% at U.S. gas stations. It’s best when your grocery rewards comfortably outweigh the annual fee.

| Best For | Pros | Cons |

|---|---|---|

| Heavy supermarket spend, families, big monthly grocery bills | 6% at U.S. supermarkets up to $6,000 per year; 3% at U.S. gas stations | Grocery bonus drops after cap; annual fee can reduce value for modest spenders |

2) Blue Cash Everyday Card from American Express

This is a strong no-annual-fee pick if you want steady rewards for both groceries and gas, plus a useful online retail bonus lane. It earns 3% cash back at U.S. supermarkets and U.S. gas stations (each up to $6,000 per year), which keeps your earning predictable.

| Best For | Pros | Cons |

|---|---|---|

| People who want solid grocery + gas rewards with no annual fee | 3% at U.S. supermarkets and 3% at U.S. gas stations, up to $6,000 per year in each category | Bonus rates are capped; “supermarket” coding can exclude some big-box/warehouse-style shopping |

3) Citi Custom Cash Card

This card is ideal if your spending shifts month to month and you want the card to automatically reward your biggest category. You earn 5% cash back on your top eligible spend category each billing cycle (up to $500), so it can be a grocery card one month and a gas card the next.

| Best For | Pros | Cons |

|---|---|---|

| People who want 5% on groceries or gas without tracking rotating calendars | 5% on top eligible category each billing cycle up to $500; no rotating category signup needed | Only one category earns 5% each cycle; after $500, that category drops to 1% |

4) AAA Daily Advantage Visa Signature

This is a strong grocery-first card with no annual fee, pairing 5% back on grocery store purchases with 3% on gas and EV charging. It’s best for people who want groceries to be the main driver while still getting a meaningful bonus rate at the pump.

| Best For | Pros | Cons |

|---|---|---|

| Grocery-heavy spenders who also want solid gas rewards without an annual fee | 5% on grocery store purchases; 3% on gas and EV charging; $0 annual fee | Reward caps and category definitions can materially change value, so you must check your card’s disclosures |

5) Bank of America Customized Cash Rewards

This card is a practical combo when you want groceries covered automatically and gas boosted via a chosen category. You get 2% at grocery stores and wholesale clubs, and 3% in a category you choose (gas is one of the options), but the combined quarterly cap is the main limiter.

| Best For | Pros | Cons |

|---|---|---|

| People who want a simple groceries + gas setup with one manageable cap | 3% category choice (gas if selected) plus 2% at grocery stores and wholesale clubs | 3% + 2% only applies to $2,500 combined per quarter, then 1% |

How To Choose The Right Card For Your Spend

A great grocery card can be a mediocre gas card, and vice versa. The fastest way to pick is to match your biggest category to the highest reliable rate.

If groceries are your biggest spend: Start with Blue Cash Preferred (high earn, cap) or AAA Daily Advantage (high earn, no fee)

If gas is your biggest spend: Choose a card that gives a permanent gas bonus (BofA category choice or Amex BCE)

If your spend varies month to month: Citi Custom Cash is the easiest “automatic optimizer”

Small Decision Table

| Your Situation | Best Style |

|---|---|

| You want set-and-forget | Amex Blue Cash Preferred / Blue Cash Everyday |

| You want the card to adapt monthly | Citi Custom Cash |

| You want a no-fee grocery-first powerhouse | AAA Daily Advantage |

| You want groceries + gas with one simple cap | BofA Customized Cash Rewards |

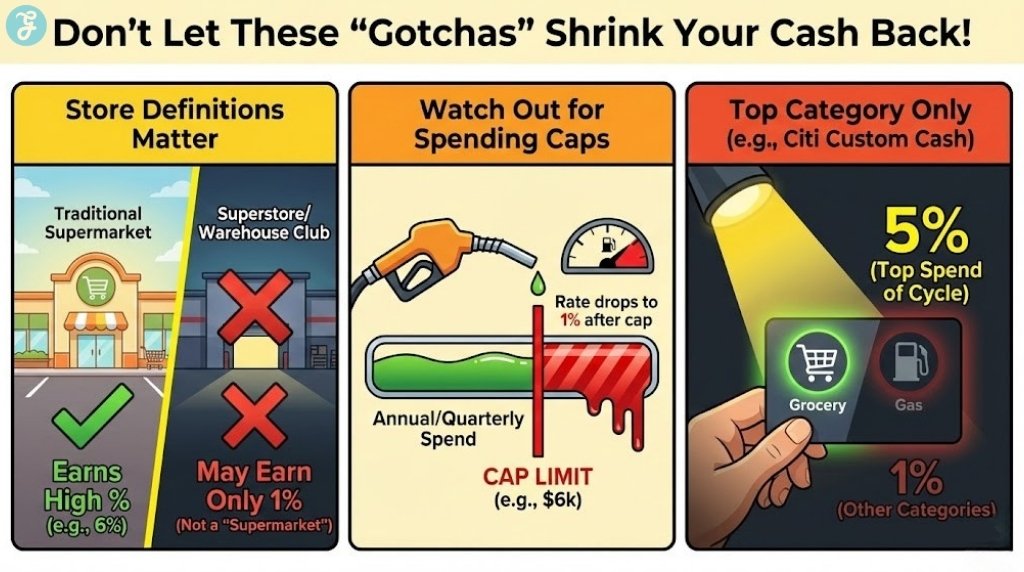

Gotchas That Can Kill Your Grocery And Gas Rewards

A lot of “bad” cash back results come from category definitions, not the rate.

Grocery definition: Some cards exclude superstores (like big-box retailers) and sometimes warehouse clubs from “supermarket” coding

Caps: Annual or quarterly caps can quietly reduce your effective rate if you spend heavily

One-category cards: Cards like Citi Custom Cash can be amazing, but only one category earns the top rate each billing cycle

A Simple Two-Card Setup That Often Wins

If you want maximum cash back with minimal hassle, a two-card combo is usually the sweet spot.

Option A: Blue Cash Preferred for groceries + Citi Custom Cash for gas (when gas is your top category that month)

Option B: AAA Daily Advantage for groceries + Blue Cash Everyday as a backup for gas/online when it fits your spend

Wrap-Up

The best cash back card for groceries and gas in Feb 2026 is the one that fits how you actually shop, not the one with the biggest headline number. If you spend heavily at supermarkets, Blue Cash Preferred can be a monster earner. If you want no annual fee and easy rewards in both categories, Blue Cash Everyday and AAA Daily Advantage are straightforward options.

Always check category rules and caps before you commit, because that’s where “5% back” often turns into “1% back” without you noticing.