As a freelancer in Ireland, understanding how to manage your taxes effectively is essential for maximizing your income. Unlike traditional employees, freelancers bear full responsibility for their tax obligations, which can be overwhelming without proper planning.

Fortunately, there are Simple Tax-Saving Strategies for Freelancers in Ireland that can significantly reduce your taxable income while ensuring compliance with Revenue regulations.

In this guide, we will explore 10 Simple Tax-Saving Strategies for Freelancers in Ireland that will help you keep more of your hard-earned money, optimize your tax liabilities, and stay on top of your financial obligations.

Whether you’re new to freelancing or a seasoned professional, these strategies will provide actionable insights to improve your financial health.

Understanding Freelancer Taxes in Ireland

Freelancers in Ireland operate as sole traders or through limited companies, which dictates their tax responsibilities. As a freelancer, you are required to:

- Register with Revenue as a self-employed individual.

- File an annual tax return under the self-assessment system.

- Pay income tax, Universal Social Charge (USC), and Pay-Related Social Insurance (PRSI) on your earnings.

- Make preliminary tax payments to cover the following year’s tax liability.

- Keep detailed financial records for at least six years as required by Irish tax law.

Why Tax Planning Matters for Irish Freelancers?

Proper tax planning ensures you:

- Minimize tax liability through deductions and allowances.

- Avoid penalties by staying compliant with tax regulations.

- Improve cash flow by managing tax obligations efficiently.

- Maximize earnings by structuring your income strategically.

- Plan for long-term financial security through smart tax-saving investments.

Maximizing Your Tax Savings – 10 Proven Strategies

Freelancers in Ireland often struggle with tax efficiency due to the complexity of the tax system. However, by implementing Simple Tax-Saving Strategies for Freelancers in Ireland, you can significantly lower your taxable income while ensuring compliance with Revenue regulations. From registering correctly to optimizing deductions, these practical strategies will help you keep more of your hard-earned money.

1. Register as Self-Employed and Stay Compliant

Why it matters: Registering with Revenue ensures that you are legally recognized and can claim tax deductions. It provides you with a legal framework to operate within, allowing you to access various tax reliefs and avoid unnecessary penalties.

Moreover, it builds credibility with clients and opens up opportunities for financial assistance, such as business loans or grants. Proper registration ensures that you are not caught off guard by unexpected tax liabilities, keeping your freelance career sustainable and financially stable.

Steps to Register:

- Visit the Revenue Online Service (ROS) and register as a sole trader.

- Obtain a Tax Reference Number (TRN) for tax filing.

- Keep proper financial records to file annual returns.

- Familiarize yourself with VAT and preliminary tax obligations to avoid non-compliance issues.

2. Claim Business Expenses to Reduce Taxable Income

Why it matters: Deducting eligible business expenses lowers the taxable income, reducing overall tax liability. By carefully tracking and claiming business-related expenses, freelancers can significantly decrease their taxable income, ultimately leading to a lower tax bill.

This strategy not only ensures compliance with Irish tax regulations but also helps freelancers reinvest savings into their business growth, improving long-term financial stability. Failing to claim eligible expenses means missing out on legitimate tax reductions, making it crucial to maintain detailed records and stay informed about deductible costs.

Essential Deductible Expenses for Freelancers:

| Expense Type | Examples |

| Office Costs | Rent, utilities, co-working space fees |

| Equipment & Software | Laptops, design tools, subscriptions |

| Travel Expenses | Business trips, mileage (if applicable) |

| Marketing & Advertising | Website hosting, social media ads |

| Training & Development | Online courses, workshops |

| Professional Services | Accountant, legal fees, tax advisor |

| Insurance | Professional indemnity, business insurance |

Tip: Always maintain accurate records and keep receipts for verification.

3. Utilize the Home Office Deduction Effectively

Why it matters: If you work from home, you can claim a portion of your household expenses as business costs. This allows freelancers to significantly reduce their taxable income by deducting necessary expenditures such as rent, utilities, and internet bills.

With more freelancers opting for remote work, taking advantage of this deduction can lead to considerable tax savings. However, it’s crucial to ensure that the home office meets Revenue’s definition of exclusive business use to qualify for these deductions without complications.

How to Calculate Home Office Deduction:

- Identify the percentage of your home used exclusively for work.

- Apply that percentage to your rent, electricity, heating, and internet bills to determine the deductible amount.

- Ensure your home office meets Revenue’s definition of exclusive business use to avoid complications.

4. Take Advantage of the Flat-Rate Expenses Scheme

Why it matters: The Irish Revenue allows certain professions to claim a fixed deduction without detailed receipts. This simplifies tax filing for freelancers, reducing the burden of tracking individual expenses.

By leveraging this scheme, freelancers can save time while ensuring they benefit from allowable deductions. This deduction is particularly advantageous for professionals with common, recurring business expenses that are difficult to document individually, helping them maximize their tax savings efficiently.

Who Qualifies?

- Writers, designers, and IT professionals.

- Those using personal resources for business purposes.

- Self-employed individuals working in industries with predefined flat-rate expense allowances.

5. Consider Incorporating Your Freelance Business

Why it matters: A Limited Company offers tax advantages, such as a 12.5% corporate tax rate, compared to higher personal income tax rates. Incorporating as a limited company can also provide added financial security, as business liabilities remain separate from personal assets.

Additionally, limited companies may benefit from more deductible expenses, allowing for further tax savings. High-earning freelancers can also take advantage of tax-efficient salary structures, dividend payments, and pension contributions to optimize their income while reducing tax burdens. Proper financial planning and consultation with a tax advisor can ensure freelancers maximize the benefits of incorporation.

Sole Trader vs. Limited Company Tax Benefits:

| Business Type | Tax Rate | Suitable for |

| Sole Trader | Up to 52% | Small-scale freelancers |

| Limited Company | 12.5% Corporate Tax | High-earning freelancers |

Tip: Consult a financial advisor before incorporating to determine if it’s the right move for your business.

6. Leverage the VAT Threshold to Your Advantage

Why it matters: If your earnings exceed €37,500 per year, you must register for VAT. However, voluntarily registering allows you to reclaim VAT on business purchases. This means that freelancers who frequently incur VAT on essential business expenses—such as software subscriptions, office supplies, and professional services—can recover these costs, ultimately reducing overall business expenses.

Additionally, VAT registration can enhance the credibility of your business, making you appear more professional and trustworthy to potential clients, particularly those in the corporate sector. While registering for VAT does require additional administrative work, the potential savings and benefits often outweigh the effort required to comply with VAT regulations.

Benefits of VAT Registration:

- Reclaim VAT on equipment and software purchases.

- Enhance credibility with corporate clients.

- Simplify compliance with European trade laws.

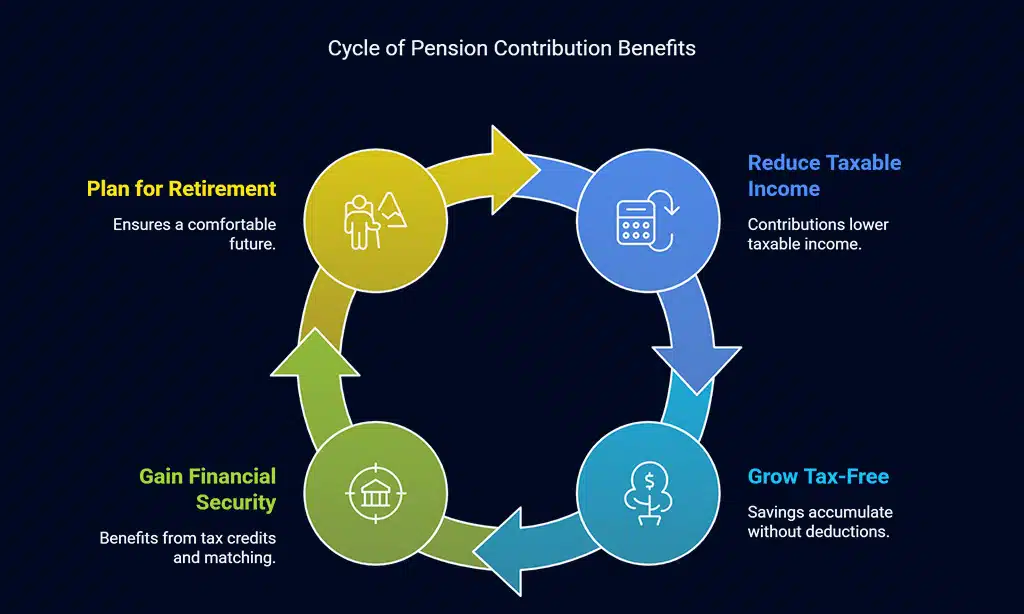

7. Use Retirement Contributions to Lower Tax Liabilities

Why it matters: Contributions to pension schemes reduce taxable income and secure your future. By setting aside funds for retirement, freelancers can take advantage of significant tax relief while building long-term financial stability. Additionally, pension contributions grow tax-free, meaning your savings accumulate without immediate deductions.

Freelancers who invest in pension schemes can also benefit from government incentives, such as tax credits and employer-matching contributions, providing additional financial security. Planning ahead with a well-structured pension strategy ensures a comfortable retirement while maximizing current tax savings.

Best Pension Plans for Freelancers in Ireland:

- Personal Retirement Savings Account (PRSA)

- Self-Employed Pension Plans

- Additional Voluntary Contributions (AVCs) for increased savings

8. Optimize Your Income with Tax Credits and Reliefs

Why it matters: Taking advantage of tax credits helps reduce overall tax payments. By leveraging available tax reliefs, freelancers can significantly lower their taxable income, ensuring they retain more of their hard-earned money. Tax credits directly reduce the amount of tax owed, making them an essential tool for optimizing financial efficiency.

Understanding and utilizing the right credits can provide substantial savings, allowing freelancers to reinvest in their businesses, plan for future growth, and maintain better financial stability. Failing to claim eligible tax credits can mean unnecessarily overpaying on taxes, making it crucial to stay informed about available relief options.

Key Tax Credits for Freelancers:

- Earned Income Tax Credit

- Home Carer Tax Credit (if applicable)

- Health Insurance Relief

- Rent Tax Credit

- R&D Tax Credits (for qualifying industries)

9. Plan for Your Tax Bill with Preliminary Tax Payments

Why it matters: Avoid fines and interest by paying your preliminary tax on time each year. Making timely preliminary tax payments ensures that you stay compliant with Irish tax regulations, preventing unexpected tax bills and financial strain.

By planning ahead and estimating your tax obligations correctly, freelancers can better manage cash flow and avoid the stress of last-minute payments. Additionally, paying your preliminary tax on time helps build a positive tax record with Revenue, which may be beneficial for future financial applications, such as business loans or grants.

10. Work with a Tax Advisor for Maximum Savings

Why it matters: A professional tax consultant can help optimize deductions and prevent costly mistakes. They have in-depth knowledge of tax laws and regulations, ensuring you take advantage of every available deduction and relief. A consultant can also assist in structuring your finances more efficiently, reducing your overall tax liability.

Additionally, they help prevent costly errors that could lead to penalties or audits, providing peace of mind and allowing you to focus on growing your freelance business. Hiring a tax expert may seem like an added expense, but the long-term savings and financial benefits often outweigh the initial cost.

How to Choose the Right Tax Consultant:

- Look for certified Chartered Accountants with freelancer experience.

- Seek advisors offering affordable fixed-rate packages.

Wrap Up

Implementing these Simple Tax-Saving Strategies for Freelancers in Ireland can significantly reduce your tax burden while ensuring compliance. By claiming deductions, leveraging tax credits, and maintaining proper records, you can retain more of your income while securing your financial future.

Stay proactive, consult a tax professional when needed, and optimize your freelance business for long-term success.