Credit cards have become the go-to way Americans pay for everyday items, from groceries to gas. But how secure are your credit cards? In a world of digital fraud, identity theft, and cybercrime, there are several things you need to know about credit card security.

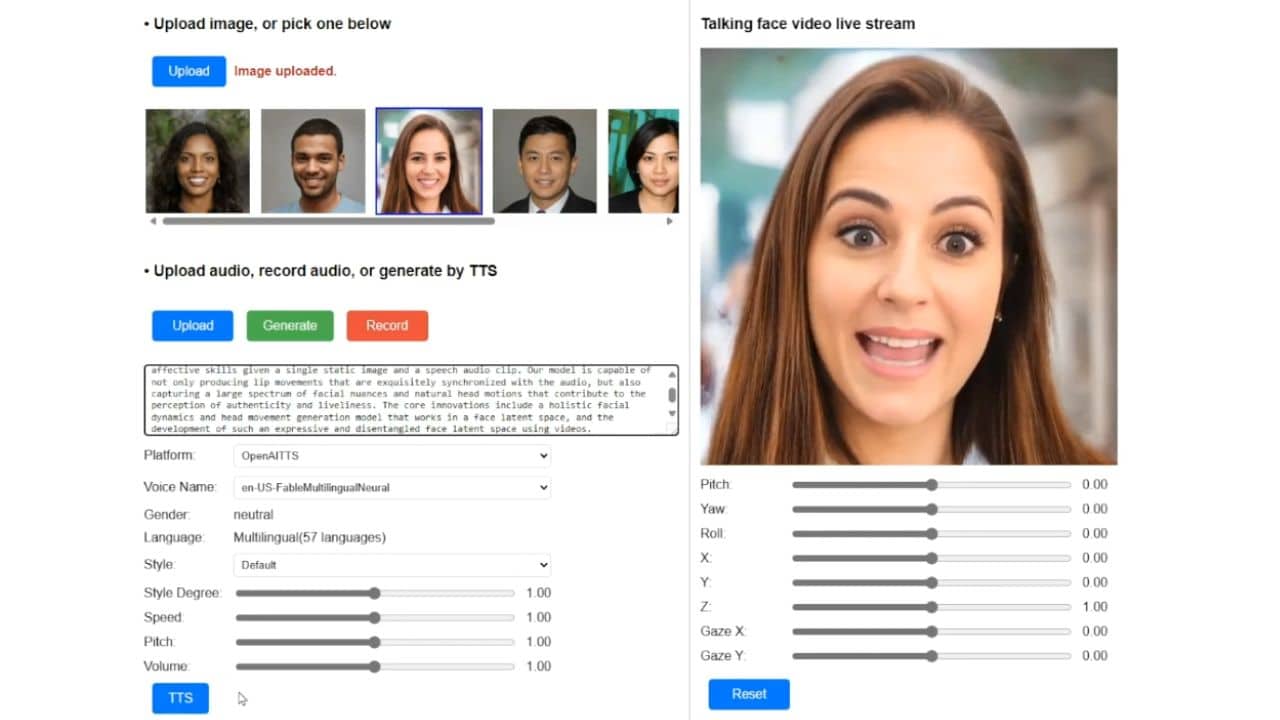

Credit card fraud

Credit card fraud has had a steady incline over the past few years. The most common types of fraud are account takeovers involving criminals using a person’s personal information to open a new account.

Businesses also fall victim to such fraud. When criminals use stolen credit card information to buy goods, it can lead to a chargeback. A chargeback happens when a consumer contacts their credit issuer and demands that the issuer reverses the transaction due to fraud. Merchants may suffer irreparable harm if it happens too often.

People can avoid credit card fraud by using virtual cards from providers like Divvy (https://getdivvy.com/). Virtual cards can regenerate a unique 16-digit number for each transaction, keeping your true financial information safe from criminals.

High fees

Credit cards come with many fees, which has led many consumers to struggle with unexpected charges. Some common examples include:

- Cash advance fee

- Late payment fee

- Balance transfer fee

- Over-the-limit fee

If you don’t read the fine print, you could end up paying dearly for your layaway financial solutions.

Staying in debt

Many people become so reliant on their cards that they cannot pay the balance month after month. These consumers may remain in the cycle of debt for years or even decades as interest and late fees compound.

Fine print

Many credit cards have hidden clauses and restrictions that consumers might not know. You can find many examples in the terms and conditions section of the application. This section may state that consumers are responsible for fraudulent charges even if they haven’t used the card.

High-interest rates

High-interest rates mean that the card will cost you a lot of money if you don’t pay off your balance in full every month. The average U.S. credit card has a 16% APR, but some cards go as high as 28%.

These APR rates can add a lot of extra charges if you don’t pay off the entire balance every month, and it will also take much longer to pay off your bill.

Tanking your credit score

Bad credit history can hurt many things in your life. You won’t qualify for another credit card, loan, or mortgage if you have bad credit.

Employees with low credit scores from late payments are often less likely to be hired when it comes to jobs. Similarly, landlords use the credit score to help assess whether or not they will rent an apartment to you.

Temptation to overspend

Credit cards make it easy for people to buy things they know they can’t afford. If you swipe your credit card at the grocery store, there is no need to stop yourself from buying snacks or other items that aren’t necessary.

Not managing a personal budget

A common problem among those who struggle with debt is that they don’t understand how to manage a personal budget. Constantly using credit over cash and taking out loans is a sure way to dig deeper and deeper into debt.

Once you learn how to manage your cash-based income and expenses, it will be much easier for you to determine what you can afford. Then you will know if you should use a credit card or cash to pay for items.

Final thoughts

Credit cards are a convenience, but they can also be dangerous. The last thing anyone wants is to end up in debt or get their identity stolen. Be sure you understand all of the risks associated with credit card use before making your next purchase.