Cryptocurrency adoption is set to reshape society by 2025. The Social Impacts Of Widespread Crypto Adoption will touch nearly every aspect of life, from banking to the environment.

Over 1 billion people without official documents could gain digital identities through blockchain technology, offering them access to financial systems. DeFi platforms could provide lending and earning opportunities for the unbanked, bypassing traditional banks entirely.

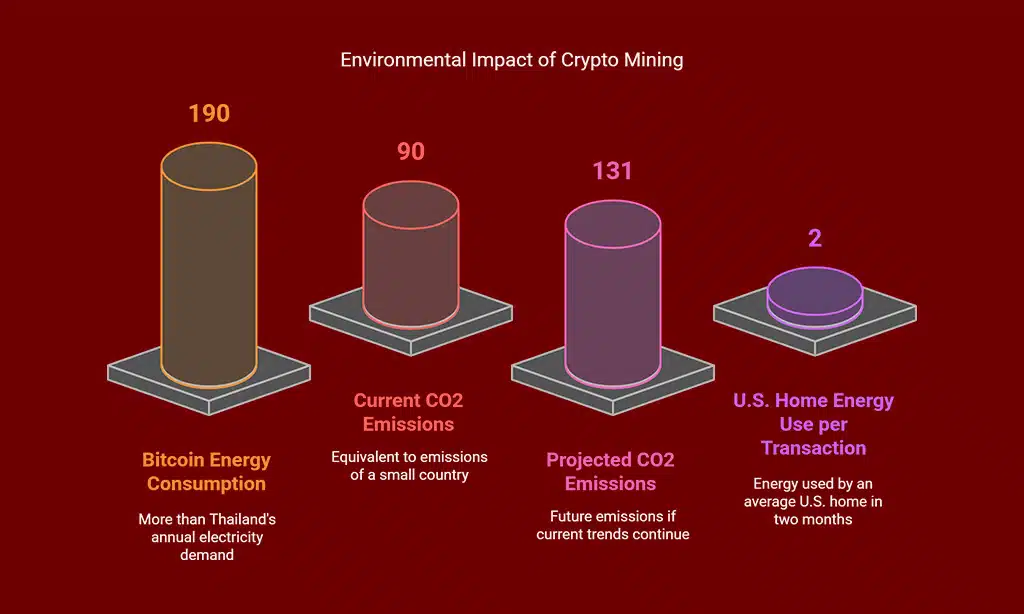

Bitcoin’s energy use already surpasses Thailand’s annual consumption, and its carbon footprint may grow to 131 million metric tons of CO2 by 2025. Ethereum’s shift to proof-of-stake shows progress to greener practices.

The Crypto Climate Accord aims to make mining more sustainable with UN support.

Decentralization promises economic empowerment but faces challenges like regulation and social governance risks. Blockchain’s transparency can strengthen peer-to-peer trust networks while challenging traditional banking systems.

Governments are exploring pathways like renewable energy incentives or bans on high-energy mining methods due to environmental concerns.

These changes bring both promise and problems that demand attention in the coming years.

Keep reading for a closer look at how crypto will shape our world in 2025!

Key Takeaways

- Cryptocurrency adoption will help over 1 billion unbanked people gain access to financial services by 2025 through blockchain-based digital identities.

- Bitcoin mining consumes 190 terawatt-hours yearly, more than Thailand’s total electricity, raising environmental concerns.

- Decentralized finance (DeFi) platforms cut transaction costs and let users borrow, lend, and earn interest without traditional banks.

- Crypto promotes social equality by removing financial barriers and enabling peer-to-peer transactions globally.

- Regulation challenges arise as crypto’s decentralized nature clashes with traditional financial oversight systems.

Financial Inclusion for the Unbanked

Cryptocurrency adoption in 2024 could bring financial services to millions without bank accounts. Over a billion people lack official identification, but blockchain technology can create secure digital identities for them.

This change allows access to basic financial tools like savings and payments.

DeFi platforms let users borrow, lend, and earn interest without traditional banks. These systems cut transaction costs and open doors for those left out of the mainstream economy.

Financial inclusion through digital currency can level the playing field for developing countries.

Economic empowerment grows as more people join the global market. Next, decentralization reshapes how money is controlled and freedom is experienced.

Keywords used: blockchain technology, decentralized finance (defi), cryptocurrency adoption, financial inclusion, developing countries

Economic Empowerment Through Decentralization

Decentralized finance empowers individuals to take direct control over their money without heavy involvement from banks. It allows decisions to be made directly through smart contracts.

This eliminates intermediaries who typically impose fees or cause delays. Imagine easily purchasing homes online using digital tools like non-fungible tokens linked directly to home offices around the world – an intriguing concept, right?

Community-based currencies are emerging everywhere, primarily due to the low costs associated with establishing locally managed networks across towns and cities globally.

By backing projects within neighborhoods, participants feel empowered, knowing contributions are genuinely helping to improve lives in communities.

Together, people move forward with unified determination, resilience, and shared values, building a brighter and prosperous future for all.

Enhanced Financial Freedom and Independence

Decentralization doesn’t just empower economies, it reshapes how people handle money. Cryptocurrencies let individuals manage wealth without relying on traditional banks. This shift gives more control over finances, cutting out middlemen and reducing fees.

DeFi platforms make lending, borrowing, and earning interest accessible to anyone with an internet connection. These tools lower transaction costs and open doors for those excluded from conventional systems.

Financial independence becomes a reality as users take charge of assets directly through digital wallets and smart contracts.

Social Equality Through Reduced Barriers

Crypto adoption can break down financial walls, giving more people access to opportunities. Blockchain technology creates tamper-proof digital identities for over 1 billion people without official documents.

This helps those left out of traditional systems.

Decentralized systems remove gatekeepers, allowing anyone to participate in the economy. Local communities can use tokens to fund projects and reward positive actions. These tools promote fairness by cutting out middlemen and reducing bias.

This shift supports global cooperation, aligning with UN Sustainable Development Goals. Next, crypto is changing philanthropy and community support.

Philanthropy and Support for Community Projects

As social equality grows through reduced barriers brought by crypto, blockchain technology transforms how people give back. It makes charitable donations transparent and traceable, especially helpful where traditional banks are weak.

This builds trust among donors who want money used well.

DAOs align directly with UN Sustainable Development Goals, boosting global teamwork and aid during crises. Meanwhile, community tokens let locals create their own digital currencies. These fund small projects and reward good behavior, empowering areas sidelined by bigger economies.

Cultural Shifts in Global Financial Perspectives

Crypto adoption is reshaping how people view money. Traditional banks are no longer the only option for managing finances. Decentralized systems like blockchain technology offer new ways to handle digital assets.

This shift challenges old ideas about control and trust in financial markets.

Ethereum’s move to proof-of-stake shows a push for energy efficiency. It also highlights a cultural change to sustainable practices in finance. People are becoming more aware of environmental costs tied to cryptocurrency mining.

Renewable energy sources like solar power are gaining attention as solutions.

Peer-to-peer transactions are growing, reducing reliance on central banks. Digital currencies provide financial autonomy, especially in regions with unstable economies. This global perspective fosters innovation and questions traditional banking norms.

The rise of decentralized finance (DeFi) encourages transparency and fairness in the global economy.

Cultural attitudes toward wealth and investment are evolving too. Non-fungible tokens (NFTs) and smart contracts introduce creative uses for digital assets. These tools empower individuals to explore new economic opportunities without middlemen.

The conversation around cryptocurrency regulation reflects broader societal changes too. Policymakers must balance innovation with environmental sustainability. As awareness grows, demand increases for user-friendly renewable energy-powered solutions.

Environmental Concerns Linked to Crypto Mining

Crypto mining guzzles energy like a marathon runner needs water. Bitcoin alone uses about 190 terawatt-hours yearly, more than Thailand’s entire electricity demand. Every transaction burns through the same power an average U.S. home uses in two months.

The carbon footprint is staggering—90 million metric tons of CO2 per year, with projections hitting 131 million soon. Mining rigs also pile up electronic waste, poisoning soil and water if not recycled right.

Some mines tap renewable energy sources like wind or solar to cut emissions, but dirty fuel still powers many operations globally. The race to profit from digital currency should not leave scorched earth behind.

Strengthening Peer-to-Peer Transactions and Trust Networks

Cryptos make peer-to-peer transactions faster without middlemen like banks getting involved directly connecting buyers and sellers worldwide securely quickly easily thanks to blockchain technology that ensures transparency and safety built right into decentralized ledgers.

Everybody sees everything clearly, openly, and honestly, cutting fraud risk dramatically and boosting confidence between strangers doing deals online.

Efforts continue with smooth, flowing, uninterrupted, hassle-free exchanges that are often exciting, satisfying, reliable, and practical. Efficiency is evident in systems that are brilliant, innovative, modern, advanced, and forward-looking.

Adoption’s Role in Fostering Innovation and Technology Growth

Widespread cryptocurrency adoption pushes innovation forward. Decentralized systems like Ethereum’s smart contracts enable new tech solutions. These tools help biotech DAOs advance cancer research through collaboration.

They also support climate-focused DAOs in tokenizing resources like rainforests to fight carbon emissions, balancing environmental sustainability with growth.

Blockchain technology drives progress in areas beyond finance, too. Public blockchains allow for permissionless access, fostering global cooperation and creativity. This aligns with UN Sustainable Development Goals, encouraging a shared effort to tackle challenges.

With energy-efficient practices like proof of stake becoming standard, the crypto ecosystem continues to evolve responsibly while sparking technological breakthroughs worldwide.

Takeaways

Crypto adoption in 2025 will reshape society. It brings financial tools to the unbanked and boosts global equality. Yet, challenges like energy use and regulation remain. The future hinges on balancing innovation with sustainability.

Together, we can build a fairer, greener world with crypto leading the way.

FAQs

1. How does cryptocurrency adoption affect energy consumption?

Cryptocurrency mining uses a lot of power, especially with proof of work systems. This can increase energy consumption and carbon footprint. Switching to renewable energy sources like solar or wind power can help reduce this impact.

2. Can blockchain technology help fight climate change?

Yes, decentralized systems like blockchain can promote sustainable practices. Using renewably sourced energy for mining operations and improving energy efficiency are steps to decarbonizing the crypto ecosystem.

3. What role does financial inclusion play in crypto adoption?

Cryptocurrencies offer financial autonomy to people without access to traditional banks, especially in poorer regions like the Democratic Republic of Congo. Peer-to-peer transactions and decentralized finance (DeFi) empower individuals economically.

4. Are NFTs bad for the environment?

NFTs often rely on blockchain networks that consume significant energy, contributing to environmental concerns if powered by unsustainable methods. Using renewable energy sources could make them more eco-friendly over time as technology evolves into 2025.

5. How do smart contracts improve regulatory compliance?

Smart contracts automate agreements on decentralized ledgers, ensuring transparency while adhering to set rules. This reduces information asymmetry between parties involved, making it easier to manage digital assets in a legally compliant way across global economy platforms.

Disclaimer: This article is informational and does not constitute financial advice. Please consult a professional for financial guidance.