Samsung Transparent Micro-LED isn’t just a flashy trade-show stunt. It tests whether screens can disappear into home décor while staying brighter than OLED, at a time when premium TV upgrades and “ambient” computing are colliding. The real gatekeepers are cost, manufacturing yields, and whether transparency becomes useful beyond novelty.

How We Got Here: From Modular Walls To See-Through Screens

Samsung has spent years training consumers to accept a counterintuitive idea: the “best” screen might not look like a TV at all. Its MicroLED push began in the luxury stratosphere—large, modular displays positioned as architectural objects as much as entertainment devices. That framing matters because Transparent Micro-LED is less a single product launch and more a directional bet about what the living room becomes next.

Samsung’s transparent concept emerged from a long R&D arc and was shown as a technology showcase rather than a retail-ready SKU. Early hands-on impressions stressed that it was a prototype. In practical terms, that means the hard part is no longer proving it can be built. The hard part is proving it can be sold, installed, and lived with.

Since then, the competitive landscape has changed in a key way: transparent TVs are no longer purely conceptual. LG commercialized a transparent OLED TV at an ultra-luxury price, signaling that the category can ship—but only at a level that behaves more like custom interior design than consumer electronics. At the same time, Samsung’s own buyable MicroLED TVs have remained extremely expensive, reinforcing how far MicroLED still is from conventional premium-TV pricing.

The result is a sharper question for 2026: not “can transparent MicroLED exist?” but “can it cross the line from spectacle to living-room product—without sacrificing the things people actually buy TVs for?”

| Milestone | What Happened | Why It Matters For Consumer Readiness |

| 2018 | Samsung introduced modular MicroLED concepts at CES-era showcases | Established MicroLED as a premium platform, not mass-market TV tech |

| Early 2024 | Samsung demonstrated Transparent Micro-LED publicly | Highlighted a shift from “best picture” to “new role for screens in space” |

| Early 2024 | Reviewers emphasized prototype status | Signals unresolved productization: cost, installation, use-case clarity |

| 2024–2025 | Transparent OLED shipped commercially at ~$60K | Proves transparency can ship, but only as ultra-luxury |

| 2025 | Market research forecast flat TV unit growth but strong growth in Mini LED and very large sizes | Suggests consumers are rewarding “bigger/brighter/value,” not transparency—yet |

The Transparency Trade-Off: Why See-Through Is Not Free

A transparent display asks consumers to accept a fundamental compromise: you are giving up the TV’s most reliable advantage—controlling the visual environment behind the image. Traditional TVs are designed to isolate content from the room. Transparent TVs fuse content with the room.

That changes what “good” looks like.

In a bright living room, transparency introduces legibility and contrast challenges. Dark scenes can appear washed out if the space behind the panel is bright. Reflections can become more obvious because the panel must behave like glass. Even the idea of “black” becomes complicated: if the screen is transparent, the “black” area is partly the room itself.

This is why the most practical transparent-TV implementations build in an escape hatch: a mode that turns the display opaque for conventional viewing. That acknowledges a basic consumer truth—people want the transparent wow factor for décor and the normal TV experience for movies, sports, and gaming.

Samsung’s transparent MicroLED demonstrations, however, hint at a different ambition: a screen that behaves like an overlay on reality—sports stats, UI elements, art layers, and “floating” visuals that feel almost architectural. That is a compelling future, but it is also a different category from “television.” It competes with interior design, lighting, and attention economics as much as it competes with OLED.

| Approach | How It Delivers Transparency | Strengths | Consumer Weaknesses |

| Transparent OLED TV with switchable backing | Transparent for décor, opaque for normal viewing | Practical “best of both,” clearer use case | Complex, expensive, still niche |

| Transparent MicroLED concept | Transparency paired with very high brightness potential | Strong “overlay” storytelling, durable materials potential | Harder to guarantee contrast in varied rooms; premium-only economics |

| Transparent LCD signage | Backlight-based transparency | Mature supply chain, common in retail | Typically lower contrast, less “premium TV” feel |

| Projection / HUD-like glass systems | Projects onto glass or uses combiner optics | Great for info overlays | Not a TV replacement; geometry constraints |

Manufacturing Reality Check: MicroLED’s Hardest Problem Is Still Making It

Transparent MicroLED is not blocked by imagination. It is blocked by manufacturing economics.

MicroLED’s long-running challenge is the difficulty of assembling enormous numbers of microscopic emitters with high precision and high yield. When yields are low, costs explode. When costs explode, the market collapses into a narrow band of luxury installs.

Industry analysis over the last two years has been consistent on two points:

- The biggest breakthroughs required are not in “picture quality theory” but in production steps—transfer, alignment, backplane integration, and defect management.

- MicroLED’s near-term adoption is expected to be led by niches that can pay for its advantages, while the broader consumer-TV market continues to be dominated by OLED and increasingly advanced LCD variants (Mini LED and emerging RGB backlight approaches).

Transparency raises the bar further. On a normal TV, you can hide structural and electronic compromises behind bezels, back housings, and clever industrial design. On a transparent TV, everything is visible: seams, driver boards, cable paths, edge treatments, and even the sense of thickness. A transparent product must look “finished” from angles conventional TVs rarely care about.

That increases cost in two ways:

- More demanding defect tolerance: visual imperfections become easier to spot.

- More demanding packaging: the industrial design must conceal what transparency naturally reveals.

| Manufacturing Constraint | Why It Matters For Transparent MicroLED | What “Ready” Looks Like |

| Yield and defect management | Transparency exposes seams and artifacts | Uniformity suitable for bright rooms, low defect visibility |

| Mass transfer and alignment complexity | MicroLED requires precise placement at huge scale | Highly automated, predictable cost per inch |

| Backplane and driver integration | Electronics become part of what users see | Clean edge packaging, hidden routing, minimal visible hardware |

| Resolution economics | Pushing 4K+ increases complexity and cost | Consumer-size 4K at non-six-figure pricing |

| Installation and service | Glass-like object in a real home | Standard mounting options, serviceability, retail-grade warranties |

The Business Case: Luxury Object, Practical Screen, Or A New Category?

Consumer readiness is not a single technical moment. It is a price-and-purpose moment.

Right now, transparent TVs are proving one thing clearly: there is a market, but it behaves like luxury décor.

An ultra-luxury transparent OLED at roughly $60,000 establishes the category’s current price anchor. Meanwhile, Samsung’s purchasable MicroLED pricing in the six-figure range for certain sizes shows how far MicroLED still is from even “premium consumer” economics. If transparent MicroLED adds manufacturing and packaging complexity on top of an already costly platform, it is not heading toward mainstream retail anytime soon.

So why pursue it at all?

Because transparent MicroLED can create value in ways that standard TVs cannot—especially for people who treat their living space as a designed environment rather than a media cave. The strongest consumer narratives are not about “better picture.” They are about “better living with a screen.”

The Space Narrative

A TV is often the ugliest object in an otherwise curated room. Transparency offers a radical fix: the screen visually disappears when not in use, reducing the sense that the room is arranged around a black rectangle.

The Ambient Narrative

A transparent display naturally supports “glanceable” information—weather, calendar, smart-home dashboards, art overlays, sports stats. It is less about cinema and more about continuous utility.

The Premium Lifestyle Narrative

Luxury homes, yachts, hospitality suites, and high-end retail environments care about design impact and customization. Those buyers also tolerate professional installation and higher service costs, which can help early categories survive.

Market research on transparent display adoption supports this direction: retail signage and commercial environments remain major drivers, while automotive and other “transparent-required” contexts are growing as well. That suggests home adoption is more likely to be downstream of commercial scale and automotive maturation than the other way around.

| Who Gains If Transparent MicroLED Matures | Why | Who Loses | Why |

| Luxury AV installers and integrators | High-margin installs + design-driven differentiation | “TV-as-furniture” conventional designs | Less differentiation when screens disappear |

| Premium hospitality & retail | Experience-driven environments reward transparent effects | Mid-tier digital signage | Pressure to upgrade experiences, not just screens |

| Automotive/HUD ecosystems | Transparent display know-how transfers to vehicles | Basic HUD suppliers | Higher performance raises expectations |

| MicroLED supply chain partners | Niche growth improves learning curves | Single-technology bets | Being leapfrogged by cheaper alternatives |

The Market Trend Reality: Consumers Are Buying Bigger And Brighter, Not See-Through

One of the most important reasons Samsung may hesitate to rush transparent MicroLED into retail is that the strongest demand signals in TV are elsewhere.

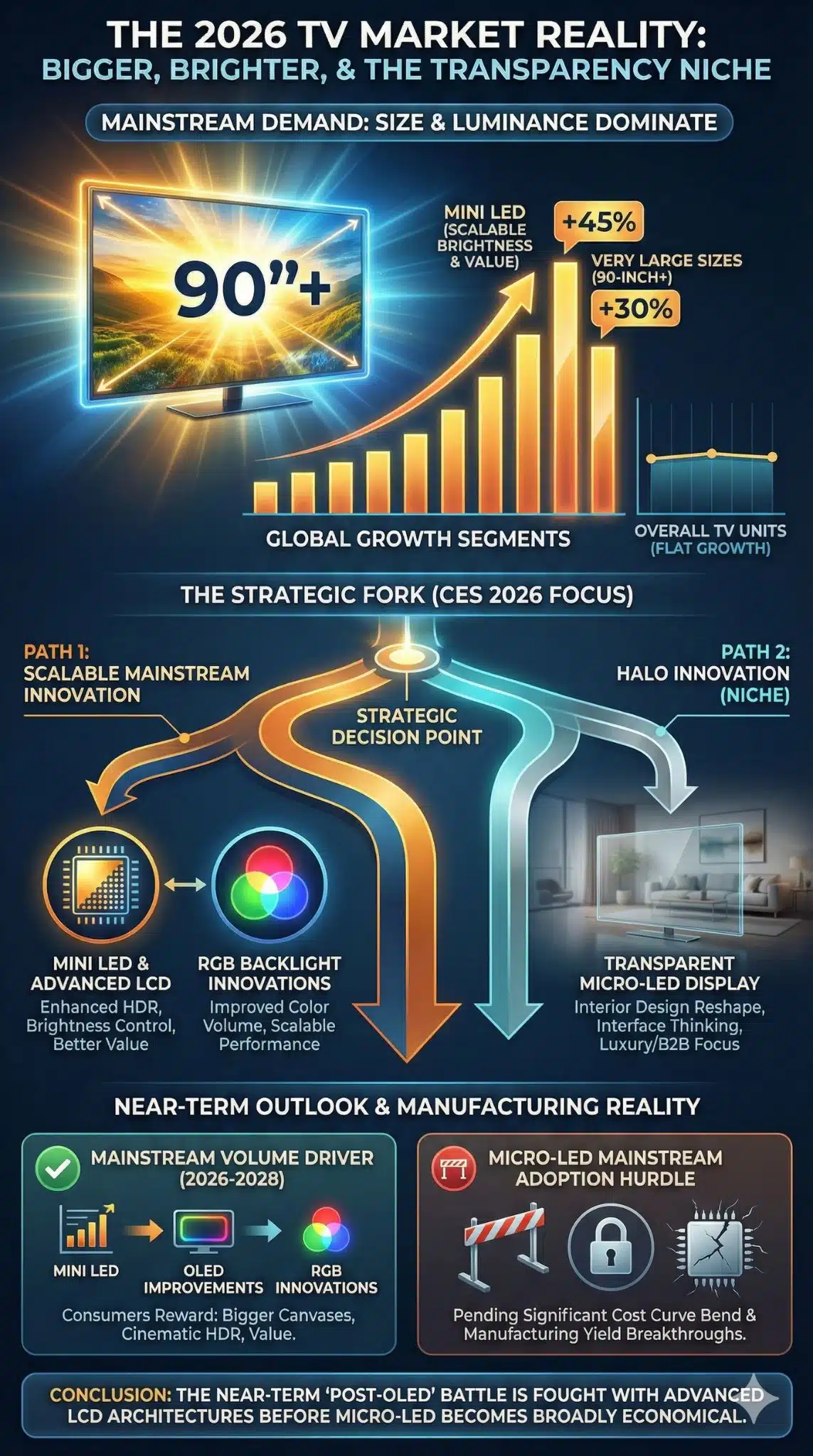

Recent market forecasts show global TV unit shipments hovering around flat, while the biggest growth pockets sit in:

- Mini LED TVs

- Very large screen sizes (90-inch and above)

This pattern tells you what the average premium buyer is rewarding: improved HDR performance, better brightness control, larger cinematic canvases, and stronger value for money. Mini LED, in particular, has advanced rapidly because it improves perceived contrast and brightness without the manufacturing leap that MicroLED requires.

At CES 2026, industry attention continued shifting toward new methods of delivering better color and brightness—such as RGB-focused backlight innovations—suggesting that the near-term “post-OLED” battle may be fought with advanced LCD architectures before MicroLED becomes broadly economical.

This is the strategic fork:

- MicroLED transparency is a halo innovation that reshapes interior design and interface thinking.

- Mini LED and emerging RGB approaches are scalable innovations that reshape the mainstream TV value curve.

Samsung can rationally pursue both, but only one is likely to drive volume in the next few years.

The Ecosystem Problem: A Transparent TV Needs Transparent-Native Software

Even if Samsung solved manufacturing costs tomorrow, transparency would still face a software challenge: most content is designed for opaque rectangles.

Movies and prestige TV assume controlled contrast and a dark surround. A transparent panel in a bright room is the opposite environment. That means transparent TVs need experiences that are built to exploit the form factor rather than fight it.

A “transparent-native” ecosystem likely includes:

- Overlay-first interfaces that treat the room as the background

- Context-aware brightness/contrast controls that adapt to ambient light and background complexity

- Purpose-built modes (art, glanceable info, smart-home dashboards, sports overlays)

- Better reflection management and UI legibility design (fonts, edge outlines, contrast-safe color systems)

This is where Samsung’s transparent MicroLED demonstrations quietly point: the company is not merely exploring a TV. It is exploring ambient computing in the living room—screens as architectural layers, not devices.

But that future also introduces consumer friction:

- Attention and distraction: always-on overlays can degrade the “home as refuge” feeling.

- Privacy: glanceable surfaces can expose personal information to visitors.

- Social dynamics: transparency makes the display part of the room’s shared visual environment even when someone is not “watching TV.”

Consumer readiness, then, is partly a question of whether companies can design transparent experiences that feel helpful rather than invasive.

Expert Perspectives: The Case For And Against Consumer Readiness

A neutral analysis has to admit both realities:

Why Some Analysts Would Say “Yes, It’s Getting Ready”

- Transparent display products have moved from concept to commercial reality (even if at luxury prices).

- MicroLED investment is expanding beyond TVs into automotive and wearables, suggesting the supply chain is still progressing.

- High-end buyers increasingly value design integration and “invisible tech,” creating a natural niche.

Why Others Would Say “No, Not For Normal Living Rooms”

- MicroLED’s production economics remain far from mass-market pricing, and transparency can increase packaging and quality costs.

- The mainstream premium market is being satisfied by Mini LED and advanced OLED at far lower prices.

- The “what do I do with it every day?” question remains unresolved for most households.

Both sides can be correct depending on what “ready” means. If “ready” means “a product exists that rich early adopters can buy,” the answer is already yes. If “ready” means “a plausible premium consumer upgrade under, say, $5,000–$10,000,” the answer is still no.

What Comes Next: The Milestones That Would Signal Living-Room Readiness

As of 2026, Samsung Transparent MicroLED looks closer to a strategic preview than a near-term consumer SKU. The more realistic path is staged:

- High-end commercial and luxury residential installs first

- Cost and design refinements through limited runs

- Broader adoption only after manufacturing yields and packaging mature

- A “hybrid transparency” model becomes standard (transparent + opaque modes)

- Eventually, a shift from “TV” to “ambient surface” becomes normal

If you want concrete signals that it is crossing into genuine consumer readiness, watch for:

- A declared product roadmap (not just demos), including sizes, installation requirements, and a launch window

- A dramatic price repositioning that brings transparent screens closer to premium OLED pricing

- A design solution for opacity that solves the contrast issue without compromising the transparent aesthetic

- A software stack built for transparency (ambient UI, smart-home overlays, adaptive contrast modes)

- Evidence of manufacturing scale through supplier commitments, yield improvements, and repeatable consumer-grade production

Final Words

Samsung’s transparent MicroLED matters because it previews a living room where screens are architectural and contextual, not dominant rectangles. In the near term, transparency will remain luxury and commercial-first. The mainstream living room is more likely to keep upgrading through Mini LED, OLED improvements, and RGB backlight innovations until MicroLED’s cost curve finally bends.