You might worry about losing money when you try yield farming. This yield farming strategy in decentralized finance lets you earn high interest by adding funds to liquidity pools. This post will show you risks like impermanent loss, smart contract bugs, rug pulls, and high gas fees.

Read on.

Key Takeaways

- Yield farming can incur impermanent loss when token prices swing. For example, the Yam Finance bug in August 2020 crashed its governance token from $167.66 to $0.97 and erased many gains.

- Smart contract bugs like reentrancy, oracle hacks, and flash-loan attacks can drain pools in seconds. Even audited code can fail, as seen when SushiSwap’s Chef Nomi dumped $13 million in tokens.

- Low liquidity and volatile markets can lock or slippage your funds. Protocols such as Aave and Balancer may liquidate positions or spike fees if collateral values fall.

- Rug pulls and scams hide in unverified code and open LP token contracts. Always check security audits, time-locked liquidity, tokenomics, and project chat channels for red flags.

- High Ethereum gas fees can jump 100× and wipe out small returns. Farmers often move to chains like Polygon or Solana. Regulators may soon tax or license yield protocols (see Trump’s March 9, 2022 executive order).

What is impermanent loss and how does it affect yield farming?

Providing liquidity in a decentralized exchange means you lock up equal values of two crypto assets in an asset pool. You get LP tokens that track your share. Price swings force the pool to rebalance, and that shift can cost you more than if you simply held the tokens.

Impermanent loss shows as a temporary shortfall versus a plain crypto asset hold. Significant volatility can wipe out your yield farming rewards fast.

The Yam Finance bug in August 2020 slashed its governance token from 167.66 to 0.97 dollars. That crash highlights how automated market maker based protocols can expose liquidity providers to sudden losses.

Drops in reward rates due to strategy obsolescence amplify price risk. Popular protocols like Uniswap, Balancer, Compound, and Curve still face this gap between trading fees and price swings.

Liquidity pools offer high yields but demand serious risk management.

What are common smart contract vulnerabilities in yield farming?

Code flaws can trigger hacks in yield farming. Reentrancy issues, unchecked math errors, and oracle manipulation open doors to attackers. Flash loan attacks let hackers borrow huge sums, crash price oracles, and drain liquidity pools within seconds.

Liquidity providers can lose all funds before they spot any warning signs. Audits do not block every exploit, since complex code in blockchain technology hides sneaky bugs.

A bug on Yam Finance in August 2020 crashed its token price from $167.66 to $0.97, despite an audit. SushiSwap developer Chef Nomi sold $13 million in tokens, fueling exit scam fears.

Even Curve, Aave, and Uniswap face flaws in smart contracts. Kadan Stadelmann, Komodo Blockchain CTO, cautions about hidden security slips in decentralized finance code.

How does market volatility impact yield farming returns?

Sharp price swings can wipe out your yield farming profits. These swings can trigger liquidations if collateral value falls below the loan amount. You could face steep penalties or end with a zero balance.

DeFi protocols like Aave and Balancer can see fees spike or governance tokens tumble in value. Price risk can outpace interest rates, making your returns vanish.

High volatility can turn an arbitrage method into a lossmaker overnight. Liquidity pools can dry up when traders flee. Strategies can go stale as volatility dips or pools fill up. Many users shift to chains like Polygon or Solana to dodge Ethereum gas fee swings.

Liquidity risks in yield farming

Low liquidity can trap your LP tokens, and that shrinks your yield fast.

If liquidity providers rush out of Uniswap V3’s concentrated liquidity pool, you face big slippage, missed withdrawals, and locked assets, so check on-chain data on Etherscan before you move.

How can liquidity shortages affect your investments?

Mass withdrawals can drain a liquidity pool fast, and leave few funds for liquidity providers. Pools with low reserves can block your exit or cause slippage that cuts profit. Yearn may stall if DeFi protocols lose core liquidity.

A fairness collapse hit retail investors at SushiSwap in September 2020. Failed swaps still cost you gas fees, and shrink returns.

Dry pools force you to sell at bad prices, locking in losses. Yield farmers on Uniswap or Balancer often face price impact when many users pull out. A shallow pool cannot match large orders, so trades slip past your target.

Farming loses its passive income feel when liquidity sinks.

What happens if you can’t withdraw your funds on time?

Yield farming pools can face liquidity shortages and lock liquidity providers in. Gas fees may spike by up to 100x during network congestion. Locked tokens can fall in price before you exit.

Ethereum blockchain slowdowns can stall or drop transactions.

DeFi protocols often freeze withdrawals or set hard limits at high demand. Hackers can exploit smart contracts and drain locked crypto. You then lose your funds if you fail to withdraw in time.

How to identify rug pulls and scams in yield farming?

Scammers flood new pools fast. Many projects lack audits.

- Scan contract code on a chain explorer to spot unverified sections, check if the creator renounced ownership rights, and watch for missing LP token locks.

- Seek reports from a security auditor to catch smart contract vulnerabilities like the bug that sank Yam Finance in August 2020, when its token plunged from $167.66 to $0.97.

- Check liquidity pool locks for time locks on LP tokens via a lock service, since open pools let developers pull out funds in a classic rug pull.

- Review tokenomics and vesting schedules for governance tokens, as massive early unlocks can let insiders sell off millions, like the $13 million dump by Chef Nomi on SushiSwap.

- Track the main wallet address for large transfers of cryptocurrency assets; sudden outflows often signal exit scams or a Ponzi scheme winding down.

- Monitor APR claims against other DeFi protocols, because sky-high returns often mask price risk or strategy risk in bogus yield farming schemes.

- Read project chat channels on Telegram and Discord for blocked users, deleted messages, or silence around audits—signs of a secretive exit scam.

- Evaluate code forks and recent updates to avoid copied projects that carry old vulnerabilities, since cloned contracts can collapse without proper fixes.

What are the regulatory risks associated with yield farming?

Regulators plan to clamp down on yield farming if they spot high risks. Chains built on blockchain technology face unclear rules around taxes and banking. Donald Trump issued an executive order on March 9, 2022, to end banking discrimination against the crypto sector.

Some DeFi protocols that mint governance tokens might need a license soon. Tax authorities will likely target yield gains, kicking off extra paperwork for liquidity providers.

Lack of clear rules can trap developers and users in legal fights. Auditors might flag smart contract vulnerabilities as unregistered securities. Strict rules on decentralized exchanges could lower your APR and hike transaction fees.

Court battles over compliance can burn through funds faster than a bot attack.

Why are gas fees high and how do they affect yield farming profits?

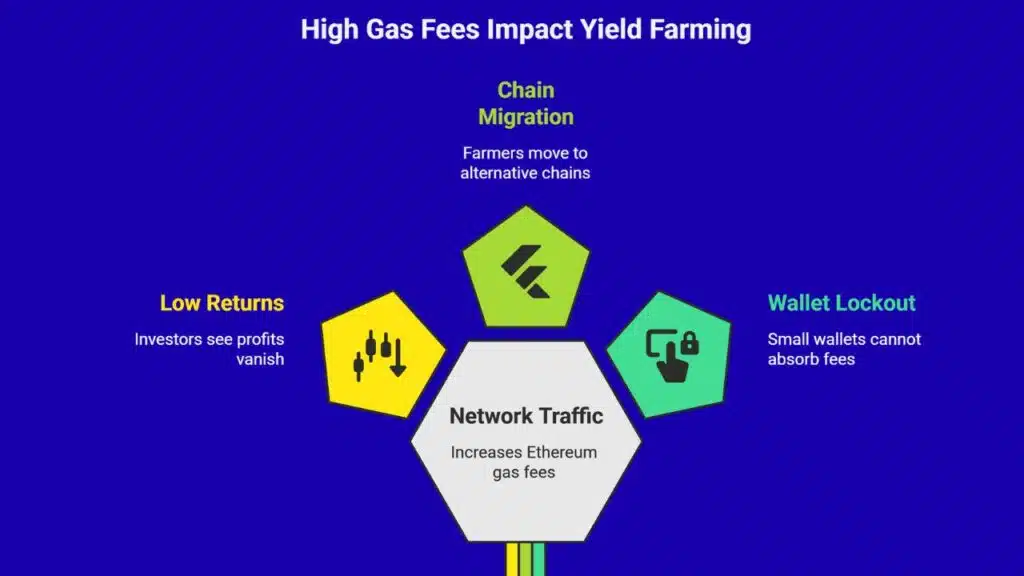

Major network traffic on Ethereum can hike gas fees up to 100 times. This spike hits yield farming profits on DeFi platforms such as Uniswap, Curve, Aave or Balancer. Blockchain technology runs these trades via smart contracts.

Too many requests clog the public ledger. Average investors see low returns vanish under steep transaction costs.

High fees kill small positions first. Users need many swaps, stakes and borrows in liquidity pools to farm yields. Each transaction costs gas on the public ledger. Farmers shift to alternative chains like Polygon, Solana, TRON or NEO to save.

Only big wallets can absorb high expenses, small wallets get locked out.

Takeaways

Here you see what makes yield farming risky. You learn about smart contract flaws and wild price swings. Quick audits of pool tokens can flag a rug pull. High gas fees and odd chain rules can drain your profit.

Block explorer data gives you a clear view. Smart farming means fast moves and calm nerves. Stay sharp in decentralized finance so your crypto works smarter, not harder.

FAQs

1. What is yield farming?

Yield farming is when you lock cryptocurrencies in liquidity pools on decentralized finance or defi platforms. Liquidity providers earn rewards in governance tokens or fees.

2. What is impermanent loss?

Impermanent loss happens when token prices shift after you add funds to a liquidity pool. Your share may be worth less than if you just held your cryptocurrencies.

3. What smart contract risks should I watch?

Smart contracts are code on a blockchain. Bugs or smart contract vulnerabilities can let hackers drain funds from liquidity pools or dapps in the defi ecosystem.

4. How do gas fees affect yield farming?

Gas fees are transaction fees on a blockchain. When networks get busy, high gas fees can eat into your earned yield, cutting your profits.

5. What is liquidation risk in defi?

If you borrow assets to farm yield and prices drop, platforms can sell your collateral. This liquidation risk can wipe out your stake.

6. How can I avoid rug pulls and scams?

A rug pull is a scheme where developers drain pooled funds. Do research on smart contracts, stick to well-known defi protocols, and watch for sudden token dumps.