India’s digital economy is set to surpass unprecedented milestones in 2025, with businesses of all sizes embracing technology to enhance operations and customer engagement. However, this digital transformation comes with a significant downside: a rising wave of cyber threats.

From ransomware attacks crippling operations to data breaches exposing sensitive customer information, Indian businesses face an alarming rise in cyber risks. High-profile incidents in recent years have underscored the vulnerabilities of even the most robust organizations. This growing menace makes cyber insurance more critical than ever.

Cyber insurance acts as a safety net, protecting businesses from the financial and operational fallout of cyberattacks. In this blog, we’ll explore why Indian businesses need cyber insurance in 2025 and provide insights into the trends, benefits, and challenges associated with it.

What Is Cyber Insurance?

Cyber insurance is a specialized form of business insurance designed to mitigate financial losses resulting from cyberattacks and data breaches. These policies typically cover costs associated with ransomware payments, legal liabilities, data recovery, and even public relations efforts to repair reputational damage.

In India, cyber insurance policies are increasingly being customized for specific industries like banking, healthcare, and e-commerce. Broadly, policies fall into two categories:

- First-party coverage: Protects businesses against direct losses such as data restoration costs and downtime.

- Third-party liability coverage: Covers claims made by clients or customers impacted by a cyber incident.

By providing financial protection and access to cybersecurity experts, cyber insurance plays a vital role in ensuring business continuity in today’s digital-first world.

Cyber Insurance Trends in India in 2025

As cyber threats grow more sophisticated, the Indian cyber insurance landscape is evolving rapidly. Key trends to watch in 2025 include:

- Rising Demand: Small and medium enterprises (SMEs) and large corporations are increasingly seeking cyber insurance as awareness of cyber risks grows.

- Sector-Specific Policies: Industries like BFSI (Banking, Financial Services, and Insurance), healthcare, and e-commerce are driving demand for tailored insurance solutions.

- Government Initiatives: Regulatory bodies like CERT-In have introduced guidelines, pushing businesses to adopt robust cybersecurity measures, including insurance.

- Data-Driven Underwriting: Insurers are leveraging data analytics and AI to assess risks and offer personalized policies.

- Bundled Policies: Many insurers are offering cyber insurance as part of broader business insurance packages to increase accessibility.

10 Reasons Why Indian Businesses Need Cyber Insurance in 2025

In today’s fast-evolving digital ecosystem, the stakes for Indian businesses have never been higher. As technology becomes an integral part of operations, cyberattacks are becoming a daily reality, affecting companies of all sizes and industries.

Whether it’s a ransomware attack that halts business activities or a data breach that erodes customer trust, the financial and reputational fallout from cyber incidents can be devastating. Yet, many businesses remain underprepared, underlining the urgent need for proactive measures.

As cyber threats grow more sophisticated in 2025, adopting cyber insurance is not just an option but a necessity for Indian businesses looking to thrive in a high-risk environment.

Reason 1: Rise in Cyberattacks

Cyberattacks targeting Indian businesses are becoming more sophisticated and frequent, putting immense pressure on organizations to defend their digital infrastructure. High-profile incidents involving ransomware crippling entire systems, phishing scams deceiving employees, and data breaches exposing sensitive customer information are now daily headlines.

The financial impact of such attacks can be staggering, ranging from ransom payments to downtime costs and reputational damage that can take years to recover from. Cyber insurance steps in as a crucial safety net, offering businesses the financial cushioning they need to recover swiftly while also providing access to expert resources to mitigate the long-term consequences of these attacks.

Having a robust cyber insurance policy is no longer a luxury, but a necessity for survival and resilience in a world where cyber threats are inevitable.

Reason 2: Regulatory Compliance Requirements

With the implementation of stricter data protection laws and frameworks like GDPR and CERT-In’s guidelines, businesses face mounting pressure to meet complex regulatory requirements. Failing to comply can result in hefty fines, operational disruptions, and significant reputational damage.

Cyber insurance not only helps organizations mitigate these risks but also covers the costs associated with regulatory penalties, breach notifications, and legal consultations. This comprehensive protection ensures businesses remain compliant while focusing on their core operations, making cyber insurance an invaluable asset in navigating the challenging regulatory landscape of 2025.

Reason 3: Protection Against Financial Loss

The financial impact of a cyberattack can be devastating, including ransom payments, revenue losses, and legal fees. Cyber insurance ensures businesses have the resources to recover without draining their reserves.

Reason 4: Safeguarding Sensitive Data

In the digital age, businesses are custodians of vast amounts of sensitive customer, employee, and financial data, making them prime targets for cybercriminals. A single data breach can unleash devastating consequences—from crippling financial losses to the erosion of hard-earned customer trust.

Beyond the immediate costs of recovery, such breaches often result in regulatory scrutiny and long-term reputational damage that can take years to rebuild. Cyber insurance provides a vital safety net, covering expenses related to data recovery, breach notifications to affected individuals, and credit monitoring services to protect those impacted.

With cyberattacks becoming increasingly sophisticated, having the right coverage ensures businesses can not only recover quickly but also maintain confidence among stakeholders.

Reason 5: Increased Digital Adoption by Indian Businesses

With businesses adopting cloud computing, IoT, and digital payment systems, vulnerabilities are expanding. Cyber insurance acts as a critical line of defense in this increasingly digital ecosystem.

Reason 6: Support for Small and Medium Enterprises (SMEs)

SMEs often lack the resources to invest heavily in cybersecurity infrastructure, making them prime targets for cybercriminals. Affordable cyber insurance policies provide SMEs with essential protection and access to expert assistance.

Reason 7: Reputational Risk Management

A cyberattack can tarnish a company’s reputation overnight. Cyber insurance often includes support for public relations efforts, helping businesses rebuild trust with customers and stakeholders.

Reason 8: Incident Response and Expertise

Many cyber insurance policies offer unparalleled access to dedicated incident response teams, cybersecurity experts, and forensic investigators. These professionals are equipped to act swiftly, minimizing the damage caused by a cyberattack and reducing costly downtime.

Beyond just mitigation, these experts provide valuable insights into the root causes of the incident, enabling businesses to bolster their defenses against future threats. This proactive support ensures businesses can return to normal operations quickly, safeguarding their reputation and maintaining trust with customers and stakeholders.

Reason 9: Mitigating Supply Chain Risks

Indian businesses increasingly rely on digital supply chains and third-party vendors. A breach in a partner’s system can impact the entire ecosystem. Cyber insurance provides coverage for losses resulting from such incidents.

Reason 10: Evolving Threat Landscape in 2025

The cyber threat landscape is evolving at an unprecedented pace, with emerging dangers such as AI-driven cyberattacks, deepfake technology used for fraud, and advanced ransomware variants targeting critical business systems. These threats are not only more sophisticated but also harder to predict, leaving businesses vulnerable to potentially catastrophic consequences.

Cyber insurance acts as a comprehensive shield, equipping businesses to handle unforeseen risks and adapt to this rapidly changing digital environment. With the right coverage, organizations can mitigate financial losses, ensure operational continuity, and safeguard their reputation even in the face of these cutting-edge cyber threats.

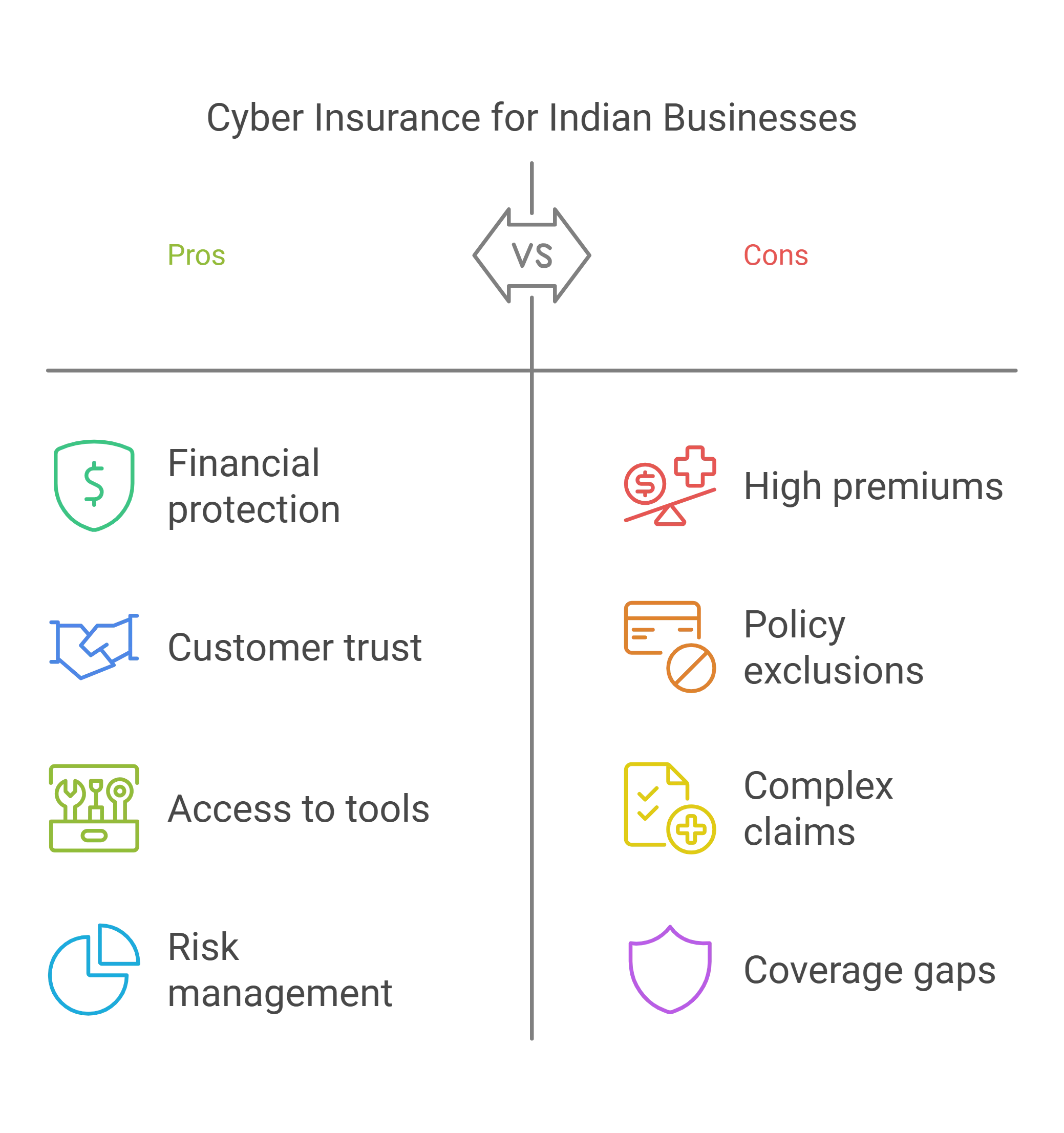

Pros and Cons of Cyber Insurance for Indian Businesses

Pros:

- Financial protection against a wide range of cyber incidents.

- Enhances customer trust and stakeholder confidence.

- Provides access to cybersecurity tools and experts.

- Encourages better risk management practices.

Cons:

- Premium costs can be high, particularly for smaller businesses.

- Some policies exclude nation-state attacks or insider threats.

- Complex claim processes can delay payouts.

- Misunderstanding of coverage may lead to gaps in protection.

How to Choose the Right Cyber Insurance Policy

Selecting the right cyber insurance policy requires a thorough understanding of your business’s unique risks and requirements. Consider the following:

- Assess Risks: Evaluate vulnerabilities based on your industry and operations.

- Policy Scope: Look for comprehensive coverage, including incident response and third-party liabilities.

- Claims Process: Choose an insurer with a reputation for efficient claim settlements.

- Add-On Services: Opt for policies that include risk assessment tools, employee training, and access to cybersecurity experts.

In India, leading insurers like HDFC ERGO, ICICI Lombard, and Tata AIG offer robust cyber insurance policies tailored for businesses of all sizes.

Takeaways

In 2025, the question isn’t whether Indian businesses will face cyber threats but when. Cyber insurance has emerged as an indispensable tool for mitigating financial losses, ensuring compliance, and safeguarding reputations in the digital age.

By investing in a comprehensive cyber insurance policy, businesses can protect their assets and build resilience against a constantly evolving threat landscape.