Nvidia (NASDAQ: NVDA), the world’s most valuable chipmaker and the company at the heart of the artificial intelligence (AI) revolution, released its second-quarter fiscal 2026 earnings on Wednesday after the market closed.

The results were strong overall—both earnings per share (EPS) and total revenue beat Wall Street’s expectations. But a small shortfall in its data center revenue, the company’s most critical growth engine, disappointed investors and triggered a selloff in after-hours trading. Shares dropped more than 3% despite Nvidia’s long streak of record-breaking results.

Record Revenue and Earnings, But a Key Miss

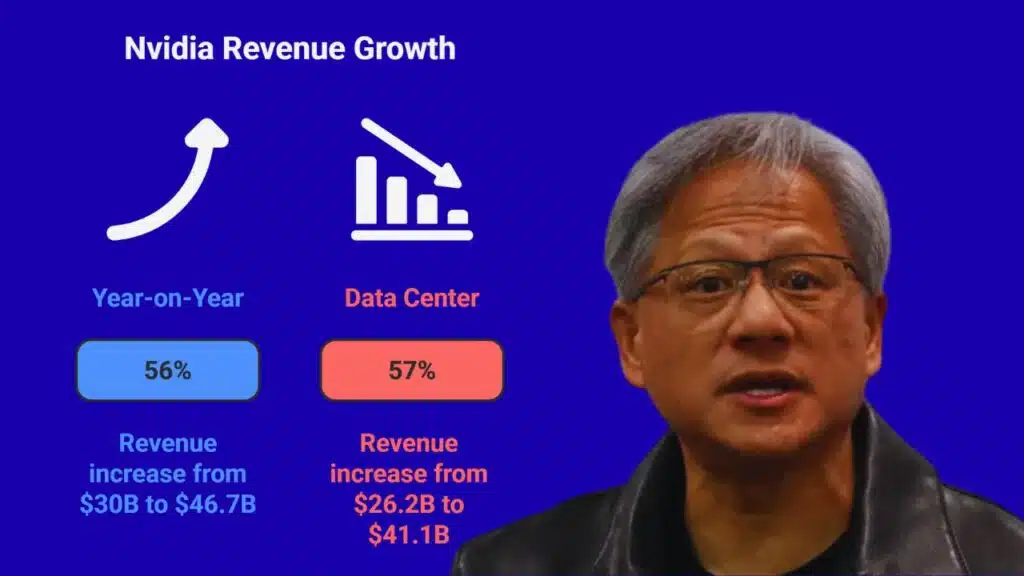

Nvidia reported revenue of $46.7 billion, up 56% year-on-year from $30 billion in the same quarter last year. Adjusted EPS came in at $1.05, also topping analyst estimates of $1.01. Net income surged to $26.4 billion, a 59% increase from a year earlier. These figures highlight Nvidia’s dominance in AI infrastructure, particularly its high-performance GPUs that power large language models, generative AI, and hyperscale data centers.

However, the company’s data center segment—its largest business line—came in slightly weaker than expected. Revenue from the segment reached $41.1 billion, short of Bloomberg’s analyst consensus of $41.3 billion. While this still represented a massive jump from $26.2 billion a year ago, the minor miss raised questions about whether Nvidia’s blistering pace of AI-driven growth is beginning to moderate.

Adding to the nuance: this figure excluded sales of Nvidia’s H20 chips into China, which have been disrupted by shifting U.S. trade policies. Nvidia also disclosed that roughly 50% of its data center revenue came from large cloud service providers, underscoring how dependent the company is on a handful of hyperscale giants like Amazon, Microsoft, and Google.

Why Data Center Performance Matters

The data center business has become Nvidia’s crown jewel, accounting for the vast majority of its growth. Since the AI boom took off in late 2022, demand for Nvidia’s A100, H100, and now Blackwell GPUs has skyrocketed. Hyperscalers, startups, and enterprises alike have been racing to build AI supercomputers to train and deploy large-scale models.

That’s why even a small miss relative to Wall Street expectations sparked concern. Nvidia’s CFO Colette Kress explained that data center compute revenue declined 1% sequentially compared to the previous quarter, largely due to a $4 billion reduction in H20 chip sales. Without that drag, data center sales would have been even stronger.

The miss also comes at a time when competitors such as AMD, Intel, and new custom AI chipmakers are trying to grab share. While Nvidia remains far ahead technologically, investors are watching closely for signs that growth might plateau after several quarters of meteoric expansion.

Gaming and Other Segments Show Strength

While AI and data centers dominate Nvidia’s story, its gaming division—once the company’s primary revenue driver—also performed well. Gaming revenue reached $4.3 billion, comfortably above estimates, thanks to continued strong demand for RTX graphics cards and the growth of PC gaming worldwide.

Other smaller segments, such as professional visualization and automotive, contributed steady revenue but remain minor compared to AI infrastructure.

Blackwell Chips: “Extraordinary Demand” and the Future of AI

Nvidia CEO Jensen Huang struck an upbeat tone despite the Wall Street wobble. In a statement, he highlighted the company’s rapid progress with its next-generation Blackwell architecture:

“Production of our next-gen Blackwell chips is ramping at full speed, and demand is extraordinary. The AI race is on, and Blackwell is the platform at its center.”

Blackwell, which succeeds Nvidia’s highly successful Hopper (H100) generation, is designed to deliver significantly higher performance while lowering energy costs for training and inference workloads. Industry analysts expect it to become the backbone of AI infrastructure globally, powering everything from foundation model training to AI-driven enterprise software.

Early reports suggest that demand for Blackwell is far outstripping supply. Many major cloud providers and AI firms have already committed billions in advance orders. This suggests that while growth may look like it’s slowing on paper, Nvidia’s pipeline for the coming quarters remains robust.

Geopolitical Headwinds: China, Tariffs, and Trump’s Policies

A major cloud hanging over Nvidia’s future is geopolitics, particularly U.S.–China tensions over advanced semiconductors. In April 2025, the Trump administration banned the sale of Nvidia’s high-end AI chips to China, citing national security concerns. In July, that ban was revoked—but replaced with a new requirement that Nvidia pay the U.S. government a 15% cut of all chip sales to China.

In August, Trump added another threat: a 100% tariff on semiconductor shipments into the U.S. unless companies commit to domestic manufacturing. Nvidia is expected to be exempt, but the unpredictability of policy shifts adds uncertainty to its China strategy.

Nvidia is currently working on a new Blackwell-based chip designed specifically for the Chinese market, but any rollout would need Washington’s approval. Meanwhile, the Chinese government has begun warning its companies against using Nvidia chips, alleging potential “backdoor” security risks. Nvidia has strongly denied these claims and is reportedly in talks with Chinese regulators to ease concerns.

Q3 Outlook and Stock Buyback Plan

Looking ahead, Nvidia guided for Q3 revenue of $54 billion ±2%, above the $53.4 billion Wall Street expected. Importantly, this projection does not include potential H20 sales to China, leaving upside if export restrictions ease. CEO Huang noted that the China market could represent as much as $50 billion in opportunity this year if barriers are lifted.

To further boost shareholder confidence, Nvidia authorized a massive $60 billion in additional stock buybacks, one of the largest programs in corporate history. Combined with $24.3 billion already returned to shareholders in the first half of the fiscal year, this underscores Nvidia’s commitment to rewarding investors.

Market Reaction and Stock Performance

Despite the strong headline numbers, Nvidia’s stock fell more than 3% in after-hours trading, reflecting disappointment around the narrow data center miss. Still, the stock remains up 35% year-to-date and more than 40% over the past 12 months. In July 2025, Nvidia also became the first company in history to surpass a $4 trillion market capitalization, cementing its dominance as the most valuable public company globally.

Some analysts caution that valuations may be stretched, comparing Nvidia’s meteoric rise to past tech bubbles. Others argue that the company’s leadership in AI hardware, combined with extraordinary demand for Blackwell, makes it fundamentally different from past speculative manias.

A Giant Facing Both Opportunity and Pressure

Nvidia’s Q2 report shows a company at the height of its power—delivering record revenue, extraordinary profitability, and unrivaled demand for its AI chips. Yet, the smallest miss in its most important business line was enough to spark investor concern, illustrating the high expectations built into its $4 trillion valuation.

The path forward will be shaped by three forces:

- Blackwell ramp-up and whether supply can meet sky-high demand.

- Geopolitical trade restrictions, especially involving China.

- Investor sentiment, as Wall Street debates whether Nvidia’s growth is sustainable or overheating.

What’s clear is that Nvidia remains the central player in the AI revolution. As Jensen Huang put it: “The AI race is on—and Blackwell is the platform at its center.”

The Information is Collected from Yahoo and CNBC.