CES 2026 made one thing clear. Smart glasses are no longer a side quest for big tech. They are becoming the next frontline device category, and the smart glasses war is now a real contest between product ecosystems, AI assistants, optics, and supply chains.

Meta arrived with tangible upgrades that sharpen its “wear it every day” pitch. Google showed up with Android XR momentum and a deepening hardware partnership strategy that looks like the early days of Android phones. Meanwhile, a wave of challengers used CES to argue that the winning glasses will not be the flashiest. They will be the ones people can wear all day, trust in public, and use without friction.

Key Takeaways

- Meta is pushing consumer readiness with practical features like teleprompter-style cards and EMG-based “virtual writing,” but supply constraints are shaping rollout strategy.

- Google is trying to turn smart glasses into a platform category through Android XR and long-term hardware partnerships, positioning developer momentum as the real weapon.

- Challengers are attacking the weakest points of early smart eyewear: comfort, battery, modularity, and assistant choice.

- CES 2026 suggests two product paths will compete in parallel: subtle AI companion glasses and optical see-through XR glasses with richer visuals.

- The unglamorous factors may decide the winner: manufacturing scale, retail distribution, privacy perception, and how quickly developers build “glasses-first” experiences.

Why CES 2026 Felt Like A Turning Point

For years, smart glasses lived in the space between promise and prototype. The vision sounded obvious. Put useful information in your line of sight and let AI help you without pulling out a phone. The reality was harder. Devices were bulky, battery life was short, and social acceptance was fragile.

CES 2026 changed the tone because the competition is no longer “AR someday.” It is “AI now.” Companies are showing features that solve immediate problems instead of chasing futuristic demos. That shift brings new urgency to the smart glasses war, because the first brands to deliver everyday usefulness can define what users expect from the category.

It also brings a more brutal kind of competition. Once consumers experience hands-free translation, glanceable navigation, or fast capture and sharing, they will demand it everywhere. That demand will pull more competitors into the market, and it will punish products that feel unfinished.

| Past Smart Glasses Era | CES 2026 Shift |

|---|---|

| Prototype-heavy demos | Shipping-focused features |

| AR-first messaging | AI-first utility |

| Bulky, short battery life | Wearability and comfort focus |

| Social acceptance unclear | Public-use confidence improving |

Meta’s CES 2026 Play: Practical Utility, Faster Inputs, And A Bigger Bet On Wearability

Meta’s position in smart glasses is built on a simple idea. Win the “daily wearable” category first, then expand what the glasses can do over time. At CES 2026, Meta reinforced that strategy by focusing on features that reduce friction during real-world use.

Teleprompter Cards: A Feature That Signals Everyday Intent

A teleprompter feature sounds small until you consider what it represents. It is a “normal life” feature. It targets creators, speakers, and professionals who want to stay present while keeping notes in view. It also reinforces the idea that smart glasses can be a productivity tool, not just a camera accessory.

More importantly, it is a design clue. Smart glasses succeed when the interface feels glanceable and non-disruptive. A card-based teleprompter fits that mental model. It is not trying to turn your face into a full HUD. It is trying to make small moments easier.

EMG Handwriting: The Quiet Battle Over Input

Smart glasses have a core UX problem. Hands-free is great until you need to type. At CES, Meta highlighted EMG-based handwriting that uses a neural band to capture subtle muscle signals and convert them into text entry. That matters because input is a bottleneck for everything else.

If you cannot reply quickly, you cannot rely on glasses for messaging. If you cannot jot notes, you cannot rely on glasses for work. EMG input aims to fix that by letting users “write” on a surface without holding a phone.

This is also a strategic move in the smart glasses war. Whoever controls a fast input method controls the habit loop. If glasses become the easiest way to respond, capture, and share, they become harder to stop wearing.

Navigation And The “Assistant In Motion” Use Case

Walking navigation is one of the clearest reasons to wear smart glasses in public. It reduces phone checking and keeps attention forward. CES coverage around expanded pedestrian navigation support highlights a push to make navigation a steady, reliable feature rather than a novelty.

Navigation also trains users to trust glasses in motion. That matters because trust is the bridge from “cool gadget” to “default device.”

The Meta Constraint That Matters: Scale

CES also highlighted a reality that can reshape the category. Supply and inventory constraints can become a strategic limiter. If demand is high but availability is tight, momentum becomes harder to sustain globally.

In the short term, this can benefit competitors. The moment a product becomes hard to buy, rival brands get a chance to land the first purchase and define the experience. In the long term, Meta’s challenge is clear. Build not just great features, but the manufacturing and distribution capacity to make those features feel ubiquitous.

| Meta Focus Area | What It Solves | Strategic Impact |

|---|---|---|

| Teleprompter cards | Hands-free reference | Creator & professional adoption |

| EMG handwriting | Fast text input | Stronger daily habit formation |

| Navigation overlays | Less phone checking | Public trust & wearability |

| Wearability-first design | Social comfort | All-day usage |

Google’s Countermove: Android XR As A Platform, Not A Single Product

Google’s smart glasses story at CES 2026 looked less like “here is one hero device” and more like “here is a platform path.” That is a meaningful difference.

Android XR: The Attempt To Create A Device Class

Google appears to be framing Android XR as a foundation for multiple product types, including glasses. This approach mirrors the old Android playbook: make the software stack the center, then build a partner ecosystem that scales faster than any single company could.

In the smart glasses war, a platform approach is a direct challenge to Meta’s stack-driven strategy. Meta wants consumers to buy into its hardware and services loop. Google wants hardware makers and developers to buy into Android XR, with Gemini as the assistant layer that ties it together.

Why XREAL And “Project Aura” Matter

Partnership announcements around XREAL and its roadmap alignment with Android XR are important because they reduce the “wait and see” hesitation. Developers and buyers hesitate when hardware feels uncertain. A named hardware partner and a visible product direction helps.

Project Aura also represents a different product philosophy. Optical see-through XR glasses aim to blend the physical world with digital overlays more naturally than camera-first glasses. That can unlock richer experiences, but it can also bring more complexity, more power draw, and higher cost.

So Google is effectively betting on a two-part story:

- Build credibility through hardware partners that can deliver real products.

- Build inevitability through a platform that many partners can adopt.

The Developer Angle: The Hidden Decider

If smart glasses become a platform category, the strongest advantage is not a single feature. It is an app ecosystem that makes glasses feel necessary.

Developers will build where they see stable APIs, stable hardware plans, and enough users to justify the effort. If Android XR can create that confidence, it can narrow Meta’s lead. If it cannot, Meta’s head start in consumer wearables becomes more durable.

| Company | Core Strategy | Long-Term Bet |

|---|---|---|

| Meta | Integrated hardware stack | Daily consumer dominance |

| Platform + partners | Ecosystem scale | |

| Result | Tight control | Faster diversification |

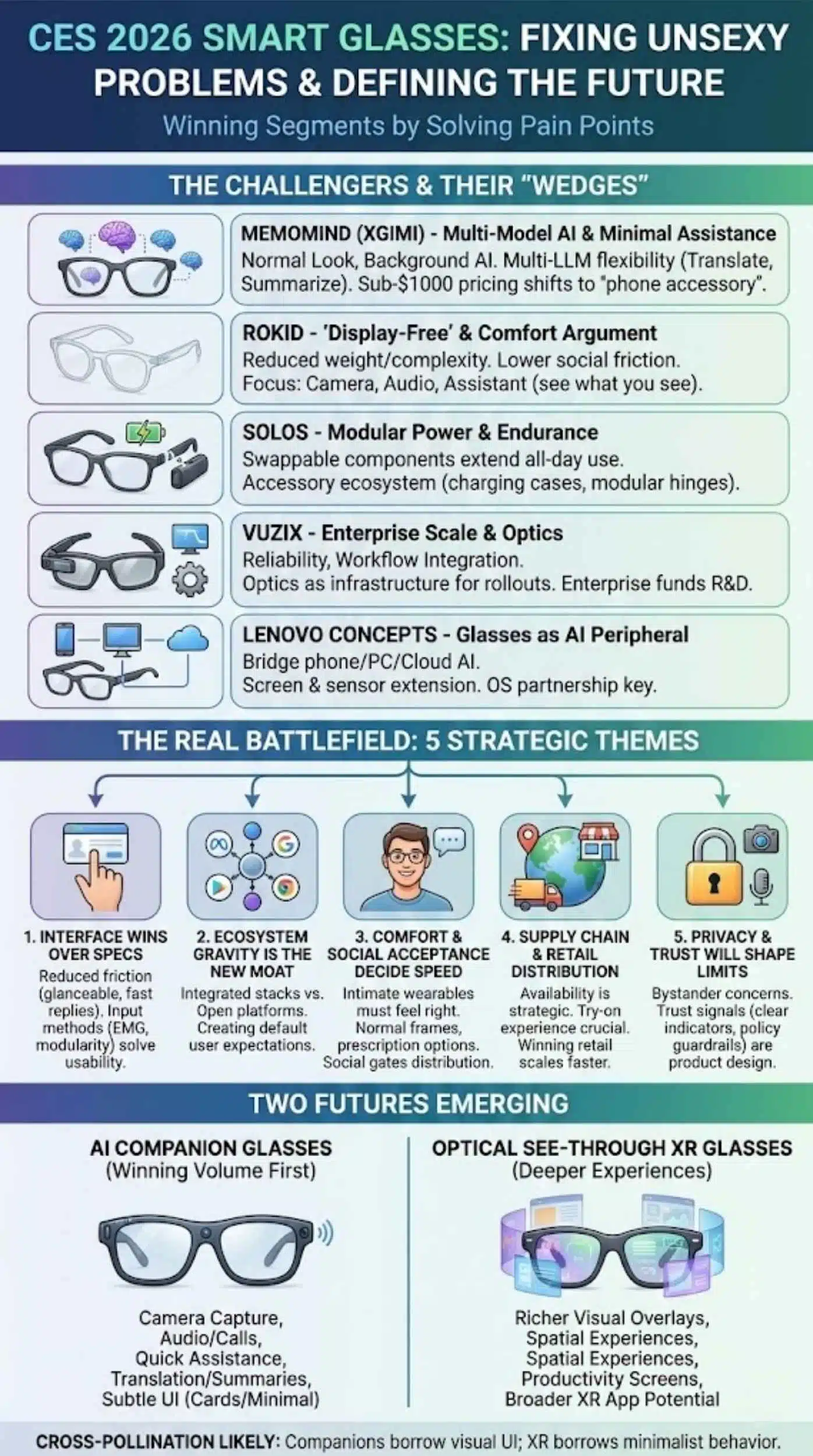

The Challengers At CES 2026: Winning By Fixing The Unsexy Problems

One reason CES felt crowded with smart eyewear is that the category now has obvious product wedges. You do not need to beat Meta or Google across the board. You can win a segment by solving one painful problem better than anyone else.

MemoMind By XGIMI: Multi-Model AI And “Minimal Assistance”

MemoMind’s debut leaned into two themes that resonate with mainstream buyers:

- Glasses that look closer to normal eyewear.

- AI that feels like background support, not constant interruption.

A multi-LLM approach also signals something deeper. Consumers may not want one assistant forever. They may want the best model for translation, note-taking, and summarization depending on the context. If that becomes the expectation, lock-in becomes harder, and the assistant layer becomes more competitive.

Pricing signals matter here too. Sub-$1,000 products shift smart glasses from “luxury experiment” toward “phone accessory tier.”

Rokid: The “Display-Free” Direction And The Comfort Argument

Rokid’s CES presence highlights a belief that the winning glasses might not need a heavy visual overlay to be valuable. “Display-free” or minimal-display designs can reduce weight and complexity. They can also lower the social friction that comes from visibly techy eyewear.

This is an important branch in the smart glasses war. Some users want a heads-up display experience. Many users may only want a good camera, good audio, and an assistant that can see what they see.

If the category splits, the market can grow faster because products can match different comfort levels and different public acceptance thresholds.

Solos And Modular Power: Battery As A Differentiator

Battery and endurance have quietly shaped every wearable category. When a product dies midday, it stops being a habit. Modularity that extends use through swappable components can be a strong advantage, especially for professionals and travelers.

This also hints at a future where “glasses accessories” become their own ecosystem: charging cases, modular hinges, prescription and frame customization, and upgrade paths.

Vuzix: Enterprise Scale And Optics As Infrastructure

Vuzix shows how the market can expand without chasing lifestyle eyewear first. Enterprise deployments care about reliability, workflow integration, and scaling tools for rollouts. Optics and waveguides matter here as much as consumer design.

Enterprise also creates a different kind of moat. If a company standardizes on hardware for warehouse picking, field service, or guided workflows, switching costs rise. That can fund the R&D that later feeds consumer products.

Lenovo Concepts: Glasses As An AI Peripheral

Concept glasses from PC makers hint at a broader trend. Glasses may become a peripheral that bridges phone, PC, and cloud AI. That matters because it reframes smart glasses from “a new standalone device” into “a screen and sensor extension for your existing devices.”

If that model wins, the most important partnership might be with operating systems and productivity ecosystems, not fashion brands.

The Real Battlefield: Five Themes That Decide Who Wins

CES 2026 offered plenty of announcements. The deeper story is what these announcements reveal about where the fight is headed.

1. Interface Wins Over Specs

Consumers do not buy FOV numbers. They buy reduced friction. The winners will deliver experiences that feel natural: glanceable cards, fast replies, quick capture, and voice that works in noisy environments.

That is why input methods like EMG handwriting and modular endurance matter. They solve the “I would wear this more if it were easier” problem.

2. Ecosystem Gravity Is The New Moat

Meta is building a tightly integrated stack across hardware, companion apps, and assistant features. Google is trying to build a platform that many hardware makers can adopt.

This is the heart of the smart glasses war. The question is not “who ships one great device.” It is “who creates the default expectations for what glasses should do.”

If users expect certain assistant behaviors, developers will build toward them. If developers build toward them, more users will choose that ecosystem. The loop compounds.

3. Comfort And Social Acceptance Decide Adoption Speed

Wearables are intimate. If the glasses pinch, look awkward, or create anxiety about cameras, they fail. That is why so many CES entrants emphasize normal-looking frames, prescription options, and subtle designs.

Social acceptance is not a marketing detail. It is a distribution gate. If people feel uncomfortable wearing glasses at work, in cafes, or on public transit, the category stays niche.

4. Supply Chain And Retail Distribution Are Strategic Weapons

A great product that is hard to buy is an invitation for competitors. Smart glasses are especially vulnerable to this because they rely on a new habit. If buyers want to try glasses and cannot find them, they might not come back for months.

Retail presence also matters. Glasses are fit products. People want to try them on. Brands that win optical retail and mainstream electronics channels can scale faster.

5. Privacy And Trust Will Shape Feature Limits

Smart glasses carry cameras and microphones. Even if users love the features, bystanders may not. That tension can limit where and how people wear them, which can limit habit formation.

This does not mean the category will stall. It means the winners will invest in trust signals: clear indicators, policy guardrails, and behavior that avoids “creepy tech” moments. Trust will be product design, not just PR.

Two Futures Emerging From CES 2026: Companion Glasses Vs XR Glasses

CES 2026 suggests the market will not choose one path immediately. It may grow through two parallel product categories.

AI Companion Glasses

These focus on:

- camera capture

- audio and calls

- quick assistance

- translation and summaries

- subtle UI like cards or minimal displays

They aim for all-day wearability and mainstream acceptance. They will likely win volume first.

Optical See-Through XR Glasses

These focus on:

- richer visual overlays

- spatial experiences

- productivity screens

- broader XR app potential

They aim for deeper experiences, which can justify higher price and complexity.

The smart glasses war will likely include both, with cross-pollination. Companion glasses will borrow more visual UI over time. XR glasses will borrow more minimalist, assistant-first behavior to feel usable outside demos.

What To Watch In 2026

CES created momentum. The next 12 months will decide whether that momentum becomes a mass market shift or a fragmented gadget phase.

1. Can Meta Scale Global Availability Without Losing Momentum

Meta’s advantage is real-world consumer traction and a clearer everyday pitch. But scaling production and distribution is the difference between “leading” and “dominating.”

2. Will Android XR Create A Developer Magnet

If Google can make Android XR feel stable, developer-friendly, and multi-device, it can accelerate ecosystem growth quickly. The question is timing. Developers build for platforms that feel inevitable, not just announced.

3. Will Modular Hardware Become Standard

Battery, comfort, and maintenance are big barriers. Modular designs and replaceable components can turn smart glasses into a longer-lived product category rather than a disposable gadget.

4. Will Multi-Assistant And Multi-LLM Experiences Become The Norm

If consumers start expecting the best model per task, assistant lock-in weakens. That pushes the fight toward user experience, privacy, and system integration rather than “my AI is better than yours.”

5. Which Category Reaches Social Normalcy First

The fastest path to mainstream adoption is the product people forget they are wearing. The companies that can deliver that experience, while still delivering real value, will define the next phase.

CES 2026 Made The Smart Glasses War Real

The biggest takeaway from CES 2026 is not that smart glasses are “coming.” It is that smart glasses are here, and the smart glasses war has shifted from speculation to competition over ecosystems, interfaces, and scale.

Meta is pushing forward with features that make glasses more useful today, especially through glanceable tools and faster input. Google is betting on Android XR to turn glasses into a platform category with a partner network that can scale. Challengers are attacking the most practical problems, from comfort and battery to modularity and assistant choice.

The winners will not be decided by who has the most futuristic demo. They will be decided by who makes glasses feel normal, useful, and easy enough to wear every day.