Do you ever wonder why your favorite payment app keeps changing, or how new financial tools pop up so fast? Most folks in South Korea face the same thing. With more people using smartphones for banking, it can get tricky to keep up.

And if you run a startup or dream about launching one, knowing what drives FinTech growth is like finding gold.

Here’s a key fact: Korea’s FinTech market could reach $10 billion by 2025. This huge leap comes from strong government help, speedy internet, and young people loving digital wallets and apps.

In this post, I will show you three big reasons behind this boom—each backed by real action from startups, vc funds like General Catalyst, government plans with scaleup funds over $10.6 billion, and fresh ideas such as Ronin Network or Axie Infinity’s tech tricks.

Want to know which trends and changes matter most? Keep reading to find out what makes Korea’s FinTech tick!

Factor 1: Government Support and Policies

The South Korean government shows strong support for fintech. They created a large fund to boost tech ideas, making it easier to start new projects.

$10.6B scaleup fund for tech innovation

A $10.6 billion scaleup fund will help Korea speed up tech innovation in fintech. Money from angel funds and venture capital groups backs new ideas fast, giving startups a big chance to grow.

VCs spot young projects that could change how people handle their money or use digital wallets.

“Big dreams need bold backing.”

This huge push brings more jobs, fresh products, and fierce competition to the Korean market. Angel investors like General Catalyst also look for smart ways to mix sustainability, psychedelics research, and new payment tools together as part of this wave.

Many founders now get the motivation they need to decarbonize financial systems too. Everyone races ahead—no one wants to be left behind as things move faster than ever before!

Regulatory frameworks promoting fintech growth

That big fund gives startups a running start, but clear rules keep the wheels turning smooth. South Korea is laying new tracks fast, using innovative laws and standards to help the fintech market flourish.

One bright example? The GENIUS ACT, a bipartisan bill from Washington that sets out guardrails for stablecoin use and growth. This law includes reserve mandates with audits each month and dual oversight for issuers holding more than $10 billion in assets.

Businesses get 18 months after it becomes law to meet these steps—plenty of time to set up shop or scale without tripping over red tape.

Such smart frameworks take some heavy lifting out of compliance worries, freeing companies to focus on bold ideas like cross-border payments or blockchain solutions. They act as a general catalyst, boosting not just trust but also helping firms decarbonise operations through digital shifts.

These moves foster both safety and growth while driving Korea toward its $10B fintech goal by 2025—all without leaving innovation stuck at the starting line.

Tax incentives for fintech startups

Building on strong regulatory frameworks, tax incentives play a huge role as a general catalyst for Korea’s fintech boom. The South Korean government uses special tax breaks to make investors smile and keep startups in the game.

For example, the $10.6 billion scaleup fund grows investment in tech companies, including those using blockchain or artificial intelligence.

The Financial Innovation Support Program also gives out funding that helps fresh fintech ideas get off the ground by offering indirect tax perks. Public investment funds act like steady hands, guiding young businesses through tough waters with extra financial help and support.

These moves flip the switch for many founders who dream of seeing their payment apps or lending platforms go big before 2025 rolls around.

Factor 2: Advanced Digital Infrastructure

South Korea boasts fast internet and widespread 5G. This tech makes online payments easy and quick. Most people use mobile payment apps daily. With smart tools like AI and blockchain, the system gets even better.

High-speed internet and 5G adoption

High-speed internet plays a big role in South Korea’s FinTech growth. Fast connections help people use digital finance easily. 5G technology is the next step forward. It will make online services faster and more reliable for everyone.

More people can access mobile payment systems too, thanks to this tech boom. Businesses will offer better services because of improved connectivity. This progress makes transactions faster and safer using tools like blockchain.

Next, let’s look at how consumers are adopting these new trends and what they want in the market.

Widespread mobile payment systems

With high-speed internet and 5G, mobile payments are everywhere in South Korea. Local players like KakaoPay and Naver Financial lead the charge in this market. Mobile payment use jumped by more than 30% over the last year.

It’s not just a trend; it’s a shift.

Millennials and Gen Z drive this change, as they love easy access to digital finance. People want quick, convenient ways to pay. The demand for mobile payment solutions grows stronger every day.

QR transactions also soared in Vietnam, reflecting similar trends across Asia. These systems are changing our daily lives for the better!

Integration of AI and blockchain technologies

Widespread mobile payment systems set the stage for fresh tech growth. AI and blockchain technologies are now stepping into the spotlight. Tech giants like Mastercard and Naver blend AI into their payment platforms.

This helps with fraud detection, algorithmic trading, and even automating customer service.

Blockchain is changing how businesses operate too. Governments explore it for aid distribution and record management. Stablecoins are in high demand; they could reach $3.7 trillion by 2030.

Together, these tools improve security and efficiency in financial transactions. They help set up a strong foundation for Korea’s FinTech market as it aims to hit that $10 billion mark by 2025.

Factor 3: Consumer Adoption and Market Demand

Consumers in South Korea love their smartphones, making digital wallets and payment apps super popular. With more people using these tools, the need for cross-border payments is rising fast.

It’s clear that folks are ready to embrace fintech like never before. Curious about how this trend will shape the future?

High smartphone penetration in South Korea

Smartphones are everywhere in South Korea. Almost everyone has one. This high smartphone use helps grow digital services. People rely on their phones for banking and payments, especially after COVID-19 sped up this trend.

More smartphones mean more demand for fintech apps too. Wi-Fi 6 boosts these devices with faster speeds and better connections, making mobile payment options even more appealing. The approval of the 6 GHz band adds to the strong wireless network across the country.

As a result, consumers want easy ways to pay through their phones every day.

Growing popularity of digital wallets and payment apps

Digital wallets and payment apps are on the rise in South Korea. More people are using these tools every day. Many enjoy the ease of making payments from their phones. In fact, mobile payment use jumped by over 30% last year alone.

This trend is not just local; it has global highlights too. Countries like Vietnam show great growth as well, with e-wallets active for around 33 million users in 2023. The average annual increase for internet payment transactions there was a whopping 52% from 2021 to 2023! As consumers seek faster ways to pay and transfer money, digital wallets will keep gaining traction.

Next up is how advanced digital infrastructure also plays a key role in this boom.

Increasing demand for cross-border payment solutions

The rise of digital wallets and payment apps drives the demand for cross-border payment solutions. More people shop online. Globalization makes it easy to buy products from other countries.

E-commerce is booming, and this trend fuels interest in fast payments.

FinTech firms help with swift international transactions. New payment technologies boost user experience too. Consumers want seamless ways to send money abroad, especially for shopping or travel.

The rapid growth in these services supports trade across borders and taps into tourism spending, which adds to South Korea’s digital economy growth.

Emerging Trends in Korea’s FinTech Market

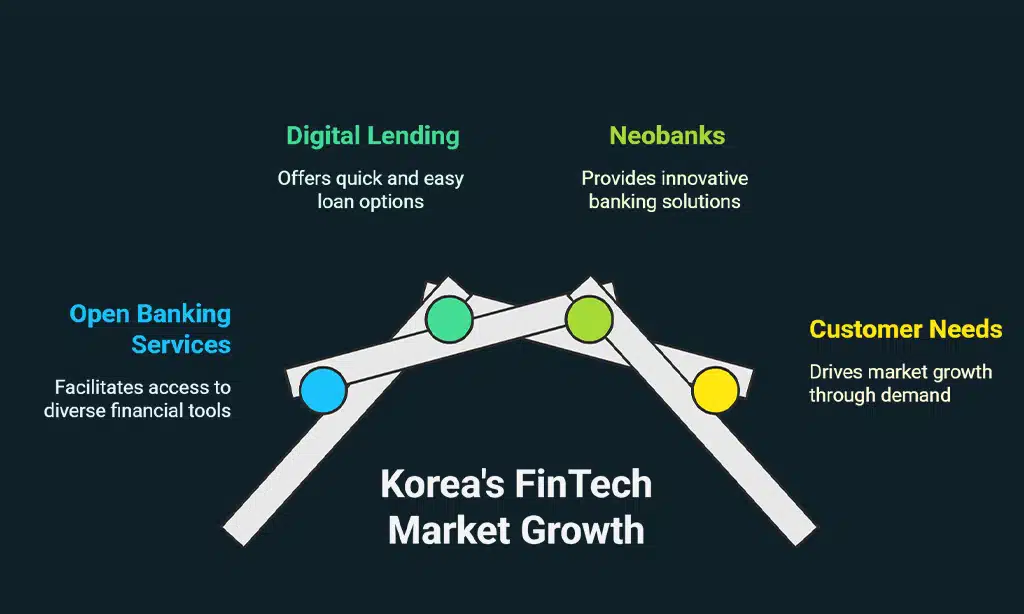

Korea’s FinTech market is buzzing with new ideas. Open banking services are taking off. Many people now have access to a variety of financial tools right on their phones. Digital lending and new banks, or neobanks, are also increasing in popularity.

People want fast and easy ways to manage money and make payments. This trend will help the market grow even more as it meets customer needs!

Expansion of open banking services

Open banking services are growing fast. This trend is shaping Korea’s fintech market. These services allow users to share their bank data with other companies safely. With better data-sharing rules, banks and apps can create more useful tools for customers.

Stablecoins and blockchain technology make transactions smoother and safer. By 2028, digital payments will be the norm, making up 94% of online transactions. The rise in mobile wallets and real-time payments shows that people want quick solutions for their money needs.

Fintech in Korea is ready to change how we think about banking forever!

Rise of embedded finance platforms

Embedded finance platforms are growing fast in South Korea. They make it easy for apps and websites to offer banking services right inside their platforms. This means you can pay, borrow money, or invest without leaving an app.

With more people using smartphones, the demand for these solutions is high. Consumers want quick and simple ways to handle money online. FinTech companies team up with banks to fill this gap in financial services.

By working together, they help more people access what they need, creating a win-win situation!

Growth of digital lending and neobanks

Digital lending and neobanks are key players in Korea’s FinTech boom. These services offer loans online without the need for traditional banks. They provide quick access to cash, which many people appreciate.

Neobanks operate entirely through apps, making banking simple and easy.

Korea’s market is set to reach $10 billion by 2025. More people use smartphones than ever before, driving this change. Digital wallets and payment apps also gain popularity daily. As a result, many customers seek fast ways to send money across borders.

This growing demand fuels more growth in the digital lending landscape and neobank space.

Challenges and Risks

The fintech scene in Korea faces some tough challenges. Rules and laws can change fast, making it hard for businesses to keep up and stay safe from cyber threats.

Regulatory compliance and global alignment

Regulatory compliance is key for fintech growth. Countries need clear policies to help innovation thrive. For example, public sandboxes in Australia and Switzerland allow new ideas to be tested safely.

These frameworks promote collaboration among businesses.

Digital identification systems are also important. They help meet rules across many countries. Fintechs must follow these regulations to gain trust. Clear guidelines pave the way for smoother operations worldwide, creating a more aligned global market.

Cybersecurity concerns in digital payments

Regulatory compliance and global alignment lead us to cybersecurity concerns in digital payments. Many people worry about the safety of their money online. Cybercriminals are always on the lookout for ways to steal sensitive information.

In fact, global cybercrime costs may reach $10.5 trillion each year by 2025. This growing threat can shake consumer trust in digital services.

To combat these threats, governments explore methods like blockchain for better security in digital identity systems. Fintech companies also seek solutions that provide safe payment options while keeping costs low; stablecoins can cut transaction fees by 30-50% compared to traditional cards.

Yet, as Korea’s fintech market grows, it must keep up with rising cybersecurity needs to protect its users from potential risks and fraud.

Market competition and saturation

Cybersecurity concerns in digital payments can lead to tough challenges. Market competition and saturation are becoming real issues for businesses in South Korea’s fintech space.

The eCommerce market is mature, with growth below 5% each year. Companies must look beyond local markets to grow.

Demand for advanced payment solutions rises as consumers seek new options. Buy Now Pay Later services reshape how people pay. This competition brings both risk and opportunity, pushing firms to form strategic partnerships with tech companies to stay ahead.

To remain competitive, adapting fast becomes key.

Takeaways

The FinTech market in Korea is set to hit $10 billion by 2025. This growth stems from strong government support, advanced technology, and rising consumer demand. South Korea’s policies help startups thrive.

The nation’s top-notch internet also makes digital payments easy. Consumers love using their smartphones for transactions, too. As we progress, keep in mind that embracing these changes can lead to great success in the financial sector!