Home insurance serves as an essential safety net for homeowners in India, offering vital protection against damage from natural disasters, theft, fire, and other unexpected events.

However, the process of filing a home insurance claim can often seem complex, especially when dealing with significant damage to your property. Understanding the steps to file a claim can significantly reduce stress and increase your chances of a successful settlement.

In this comprehensive guide, we’ll walk you through the process of how to file a home insurance claim in India, providing actionable insights, practical tips, and expert advice to ensure a smooth experience.

Understanding Home Insurance in India

Before delving into the claims process, it’s crucial to first understand the role of home insurance in India, the types of policies available, and why this coverage is an indispensable safeguard for homeowners.

What is Home Insurance?

Home insurance in India provides coverage against damage to the physical structure of your home and its contents. In a country where risks such as earthquakes, floods, and other natural calamities are prevalent, having home insurance can protect you financially from such unexpected losses. Essentially, it ensures that you do not bear the full financial burden of replacing or repairing damaged property.

Key Benefits of Home Insurance:

- Financial Security: Provides compensation for damages caused by disasters or accidents.

- Peace of Mind: Offers a sense of security knowing that your home and belongings are protected.

- Wide Coverage: Protects against a range of risks, including fire, theft, storms, and earthquakes.

Types of Home Insurance Policies in India

India offers different types of home insurance policies based on what they cover. It’s important to choose the right one according to your needs. Here’s an overview of the main types:

| Policy Type | Description |

| Structure Insurance | Covers damage to the physical structure of the property, including walls, roof, and foundation, caused by risks such as earthquakes, floods, and fire. |

| Content Insurance | Covers damage or loss to household items like furniture, electronics, appliances, and personal belongings due to perils like theft, fire, or natural calamities. |

| Comprehensive Coverage | A combination of both structure and content insurance, offering complete protection for both the physical property and the contents inside it. |

Why You Need Home Insurance in India

Given India’s vulnerability to natural disasters and the rising risk of man-made events like theft and fire, home insurance is essential. Here are some compelling reasons why it’s indispensable:

- Protection from Natural Disasters: Earthquakes, floods, and cyclones are common in India, and home insurance ensures you’re financially prepared for these risks.

- Covering Losses from Theft and Fire: With increasing rates of theft and accidental fires, home insurance provides compensation for your valuable possessions.

- Peace of Mind for Homeowners: Home insurance offers peace of mind by covering you financially, helping you to recover without draining your savings.

Key Steps to File a Home Insurance Claim in India

Knowing how to file a home insurance claim in India can significantly impact the ease of the process. By following these steps, you can ensure a faster, smoother claim resolution. Below is a detailed breakdown of the process:

Step 1: Review Your Home Insurance Policy

Before filing a claim, it is crucial to understand the coverage provided by your home insurance policy. The more you know about your policy, the easier it will be to determine what is covered, and what the limitations are.

Check Coverage and Terms

Home insurance policies may have exclusions, limitations, and specific conditions. Take the time to carefully read through the details of your policy, focusing on:

- Perils Covered: Make sure that the damage you are claiming for is covered. Typical covered events include fire, flood, earthquake, and vandalism.

- Exclusions: Many policies exclude specific events, such as damages caused by war, civil unrest, or wear and tear.

- Sum Insured: This is the maximum amount the insurer will pay for damages. Verify that this amount is sufficient to cover your home and belongings.

Know the Claim Process and Requirements

Your policy may outline specific instructions on how to file a claim. Here’s a typical list of documentation that insurers may require:

- Proof of ownership [for valuables].

- A copy of the police report [for theft].

- Photographs and videos of the damage.

- Proof of purchase for items that have been damaged or stolen.

Step 2: Notify Your Insurer Immediately

Timeliness is key when filing a claim. Most home insurance policies in India require that you inform the insurance company within 24 to 48 hours of the incident. Delayed reporting can result in claim rejection or reduced payout.

How to Notify the Insurance Company

Here’s a quick guide on how to inform your insurer:

- Phone Call or Email: Most insurers have dedicated helplines or email addresses to report claims. Have your policy number ready when calling.

- Online Claim Portal: Many insurers have online claim portals or mobile apps, where you can quickly report the damage.

- Written Notification: Some insurers might also require you to submit a written claim notice, either physically or digitally.

Step 3: Document the Damage

Thorough documentation is essential for processing your home insurance claim smoothly. The more evidence you provide, the better.

Importance of Proper Documentation

High-quality photos and videos are the best forms of evidence in a claim. Here’s a checklist for effective documentation:

- Photographs: Take clear images of all damaged areas, and if possible, take pictures of valuables [e.g., electronics, furniture] that have been affected.

- Videos: Record video footage of the damage. This gives the insurer a better perspective on the extent of the loss.

- List of Damaged Items: Create an inventory list of all the items damaged or destroyed, including approximate values and age of items.

| Documentation Checklist | Required Details |

| Damage Photos and Videos | Clear images of all affected areas and items. |

| List of Damaged Items | Include descriptions and estimated costs of each item. |

| Proof of Purchase | Receipts or invoices for valuables like electronics or furniture. |

| Police Report [for theft cases] | A report filed with local authorities regarding stolen items. |

Step 4: Fill Out the Claim Form

Once you’ve notified the insurer, the next step is to complete the formal claim process by filling out the claim form. This is where you’ll provide details of the damage and the losses sustained.

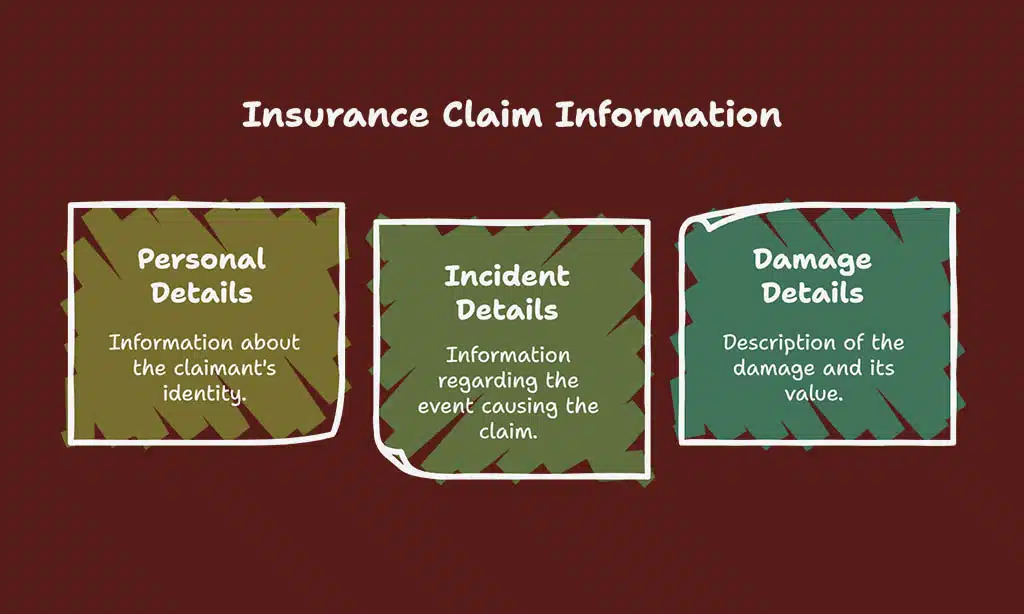

Information You Need for the Claim Form

Ensure that you provide all required information accurately. Here’s what the claim form typically asks for:

- Personal Details: Name, address, and policy number.

- Incident Details: Date, time, and description of the damage or loss.

- Damage Details: A description of the damage, including affected areas/items and their approximate value.

Where to Submit the Claim Form

After filling out the form, submit it through the insurer’s preferred medium—whether online, via email, or through post. Some insurers also accept claims in person at branch offices. Make sure to keep a copy of the submitted form and any accompanying documents.

Step 5: Survey and Inspection by the Insurer

After submitting the claim, the insurer will likely send a surveyor to assess the extent of the damage. This is an important step in the claims process, as it ensures that your claim is legitimate and that the damage is accurately documented.

How the Surveyor Assesses the Damage

The surveyor’s job is to verify the damage and assess how much the insurer should pay out. The surveyor will:

- Inspect the Damaged Property: They will inspect the damaged areas and evaluate the extent of the loss.

- Match Documentation to Losses: The surveyor will compare the photographs, videos, and inventory list to the physical damage.

- Provide a Report: Based on their findings, the surveyor submits a report to the insurance company, which will guide the settlement process.

Ensure Accurate Assessment of Losses

To ensure the surveyor’s assessment is accurate, consider being present during the inspection. This allows you to address any questions or discrepancies and provide additional documentation if necessary.

Step 6: Claim Settlement and Payout

Once the surveyor completes their inspection and the insurer reviews the findings, the next step is the settlement of the claim. The insurer will calculate the payout based on the sum insured and any applicable deductions.

How Insurance Payouts Work

Insurance payouts are typically made after the claim is approved. Depending on the policy, payouts may be:

- Full Settlement: A full payout for the damage, minus the deductible [if applicable].

- Partial Settlement: If the damage exceeds your coverage limit or falls under exclusions, the insurer may only provide partial compensation.

Possible Deductions and Adjustments

Insurers may deduct certain costs from the settlement amount, such as:

- Deductibles: The amount you pay out-of-pocket before the insurance payout kicks in.

- Depreciation: The insurer may adjust the payout based on the depreciation of certain items, such as electronics or furniture.

Common Challenges in Filing Home Insurance Claims

Filing a home insurance claim can sometimes come with challenges, but being aware of potential issues can help you navigate the process more smoothly.

Delayed Settlements

One of the most common complaints among policyholders is delayed claim settlements. Delays can occur due to incomplete documentation, disputes over the cause of the damage, or the sheer volume of claims during peak times like monsoon seasons. To avoid delays:

- Ensure all documents are complete and submitted on time.

- Stay in contact with your insurer to monitor the status of your claim.

Disputes Over Coverage

Sometimes, insurers may dispute the extent of the damage or refuse to cover specific claims based on exclusions. For example, if a policy doesn’t cover damage caused by a flood and you file a claim for flood damage, it may be rejected.

- Be proactive in reviewing your policy’s exclusions and seek clarification on any ambiguous terms.

Insufficient Documentation

If you fail to provide adequate evidence of damage, your claim could be delayed or rejected. To prevent this, take comprehensive photographs, maintain an inventory of your belongings, and keep receipts for valuable items.

Tips to Avoid Claim Rejection in India

To ensure that your claim is successful, follow these simple yet crucial tips:

Ensure Your Policy Is Active

Before filing a claim, always verify that your insurance policy is active and premiums are paid up-to-date. If your policy is lapsed, the insurer will not honor the claim.

Be Honest and Transparent with Your Insurer

Transparency is key when filing a claim. Be honest about the circumstances of the damage or loss, and avoid exaggerating the extent of the damage.

Maintain Regular Documentation

Regularly updating your home inventory list and taking pictures of your property can save time in the future when you need to file a claim.

Wrap Up: Navigating the Home Insurance Claim Process in India

Filing a home insurance claim in India may seem overwhelming, but following the right steps and understanding the ins and outs of the process can make it much easier.

By reviewing your policy, documenting the damage thoroughly, and communicating clearly with your insurer, you can avoid common pitfalls and ensure a smooth claim process.

Remember, being proactive and prepared is the key to minimizing stress and getting your home back in order quickly. Whether you’re filing for natural disaster damages or loss due to theft, knowing how to file a home insurance claim in India will empower you to take charge of the situation.