What if paying off your debt too fast is actually hurting your business?

Sounds strange, right? But it’s true. Trying to wipe out debt as quickly as possible might leave you with little to no cash to cover the things your business really needs, like payroll, rent, or supplies. And no cash means no breathing room.

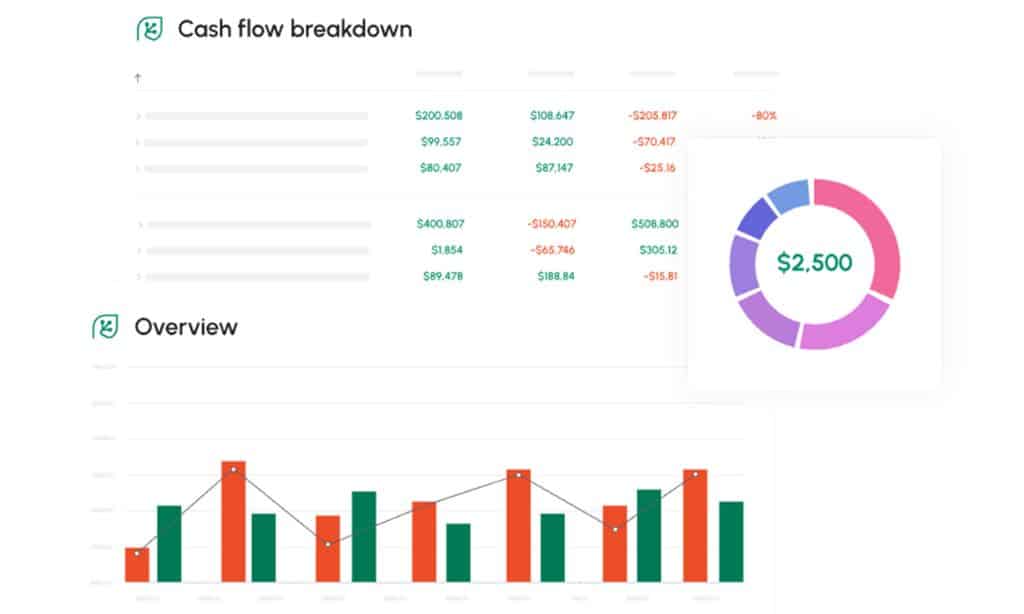

According to a U.S. Bank study, 82% of business failures are linked to poor cash flow management. That’s a massive number, and it shows just how important it is to get this right. Using the right software for forecasting cash flow, such as Cash Flow Frog, can make it much easier to stay ahead and plan smarter.

So how do you stay on top of debt without draining your bank account?

This quick guide will show you how to balance both—how debt and cash flow work together, how to keep the money moving, and how smart planning can keep your business strong.

Understanding the Cash Flow–Debt Relationship

Cash flow is all about how money moves in and out of your business. Debt is money you borrowed that needs to be paid back.

Here’s the deal: if you throw every dollar at your loans, you might end up without enough money to run your business. But if you avoid your debts to keep cash on hand, you’ll rack up interest and possibly hurt your credit.

They’re not enemies, but they need to work together. Finding the sweet spot means you’re covering what you owe while keeping enough cash on hand to operate with confidence.

Prioritizing Debt Payments Without Sacrificing Liquidity

Paying down debt is important, but draining your bank account just to do it can backfire. You need a smart way to prioritize debt payments so you’re not stuck without cash when you need it.

Try this:

- Make a list of your debts with interest rates, due dates, and balances

- Focus on the high-interest ones first, since they cost you the most

- Always pay the minimum on everything else to avoid penalties

- Keep a small cash buffer so you’re not living from invoice to invoice

- Reach out to lenders if you need better terms — many are open to working with you

This way, you chip away at your debt without draining your account dry.

Boosting Cash Flow to Ease Debt Pressure

Want to make debt easier to handle? Bring in more cash. It sounds obvious, but small tweaks can really help.

Here are a few ways to get more money flowing in:

- Give early payment discounts to clients who pay fast

- Stay on top of unpaid invoices — don’t let them pile up

- Rethink your pricing if you’re selling yourself short

- Cut non-essential expenses or delay big purchases

- Offer subscriptions or retainers so money comes in regularly

The steadier your cash flow, the less stressful debt feels.

Tools and Techniques for Smarter Balancing

Doing cash flow management all on paper or in your head? That’s a headache waiting to happen.

Using digital tools can make your life much easier. It helps you:

- Track your cash in and out in real time

- See when money might get tight

- Test out “what if” situations, like if a client pays late

- Get reminders before bills are due

- Sync everything with your accounting system

Basically, it turns a messy spreadsheet into something you can actually use to make smart decisions.

Long-Term Strategies for Debt and Cash Flow Harmony

Short-term wins are great, but long-term habits are what keep your business steady through the ups and downs. Here’s how to build that kind of stability:

- Set quarterly cash flow goals – Check in regularly to stay on track and spot issues early.

- Refinance when better rates come up – Lower interest means more cash in your pocket.

- Build an emergency fund – Even small contributions add up and give you breathing room.

- Level up your money skills – A little financial know-how goes a long way in smarter decision-making.

- Diversify your income – Relying on one big client is risky. Multiple streams create stability.

These simple habits help your business stay flexible, resilient, and ready for growth.

In conclusion

You’re not the only one trying to figure this out. A QuickBooks study found that 69% of small business owners lose sleep over cash flow worries. That’s a clear sign this challenge is real and that peace of mind matters just as much as the numbers.

You don’t have to choose between paying off debt and keeping your business running. With the right strategy to prioritize debt payments, you can reduce what you owe without putting your operations at risk.

It’s all about balance. When you manage your cash with intention, you give your business room to grow, adapt, and stay steady—even when things get tough.

Have a tip or story about finding that balance? We’d love to hear it.