Divorce can bring big life changes, and taxes are no exception. Many people feel confused about how divorce affects their tax return. Filing status, alimony payments, and dependency claims might seem tricky.

These changes can also impact your tax brackets and credits.

For example, your marital status on December 31 decides if you file as “Single” or “Head of Household.” This choice directly impacts your taxable income and potential deductions. Understanding these details helps you avoid surprises during tax season.

This guide will break down the key tax rules for divorced individuals in 2025. You’ll learn steps to handle taxes after a divorce with ease. Keep reading to simplify this important part of life!

Filing Status After Divorce

Your tax filing status changes once you’re divorced. The choice between single or head of household affects your tax bracket and possible benefits.

Single vs. Head of Household

Divorce changes how you file your taxes. Your filing status affects your tax bracket, credits, and deductions. Determining whether you qualify as “Single” or “Head of Household” is crucial.

| Filing Status | Key Points |

| Single |

|

| Head of Household |

|

Deadlines for changing filing status

Your marital status on December 31, 2025, will determine your tax filing status for the year. If your divorce is final by that date, you can no longer file as “Married Filing Jointly” or “Married Filing Separately.” Instead, you must select either Single or Head of Household.

To qualify for Head of Household, you must meet specific requirements. You need to pay more than half the cost of maintaining a home and have at least one dependent living with you for over six months in 2025.

Changes after December 31 won’t affect this year’s taxes but will apply to future filings.

Alimony and Tax Implications

Alimony payments can affect your taxable income, depending on recent tax law changes. Understanding these shifts is key to planning your finances after a divorce.

Is alimony taxable or deductible?

For divorces finalized or modified after 2018, alimony is neither taxable income for the recipient nor tax-deductible for the payer. This change stems from the Tax Cuts and Jobs Act (TCJA), which applies to agreements settled on or after January 1, 2019.

If your divorce was before this date, different rules apply. Payments may still be deductible by the payer or taxed as income for the payee. Always check your divorce decree and consult a tax professional to understand your obligations fully.

Key changes in federal tax laws

Alimony rules changed after 2019. Payments are no longer tax deductible for the payer. Recipients also do not report alimony as taxable income. This applies to all divorce agreements finalized or updated from January 1, 2019, onward.

Your filing status impacts your taxes significantly. As of December 31, your marital status determines whether you file as Single or Head of Household. Changes in laws now focus on ensuring accurate reporting and proper deductions during a legal separation or divorce settlement process.

Always review updates through reliable IRS publications like Publication 504 (2024).

Claiming Dependents

Determining who can claim dependents impacts your tax bills. Understand the rules to avoid missing credits or deductions.

Who claims child tax credits?

The custodial parent usually claims the child tax credits. This means the parent who has the child for most of the year gets the credit. For divorces finalized in 2025, custody arrangements decided by December 31 determine this eligibility.

Sometimes, a noncustodial parent can claim it if they have a written agreement or divorce decree saying so.

Tax rules also apply to medical expenses and childcare costs. Only one parent can deduct these expenses on their taxes. To qualify for claiming dependents or tax credits like earned income tax credit (EITC), clear agreements should be part of your separation agreement or divorce settlement.

Always check IRS Publication 504 for updated guidelines.

Rules for medical expenses and childcare costs

Medical expenses for children can be claimed by the parent who pays them. This applies even if that parent cannot claim the child as a dependent. To deduct these costs, they must exceed 7.5% of your adjusted gross income (AGI).

Keep receipts and ensure all payments qualify under IRS rules.

Childcare costs may qualify for a Child and Dependent Care Credit. Only the custodial parent, or the one living with the child most of the year, is usually eligible to claim this credit.

Work-related childcare expenses like daycare often meet requirements for claiming this tax benefit.

Property Transfers and Tax Exclusions

Dividing property during divorce can trigger tax consequences based on the type of assets involved. Understanding rules for homes, investments, and other transfers is vital to avoid unnecessary taxes.

Tax rules for transferring assets

Asset transfers during divorce are tax-free if done under a divorce decree. For 2025, the IRS treats these as non-taxable events. Moving property from one spouse to another does not lead to capital gains taxes at that time.

The receiving spouse takes on the same cost basis for the asset, which affects future taxes if they sell it. This rule applies regardless of whether you’re legally separated or fully divorced.

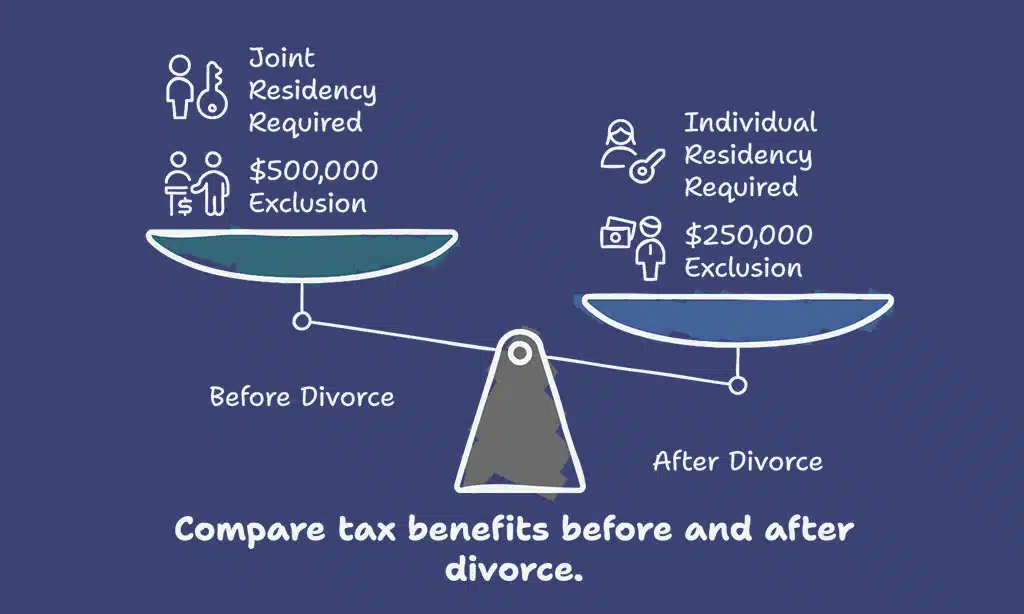

Selling a shared home can trigger capital gains tax unless exclusions apply. If both spouses lived in the home for two out of five years before selling, each may exclude up to $250,000 in profit from taxation.

After divorce, only the person keeping the house qualifies for this exclusion—if they meet residency rules alone. Proper planning ensures fewer surprises during property division and keeps your finances stable long-term.

Home sale exclusions after divorce

Divorced couples may face tax implications when selling a home. The IRS allows up to $250,000 in capital gains tax exclusion for single filers or $500,000 if you qualify as married filing jointly before the divorce is final.

To claim this, both spouses must meet ownership and residency tests. You must have lived in the home for at least two of the past five years.

Selling after divorce can affect who gets the exclusion. If one spouse keeps the house but later sells it alone, they only qualify for up to $250,000 in exclusions as a single filer.

Proper planning and understanding deadlines help reduce taxes owed on any profit from a sale.

Retirement Accounts and IRAs

Dividing retirement accounts during divorce can trigger tax penalties if not handled properly. Learn how a qualified domestic relations order (QDRO) helps avoid extra taxes or fees.

Taxable implications for IRA contributions

Traditional IRA contributions may impact your taxable income. These are often tax-deductible, but the deduction depends on your income and if you or your ex-spouse have a workplace retirement plan.

For 2025, check updated limits to avoid penalties.

Roth IRA contributions use after-tax dollars, so they don’t reduce taxable income now. But qualified withdrawals in retirement are tax-free. If divorce changes your income level or filing status, this could affect contribution limits for both IRAs.

Rules for dividing retirement funds

Dividing retirement accounts like IRAs during a divorce has strict rules. Use a Qualified Domestic Relations Order (QDRO) for 401(k)s or pensions to avoid tax penalties. This legal document tells the plan administrator how to split funds between both parties.

Without it, early withdrawals may face heavy taxes and fees. For Roth IRAs or Traditional IRAs, follow guidelines in your divorce decree to ensure no extra tax liability.

Transfers between spouses are usually tax-free if done before the divorce is final. But after that, transfers can trigger taxable income depending on the account type or withdrawal timing.

Any changes to beneficiary designations should be updated immediately after dividing these assets to protect future financial interests. Seek advice from a financial advisor for better compliance with federal income tax laws and efficient asset division strategies.

Tax Withholding and Name Changes

Updating tax documents after divorce is crucial to avoid errors. Notify the IRS about any name changes to prevent delays in processing your returns.

Updating tax withholding forms

Divorce can change your income and tax liabilities. It’s crucial to update your tax withholding forms to avoid underpaying or overpaying taxes.

- Fill out a new Form W-4 with your employer after your divorce is finalized. Your filing status may switch from “married filing jointly” to “single filing status” or “head of household.”

- Adjust the number of dependents claimed on your W-4 if you lose or gain custody of children. This helps ensure correct withholding for child tax credits.

- Report any significant changes in income, including alimony received. Alimony qualifies as taxable income for divorces finalized before 2019 but not afterward.

- Check if spousal support affects your taxable income bracket. Higher payouts might bump you into a higher tax bracket.

- Update beneficiary information on retirement accounts and life insurance policies tied to your divorce decree.

- Recheck state-specific rules for separate maintenance payments, as some states have unique laws impacting withholding levels.

- Work with a tax professional if dividing assets like IRAs or handling early withdrawal penalties on shared retirement funds. Professionals help align withholding amounts properly.

- Moving forward with accurate updates prevents surprises during tax season—like owing taxes due to incorrect filing statuses or missed exemptions!

Reporting name changes to the IRS

Changing your name after a divorce can affect your taxes. The IRS must have your correct name to match tax filings with Social Security records.

- Contact the Social Security Administration (SSA) first to update your name. Submit Form SS-5 and provide legal documents, like your divorce decree or court order.

- After updating with SSA, ensure the new name appears on your Social Security card. This step is necessary before filing taxes.

- Use the updated name when filing your next tax return. Incorrect names can delay refunds or cause issues with processing.

- Notify other institutions of the change, like banks or employers, so tax records match across all systems.

- Check that IRS forms reflect the correct information after the update to avoid mismatches during income verification.

- If you filed taxes under a previous name but changed it later, keep copies of related documents for future reference in case of audits or discrepancies.

- Speak with a tax professional if unsure about any steps to prevent errors that could impact financial outcomes.

Takeaways

Divorce changes how taxes work for you. Your filing status, alimony rules, and claiming dependents all matter. Dividing property or retirement accounts can bring tax costs if done wrong.

Updating your tax forms and name with the IRS is a smart move. These steps help make the process easier and less costly. Stay informed on updates to tax laws in 2025 to avoid surprises.

A trusted tax professional can guide you through this big change effectively.

FAQs

1. How does divorce affect your tax filing status?

Your tax filing status changes based on whether you are legally married at the end of the year. After a divorce, you may file as single or head of household if you meet certain requirements.

2. What is a Qualified Domestic Relations Order (QDRO), and how does it impact taxes?

A QDRO allows retirement accounts to be divided without early withdrawal penalties. Taxes still apply when funds are withdrawn later.

3. Is child support taxable income for the recipient?

Child support payments are not taxable income for the custodial parent and cannot be deducted by the payer.

4. Can spousal support affect taxable income?

Yes, spousal maintenance received is considered taxable income unless specified otherwise in your divorce decree under current tax laws.

5. Who claims the child tax credit after a divorce?

Usually, only the custodial parent can claim the child tax credit unless both parents agree otherwise in their legal separation agreement or court order.

6. Are property transfers during a divorce taxed?

Property division as part of a divorce settlement typically has no immediate capital gains tax implications but could affect future taxes when assets are sold or transferred later.