The global energy transition has reached a critical inflection point as we move deeper into the decade. While the 2020s were defined by the massive scaling of wind and solar, the 2030s are shaping up to be a decade of “system integration,” where the storage and transport of energy become as important as its generation. In this context, the Green Hydrogen vs Solar 2030 Outlook suggests that we are not looking at a zero-sum game, but rather a complex, multi-layered energy ecosystem.

As of early 2026, the data confirms that while solar remains the cheapest and fastest-growing electricity source, green hydrogen is rapidly maturing to solve the “last mile” of decarbonization, targeting industries that electricity simply cannot reach.

Key Takeaway

- Solar is for Power: It will remain the primary, cheapest source of electricity for residential and commercial use.

- Hydrogen is for Industry: It is the essential fuel for steel, shipping, and chemicals.

- They are Partners: Green hydrogen provides the storage and transportability that solar lacks, while solar provides the cheap energy hydrogen requires.

- The 2030 Inflection Point: By 2030, the “Green” versions of these technologies will finally reach price parity with fossil fuels, ending the era of the “green premium.”

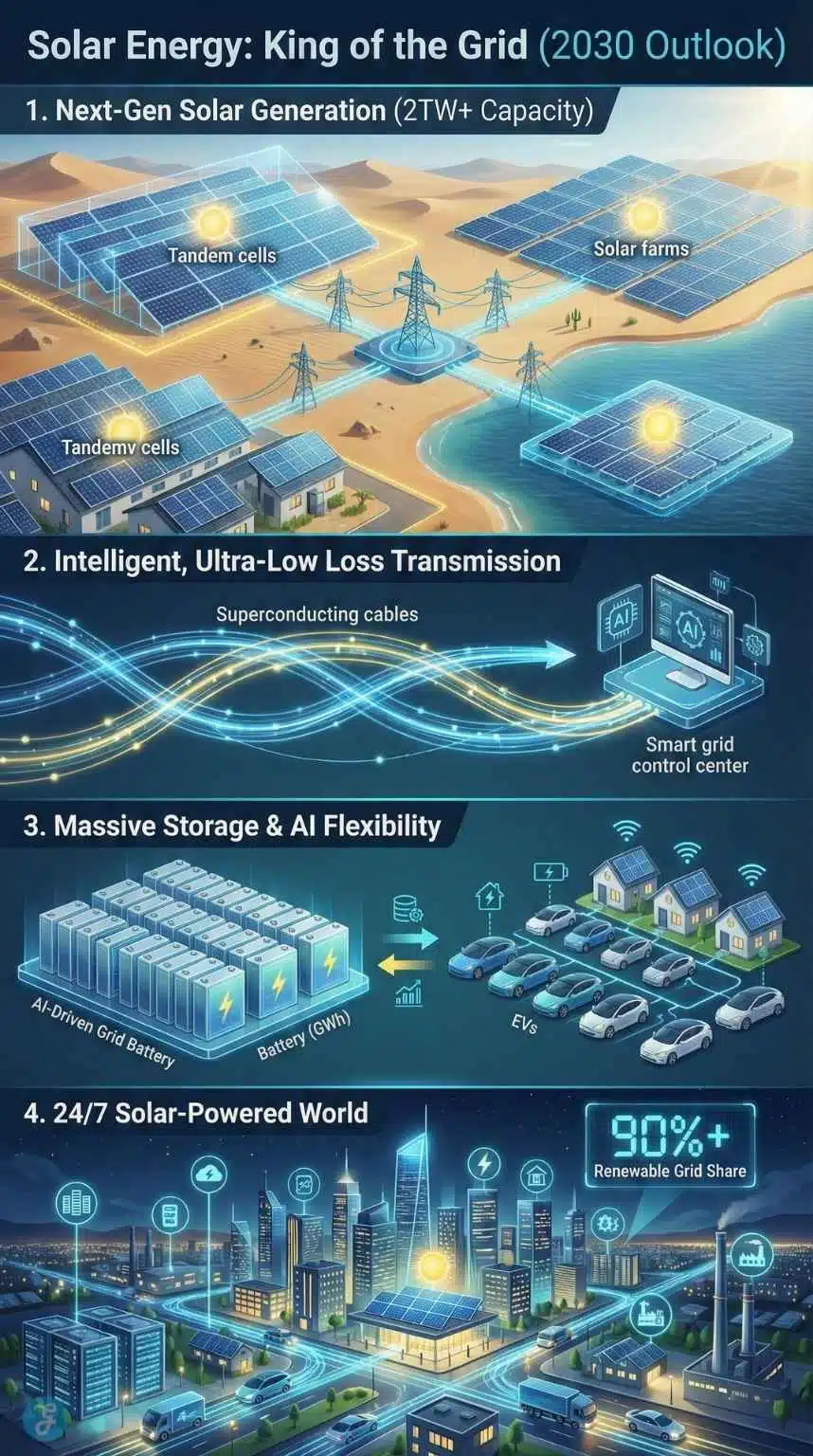

Solar Energy: The Undisputed King of the Grid

Solar power has officially entered its “maturity” phase. By the end of 2025, global solar capacity exceeded 2 terawatts (TW), and projections for 2030 suggest we will see a tripling of yearly deployments compared to the start of the decade.

The Rise of Perovskite Tandem Cells

One of the most significant developments in 2026 is the commercialization of Perovskite-Silicon tandem cells. Traditional silicon panels have an efficiency limit of around 29%. Tandem cells, which layer perovskite materials on top of silicon, are already hitting 33-35% in pilot lines. This shift is crucial for the 2030 outlook because it allows for more power generation from the same land area, further driving down the Levelized Cost of Electricity (LCOE).

Market Saturation and the “Duck Curve”

As solar penetration increases, many regions are facing the “Duck Curve” problem, an oversupply of energy during the day and a shortage at sunset. This is where the synergy with hydrogen begins. Instead of “curtailing” (wasting) excess solar power, grid operators are now looking at massive electrolyzer plants to soak up this cheap mid-day energy. This effectively turns a grid problem into an industrial fuel solution.

Green Hydrogen: The “Missing Link” for Hard-to-Abate Sectors

If solar is the heart of the new energy system, green hydrogen is the muscle. Batteries are excellent for passenger cars and short-duration grid storage, but they lack the energy density required for heavy-duty applications.

Decarbonizing Heavy Industry

The 2030s will see green hydrogen dominate three specific “hard-to-abate” sectors where direct electrification is technically or economically impossible:

- Steel Manufacturing: Replacing coking coal with hydrogen in Direct Reduced Iron (DRI) plants is no longer a pilot concept; in 2026, full-scale industrial plants are coming online in Sweden and Germany.

- Chemicals & Fertilizers: The world depends on ammonia for food security. Transitioning from “Grey” hydrogen (made from natural gas) to “Green” hydrogen is the only way to decarbonize global agriculture.

- Heavy Shipping: Using hydrogen-derived fuels like green methanol or ammonia to power cargo fleets is becoming the industry standard for new vessel orders.

Beyond Pure Gas: The Rise of Hydrogen Derivatives

A major component of the Green Hydrogen vs Solar 2030 Outlook is the realization that hydrogen may not always be used as a gas. Because hydrogen is difficult to transport, the 2030s will see a massive surge in “Power-to-X” technologies.

- Green Ammonia: Ammonia is easier to liquefy and transport than pure hydrogen. It is becoming the primary medium for international energy trade.

- E-Methanol: By combining green hydrogen with captured CO2, we create a carbon-neutral liquid fuel that can run in existing ship engines.

- Sustainable Aviation Fuel (SAF): Hydrogen-based synthetic kerosene is the leading contender for long-haul flight decarbonization, as battery-electric planes are limited to short, regional hops.

The Derivatives Race: Ammonia vs. Methanol vs. LOHC

While solar produces pure electrons, the 2030 outlook for hydrogen is split by how we move the molecule.

- Green Ammonia ($NH_3$): The frontrunner for long-haul shipping and fertilizer. It is easier to store but highly toxic if leaked.

- E-Methanol: The “Drop-in” solution. It can run in existing modified engines, making it the favorite for the transitional 2030s.

- LOHC (Liquid Organic Hydrogen Carriers): A 2026 breakthrough technology that allows hydrogen to be “soaked” into a safe oily liquid, transported in standard oil tankers, and “squeezed out” at the destination.

The Economic War: Cost Trajectories to 2030

The primary barrier to green hydrogen has always been cost. In early 2024, green hydrogen cost roughly $5–$7 per kg, while “Grey” hydrogen was under $1.50. However, 2026 marks a turning point due to massive economies of scale in electrolyzer manufacturing.

Cost Projections: LCOE vs. LCOH

By 2030, several regions, including India, Australia, and Chile, are targeting the “2-1-2” goal: $2 per kg of hydrogen, produced with $1 per watt electrolyzers, within the next decade.

| Metric | 2024 Average | 2026 (Current) | 2030 Projection |

| Solar LCOE (Global) | $0.045 / kWh | $0.030 / kWh | $0.018 / kWh |

| Green Hydrogen LCOH | $6.20 / kg | $3.80 / kg | $2.10 / kg |

| Electrolyzer CapEx | $1,200 / kW | $750 / kW | $350 / kW |

| Carbon Credit Price | $40 / ton | $85 / ton | $150+ / ton |

Technical Deep Dive: Electrolyzer Scaling

To meet the 2030 goals, the world needs massive electrolyzer capacity. We are moving from megawatt-scale pilots to gigawatt-scale factories.

- Alkaline Electrolyzers (AWE): These are the workhorses of the industry. They are cheaper to build but require a steady power supply, making them less ideal for purely solar-powered setups without battery buffers.

- Proton Exchange Membrane (PEM): These are highly “flexible,” meaning they can ramp up and down in seconds to match the volatility of solar power. While currently more expensive due to iridium and platinum components, recycling programs and new catalysts are slashing costs in 2026.

- Solid Oxide (SOEC): An emerging 2030 contender that operates at high temperatures, offering up to 90% efficiency when integrated with industrial waste heat.

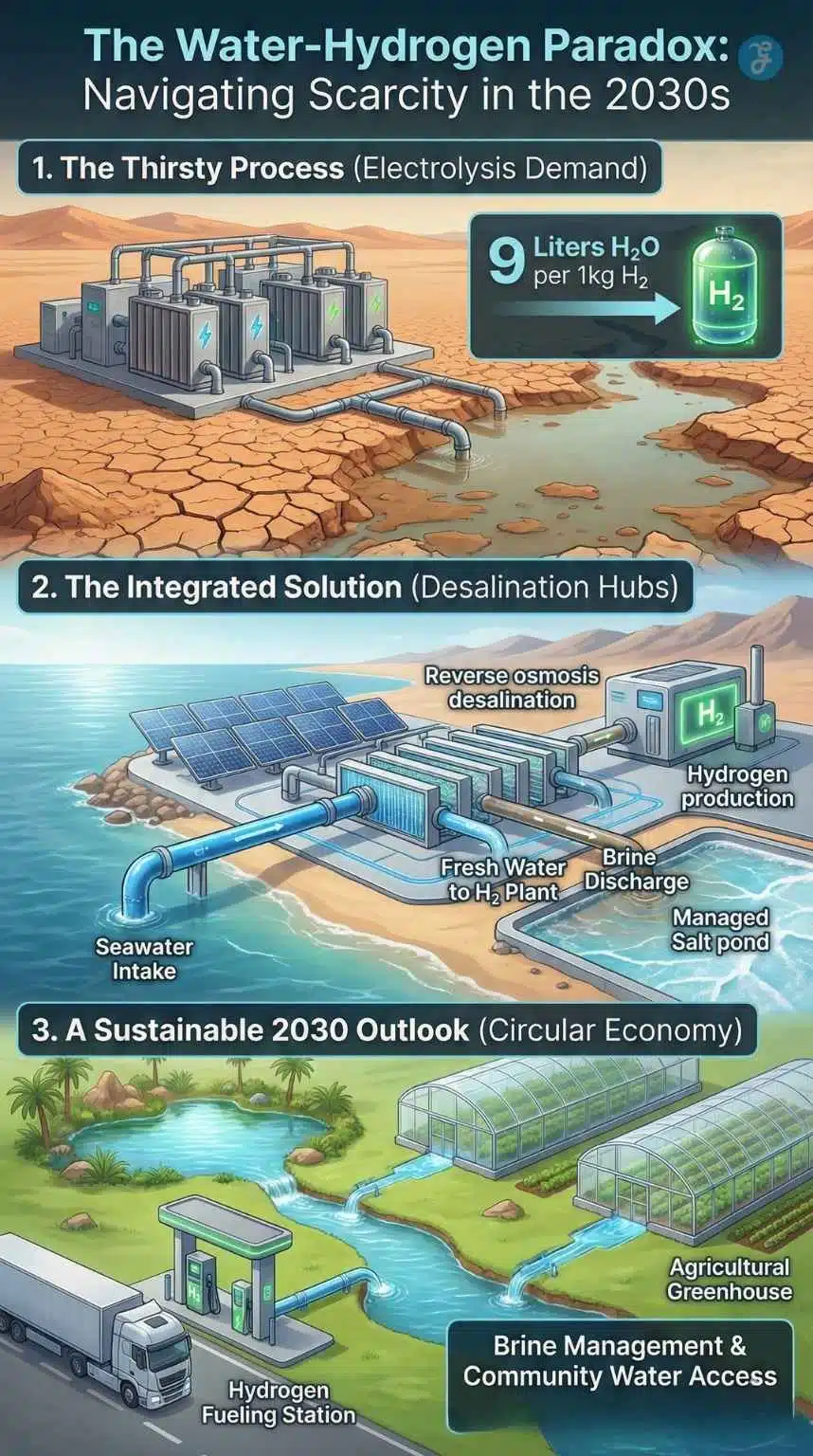

The Water Scarcity Challenge: The Hydrogen Bottleneck

One often overlooked aspect of the Green Hydrogen vs Solar 2030 Outlook is the water requirement. Producing 1kg of green hydrogen requires approximately 9 liters of high-purity, demineralized water.

In arid regions perfect for solar (like North Africa or the Middle East), water is scarce. This has led to the rise of Integrated Desalination-Hydrogen Hubs. By 2030, the cost of desalination will represent less than 1% of the total hydrogen production cost, but the environmental management of the leftover brine will be a major regulatory focus.

The Circular Economy: Solar & Hydrogen Waste Management

By 2030, the first generation of mass-deployed solar panels from the early 2010s will reach their end-of-life. A critical part of the Green Hydrogen vs Solar 2030 Outlook is how we handle this waste.

- Solar Recycling: 2026 has seen the rise of “Closed-Loop” manufacturing. Companies are now recovering 95% of silver and silicon from decommissioned panels, reducing the reliance on virgin mining.

- Electrolyzer Recovery: Green hydrogen plants rely on rare minerals like Iridium and Platinum. The 2030s will see a booming secondary market for “Refurbished Stacks,” where electrolyzer membranes are recycled to lower the capital expenditure (CapEx) of new plants.

The Synergy: Hydrogen is “Liquid Solar”

The most important takeaway is that hydrogen allows us to “package” solar energy and move it across oceans.

- Seasonal Storage: Solar energy captured during the peak of summer can be converted to hydrogen, stored in underground salt caverns, and burned for heat or power during the dark winter months.

- Grid Balancing: When solar farms produce more energy than the grid can handle, that “wasted” energy is diverted to electrolyzers. This increases the “capacity factor” of the solar farm, making the entire project more profitable.

AI & The Decentralized Grid: The 2030 Software Layer

Hardware alone cannot solve the energy crisis. The 2030s will be defined by Autonomous Energy Orchestration.

- Predictive Maintenance: AI models now use satellite data to predict “Solar Dips” (cloud cover) hours in advance, automatically ramping up hydrogen fuel cell discharge to keep the grid stable.

- Smart Arbitrage: By 2030, energy will be traded in microseconds. AI “Trading Bots” will decide if a solar farm should sell electricity to the local city or divert it to hydrogen production based on real-time global commodity prices for Green Ammonia.

AI and the Autonomous Grid: Managing Complexity

By 2030, the energy grid will be too complex for human operators to manage in real-time. We will see the rise of AI-Driven Energy Orchestration.

- Predictive Electrolysis: AI models will analyze weather patterns to predict solar dips and automatically adjust hydrogen production to ensure the electrolyzers always run at peak efficiency.

- Smart Arbitrage: AI will decide whether to sell solar electricity directly to the grid, store it in a battery, or convert it to hydrogen based on live market prices.

Geopolitics: The New Energy Map

The 2030s will see a shift in global power dynamics.

1. The Manufacturing King: China’s Strategic Dominance

As of 2026, China has effectively become the “OPEC of Electrolyzers.” Under its 15th Five-Year Plan (2026–2030), China has consolidated 60% of global electrolyzer manufacturing capacity. By leveraging its massive domestic solar overcapacity, China is producing green hydrogen at a cost of $1.50–$1.75/kg, significantly undercutting Western competitors. This dominance has created a “technology dependency” where the West relies on Chinese hardware to meet its own climate targets.

2. The European Hub: Regulation as Power

The European Union is carving out its role not as a producer, but as the world’s most influential hydrogen regulator and consumer.

- The Hydrogen Backbone: By 2030, the EU aims to have a 28,000km dedicated hydrogen pipeline network connecting solar-rich Spain and North Africa to the industrial heart of Germany.

- Carbon Diplomacy: Through the Carbon Border Adjustment Mechanism (CBAM), the EU is forcing global trade partners to adopt green standards. If a country wants to sell steel or chemicals to Europe in 2030, it must use green hydrogen, or face crippling tariffs.

3. The Rise of the “Renewable Superpowers”

A new class of nations is emerging—countries with low populations but massive “solar-to-hydrogen” potential.

- Australia: Currently holds the world’s largest pipeline of export-oriented hydrogen projects. It is positioning itself as the primary energy provider for Japan and South Korea, replacing coal exports with “Green Ammonia.”

- Chile & Namibia: Both nations are utilizing their unique geography (high wind + high solar) to target the lowest production costs globally. Namibia’s $10 billion Hyphen project is set to become a primary supplier for the EU by 2030.

- The Gulf Pivot: Saudi Arabia (NEOM) and Oman are racing to diversify. They are no longer just “oil states” but are building the world’s largest integrated solar-hydrogen hubs to ensure they remain energy leaders in a post-oil world.

4. The Fragmentation Risk: A Two-Tier Market?

By 2030, we expect to see a “Two-Tier” global hydrogen market:

- The “Green” Tier: High-standard, certified hydrogen (mostly EU and US-aligned) that fetches a premium price.

- The “Value” Tier: Lower-cost hydrogen produced with less stringent environmental tracking, dominated by Chinese technology and exports to developing nations.

| Feature | The Hydrocarbon Map (Pre-2020) | The Solar-Hydrogen Map (2030) |

| Power Source | Extractive (Natural Resource Wealth) | Manufacturing (Industrial Efficiency) |

| Trade Bottlenecks | Straits of Hormuz / Suez Canal | Electrolyzer Supply Chains / Rare Earths |

| Leading Nations | USA, Russia, Saudi Arabia | China, Australia, EU, India |

| Market Style | Global Commodity Price | Regionalized Pipeline & Hub Networks |

Socio-Economic Prosperity: Jobs and the Global South

The transition to a solar-hydrogen economy is a massive job engine. Estimates for 2030 suggest that the green hydrogen value chain alone could create over 2 million jobs globally.

- Local Manufacturing: Countries in the Global South are moving away from just exporting raw energy to manufacturing the components (solar glass, electrolyzer membranes) domestically.

- Rural Electrification: Hydrogen fuel cells are providing a “clean” alternative to diesel generators in remote villages, leapfrogging the need for expensive traditional grid infrastructure.

2026 Progress Report: Proving the 2030 Vision

To understand the 2030 outlook, we must look at the “Gigascale” projects currently coming online:

- NEOM Green Hydrogen (Saudi Arabia): As of 2026, this remains the world’s largest project, integrating 4GW of solar and wind to produce 600 tonnes of hydrogen per day.

- The HyDeal Ambition (Europe): A massive initiative to deliver green hydrogen across Europe at $1.50/kg by 2030 using a dedicated pipeline “backbone.”

- Australia’s ‘Sun Cable’: A massive solar-plus-storage project that proves how solar can be exported directly via subsea cables, competing with hydrogen’s shipping model.

Final Thought: The Era of the Molecule and the Electron

In the “Green Hydrogen vs Solar 2030 Outlook,” the winner is the planet. We are moving away from a world of “extractive energy” (digging things up) to a world of “manufactured energy” (capturing what falls from the sky). Solar gives us the electrons we need to run our modern lives, and hydrogen gives us the molecules we need to build our modern world.

In the 2030s, these two forces will merge into a single, unstoppable clean energy machine.