Many people feel lost when they try to find the next big startup in Germany. The 2024 Deutscher Startup Monitor shows that venture capital in renewable energy and software as a service firms set a new record.

This post highlights ten top firms, from a process mining platform that uses machine learning to a mobile banking app that drives financial inclusion. Ready to see them?

Key Takeaways

- Venture capital in renewable energy and SaaS hit a record in 2024, according to the Deutscher Startup Monitor.

- Celonis values itself above €10 billion. It uses AI and machine learning in Task Engine to find and fix slowdowns in SAP and Oracle workflows.

- In 2020, BioNTech’s Mainz team won global approval for its mRNA COVID-19 vaccine, which showed over 90% protection. It now runs small cancer immunotherapy trials.

- N26 and Trade Republic hail from Berlin. N26 serves millions with mobile banking, contactless pay, savings goals, and ETFs. Trade Republic offers commission-free trading in stocks, ETFs, and crypto. Raisin DS links savers to 120 banks via an API-driven marketplace.

- HelloFresh raised $367 million to power ML-driven meal kits, green warehouses, and EV vans. Personio raised $266 million in 2021 to automate HR for over 6,000 SMEs at a $6.3 billion valuation. Scout24 uses ML and large language models in real estate and auto marketplaces. Wefox raised $235 million by 2023 to power AI-driven insurance. Contentful serves 30% of Fortune 500 with a headless CMS.

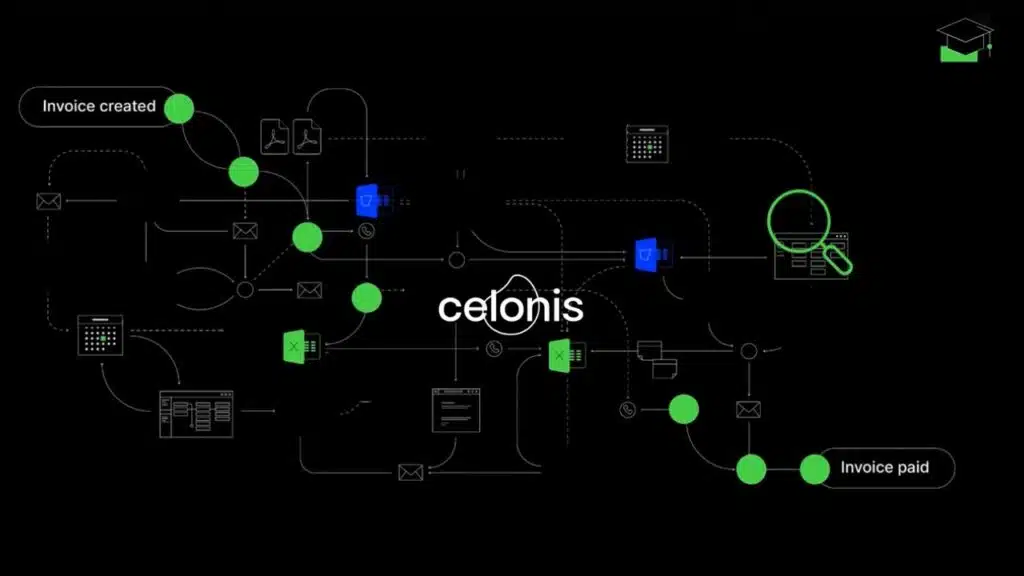

Celonis: Revolutionizing process mining and automation

Celonis delves into process mining with a data-first focus. The platform uses artificial intelligence and machine learning. It spots hidden slowdowns in finance, supply chains, and energy management.

It drives fast action with Task Engine.

The company built an Operations Management System that links to live apps like SAP and Oracle. That system taps predictive analytics to flag trouble spots. Investors back its unicorn status with a valuation above €10 billion.

The move shapes today’s Germany startup ecosystem.

BioNTech: Pioneering advancements in biotechnology and vaccines

BioNTech rose in 2020 as a leader in mRNA-based covid-19 vaccine work. A compact team in Mainz designed a messenger RNA jab that kicked the immune system into high gear, yielding over 90 percent protection in trials.

Regulators worldwide gave the green light in record time, and the vaccine rolled out across borders. This leap showcased the strength of the Germany startup ecosystem.

A group of doctors studies individualised cancer immunotherapy that uses mRNA tech. They mix disease data with genetic code, hoping to spark a patient’s immune response against cancer.

Trials run across clinics in Germany, and each study holds just a few dozen participants. Backers from Berlin startups and health funds pour millions into these trials to fuel the next biotech breakthrough.

N26 Group: Redefining digital banking solutions

N26 Group launched in Berlin as a digital bank. It leads with mobile banking features that serve millions in Europe and the US. The design fits in a pocket. It offers a debit card and credit options.

Clients tap phones to pay in seconds.

Berlin startups often hone their craft in fintech. N26 rides that wave as a fintech company. The mobile app ties into mobile wallets and open banking API. Investors poured capital to scale operations.

Users log in fast. They set savings goals. They use contactless pay. They invest in ETFs. This digital bank skips branch visits.

Zalando: Leading Europe’s e-commerce innovation

Zalando is a top online fashion retailer in Europe. It uses machine learning, cloud computing, and big data analytics to speed logistics and boost customer satisfaction.

This online marketplace adapts to each shopper with smart recommendations and a user-friendly app. That approach inspires other Berlin startups and e-tailers across the germany startup ecosystem.

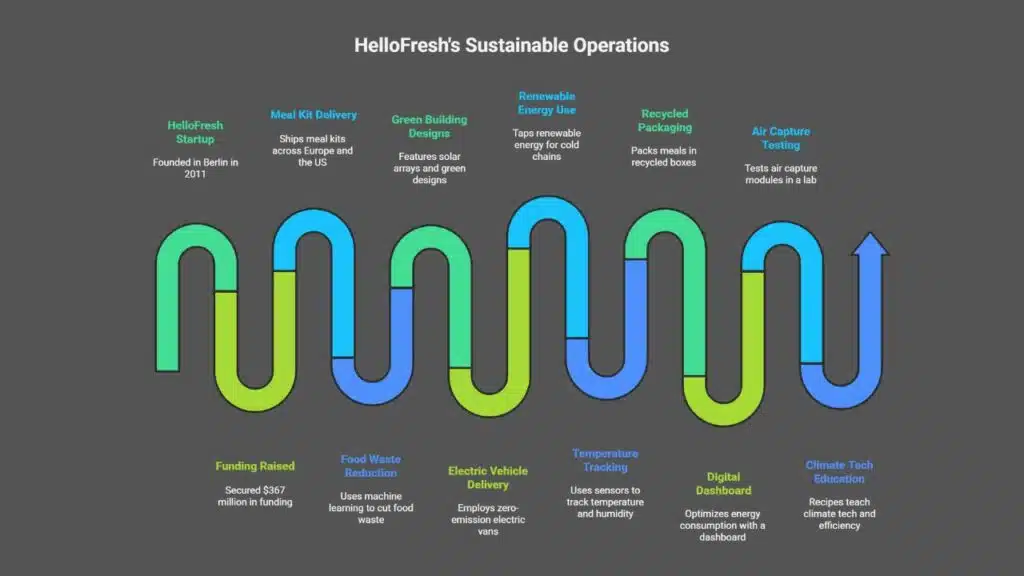

HelloFresh: Transforming meal kit delivery services

HelloFresh started in Berlin in 2011 with a fresh idea. The startup raised $367 million in funding. It ships meal kits across Europe and the US. The service cuts food waste with smart machine learning models.

Warehouse sites feature green building designs loaded with solar arrays. Delivery drops use electric vehicle vans built for zero emissions. An ecommerce platform ties orders to battery storage stats.

Leaders at HelloFresh tap renewable energy sources to power cold chains. Sensors from a German aerospace center project track temperature and humidity. Staff pack meals in recycled boxes to promote a sustainable lifestyle.

A digital dashboard uses federated learning to optimize energy consumption metrics. Partners test direct air capture modules in a small scale kitchen lab. Each recipe presents a lesson in climate tech and efficiency.

Personio: Simplifying human resources management for SMEs

Personio launched in 2015 in Munich. It helps SMEs with HR tasks through a cloud HRIS. The platform covers onboarding to offboarding. It cuts manual work by 80%. Personio integrates payroll tasks, time tracking, and performance reviews in one view.

Hanno Renner and team raised $266 million in 2021, reaching a $6.3 billion valuation. They brought Personio into the circle of tech unicorns that shape the germany startup ecosystem.

The software uses machine learning to spot compliance gaps and cut errors, saving HR teams 14 hours per month. It feels like a Swiss army knife for HR processes. Over 6,000 companies, from berlin startups to retailers and service shops, rely on its solution.

It links to popular tools like Slack, LinkedIn, and schedule tools through open APIs. This solution rivals many enterprise resource planning systems at a fraction of the cost.

Trade Republic: Making investment accessible through mobile platforms

Trade Republic packs a full brokerage into your phone. It slashes fees and cuts out middlemen. It lets you trade stocks, exchange-traded funds (ETFs), and crypto at no commission. This mobile banking star joins Berlin startups that revamp financial technology.

It wins fans in the Germany startup ecosystem with its clear layout and quick trades.

Users tap into renewable energy or climate tech ETFs in a few taps. They load cash in minutes, then swipe to buy shares in clean-tech or electric vehicle firms. It shines in transparency, so you spot every fee before you hit buy.

It uses order books, not derivatives, so you catch raw market prices.

Scout24 Holding: Innovating the real estate and automotive marketplaces

Scout24 Holding leads digital marketplaces for real estate and automotive trades throughout Germany. A 2024 Deutscher Startup Monitor report highlights Germany’s strong tech startup ecosystem and climate tech hubs.

Berlin and Munich set the pace, while North Rhine-Westphalia and Bavaria join in. The group blends deep market know-how with fresh ideas born since 2023. Groups like Bees & Bears in renewable energy funding and Ovom Care in fertility care show how startups pair tech with green goals.

Scout24 uses machine learning and large language models to match landlords and buyers fast. It shows energy efficiency scores and carbon data right on property pages. Buyers can spot sustainable building features or check waste management plans.

Dealers list used cars, electric vehicles, and classic cars in one spot. Smart search tools and clear customer journeys make the online store simple to use.

wefox: Driving the future of digital insurance solutions

Wefox launched in 2015 in Berlin, during a boom of berlin startups. It secured $235 million in funding by 2023. The platform taps machine learning, Cloud computing and REST API for fast claims.

It serves drivers, renters and small business owners, via a slick mobile app. Steady user growth across Europe shows its power in the germany startup ecosystem.

Developers design AI models to spot risks and cut policy costs in real time, like trimming fat from a steak. Grassroots feedback flows through in-app chat, so agents react in minutes, not weeks.

Customers enjoy dips in rates and smooth sign ups, as if they held a safety net in their pocket. Bold moves in digital insurance push rivals to rethink their offers and speed. Wefox brings mobile banking flair to the insurance game, using data to reward good habits.

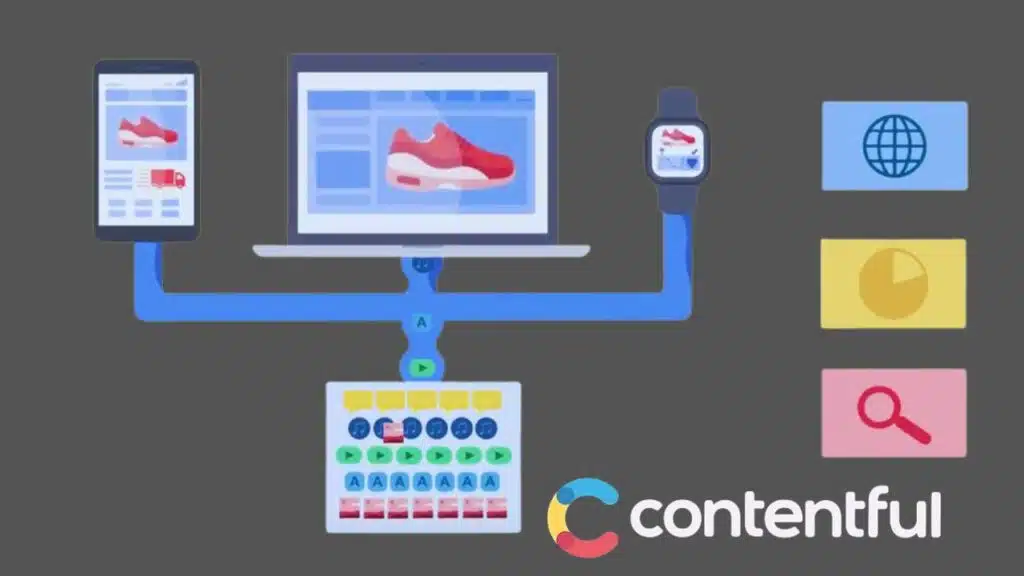

Contentful: Empowering digital content management

Contentful’s headless CMS drives modern sites with clear APIs, fast content pushes. Developers tap a REST API or GraphQL to fetch articles in no time. Brands ranging from online shopping hubs to digital insurance apps rely on this platform.

It serves 30 percent of Fortune 500 companies. Teams in the Berlin startups scene often pick it over bulky setups.

Localization and JSON support let teams roll out multilingual sites without extra code. Content Delivery Network syncs pages across the web like a global fleet of couriers. JavaScript SDK and CLI tools save time when you tweak layouts or fix a typo.

Climate tech blogs on decarbonization, renewable energy, even fusion power pick this tool for its speed. This platform slots into energy infrastructure dashboards and mytaxi clones with no fuss.

Raisin DS: Revolutionizing savings and investment opportunities

Raisin DS links savers to 120 partner banks across Europe. The platform acts as a pan-European savings and banking marketplace. It uses APIs to show interest rates for savings accounts and fixed term deposits in a clear dashboard.

Berlin startups and other tech startups in the German startup ecosystem tap this deal pool. Users tap a few times in mobile banking apps to open an account.

Savers can track rates via web browsers or smartphone tools. Raisin DS follows each bank’s local deposit protection laws to guard funds. APIs feed real-time data to power personalized suggestions.

The dashboard shows simple comparative analytics. Customers sort offers by interest rate, term length, and deposit insurance details. The site stands apart from digital insurance and mobile finance tools by focusing on savings and wealth growth.

Takeaways

Germany powers leaps in renewable energy and machine learning. A process mining software firm shakes up workflows and a vaccine maker saves lives. A mobile banking provider simplifies payments as a meal kit service delights tummies.

An investment app meets savings goals while a content management system fuels web pages and a digital insurance platform protects users. These pioneers drive Europe’s next wave. Users sometimes use adblock plus to speed e-commerce browsing.

FAQs

1. What is the Germany startup ecosystem like?

The Germany startup ecosystem is a lively network, stretching from Berlin to Munich. Berlin startups drive mobile banking, power digital insurance, and shake up commercial real estate tools.

2. Which sectors lead the charge in climate tech and renewable energy?

Companies in climate tech tap renewable energy sources like wind and solar, plus energy storage to cut carbon. They craft sustainable energy plans, test fusion energy with magnetic confinement, and modernize power plants and the power grid.

3. How do startups use machine learning in health and language apps?

They run machine learning models to spot autoimmune signs early. They build slick translators like Linguee once did, and curb wild ads, think adblock plus on turbo boosters.

4. Do big cities have all the action, or is innovation elsewhere too?

Big hubs like Berlin lead, but smaller towns join in, too. Teams there tap local power plants and power grid upgrades, so change grows fast, like seeds in spring.

5. What can users try now from these startups?

You can open a mobile banking app in minutes, buy digital insurance with a click, or block ads in a snap with adblock plus. You can also chat with a translator that outsmarts Linguee.