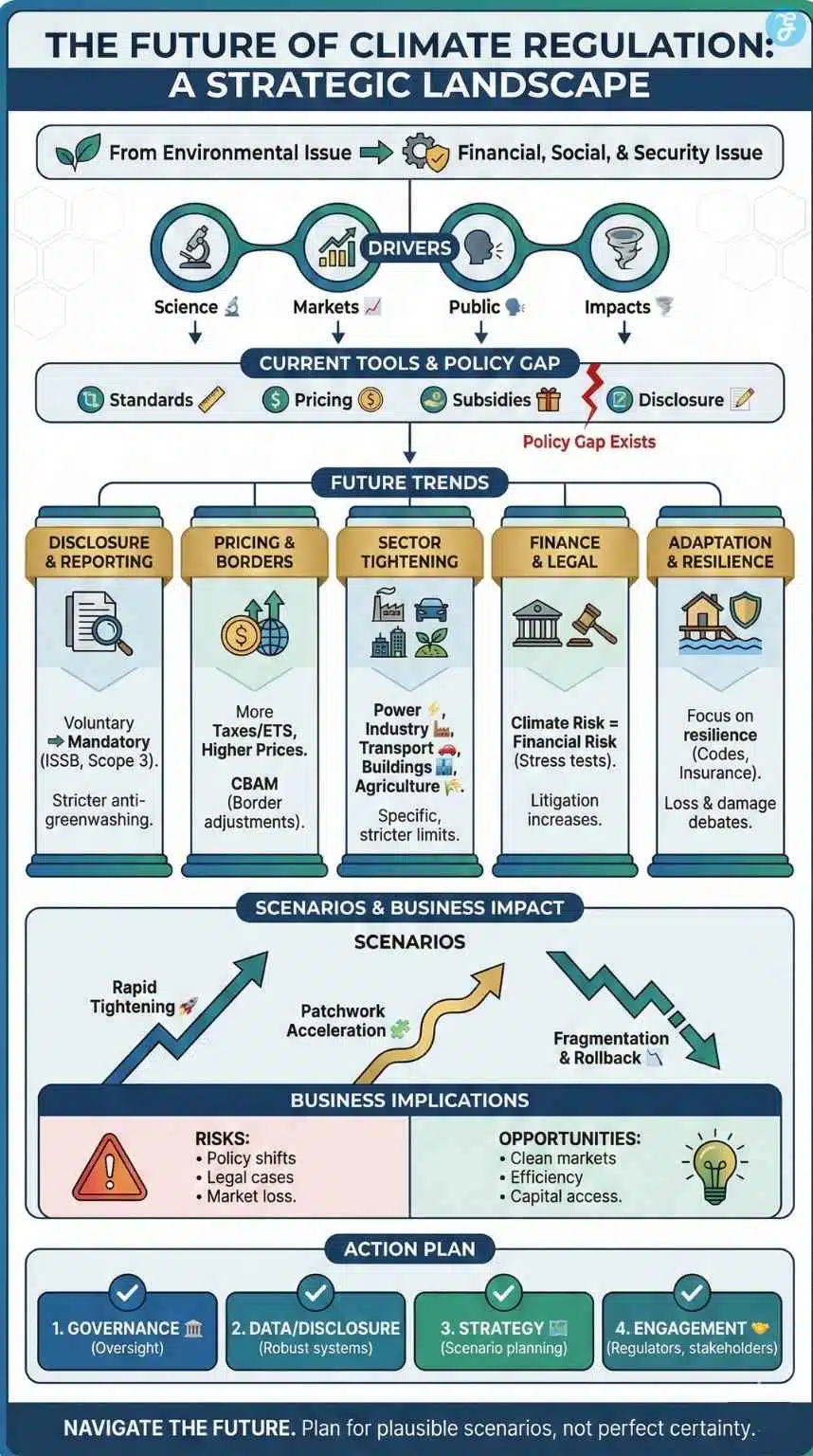

The future of climate regulation will shape how economies grow, how companies operate, and how societies respond to climate risks. Climate change is no longer seen only as an environmental issue. It is a financial, social, and security issue. Governments now use laws, standards, and market tools to push emissions down, guide investment, and protect people from climate impacts.

At the same time, businesses face growing pressure from investors, customers, and courts. They must show credible climate strategies and transparent reporting. Some rules are tightening, while others face political pushback. The result is a complex, fast-moving regulatory landscape.

Global Snapshot Of Climate Rules Today

Climate regulation already reaches deep into economies. It is not starting from zero.

Many countries have framework climate laws that set targets for emissions reductions and net-zero timelines. Others rely on sectoral rules, such as power plant standards or vehicle emissions limits. International agreements, like the Paris Agreement, guide national targets and reporting.

Governments use a mix of tools:

- Emissions and efficiency standards

- Carbon pricing (taxes or emissions trading systems)

- Subsidies and tax credits for clean technologies

- Planning laws and building codes

- Mandatory climate risk disclosure for companies and financial institutions

Yet, current policies still do not fully align with global temperature goals. This gap is one reason regulators are under pressure to do more.

Key points at a glance

| Topic | Summary |

| Starting point | Thousands of climate-related laws and policies already exist worldwide. |

| Main tools | Standards, carbon pricing, subsidies, disclosure, and planning rules. |

| International layer | The Paris Agreement sets the global framework but leaves details to each country. |

| Policy gap | Existing rules are not yet enough to meet the agreed climate goals, so more action is likely. |

The Future Of Climate Regulation In Disclosure And Reporting

The future of climate regulation is closely linked to how companies report climate risks, opportunities, and emissions. What began as voluntary sustainability reporting is turning into detailed, mandatory disclosure.

New standards, such as those issued by the International Sustainability Standards Board (ISSB), aim to harmonize climate reporting across markets. They ask companies to disclose how climate risk affects strategy, governance, and financial performance, along with key metrics and targets.

In parallel, major jurisdictions are building or refining their own rules:

- The European Union requires broad sustainability and climate reporting from large and listed companies.

- Securities regulators in several countries have adopted or proposed climate risk disclosure rules.

- Some states and regions add their own climate reporting laws on top of national rules.

In the coming years, regulators are likely to:

- Expand coverage from large listed companies to more mid-sized and private companies.

- Tighten requirements on value chain (Scope 3) emissions where data improves.

- Increase enforcement of misleading or incomplete climate claims, often called greenwashing.

This creates both a burden and a benefit. Companies need stronger data systems and internal controls, but they also gain more consistent reporting expectations across markets.

Key points at a glance

| Topic | Summary |

| Trend | Voluntary ESG reports are giving way to mandatory climate disclosure standards. |

| Global standards | ISSB and similar frameworks push toward more consistent climate reporting. |

| Regional rules | The EU and several securities regulators have introduced detailed climate risk rules. |

| Likely next steps | Wider scope, stricter Scope 3 expectations, and tougher greenwashing enforcement. |

Carbon Pricing And Border Measures

Carbon pricing is one of the most powerful tools regulators use to cut emissions. It puts a direct cost on greenhouse gas pollution through carbon taxes or emissions trading systems.

In recent years, more countries and regions have adopted carbon pricing. Revenues have risen to record levels, and some governments use this money to fund climate and nature projects or to ease the burden on households and firms.

However, many carbon prices still remain below levels that climate economists see as consistent with agreed temperature goals. Coverage also varies widely between countries and sectors.

To deal with the risk of “carbon leakage” (moving production to places with weaker rules), new border measures are emerging. The European Union’s Carbon Border Adjustment Mechanism (CBAM) is the most advanced example. It puts a carbon cost on selected imported goods, such as steel, cement, and fertilizers, in line with the carbon price faced by EU producers.

Looking ahead, regulators are likely to:

- Expand carbon pricing to more sectors and raise prices over time.

- Refine CBAM-style regimes and possibly extend them to more products.

- Use carbon pricing revenues to support vulnerable households, fund green infrastructure, and back innovation.

- Explore climate clubs or cooperative arrangements to coordinate carbon prices and reduce trade tensions.

For businesses that trade internationally, this means carbon cost is becoming a core competitiveness factor.

Key points at a glance

| Topic | Summary |

| Carbon pricing today | Dozens of carbon taxes and emissions trading schemes exist worldwide. |

| Revenue use | Governments use revenues for climate projects, social support, and deficit reduction. |

| Border measures | CBAM puts a carbon price on certain imports to prevent carbon leakage. |

| Likely developments | More carbon pricing, higher prices, wider CBAM coverage, and more coordination efforts. |

Sector-by-Sector Tightening Of Climate Rules

Climate policy is now moving from broad national targets to detailed sector rules. Different sectors face different pathways and timelines.

Power and energy:

- Stricter emissions limits for fossil-fuel power plants

- Faster phase-down of coal without carbon capture

- Incentives and rules that speed up renewable energy, storage, and grid upgrades

Industry:

- Performance standards for emissions-intensive products (steel, cement, chemicals)

- Requirements for cleaner production technologies, such as green hydrogen or alternative materials

- Public procurement policies that favor low-carbon materials

Transport:

- Tighter efficiency and emissions standards for passenger cars, vans, and trucks

- Timetables for ending sales of new internal combustion engine vehicles in some regions

- Fuel standards and blending mandates for aviation and shipping

Buildings and cities:

- Stronger energy performance rules for new buildings

- Incentives or mandates to retrofit older buildings

- Planning laws that support public transport, cycling, and walking

Agriculture and land use:

- Deforestation-free supply chain rules

- Support and standards for climate-smart agriculture

- Protection and restoration of forests, wetlands, and other carbon-rich ecosystems

These changes will not happen at the same pace everywhere. But the direction is clear: higher expectations for efficiency, lower emissions, and climate-resilient infrastructure.

Key points at a glance

| Sector | Likely regulatory direction |

| Power and energy | Stricter emissions limits, coal phase-down, support for renewables and grids. |

| Heavy industry | Standards for product emissions, cleaner technologies, and greener procurement. |

| Transport | Tougher vehicle standards, ICE phase-out dates, cleaner fuels for shipping and aviation. |

| Buildings and cities | Stronger building codes, retrofits, and climate-aware urban planning. |

| Agriculture and land | Rules on deforestation, support for low-carbon farming, ecosystem protection, and restoration. |

Financial Regulation, Risk, And Climate Litigation

Financial regulators and central banks now treat climate change as a risk to financial stability. Physical risks, such as storms and floods, and transition risks, such as rapid policy changes or technology shifts, can hit banks, insurers, and investors.

Supervisors respond in several ways:

- Climate stress tests and scenario analysis for banks and insurers

- Guidance on managing climate risk in governance and risk frameworks

- Expectations for more transparent climate-related financial disclosures

At the same time, climate-related litigation is increasing. Cases target governments, companies, and sometimes directors. Many focus on greenwashing: claims that climate goals or products are greener than the evidence supports. Courts have ordered changes to public statements, marketing, and in some cases, business plans.

In the future, regulators may:

- Integrate climate risk more directly into capital requirements

- Require better tracking of financed emissions and transition plans

- Coordinate more closely with competition, consumer, and advertising regulators on green claims

For companies, this means that climate risk is no longer only a reputational issue. It is also a regulatory and legal issue that can affect the cost of capital, market access, and governance expectations.

Key points at a glance

| Topic | Summary |

| Financial stability | Climate change is now treated as a source of systemic financial risk. |

| Supervisory tools | Stress tests, scenario analysis, and climate risk guidance are becoming common. |

| Litigation trends | More cases challenge greenwashing and inadequate climate strategies. |

| Future direction | Possible climate-linked capital rules, better emissions tracking, and tougher enforcement. |

Adaptation, Resilience, And Loss And Damage

For many years, climate policy focused mainly on cutting emissions. Now, adaptation and resilience are equally important. Climate impacts are already visible in heatwaves, floods, storms, and sea-level rise.

Regulators are starting to require resilience in critical infrastructure, housing, and public services. Examples include:

- Building codes that reflect future climate conditions, not only past weather patterns

- Flood risk mapping and land-use rules that restrict building in high-risk areas

- Requirements for utilities and transport systems to maintain service under extreme conditions

Insurance plays a key role. More frequent and severe disasters can make coverage costly or unavailable in high-risk zones. Regulators may need to balance consumer protection, financial stability, and fairness when setting rules on pricing and coverage. Some countries explore public backstops and new risk-sharing models.

Internationally, debates on loss and damage finance focus on how to support vulnerable countries facing unavoidable climate impacts. This can shape domestic rules, for example, by linking funding to stronger resilience standards.

Key points

| Topic | Summary |

| Shift in focus | Adaptation and resilience now stand alongside emissions cuts as policy priorities. |

| Domestic rules | Building codes, land-use planning, and infrastructure standards reflect climate risks. |

| Insurance | Climate risk challenges insurability, prompting regulatory attention and new models. |

| International dimension | Loss and damage finance and resilience standards influence national policies. |

Diverging Policy Paths And Possible Scenarios

The future of climate regulation will not be uniform. Politics, economics, and public opinion push countries in different directions.

In some regions, governments are strengthening climate laws, expanding carbon pricing, and tightening disclosure. They see climate action as part of industrial strategy, energy security, and risk management.

Elsewhere, political leaders resist or roll back climate rules. They may frame them as costly or intrusive, or question the role of certain institutions in regulating climate risk. Legal challenges try to limit the powers of environmental and financial regulators.

From this mix, several scenarios emerge:

- Rapid tightening

- More regions adopt ambitious targets and strong policy tools.

- Carbon prices rise, climate disclosures converge, and fossil-fuel infrastructure faces faster phase-down.

- Patchwork acceleration

- A group of “first movers” moves ahead with tough climate rules.

- Others lag or delay, creating a patchwork of standards, prices, and disclosure regimes.

- Fragmentation and rollback

- Legal and political pushback slows or reverses climate regulations in key economies.

- Courts, investors, and sub-national authorities try to fill the gap, but uncertainty remains high.

The future of climate regulation is likely to sit somewhere between the first two scenarios, with strong regions pulling others along over time. But businesses need to prepare for all three.

Key points in this section

| Scenario | Characteristics |

| Rapid tightening | Broad global momentum, stronger tools, faster fossil fuel phase-down. |

| Patchwork acceleration | Ambitious leaders vs. laggards, complex cross-border compliance. |

| Fragmentation and rollback | Political resistance, legal pushback, greater uncertainty. |

| Overall outlook | Mixed picture, with some regions driving higher standards that affect global markets. |

What The Future Of Climate Regulation Means For Businesses And Investors

For businesses and investors, the future of climate regulation is not only a compliance issue. It is a strategic one.

Key risks include:

- Policy risk: sudden changes in taxes, standards, subsidies, or phase-out dates

- Legal risk: greenwashing cases and claims of failing to manage foreseeable climate risks

- Market risk: loss of competitiveness if products carry a higher carbon footprint or fail new standards

Key opportunities include:

- Access to growing markets for clean technologies, low-carbon materials, and climate services

- Lower operating costs through efficiency and resilience investments

- Improved access to capital for companies with credible climate transition plans

Practical steps for organizations:

- Governance

- Clarify board and management roles in climate oversight.

- Link climate targets to incentives and performance reviews.

- Data and disclosure

- Build robust emissions and climate-risk data systems.

- Align reporting with leading climate disclosure standards.

- Strategy and capital allocation

- Use climate scenarios to test business models and investments.

- Prioritize projects that improve resilience and reduce emissions.

- Engagement

- Engage regulators and standard-setters through consultations.

- Communicate clearly with investors, customers, and employees.

By treating regulation as a signal rather than only a burden, companies can position themselves ahead of likely changes.

Key points at a glance

| Topic | Summary |

| Main risks | Policy, legal, and market risks rise with stricter climate rules. |

| Main opportunities | New markets, cost savings, and better access to capital. |

| Priority actions | Strengthen governance, data, strategy, and engagement. |

| Overall message | Proactive preparation turns regulatory change into a competitive advantage. |

How To Track Climate Regulation Changes

Because climate rules evolve quickly, horizon-scanning is now an essential function, not a luxury.

Key places to watch:

- International climate negotiations and stocktakes

- National and regional legislatures and regulators for the environment, energy, finance, and securities

- Central banks, financial supervisors, and standard-setting bodies

- Courts and regulators handling advertising, competition, and consumer protection

Signals that change is coming:

- Consultation papers, technical guidance, and draft bills

- Policy speeches and strategy documents from ministers, regulators, and central bank leaders

- Landmark court decisions that reshape how existing laws apply to climate risk

Practical monitoring tips:

- Assign clear internal responsibility for tracking climate policy and regulation.

- Build relationships with industry associations, think tanks, and legal advisers.

- Use scenario planning to link policy signals to potential business impacts.

In short, the future of climate regulation is not a one-off event. It is a moving process that requires constant attention.

Key points to remember

| Topic | Summary |

| Why monitor | Climate rules change fast and can materially affect strategy and risk. |

| Where to look | International forums, national regulators, courts, and central banks. |

| What to track | Draft rules, speeches, guidance, and key court cases. |

| How to respond | Assign responsibility, build networks, and link signals to scenarios. |

FAQs On The Future Of Climate Regulation

What are the most important upcoming climate regulations businesses should watch?

Businesses should watch climate disclosure rules, carbon pricing changes, and sector-specific standards for power, transport, buildings, and heavy industry. Border carbon adjustments, like CBAM, will also matter for trade-exposed sectors.

Will climate disclosure rules become the same everywhere?

Complete global uniformity is unlikely. However, many regulators are aligning with shared climate disclosure principles. Over time, this should reduce fragmentation, even though regional differences will remain.

How will stricter climate regulations affect company profits?

Short-term, they can raise costs, especially for energy-intensive sectors. Long-term, they can drive innovation, efficiency, and new markets. The impact depends on how quickly companies adapt, how they pass on costs, and what support policies exist.

Could some countries roll back climate regulations?

Yes. Political shifts and legal challenges can delay, weaken, or reverse rules. But sub-national authorities, investors, courts, and trading partners may still push for stronger climate action, even when national governments slow down.

How can a company prepare for the future of climate regulation?

A company can prepare by improving climate governance, data, and scenario planning; aligning investment decisions with net-zero and resilience goals; and engaging openly with regulators and stakeholders. Treating climate as a core strategic issue, not a narrow compliance topic, is key.

Final Thought: Navigating The Future Of Climate Regulation

The future of climate regulation will be shaped by science, politics, markets, and courts. It will not follow a straight line. Some rules will advance quickly; others will stall or be challenged. But the broad direction is toward more attention to climate risk, more pressure to cut emissions, and more focus on resilience.

For governments, effective climate regulation can support cleaner growth, protect people from climate impacts, and provide clearer signals to investors. For businesses and investors, it brings both risk and opportunity. Those who wait for perfect certainty may fall behind. Those who plan for several plausible futures may find new ways to compete and create value.

In short, the future of climate regulation is not only a policy question. It is a strategic landscape that every government, company, and citizen must learn to navigate.