Fintech, or financial technology, has emerged as one of the most transformative forces reshaping the global financial ecosystem. By leveraging cutting-edge technologies such as blockchain, artificial intelligence, and mobile applications, fintech companies are redefining how we interact with money, access credit, and conduct transactions.

In this article, we’ll explore the top 10 fintech companies that are redefining global finance and driving innovation across industries. Along the way, we’ll also highlight key trends and insights into their impact on the global economy.

Decorating with natural fibers has proven to be an eco-friendly and sustainable trend, and similarly, these fintech companies are creating sustainable financial solutions for modern needs.

What Makes Fintech Companies Game-Changers?

The rise of fintech companies has disrupted traditional financial institutions by introducing more accessible, efficient, and innovative solutions. Here’s what sets them apart:

- Leveraging Technology: Fintech companies utilize technologies such as blockchain, AI, and big data to create smarter, faster, and more secure financial services.

- User-Centric Approach: These companies prioritize user experience, offering seamless, digital-first solutions that cater to the needs of modern consumers.

- Adaptability: Fintech firms are quick to adapt to changing market trends, providing innovative products such as mobile wallets, peer-to-peer lending, and robo-advisors.

- Just as decorating with natural fibers brings an organic and refreshing touch to interior design, these companies bring sustainability and innovation to global finance.

Top 10 Fintech Companies Redefining Global Finance

Fintech is a rapidly growing sector that continues to redefine the way people and businesses interact with financial systems globally.

These companies are harnessing advanced technologies to provide innovative solutions, making finance more accessible, transparent, and efficient.

In this section, we will delve into the top players in the fintech industry and examine how they are revolutionizing global finance.

1. Stripe: Revolutionizing Online Payments

Stripe has revolutionized online payments with its developer-friendly APIs and seamless integration options.

Founded in 2010, Stripe offers businesses the tools to accept payments globally while providing enhanced security features. Its impact on e-commerce has been transformative, enabling startups and enterprises to scale quickly. Stripe is now trusted by millions of businesses, from small startups to global giants like Amazon and Shopify, for its reliability and innovation.

For example, Shopify uses Stripe to provide integrated payment solutions that cater to both merchants and customers, making the checkout process smooth and efficient. Decorating with natural fibers in their workspace often symbolizes their commitment to sustainability.

| Feature | Details |

| Core Offering | Online payments and APIs |

| Key Innovation | Seamless integration, fraud prevention |

| Global Reach | 120+ countries |

| Notable Clients | Amazon, Shopify |

| Revenue (2024) | $15 billion |

2. PayPal: Pioneer in Digital Transactions

PayPal, one of the earliest fintech pioneers, continues to dominate the digital payments space. From its humble beginnings in 1998 to its current expansion into cryptocurrency and buy-now-pay-later services, PayPal remains a household name. PayPal’s user-friendly platform and extensive global reach have made it indispensable for both consumers and businesses. The company processes over $1.3 trillion in transactions annually.

A real-world example includes its partnership with BigCommerce, allowing merchants to offer a variety of payment methods, including Venmo and PayPal Credit. Just like decorating with natural fibers adds an eco-friendly element to interiors, PayPal’s sustainable business practices contribute to its global appeal.

| Feature | Details |

| Core Offering | Digital payments and transfers |

| Key Innovation | Crypto payments, BNPL services |

| Global Impact | 400+ million accounts worldwide |

| Annual Transaction Volume | $1.3 trillion |

| Revenue (2024) | $29 billion |

3. Square: Empowering Small Businesses

Square has democratized financial services for small businesses, providing tools like Square Reader and Square Terminal. Its peer-to-peer payment system, Cash App, has also gained significant popularity.

By simplifying payment processing, Square has enabled small businesses to thrive in a competitive marketplace. Square also actively supports underserved communities by offering micro-loans. Notably, Square partnered with the SBA [Small Business Administration] during the pandemic to process PPP (Paycheck Protection Program) loans efficiently.

Similarly, businesses opting for sustainable practices like decorating with natural fibers create a more appealing and responsible brand image.

| Feature | Details |

| Core Offering | Payment processing, merchant tools |

| Key Innovation | Square Reader, Cash App |

| Focus | Small businesses, micro-loans |

| Global Reach | Available in multiple countries |

| Annual Transaction Volume | $200 billion |

4. Revolut: The Global Banking Alternative

Revolut’s digital banking platform offers a comprehensive suite of financial services, from international money transfers to cryptocurrency trading. With its user-centric approach, Revolut has quickly become a favorite among millennials.

The app also integrates budget tracking and savings features, making it an all-in-one financial solution. An example of its impact is its ability to offer instant currency exchange at interbank rates, saving users significant costs when traveling or making cross-border transactions.

Its commitment to innovation resonates with sustainable practices, much like decorating with natural fibers does in eco-conscious homes.

| Feature |

Details |

| Core Offering | Digital banking, crypto trading |

| Key Innovation | Fee-free transfers, budgeting tools |

| User Base | 28+ million |

| Popular Features | Savings vaults, instant notifications |

| Valuation (2024) | $33 billion |

5. Robinhood: Democratizing Investment

Robinhood disrupted the investment world by introducing commission-free trading, making investing accessible to everyone. Its easy-to-use platform and focus on younger investors have contributed to its rapid growth.

Robinhood’s success is a testament to how simplifying complex financial systems can empower users. During the GameStop saga, Robinhood played a pivotal role, showcasing the power of retail investors in reshaping financial markets.

Just like decorating with natural fibers brings authenticity to home decor, Robinhood has brought transparency and inclusivity to the investment landscape.

| Feature | Details |

| Core Offering | Stock trading, investment tools |

| Key Innovation | Commission-free trading |

| Target Audience | Millennials, Gen Z |

| Assets Under Management | $100+ billion |

| Monthly Active Users | 23 million |

6. Coinbase: Leading the Cryptocurrency Revolution

As a leading cryptocurrency exchange, Coinbase has played a pivotal role in mainstreaming cryptocurrencies. It provides a secure platform for trading and storing digital assets, making crypto accessible to millions.

Coinbase also supports over 100 cryptocurrencies and offers educational content for beginners. Its IPO in 2021 marked a milestone for the cryptocurrency industry, solidifying its role in global finance.

Like decorating with natural fibers ensures a sustainable lifestyle, Coinbase ensures security and accessibility in the ever-changing cryptocurrency space.

| Feature | Details |

| Core Offering | Crypto exchange, wallets |

| Key Innovation | Simplified trading, education |

| Supported Cryptocurrencies | 100+ |

| Global Impact | 110+ countries |

| Valuation (2024) | $54 billion |

7. Ant Group: Innovating Financial Services in Asia

Ant Group, the parent company of Alipay, has revolutionized financial services in Asia. With its diverse range of offerings, including wealth management and credit scoring, Ant Group is a significant player in the fintech space. Alipay processes billions of transactions daily, showcasing the platform’s scalability.

In 2024, Ant Group launched a green finance initiative to support environmentally sustainable projects. Their emphasis on eco-friendly practices mirrors the simplicity of decorating with natural fibers.

| Feature | Details |

| Core Offering | Mobile payments, credit scoring |

| Key Innovation | Alipay’s super-app ecosystem |

| Daily Transactions | Billions |

| User Base | 1+ billion |

| Revenue (2024) | $23 billion |

8. Adyen: Streamlining Global Payments

Adyen’s end-to-end payment platform simplifies cross-border transactions for businesses. By partnering with major global brands, Adyen ensures seamless payment experiences. It also offers real-time data analytics, enabling businesses to make informed decisions. For instance, Adidas uses Adyen to provide consistent payment experiences across physical stores and e-commerce platforms.

Adyen’s integration of efficiency reflects the same thoughtful innovation as decorating with natural fibers.

| Feature | Details |

| Core Offering | Payment processing, analytics |

| Key Innovation | Unified commerce, data insights |

| Notable Partners | Spotify, Uber, Microsoft |

| Supported Regions | Worldwide |

| Revenue (2024) | $8 billion |

9. Nubank: Redefining Banking in Latin America

Nubank’s digital-first approach to banking has made it a leader in Latin America’s fintech space. By focusing on financial inclusion, Nubank has gained a loyal customer base in underserved markets.

Its mobile-first model eliminates the need for physical branches. Nubank’s recent IPO on the NYSE further underscores its growing influence in global finance. Like decorating with natural fibers that resonate with the local environment, Nubank’s approach is deeply rooted in solving regional challenges.

| Feature | Details |

| Core Offering | Digital banking, credit cards |

| Key Innovation | No-fee accounts |

| User Base | 70+ million |

| Focus | Underserved markets |

| Valuation (2024) | $42 billion |

10. Klarna: Innovating Buy Now, Pay Later (BNPL)

Klarna has become synonymous with buy-now-pay-later services, transforming how consumers shop online. Its partnerships with major e-commerce platforms have driven its success. Klarna also offers a rewards program, further enhancing customer loyalty.

During Black Friday 2024, Klarna processed over $10 billion in transactions, highlighting its critical role in online retail. Klarna’s approach to customer-centric innovation is as appealing as decorating with natural fibers for timeless design.

| Feature | Details |

| Core Offering | BNPL, consumer financing |

| Key Innovation | Shopper-friendly financing options |

| User Base | 150+ million |

| Notable Partners | H&M, IKEA, ASOS |

| Annual Transaction Volume | $80 billion |

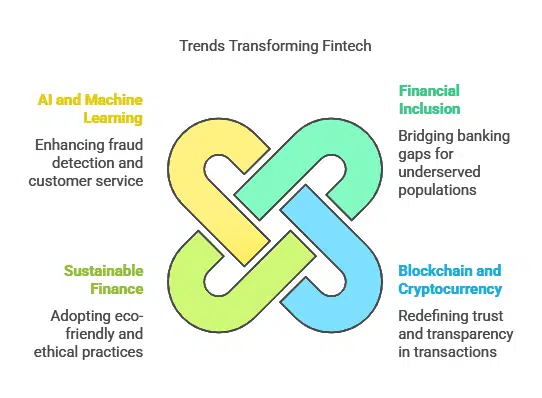

Key Trends Shaping the Fintech Landscape

1. Increased Focus on Financial Inclusion

Fintech companies are bridging the gap for underserved populations, providing access to banking, loans, and credit.

2. Growth of Blockchain and Cryptocurrency Adoption

The rise of blockchain and cryptocurrency is redefining trust and transparency in financial transactions.

3. Emphasis on Sustainable and Ethical Finance

Like decorating with natural fibers promotes sustainable living, fintech companies are adopting eco-friendly and ethical practices.

4. Integration of AI and Machine Learning in Financial Services

AI and machine learning are improving fraud detection, customer service, and financial forecasting.

How Fintech is Transforming the Global Economy

- Positive Impacts: Increased accessibility, cost reduction, and enhanced innovation.

- Challenges: Regulatory hurdles, cybersecurity threats, and market volatility.

- Future Outlook: Fintech will continue to drive economic transformation, shaping the future of global finance.

Wrap Up

The top 10 fintech companies highlighted in this article are not only redefining global finance but also inspiring innovation across industries. Their focus on accessibility, user experience, and sustainability mirrors the values of decorating with natural fibers—creating solutions that are both practical and forward-thinking.

As fintech continues to evolve, its potential to reshape the global economy remains limitless.