The banking industry has undergone a significant transformation with the rise of digital banks. Unlike traditional banks, which rely on physical branches and manual processes, digital banks leverage cutting-edge technology to provide seamless, fast, and cost-effective financial services.

Customers are now prioritizing convenience, security, and accessibility, making digital banking an increasingly attractive alternative.

This article explores the top 10 features of digital banks that traditional banks can’t match, demonstrating why they are the future of banking. We will also include case studies, current trends, and detailed tables for a better understanding of how digital banks outperform their traditional counterparts.

1. Seamless and Paperless Account Opening

One of the most striking features of digital banks that traditional banks can’t match is the ability to open an account seamlessly, without paperwork or in-person visits. Traditional banks often require customers to visit branches, fill out extensive paperwork, and wait days or even weeks for their accounts to be approved.

Digital banks eliminate these inefficiencies by allowing users to open an account online within minutes. With AI-driven identity verification and biometric authentication, customers can onboard instantly from anywhere, streamlining the entire process.

Instant Digital Onboarding

- Fully online account opening process within minutes.

- No need for physical branch visits.

- Simple ID verification through AI-powered KYC (Know Your Customer) solutions.

- Reduced processing delays, ensuring instant access to banking services.

- Increased convenience for individuals and businesses needing quick account setup.

| Feature | Digital Banks | Traditional Banks |

| Account Opening Time | Few minutes | Several days |

| Paperwork | None | Extensive |

| KYC Verification | Online & AI-based | Manual & In-Person |

E-KYC and Biometric Authentication

- AI-driven facial recognition, fingerprint scans, and OTP-based verifications.

- Enhanced security without compromising user experience.

- Reduces fraud risks through advanced digital identification.

- No requirement for multiple physical identity proofs.

- Quick and secure verification using globally accepted digital KYC standards.

2. 24/7 Banking Accessibility

Traditional banks have fixed working hours, whereas digital banks offer round-the-clock services. Customers can manage their finances without being restricted by banking hours, ensuring higher convenience and efficiency.

Digital banks allow access to funds, account details, and transactions anytime, making financial management more seamless and eliminating the stress of visiting a branch.

Mobile and Web Banking Convenience

- Users can check balances, transfer funds, and manage transactions anytime.

- Banking services are accessible via mobile apps or web platforms.

- Users can apply for loans and credit cards digitally.

- No dependency on in-person banking visits, reducing inconvenience.

- User-friendly dashboards providing detailed financial insights.

No Physical Branch Dependency

- No queues, paperwork, or waiting time.

- Customers can complete transactions from any location worldwide.

- Customer support via live chat, email, and AI chatbots for instant assistance.

- No geographical restrictions, making international banking hassle-free.

- Instant mobile notifications for real-time updates on transactions.

| Feature | Digital Banks | Traditional Banks |

| Availability | 24/7 | Limited Hours |

| Location Restriction | None | Requires Branch Visit |

| Support Channels | Chatbots, Email, Call | In-Branch, Phone |

3. Lower Fees and Higher Interest Rates

One of the compelling features of digital banks that traditional banks can’t match is cost-efficiency. Digital banks operate without physical branches, significantly reducing overhead costs.

This enables them to offer lower fees and better interest rates on savings and loans. Traditional banks, with their operational expenses, often impose higher fees on account maintenance, transactions, and withdrawals.

Minimal or Zero Account Maintenance Fees

- No overhead costs from maintaining physical branches.

- No hidden charges for transactions and account management.

- Free ATM withdrawals and no penalties for low balances.

- Lower transaction fees compared to traditional banks.

- More transparent fee structures that prevent unnecessary deductions.

Competitive Savings & Loan Interest Rates

- Digital banks offer better interest rates due to reduced operational expenses.

- Attractive loan options with lower processing fees and quick approvals.

- Higher annual percentage yields (APY) compared to traditional banks.

- AI-driven algorithms help assess creditworthiness more efficiently.

4. AI-Powered Financial Management Tools

Digital banks integrate AI to help users make informed financial decisions. These tools provide data-driven insights, allowing customers to manage their finances efficiently.

AI-driven financial management solutions help users track expenses, automate savings, and make better investment choices, ensuring a more personalized banking experience.

Smart Budgeting and Expense Tracking

- AI-driven expense categorization and real-time insights.

- Customizable budget alerts and recommendations.

- Automated reminders for bill payments.

- Graphical reports to help users understand spending habits.

- AI predictions on upcoming expenses to improve financial planning.

Automated Savings and Investment Features

- Round-up savings feature for automatic micro-savings.

- AI-powered investment recommendations based on spending patterns.

- Robo-advisors for personalized wealth management.

- Goal-based savings plans with real-time tracking.

- Automated deposits into investment portfolios for wealth growth.

| Feature | Digital Banks | Traditional Banks |

| Budgeting Tools | AI-driven insights | Manual tracking |

| Investment Tools | Robo-advisors | In-person advisors |

| Savings Automation | Yes, fully automated | Manual, user-dependent |

5. Faster and Hassle-Free Transactions

Digital banks ensure that transactions are processed instantly, minimizing delays that are common with traditional banking systems. The ability to complete fund transfers, payments, and international transactions within seconds improves overall user experience.

Instant Fund Transfers and Payments

- Real-time payments and transfers via digital wallets and UPI (Unified Payments Interface).

- No delays in clearing or processing payments.

- International transactions without excessive fees.

- QR-code-based transactions for seamless in-store payments.

- Integration with peer-to-peer (P2P) payment networks for instant money transfers.

Cryptocurrency and Digital Wallet Integration

- Seamless linking with crypto exchanges and digital wallets.

- Enables quick transactions across multiple financial platforms.

- Secure storage and easy conversion of digital assets.

- Option to invest in cryptocurrencies directly from banking apps.

- Digital wallet compatibility with multiple payment gateways.

| Feature | Digital Banks | Traditional Banks |

| Transfer Speed | Instant | Hours to Days |

| Crypto Support | Yes | No |

| Payment Methods | Multiple Digital Wallets | Limited Options |

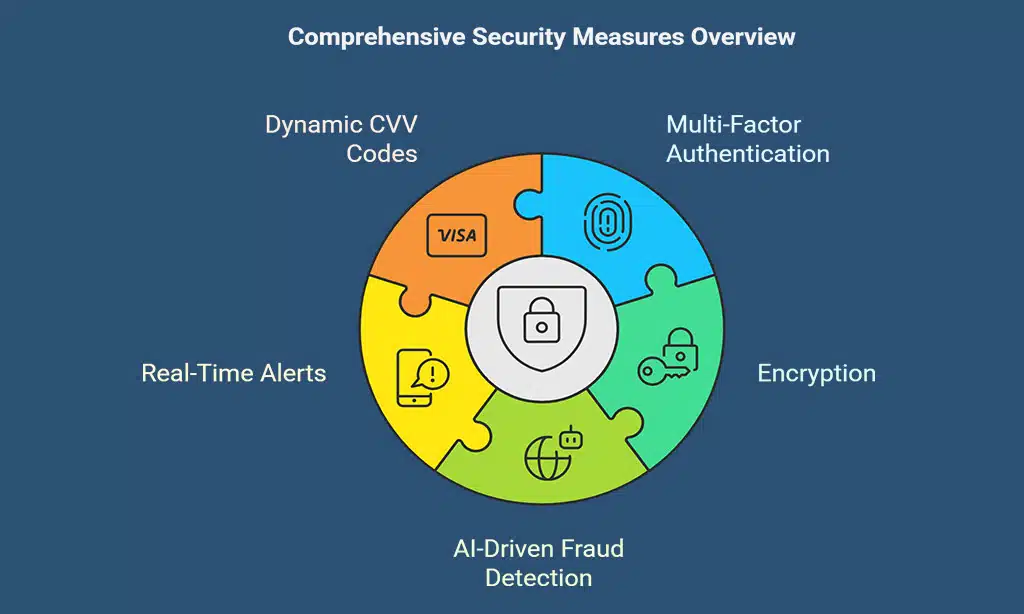

6. Advanced Security and Fraud Protection

Security is a top priority for banking institutions, and digital banks utilize cutting-edge technology to safeguard users’ funds and personal information. With AI-driven fraud detection, multi-factor authentication, and biometric security, digital banks ensure maximum protection for their customers.

Multi-Factor Authentication and Encryption

- Implementation of biometric security, 2FA (Two-Factor Authentication), and encryption.

- AI-driven fraud detection to identify suspicious activities in real-time.

- Instant alerts and the ability to freeze accounts if unauthorized access is detected.

- End-to-end encryption for secure data storage and transactions.

- Dynamic CVV codes to enhance credit and debit card security.

AI-Based Fraud Detection and Alerts

- Machine learning algorithms that monitor transaction patterns and detect anomalies.

- Real-time fraud alerts for enhanced security.

- Proactive fraud prevention strategies reducing financial risks.

- AI-driven risk assessments to block suspicious transactions automatically.

- Custom security settings allowing users to manage transaction limits.

| Feature | Digital Banks | Traditional Banks |

| Authentication | Biometric & 2FA | PIN & Password |

| Fraud Detection | AI-based, real-time | Manual, delayed |

| Data Encryption | End-to-end encryption | Standard encryption |

7. Personalized Banking Experience

Digital banks offer personalized banking experiences using AI and data analytics to tailor services to individual users. The ability to customize financial products and receive proactive financial advice makes digital banking more user-friendly and efficient.

AI-Driven Customer Support and Chatbots

- 24/7 AI-powered chatbots that handle customer queries instantly.

- Reduced wait times compared to traditional call centers.

- Intelligent responses based on past interactions and user preferences.

- Personalized financial tips based on user spending habits.

- Human-assisted chat options for complex queries.

Customizable Banking Features and Alerts

- Users can set personalized transaction alerts and spending limits.

- Custom financial insights based on spending habits.

- Tailored product recommendations such as loans, credit cards, and savings plans.

- Real-time notifications for bill payments and due dates.

- AI-driven insights on how to save more based on past transactions.

| Feature | Digital Banks | Traditional Banks |

| Customer Support | AI chatbots, 24/7 | Limited hours |

| Personalization | AI-driven suggestions | Generic services |

| Notifications | Real-time, custom alerts | Standard alerts |

Tailored loan offers with lower interest rates and flexible repayment plans.

| Feature | Digital Banks | Traditional Banks |

| Monthly Fees | Low or None | High |

| Interest on Savings | Higher | Lower |

| Loan Processing Time | Quick | Lengthy |

8. Global Reach and Multi-Currency Support

Unlike traditional banks, digital banks facilitate seamless international transactions without high fees or complicated processes. Customers who frequently travel or engage in international business benefit from multi-currency support and real-time currency conversions. Digital banks make cross-border transactions affordable, simple, and efficient.

Easy International Transactions

- No additional paperwork required for global transfers.

- Real-time currency conversion at competitive exchange rates.

- Integration with global payment systems like SWIFT, SEPA, and Wise.

- No restrictions on transferring funds between countries.

- Reduced transaction fees compared to traditional banks.

No Hidden Fees for Foreign Transactions

- Transparent pricing structure with no surprise charges.

- Competitive foreign exchange rates without inflated markups.

- Multi-currency accounts for seamless travel and business transactions.

- Instant currency conversion in digital banking apps.

- No added surcharges for cross-border payments.

| Feature | Digital Banks | Traditional Banks |

| Foreign Exchange Rates | Competitive, transparent | Marked-up rates |

| Hidden Fees | None | Various surcharges |

| International Transfers | Instant, cost-effective | Lengthy & expensive |

9. Integration with Fintech and Third-Party Services

Digital banks offer seamless integrations with financial technology (Fintech) services, improving functionality and usability. Open banking APIs allow customers to link their banking information with external financial services, improving accessibility and control.

Open Banking API and Connectivity

- Open banking APIs enable seamless integration with third-party financial services.

- Users can access budgeting apps, investment platforms, and payment solutions in one interface.

- Unified financial management from multiple sources within a single dashboard.

- Automatic synchronization of financial transactions across apps.

- Enhanced security and user control over financial data sharing.

Access to Digital Loans, Insurance, and Investments

- Quick access to personal loans without traditional credit checks.

- Digital-first insurance policies offering faster claim processing.

- Automated investment solutions such as robo-advisors.

- Lower processing fees on financial products compared to traditional banks.

- Instant approval and disbursement of digital loans.

| Feature | Digital Banks | Traditional Banks |

| API Integration | Open banking enabled | Limited or none |

| Loan Processing | Instant approval | Lengthy approval |

| Investment Tools | Robo-advisors, AI-based | Manual, advisor-led |

10. Eco-Friendly and Sustainable Banking Approach

Digital banking is not only more efficient but also environmentally friendly, promoting sustainability. With paperless transactions and digital-first approaches, digital banks significantly reduce carbon footprints and support eco-conscious financial management.

Paperless Transactions and E-Statements

- Eliminates paper waste through digital statements and receipts.

- Encourages electronic fund transfers over physical cash transactions.

- Secure document storage, reducing the need for paper-based records.

- Instant electronic invoicing for businesses.

- Digital signatures for loan approvals and agreements.

Green Banking Initiatives and Social Responsibility

- Investments in sustainable and ethical projects.

- Carbon footprint tracking for environmentally conscious customers.

- Incentives for customers who adopt sustainable banking habits.

- Support for renewable energy projects through financial investments.

- Partnerships with eco-friendly organizations promoting responsible finance.

| Feature | Digital Banks | Traditional Banks |

| Paper Usage | Fully digital | High paper dependency |

| Environmental Impact | Low | Higher carbon footprint |

| Green Initiatives | Sustainability-focused | Limited efforts |

Takeaways

The financial world is shifting rapidly, and digital banking is leading the way with unmatched innovation. The features of digital banks that traditional banks can’t match include seamless account setup, AI-driven financial tools, global accessibility, and eco-friendly banking.

These features not only enhance customer experience but also redefine how banking functions in a digital world.

Additionally, the rapid integration of advanced technologies such as AI, blockchain, and machine learning continues to push digital banking beyond the limitations of traditional financial institutions. More users are embracing digital banking as it provides a more intuitive, flexible, and cost-effective alternative.

To stay ahead in financial management, consider switching to digital banking today and unlock a world of convenience, security, and efficiency.