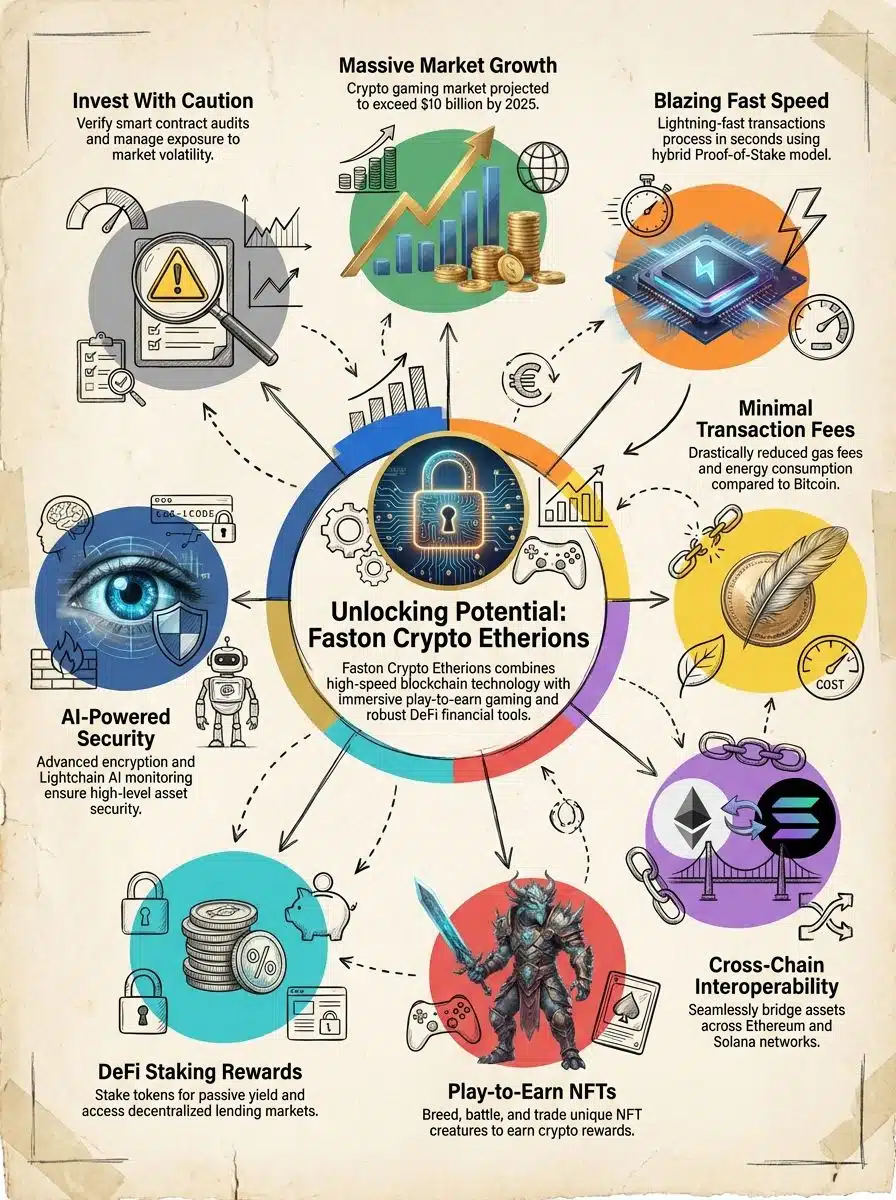

Have you ever looked at crypto gaming and thought, “This seems fun, but how do I know it’s real value and not just hype?” If you’ve worried about sketchy NFTs, confusing wallets, or whether you can actually use gaming tokens for anything, you’re asking the right questions. Faston Crypto Etherions sits in that sweet spot people want: a token-driven gaming experience (etherions) paired with blockchain technology, smart contract tools, and a marketplace feel.

One 2025 market outlook from The Business Research Company projects the blockchain gaming market at about $11 billion for 2025, which helps explain why so many crypto projects are racing into play-to-earn and NFTs.

In this guide, I’ll walk you through the core features, real-world use cases, and the due diligence checklist you should run before you risk a dollar.

Key Takeaways

- Faston and etherions are only “fast and safe” if the basics are in place: transparent smart contracts, clear token rules, and reliable wallet support.

- NFT gaming works best when the NFT has a job: upgrades, crafting, breeding, access passes, or tournament entry, not just “rare art.”

- DeFi features can add real utility: staking, swaps, and lending make a token easier to use, but they also add smart contract risk.

- Bridges and cross-chain links are a common failure point: treat them like high-risk infrastructure and limit what you move.

- For U.S. readers, taxes are part of the decision: plan for recordkeeping from day one, even if you start small.

Core Features of Faston Crypto Etherions

Faston Crypto Etherions is presented as a fast, low-fee crypto ecosystem where gaming, NFTs, and decentralized finance live on top of smart contract functionality.

That promise can be exciting, but you should translate it into concrete checks: what chain does it use, how do transactions settle, where are the smart contracts, and who has admin control?

Security and cross-chain risk matter more than most people think: CertiK reported about $2.47 billion lost to hacks and scams in the first half of 2025, and Elliptic reported over $21 billion in cross-chain crime activity as of May 2025.

Decentralized Platform: What “You Control It” Should Mean

In a decentralized platform, you typically hold the private keys in your own cryptocurrency wallet, and the smart contract enforces the rules instead of a single company approving every move.

That’s the upside. The tradeoff is that if you sign the wrong transaction, there may be no customer support button that can undo it.

Investopedia’s overview of the 2022 Ethereum Merge explains two details that matter for readers: Ethereum’s move to proof of stake cut energy use by about 99.95%, and running a validator requires staking 32 ETH.

- Action step: If Faston runs on Ethereum blockchain smart contracts, look for the contract addresses, whether they are verified on a major block explorer, and whether admin keys can pause, mint, or change fees.

- Action step: If you plan to stake, decide upfront if you want self-custody staking (more control, more responsibility) or a pool (simpler, more counterparty risk).

- Action step: Use a “spending wallet” for dapps and a separate cold storage wallet for savings, so one mistake does not drain everything.

Enhanced Transaction Speed and Security: How to Sanity-Check Big Claims

Many crypto projects advertise “transactions in seconds,” “low fees,” and “scalability.” Some deliver. Some exaggerate. Instead of trusting the headline, you want proof you can observe: confirmation speed, failed transaction rate, and whether fees spike during heavy gaming traffic.

| Claim you’ll see | What it means in practice | What you should check |

|---|---|---|

| “Fast transaction speeds” | You can trade, mint NFTs, or settle in-game rewards with less waiting | Typical confirmation time at peak hours, plus how many confirmations exchanges are require |

| “Low fees” | Smaller NFT trades and frequent in-game actions stay affordable | Fee history during busy periods, plus whether bridge fees add hidden cost |

| “Millions-per-second scaling” | Marketing language unless independently benchmarked | Public performance data, transparent architecture, and third-party testing details |

Security Tooling That Serious Crypto Projects Use

If Faston Crypto Etherions positions itself as a long-term ecosystem, it should treat monitoring as part of the product, not as an afterthought.

Many established teams use tools like OpenZeppelin Monitor for smart contract alerting and incident response workflows, and some protocols integrate on-chain detection networks like Forta to flag suspicious activity.

Action step: Look for signs of “operational security,” like a clear audit history, monitoring disclosures, bug bounty programs, and a documented process for pausing contracts if something goes wrong.

Potential Applications in the Digital Currency Space

When a crypto project talks about “utility,” you want to see where the token actually gets used: in gaming, in NFTs, or in DeFi. The best projects make that utility easy to understand. You should be able to explain the use case in one sentence without using buzzwords.

Integration With NFTs and Gaming Ecosystems

In an Etherions-style setup, NFTs usually act like game characters or items, and the token acts like the currency that powers upgrades, crafting, or entry fees.

You’ve already seen this general pattern in well-known crypto gaming titles like Axie Infinity, The Sandbox, and Gods Unchained, where the NFT is meant to be playable, tradable, or both.

- Make the NFT do something: give it gameplay purpose (breeding traits, battle stats, crafting bonuses) so it has demand beyond “collectible.”

- Check rarity rules: you want clear limits on supply, minting schedules, and whether the team can create new items at will.

- Watch the marketplace mechanics: fees, royalties, listing rules, and whether wash trading protections exist.

- Assume scams exist: never connect your wallet to random “airdrop” pages, and do not sign transactions you do not understand.

- Plan your exit route: know where liquidity comes from (in-game sinks, marketplace volume, or external exchanges).

Opportunities in Decentralized Finance (DeFi)

DeFi is where smart contracts replace traditional finance workflows like swapping, lending, and earning yield. If Faston supports defi, your token may be usable for staking rewards, liquidity pools, or collateral, which can make the ecosystem stickier for real users.

A November 2025 report cited by Reuters noted that yield-generating crypto assets make up only about 8% to 11% of crypto, compared with 55% to 65% in traditional finance, which is why staking and yield features keep showing up in new digital finance products.

- Swaps: If your token has a swap market, confirm where liquidity lives and how pricing works during volatility (thin liquidity can punish you).

- Staking: Separate “real staking” (protocol security or utility) from “promo yield” (subsidized rewards that may not last).

- Loans and collateral: Treat token-backed lending as high risk, since liquidation rules can sell your assets fast during a crypto market drop.

- Cross-chain links: Use bridges only when you need them, and move the smallest amount that still gets the job done.

Investment Considerations

If you’re thinking about investment opportunities tied to Etherion’s Faston crypto, your edge is not speed. It’s discipline. That means verifying contracts, understanding custody, and staying realistic about volatility (finance), especially in emerging digital currency projects.

Risk Analysis and Due Diligence

Start with what you can verify in minutes, then move deeper if the basics check out.

- Smart contract audits: Look for audits from known firms such as Trail of Bits, CertiK, ConsenSys Diligence, or OpenZeppelin, and read what was fixed (not just the badge).

- Admin controls: Confirm whether contracts can be paused, upgraded, or have fees changed, and who controls those permissions.

- Token supply and unlocks: Check total supply, emissions, vesting schedules, and whether insiders can dump into retail buyers.

- Custody plan: Decide whether you will self-custody (hardware wallet plus safe backups) or use a custodian (simpler, but adds platform risk).

- Privacy basics: Review what the app tracks, including wallet connection prompts and any HTTP cookie behavior on the front end.

Market Position and Scalability: Questions that Cut Through the Noise

Scalability is only meaningful if users show up and if the chain stays stable when the game is busy. Before you buy, ask questions you can measure over time: daily active users, marketplace volume, transaction success rate, and whether the developer team ships updates on schedule.

| What to evaluate | Why it matters | A practical test |

|---|---|---|

| Real usage | Tokens with no users rely on speculation | Track marketplace activity and in-game participation for a few weeks |

| Scalability under load | Gaming needs frequent, small transactions | Try a low-stakes trade during peak hours and note confirmation and fees |

| Ecosystem fit | Projects grow faster with strong tooling and integrations | Check wallet support, exchange listings, and developer docs clarity |

U.S. Taxes and Recordk eeping (yes, even for small trades)

For U.S. readers, crypto activity is not just “fun money”; it creates reporting work.

In a September 2025 update, the IRS said brokers will report digital asset proceeds for transactions beginning in calendar year 2025 using Form 1099-DA, with statements expected to reach taxpayers in early 2026 (and the IRS noted that cost basis generally will not be included for 2025).

Action step: Keep your own records now: date, amount, USD value at the time, fees, and what you received, so you can calculate basis and gains later.

Takeaways

Faston Crypto Etherions can sound like the perfect mix of crypto gaming, NFTs, and DeFi utility. The difference between a fun token and a painful lesson is your due diligence.

Start with a small stake, test how the Faston crypto platform behaves in real use, and only scale up if the security, transparency, and token rules hold up.

FAQs on Faston Crypto Etherions

1. What are Faston Crypto Etherions?

Faston Crypto Etherions are digital assets from the Faston project; they live in the world of etherions. They work like tokens in the world of cryptocurrency; you can trade or hold them.

2. How do I buy and store them?

Use a trusted exchange, buy the asset, move it to a private wallet, and keep your keys safe; treat this like any cryptocurrency investment.

3. Are they risky to buy?

Yes, they can swing fast, like a roller coaster. The world of etherions is new, and prices can jump or drop in a day. If you try cryptocurrency investment, only use money you can live without.

4. What can Etherions do for me or my business?

They can fund projects, pay for services, or power apps in the Ethereum ecosystem; they act as a bridge into the world of cryptocurrency. Start small, read the white paper, and watch how the market moves.