In December 2025, history was rewritten. Elon Musk’s personal net worth breached the $750 billion mark, a figure so vast it distorts traditional economic metrics. To visualize this: Musk now controls wealth equivalent to the GDP of Switzerland. This milestone is not merely a triumph of stock speculation; it is the ratification of a new economic paradigm where one individual controls the critical infrastructure of the future—Earth’s energy, global connectivity, and the very supply of labor itself.

The Anatomy of $750 Billion: Where Does the Money Come From?

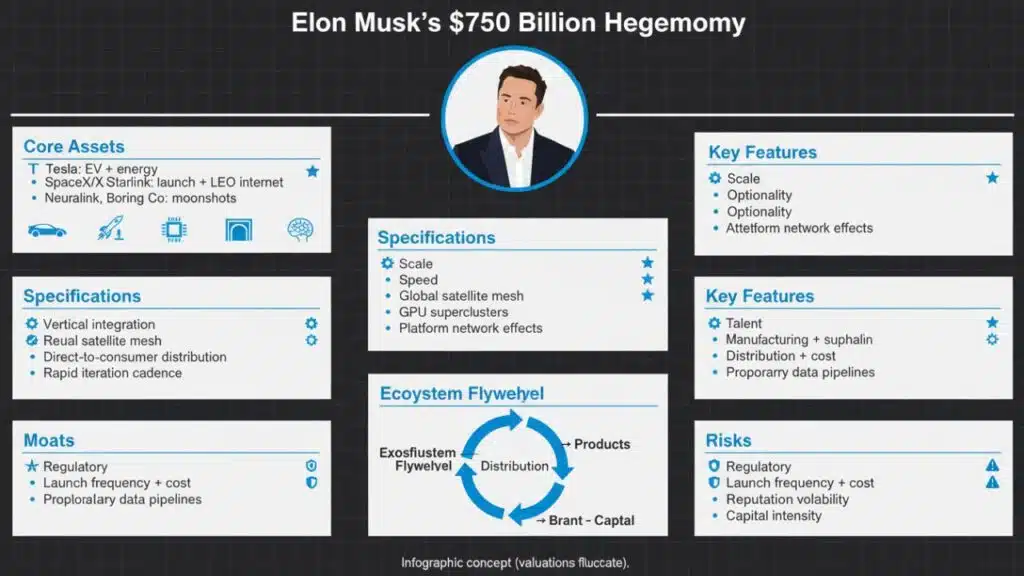

To understand the “Why,” we must first break down the “What.” The $750 billion figure is the sum of a diversified conglomerate that dominates three distinct layers of civilization.

The Musk Portfolio Breakdown (December 2025 Estimates)

| Company | Sector | Valuation / Market Cap | Musk’s Stake (Est.) | Contribution to Net Worth |

|---|---|---|---|---|

| SpaceX | Aerospace & Internet | $800 Billion | ~42% | ~$336 Billion |

| Tesla | EV, Robotics, Energy | $1.6 Trillion | ~20.5% | ~$328 Billion |

| xAI | Artificial Intelligence | $150 Billion | ~40% | ~$60 Billion |

| X (Twitter) | Media & Data | $30 Billion | ~70% | ~$21 Billion |

| Neuralink/Boring | Biotech/Infra | $15 Billion | Various | ~$5 Billion |

| Total | ~$750 Billion |

Analysis: The pivotal shift in 2025 is that SpaceX has overtaken Tesla as the crown jewel of his fortune (on a per-share impact basis), driven by the Starlink monopoly and Starship’s operational success.

Core Analysis: The Three Pillars of Dominance

1. The “Optimus” Effect: Manufacturing Labor

The most explosive growth driver in Q4 2025 was the market’s realization that Tesla is pivoting from a “Car Company” to a “Labor Company.”

- The Thesis: The global economy is labor-constrained (aging populations in China, Japan, EU). Tesla’s Optimus Gen-3 Robot offers a solution: “Synthetic Labor.

- The Economics: Building an Optimus robot costs Tesla ~$15,000. If leased at $5/hour, it generates ~$40,000/year in pure profit. Investors are pricing Tesla not on car sales, but on the potential to deploy millions of these robots. This “call option” on solving the labor shortage added roughly $200 billion to Musk’s net worth in late 2025 alone.

2. SpaceX: The “Railroad” of the Solar System

SpaceX is no longer just a launch provider; it is a global utility.

- Starlink: By late 2025, Starlink controls 60% of the world’s satellite internet traffic, becoming the backbone for global shipping, aviation, and military communications.

- Starship: The fully reusable Starship rocket has reduced orbit costs to <$100/kg. This monopoly allows SpaceX to dictate the price of access to space, effectively taxing the entire future space economy.

3. The Geopolitical Shield (The “State” Actor)

Musk has achieved “Sovereign Immunity” through infrastructure.

- Military Dependence: The Pentagon relies on SpaceX for launch and Starlink for communications (Starshield).

- Information Control: Through X (formerly Twitter), he controls a dominant platform for political discourse.

- Implication: Regulators in the US and EU find it increasingly difficult to penalize his companies because they are critical to national security. This perceived safety from regulation reduces the “risk discount” on his stocks.

Comparative Analysis: The “Technoking” vs. Traditional Tycoons

Musk has effectively decoupled from his peers. He is playing a different game entirely—one of vertical integration across physics and digital intelligence.

The Power Gap – Musk vs. Rivals (Dec 2025)

| Feature | Elon Musk | Jeff Bezos | Mark Zuckerberg | Jensen Huang (NVIDIA) |

|---|---|---|---|---|

| Net Worth | ~$750B | ~$285B | ~$260B | ~$190B |

| Physical Assets | Global (factories, satellites, rockets) | Global (warehouses, servers) | Low (Servers/Cables) | Low (Chip Design only) |

| AI Strategy | Real World AI (Robots/Cars) | Cloud AI (AWS) | Digital AI (Metaverse) | The “Shovel Seller” (Chips) |

| Govt. Leverage | Critical (Defense/Space) | High (CIA Cloud) | Low (Regulatory Target) | High (Chip Sovereignty) |

| Labor Strategy | Creating Labor (Optimus) | Automating Logistics | Remote Work Tools | Enabling AI Compute |

Expert Perspectives

- The Macro-Economist View: “Musk is building the ‘General Electric’ of the 21st century, but on a planetary scale. He provides the energy (Tesla), the transport (SpaceX), the intelligence (xAI), and the labor (Optimus). It is a vertical monopoly on civilization’s inputs.” — Chief Strategist, Goldman Sachs.

- The Geopolitical Risk View: “The concentration of such power in an unelected individual is unprecedented. If Musk decides to shut off Starlink over a conflict zone, he changes the outcome of a war. He is a ‘Wild Card’ superpower.” — Foreign Policy Analyst, The Hague.

Future Outlook: The Trillion-Dollar Horizon

When will Musk become the world’s first Trillionaire?

- Prediction: Q3 2026.

- The Catalyst: The IPO of Starlink. Spinoff rumors suggest Starlink could be spun out of SpaceX as a separate public company. Given its utility-like cash flows, an IPO could unlock an additional $200-$300 billion in liquid value.

- The Wild Card: Neuralink. Human trials in 2025 showed promise. If Neuralink proves it can restore vision or mobility on a mass scale, it opens a new healthcare sector worth billions, pushing him over the line.