Hey there, are you tired of fumbling with cash or worrying about losing your debit card? It’s a hassle to keep track of money the old way, especially when you’re on the go in South Africa.

Digital payments can feel like a maze, but guess what? There’s a simpler path waiting for you with digital wallets.

Did you know the digital payments market in South Africa is set to hit a whopping $22.53 billion by 2024? That’s a huge leap into a cashless world. This blog will guide you through five amazing e-wallet apps like FNB eWallet and Zapper, transforming how you handle online payments and contactless payments.

We’ll break down their cool features and show you how they fit into the growing digital economy. Stick around, it’s worth it!

Key Takeaways

- FNB eWallet App is a top pick with a 4.8 rating and 10 million downloads, perfect for instant cash sends in South Africa.

- SnapScan, rated 3.9 with over 500,000 downloads, makes QR code payments easy for local shops and online buys.

- Zapper, also rated 3.9 with 1 million downloads, offers quick QR payments and cool rewards in South Africa.

- Nedbank Money App, with a 3.5 rating and 100,000 downloads, simplifies online payments and virtual card use.

- ABSA Banking App, rated 4.4 with over 5 million downloads, supports secure contactless payments and bill handling.

FNB eWallet App

FNB eWallet App is a game-changer for digital payments in South Africa. This handy tool lets you send cash instantly, even to folks without a bank account. Rated an impressive 4.8, it boasts 10 million downloads and over 270,000 reviews.

Talk about a crowd favorite! It’s like having a reliable companion for all your mobile money needs.

Now, imagine avoiding the inconvenience of cash or cards with this app. You can make swift online payments or manage bill payments with ease. It’s a great choice for anyone stepping into the digital economy.

Plus, with secure features like a one-time pin, your transactions remain protected. How awesome is that for cashless transactions?

SnapScan

Hey there, folks, let’s chat about SnapScan, a game-changer in South Africa’s digital payment scene. This app, rated a solid 3.9 with over 500,000 downloads and 289,000 reviews, is making waves with its easy approach.

It focuses on QR code-based transactions, so you just scan and pay, no fuss at all.

Ever tried paying with a quick flip of your phone? SnapScan lets you do that for online payments or at local shops. It’s like having a digital wallet right in your pocket, perfect for contactless payments.

Plus, it hooks into mobile applications, so managing your money feels like a breeze in today’s digital economy. Stick around to see how it fits into your daily grind!

Zapper

Zapper is making waves in South Africa with its easy approach to digital payments. This app lets you pay with a simple scan of a QR code, no fuss at all. Rated at 3.9 stars with over 1 million downloads and 203,000 reviews, it’s clear folks are loving this mobile payment tool.

You can settle bills or split costs with pals in a snap.

Beyond just paying, Zapper hooks you up with sweet rewards and deals every time you use it. Imagine getting a little perk just for buying your morning coffee, pretty cool, right? It’s a solid pick for anyone jumping into the digital wallet game in South Africa, blending speed with some neat extras for online payments.

Nedbank Money App

Hey there, let’s chat about the Nedbank Money App, a handy tool shaking up digital payments in South Africa. This app, with a solid rating of 3.5, has already hit 100,000 downloads and racked up 2,561 reviews.

It’s a go-to for many looking to handle their cash with ease through digital banking and wallet services.

Isn’t it cool how this app simplifies online payments and bill payments? You can manage your debit cards or even use virtual cards for safer transactions. Plus, it fits right into the digital economy, making card payments a breeze.

Stick with this gem, and watch how it turns your phone into a powerful money hub!

ABSA Banking App

ABSA Banking App stands out as a top choice for digital payments in South Africa. It offers a full digital wallet packed with banking services. With a solid rating of 4.4 on Google’s Play Store, it has over 5 million downloads.

Plus, more than 4,741 reviews show users trust this app for online payments. It’s like having a bank in your pocket, ready to roll whenever you need it.

Got a bill to pay or need to send cash fast? This app handles bill payments and transfers with ease. It supports contactless payments, so you can tap and go without fuss. Security is tight with encrypted transactions and one-time pins to keep your money safe.

Whether you’re managing a transactional account or using virtual cards, ABSA makes the digital economy in South Africa feel like a breeze.

Key Features Driving the Success of These E-Wallets

Let’s talk about what makes digital wallets like FNB eWallet and SnapScan stand out in South Africa. Imagine these apps as your reliable partner for digital payments. They’re packed with great features, like analytics-based dashboards that clearly show where your money is going.

Need to monitor spending or manage a budget? These tools make online banking effortless. And who can resist a good offer? Discounts and rewards make the switch to contactless payments even more appealing, encouraging you to leave cash behind.

Think of this as your safeguard in the digital economy. Strong security measures are a key focus, with two-factor authentication, biometrics, and PINs protecting your funds. There’s no need to worry about fraud when using Google Pay or Samsung Wallet.

Beyond that, chatbots provide round-the-clock support, resolving queries in a flash. It’s like having a friend always ready to assist, ensuring your experience with virtual cards and online payments remains seamless and worry-free.

The Role of Secure Authentication in Digital Payments

Secure authentication is the backbone of safe digital payments in South Africa. Think of it like a sturdy lock on your front door, keeping intruders out. Without it, your money could slip through the cracks.

Methods like two-factor authentication, biometrics, and one-time PINs stand guard over your online transactions. These tools make sure only you can access your digital wallet, whether you’re using apps for contactless payments or online banking.

Now, here’s the deal, folks, trust is everything in this digital economy. Strong security features build that trust between you and your payment methods. In South Africa, where financial technology is booming, protecting your credit card or virtual card details from fraud is a big deal.

Biometric scans, like fingerprints, and secure passwords act like a trusty watchdog, making sure every transaction, from bill payments to Google Pay taps, stays safe.

Benefits of Contactless Payments in South Africa

Hey there, South Africans, ready to tap into the future of money? Contactless payments are speeding up your shopping, making every transaction a breeze with just a quick wave of your phone or card.

Imagine no more fumbling for cash at the store; apps like Apple Pay and Samsung Pay keep things smooth and fast. So, why not jump on this trend and enjoy the ease of a cashless life today?

**Benefits of Contactless Payments in South Africa**

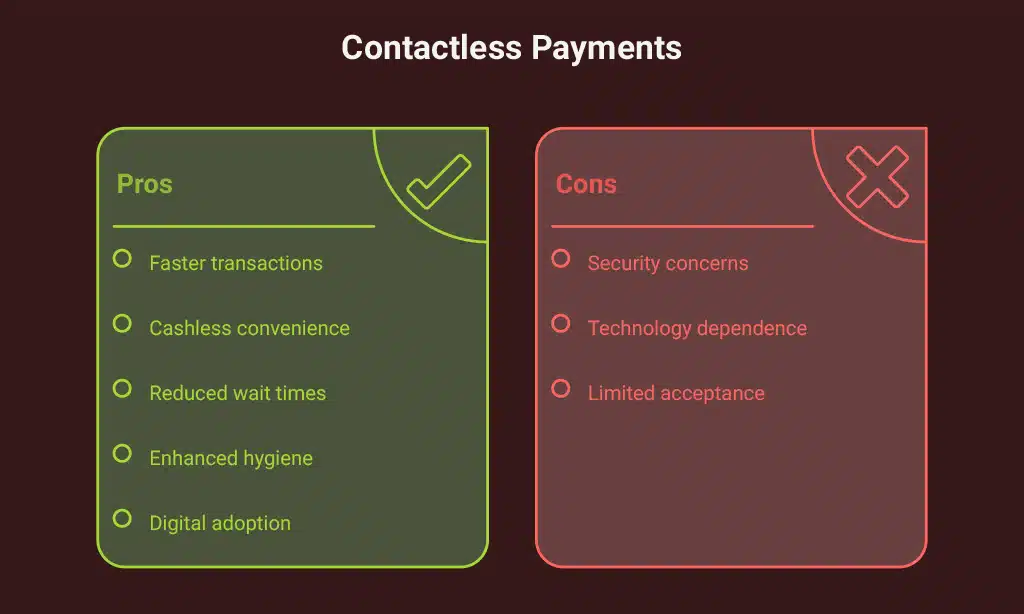

Listen up, folks, contactless payments are changing the game in South Africa! With a simple tap of your device using tools like Google Wallet or virtual cards, you pay for stuff in seconds.

No need to carry cash or swipe cards; it’s all about speed and safety. Plus, in busy spots like markets or malls, this method cuts down wait times and keeps germs at bay. Think about tapping your phone to buy groceries, quick as a flash, without touching a thing.

Isn’t it time to ditch the old ways and go digital for good?

How E-Wallets Are Promoting Financial Inclusion

Let’s chat about how digital wallets are opening doors for so many in South Africa. Imagine living far from a bank, with no easy way to save or send money. That’s a real struggle for lots of folks, especially in rural spots.

E-wallets, like FNB eWallet, step in as a game-changer here. They let people, even the unbanked, get paid instantly on their phones. No account needed, just a simple number to cash out at ATMs.

How cool is that?

Now, take uKheshe, another star in this digital economy. It links both banked and unbanked users with virtual cards, like a Mastercard, for online payments or bill payments. This means more people can join the financial world, buy stuff on the web, or pay for services without needing a traditional bank.

It’s like handing someone a key to a whole new marketplace. These tools are breaking down walls, bit by bit, for a fairer shot at money matters.

Challenges Facing Digital Wallet Adoption

Hey there, folks, let’s chat about the hurdles blocking digital wallets in South Africa. It’s a bit of a bumpy road, sadly. Even with growth in digital payments, these handy apps are still underused at Point of Sale systems across the country.

Many shops just don’t have the right tech to accept contactless payments. That’s a big wall stopping folks from tapping their phones to pay.

On top of that, there’s a gap in solid info about apps like Apple Pay, Samsung Pay, and Google Pay. Since they’re tied into bigger platforms, tracking their usage stats is like chasing a ghost.

This lack of clear data makes it tough for businesses to trust and push digital wallets. Add to that, some people worry about safety with online payments. It’s like trying to convince your grandma to text, a hard sell when doubts linger.

Future Trends in the South African E-Wallet Landscape

Gosh, the digital payment scene in South Africa is buzzing with fresh ideas. Picture a world where your phone does all the money magic. Digital wallets are set to soar, with transaction volumes already up by 91% from 2019 to 2023, according to Discovery Bank.

That’s a massive leap, right? Soon, more folks will tap into contactless payments for quick buys at the store. Think Apple Pay, Samsung Pay, and Google Pay joining the party. The e-commerce boom, projected to hit $74.79 billion by 2033, will push this trend even harder.

It’s all about speed and ease, my friends.

Now, let’s chat about what’s next for financial technology here. A 2022 McKinsey survey showed that globally, interest in using three or more digital wallets jumped from 18% to 30% in just one year.

In South Africa, 52% of consumers used a digital wallet last year, and 60% plan to keep at it. This hints at a future packed with online payments and virtual cards. Imagine loyalty card perks tied right into your app.

Or, how about super-safe tokenisation making every deal secure? The digital economy is growing fast, and these tools are paving the way for everyone to join in.

Takeaways

Hey there, South African readers, let’s wrap this up with a quick thought! Digital payments are zooming ahead with e-wallet apps like FNB eWallet and Zapper leading the charge. Isn’t it wild how a tap on your phone can pay for groceries or split a bill? These tools are making our cashless world safer and easier every day.

Stick with this tech wave, and watch your money moves get smoother!

FAQs

1. What are the top e-wallet apps changing digital payments in South Africa?

Hey, let’s chat about the game-changers in the digital economy down in South Africa. Apps like Apple Pay, Samsung Pay, and Google Pay are leading the pack with slick contactless payments. Then you’ve got others like PaySafeCard and WeChat, making online payments a breeze with just a tap.

2. How do digital wallets make life easier in South Africa?

Man, digital wallets are like having a magic pocket. They handle bill payments, online banking, and even virtual cards without breaking a sweat in this fast-paced financial technology world.

3. Are these e-wallet apps safe for online payments in South Africa?

Absolutely, pal, safety’s the name of the game. These apps authenticate every transaction, often with a one-time pin, so your money stays locked tight. It’s like having a guard dog for your digital wallet, keeping those online payments secure.

4. Why are contactless payments gaining traction in South Africa?

Yo, contactless payments are popping off because they’re quick as a flash. In a busy market, whether you’re using Samsung Pay or Apple Pay, you just tap and go, no fuss. It’s like cutting through red tape in the digital economy, saving time for everyone.

5. Can e-wallet apps support different payment methods in South Africa?

Hey there, wanna know a cool tidbit? These apps aren’t just one-trick ponies; they juggle various payment methods like online payments and even link to your bank for seamless transfers. Whether it’s Google Pay or WeChat, they’ve got your back in this ever-growing world of financial technology.