Cryptocurrencies have grown exponentially in recent years, reshaping how we think about money, investments, and financial systems. While the potential of digital assets is vast, so are the risks associated with them.

Governments and regulatory bodies worldwide are working tirelessly to create frameworks to manage the impact of crypto on the economy and protect investors. Understanding these regulations is crucial, whether you’re an investor, a trader, or someone just curious about the crypto world.

In this article, we’ll explore seven critical crypto regulations you need to know about, why they matter, and how to stay compliant. Let’s dive in!

Why Crypto Regulations Matter?

Crypto regulations aim to provide clarity and structure in the digital asset ecosystem. Without regulations, the crypto market can be a breeding ground for fraud, money laundering, and scams. Here are a few reasons why these rules are essential:

- Investor Protection: Regulations help safeguard individuals from fraudulent schemes and misinformation.

- Market Stability: Rules create a more predictable and secure environment for trading and investing.

- Global Standardization: A clear framework promotes cross-border trade and prevents discrepancies between jurisdictions.

By adhering to these regulations, both businesses and individuals can operate within the legal framework and avoid penalties.

A Global Perspective on Crypto Regulations

Regulations vary widely across regions, with some countries embracing crypto innovation while others impose strict restrictions. Here is an overview:

| Region | Regulation Type | Key Details |

| United States | Taxation, KYC/AML | Strict guidelines by SEC and IRS. |

| European Union | MiCA (Markets in Crypto-Assets) | Comprehensive crypto asset regulations. |

| China | Complete Ban | No trading or mining allowed. |

| Japan | Licensing, Investor Protections | Heavy focus on exchange licensing. |

| El Salvador | Legal Tender | Bitcoin adopted as an official currency. |

While some nations take a restrictive approach, others aim to integrate crypto into their financial systems responsibly.

7 Key Crypto Regulations to Be Aware Of

1. Taxation Policies on Crypto Transactions

Cryptocurrency taxation is one of the most significant aspects of regulation. Many countries classify cryptocurrencies as property, making them taxable. Key points to note:

- Taxable Events: Buying, selling, trading, or earning cryptocurrencies are often considered taxable events.

- Capital Gains Tax: Investors must pay taxes on profits made from crypto trades or investments.

| Country | Tax Rate on Crypto Gains | Notes |

| United States | 0-37% | Depends on income level and holding period. |

| Germany | 0% (if held for over 1 year) | Tax-free after 1-year holding. |

| India | 30% | Flat tax on all gains without deductions. |

Failing to report your crypto earnings can lead to severe penalties. Use tools like CoinTracker to keep track of your transactions.

2. Know Your Customer (KYC) and Anti-Money Laundering (AML) Laws

KYC and AML laws require crypto platforms to verify user identities to prevent illegal activities like money laundering and terrorism financing. These regulations:

- Increase Transparency: Ensure accountability in the crypto space.

- Promote Trust: Legitimate users benefit from safer platforms.

| Key Features | Why It Matters |

| Identity Verification | Reduces fraud and illegal activities. |

| Transaction Monitoring | Ensures funds are not used for illicit purposes. |

| Legal Compliance | Prevents fines for exchanges and businesses. |

Exchanges like Binance and Coinbase require users to complete KYC processes before trading.

3. Regulations on Crypto Exchanges

Crypto exchanges serve as the bridge between traditional finance and the digital asset world. To operate legally, they must comply with specific regulations, including:

- Licensing Requirements: Exchanges must register with relevant authorities (e.g., SEC in the U.S.).

- Operational Guidelines: Includes security measures to protect user funds.

| Exchange | License Requirement | Jurisdiction |

| Binance | Registered in multiple regions | U.S., Europe, and Asia. |

| Coinbase | SEC-compliant | United States. |

| Bitstamp | EU MiCA-compliant | European Union. |

A lack of compliance can lead to shutdowns, as seen in cases like FTX.

4. Security Token Offerings (STOs) vs. Initial Coin Offerings (ICOs)

Raising funds via crypto has evolved. ICOs, once popular, faced criticism for scams, leading to the rise of STOs. Here’s a comparison:

| Aspect | ICO | STO |

| Regulation | Minimal | Strict adherence to securities laws. |

| Investor Rights | Limited | Offers legal protections. |

| Popularity | 2017-2018 | Increasing since 2020. |

Regulators like the SEC ensure that STOs meet securities standards, reducing risks for investors.

5. Stablecoin Oversight and Reserve Backing

Stablecoins, pegged to assets like USD, are under scrutiny due to their role in the market. Key regulations include:

- Reserve Requirements: Issuers must maintain adequate reserves to back their tokens.

- Transparency: Regular audits are mandatory.

| Stablecoin | Backing Asset | Regulation |

| Tether (USDT) | USD and other assets | Facing global regulatory reviews. |

| USD Coin (USDC) | 100% backed by USD | Regularly audited. |

Regulations aim to prevent collapses similar to TerraUSD (UST).

6. Bans and Restrictions on Cryptocurrencies in Certain Countries

Some nations have outright banned crypto trading and mining. Common reasons include energy concerns, financial instability, and lack of control over decentralized currencies.

| Country | Type of Ban | Reason |

| China | Total ban on trading and mining | Energy concerns, capital outflows. |

| India | Proposed ban on private cryptos | Regulatory uncertainty. |

| Nigeria | Ban on banks handling crypto | Control over monetary policy. |

Understanding local laws is vital if you’re operating in these regions.

7. Crypto-Related Licensing Requirements

Many countries now require crypto companies to obtain licenses to operate. This ensures compliance with local laws and builds trust.

- Financial Licenses: Issued by regulatory authorities.

- Consumer Protections: Ensures platforms are accountable.

| Country | License Required | Regulatory Body |

| United States | Money Transmitter License | FinCEN. |

| Japan | Exchange License | Financial Services Agency (FSA). |

| Singapore | Payment Services License | Monetary Authority of Singapore (MAS). |

Potential Risks of Ignoring Crypto Regulations

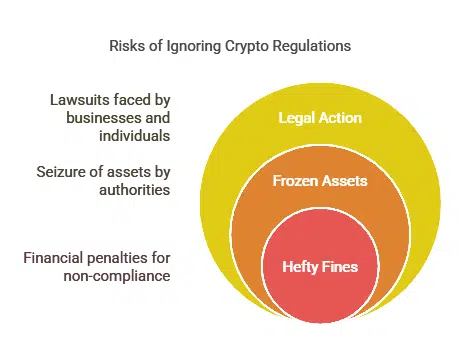

Failing to comply with crypto laws can lead to severe consequences, such as:

- Hefty Fines: Non-compliance often results in financial penalties.

- Frozen Assets: Authorities may seize assets linked to illegal activities.

- Legal Action: Businesses and individuals may face lawsuits.

By staying informed and compliant, you can minimize these risks.

Emerging Trends in Crypto Regulations

As the crypto industry evolves, so do regulations. Recent trends include:

- DeFi Regulations: Addressing risks in decentralized finance protocols.

- CBDC Frameworks: Countries developing Central Bank Digital Currencies.

| Trend | Details |

| DeFi Oversight | Rules for decentralized platforms. |

| Environmental Concerns | Focus on energy-efficient crypto mining. |

| Cross-Border Policies | Harmonizing international crypto laws. |

How to Stay Compliant with Crypto Regulations?

Here are some practical tips to ensure compliance:

- Stay Updated: Follow regulatory news and updates.

- Use Tracking Tools: Platforms like CoinTracker help manage taxes.

- Consult Experts: Seek legal advice for complex issues.

By taking proactive steps, you can navigate the crypto space confidently.

Takeaways

Understanding crypto regulations is essential in today’s evolving digital economy. By staying informed about the latest laws and trends, you can protect your investments and operate legally.

As the crypto world continues to grow, regulatory frameworks will play a pivotal role in shaping its future. Stay compliant, stay informed, and embrace the opportunities that crypto offers.