If you’ve tried to get a bank loan as a startup, you already know the obstacles: limited operating history, weak collateral, strict underwriting, and long approval timelines. Best Alternatives to Traditional Bank Loans exist because early-stage businesses often need funding before they look “safe” on paper. The right option depends on how fast you’re growing, what you can offer in return, and how much risk you’re willing to take on.

This guide is designed to match real startup needs. You’ll get a clear picture of what each funding path looks like, what it costs in money or control, and when it makes sense to choose it.

Why Startups Often Struggle With Bank Loans

Traditional banks are built to protect downside risk. That’s great for stable businesses with steady revenue, assets, and predictable cash flow. Startups usually have the opposite: uncertain demand, evolving products, and limited financial history.

Even when a founder has a strong plan, banks typically want proof. That proof often means multiple years of financial statements, collateral that can be seized, and a consistent ability to repay. Many startups can repay eventually, but they cannot prove it early enough for bank standards.

Banks also move slowly. If you need to hire quickly, buy inventory ahead of a season, or push marketing while momentum is hot, a long approval cycle can be a deal-breaker.

What to Know Before Choosing Any Funding Option

Before you pick a funding route, get clear on what you’re actually trying to solve. Startups usually raise for one of four reasons: runway, growth, inventory, or product development. Different goals fit different funding types.

Here are practical questions to ask yourself first:

-

Are you funding growth that already has demand, or are you still searching for product-market fit?

-

Can you handle fixed monthly payments, or do you need flexible repayment?

-

Are you willing to give up equity or decision influence?

-

Do you need money fast, or can you wait for a longer fundraising process?

-

Will this funding help you reach a milestone that unlocks better funding later?

A common mistake is choosing funding based on availability instead of fit. Cheap money that arrives too late is not useful. Fast money that crushes cash flow can be dangerous.

The Startup Funding Triangle: Speed, Cost, and Control

Every alternative to a traditional bank loan trades off three things. If you understand this triangle, you’ll stop chasing “the best” funding and start choosing what fits your situation.

Speed (How fast money arrives)

Some options can fund you in days (credit cards, vendor terms, customer prepayments). Others take months (VC rounds, many grants). If timing is urgent, speed can matter more than price.

Cost (What you pay back or give up)

Cost isn’t only an interest. It includes fees, payback multiples, discounts, and the hidden cost of fundraising time. The cheapest option on paper can still be expensive if it stalls growth or distracts you for months.

Control (Ownership + decision influence)

Equity investors can change your roadmap, your hiring pace, and your exit timeline. Debt-like tools usually preserve control, but they add payment pressure.

Rule of thumb: You can usually optimize two—never all three.

-

Fast + cheap usually costs control (hot investor term sheets).

-

Cheap + control usually isn’t fast (grants, slow approvals).

-

Fast + control often costs more (cards, short-term capital).

Use the triangle to narrow your choices before you compare offers.

Here Are 10 Startup Funding Options That Can Replace Bank Loans

Below are ten strong options startups use to fund operations, growth, and product development. Each one has a different “price,” whether that price is repayment, equity, or constraints.

1. Angel Investors

Angel investors are individuals who invest their own money in early-stage startups, often in exchange for equity. Angels can be a strong fit when you need more than cash, such as mentorship, industry connections, or credibility.

This path works best when your startup has a clear concept, early traction, or a founder with domain expertise. Compared to banks, angels can move faster and take bigger risks, but you are giving up ownership.

What to watch:

-

Equity dilution and valuation terms

-

Investor expectations for updates and involvement

-

Misalignment on growth speed and strategy

2. Venture Capital

Venture capital is typically designed for startups aiming for rapid scale. VC can fund aggressive hiring, product development, and market expansion, but it comes with pressure to grow fast and pursue large outcomes.

VC is usually not ideal for businesses that want steady, controlled growth or founders who want to maintain full autonomy. It can be powerful when the market opportunity is large and timing is critical.

What to watch:

-

Term sheets, liquidation preferences, and control provisions

-

Pressure to prioritize growth over profitability

-

Fundraising time and distraction

3. Startup Grants and Non-Dilutive Programs

Startup grants are one of the most attractive options because they don’t require repayment and don’t take equity. They are often offered by governments, NGOs, universities, and innovation programs, especially in tech, sustainability, health, and research-heavy industries.

The downside is effort and competition. Applications can be time-consuming, and compliance requirements can be strict. Still, for many startups, grants are worth pursuing because they preserve ownership.

What to watch:

-

Eligibility rules and reporting requirements

-

Restrictions on how funds can be spent

-

Application timelines that may not match urgent needs

4. Revenue-Based Financing

Revenue-based financing (RBF) provides capital that is repaid as a percentage of revenue until a fixed return is reached. This can feel more flexible than a bank loan because repayment scales up or down based on performance.

RBF can be a strong fit for startups with consistent revenue and good margins, especially subscription or repeat-purchase models. It is often not a fit for companies still pre-revenue or with unpredictable sales.

What to watch:

-

The total payback multiple, not just the monthly percentage

-

Cash flow strain during slower months

-

Whether the lender requires minimum revenue thresholds

5. Business Credit Cards and 0% Intro APR Offers

Credit cards can be useful for short-term cash flow and startup expenses, especially when paired with 0% introductory APR periods. This route can fund early operating costs without formal underwriting.

This option is best for disciplined founders who can repay before promotional periods end. It is not ideal for large capital needs or ongoing financing because rates can become punishing.

What to watch:

-

Interest rate cliffs after promo periods

-

Founder personal credit risk if the cards are personally guaranteed

-

Overspending due to easy access

6. Crowdfunding

Crowdfunding allows startups to raise money from the public, either through rewards-based models (pre-selling a product) or equity crowdfunding (selling shares). Rewards-based crowdfunding can be especially powerful for product companies because it validates demand while funding production.

This works best when your product is easy to explain, visually compelling, and deliverable on a clear timeline. It can also create strong early community support.

What to watch:

-

Fulfillment complexity and delivery deadlines

-

Platform fees and marketing costs

-

Reputation risk if timelines slip

7. Strategic Partnerships and Corporate Funding

Some startups raise capital through partnerships with larger companies that want access to innovation, distribution, or technology. Funding can come as a direct investment, joint venture support, or paid pilot projects.

This approach can be valuable because it may come with customers, credibility, and resources. It also comes with risk if the partner’s goals dominate your roadmap.

What to watch:

-

Exclusivity clauses that limit future options

-

Dependency on one corporate relationship

-

Slow corporate decision cycles

8. Accelerator and Incubator Programs

Accelerators often provide a small amount of funding, mentorship, and a network in exchange for equity. The cash might not be huge, but the real value can come from access to investors, guidance, and structured momentum.

This route works well if you’re early-stage and can benefit from rapid iteration and pitch readiness. Not all accelerators are equal, so selection matters.

What to watch:

-

Equity terms relative to funding size

-

The real quality of mentorship and network

-

Whether the program aligns with your business model

9. Customer Prepayments and Pre-Sales

One of the most underrated ways to fund a startup is to get paid before delivery. Pre-sales, deposits, annual upfront subscriptions, and milestone-based contracts can generate working capital without taking on debt or giving equity.

This approach works best when you have strong customer trust or a clear value proposition. It also forces discipline, because you must deliver what you promised.

What to watch:

-

Overpromising timelines

-

Cash flow mismatches if delivery costs come first

-

Refund policies and customer expectations

Pro Tip: If you offer prepayment, pair it with a clear delivery timeline and a simple “what’s included” scope. Clarity protects trust.

10. Vendor and Supplier Financing

Some vendors offer net terms, installment plans, or supplier credit, which can reduce the need for upfront cash. For inventory-based startups, this can be a practical way to fund growth without borrowing from a bank.

This option can be especially useful when your suppliers want long-term relationships, and your sales cycle is predictable.

What to watch:

-

Late-payment penalties and interest-like fees

-

Supplier leverage over pricing and inventory access

-

Whether terms are stable or can be tightened quickly

Is It Expensive to Avoid Bank Loans?

It can be, but not always. The real cost is not only interest rate. It’s the total trade-off: dilution, control, repayment pressure, fees, or time spent fundraising.

Some alternatives cost more than a bank loan in pure interest terms, but they are still “cheaper” strategically if they help you move faster, capture market share, or avoid giving away equity too early. In other cases, the cheapest option is not debt at all, but grants, credits, or customer-funded growth.

The key is to evaluate cost in context: what you give up and what you gain in speed, flexibility, and survivability.

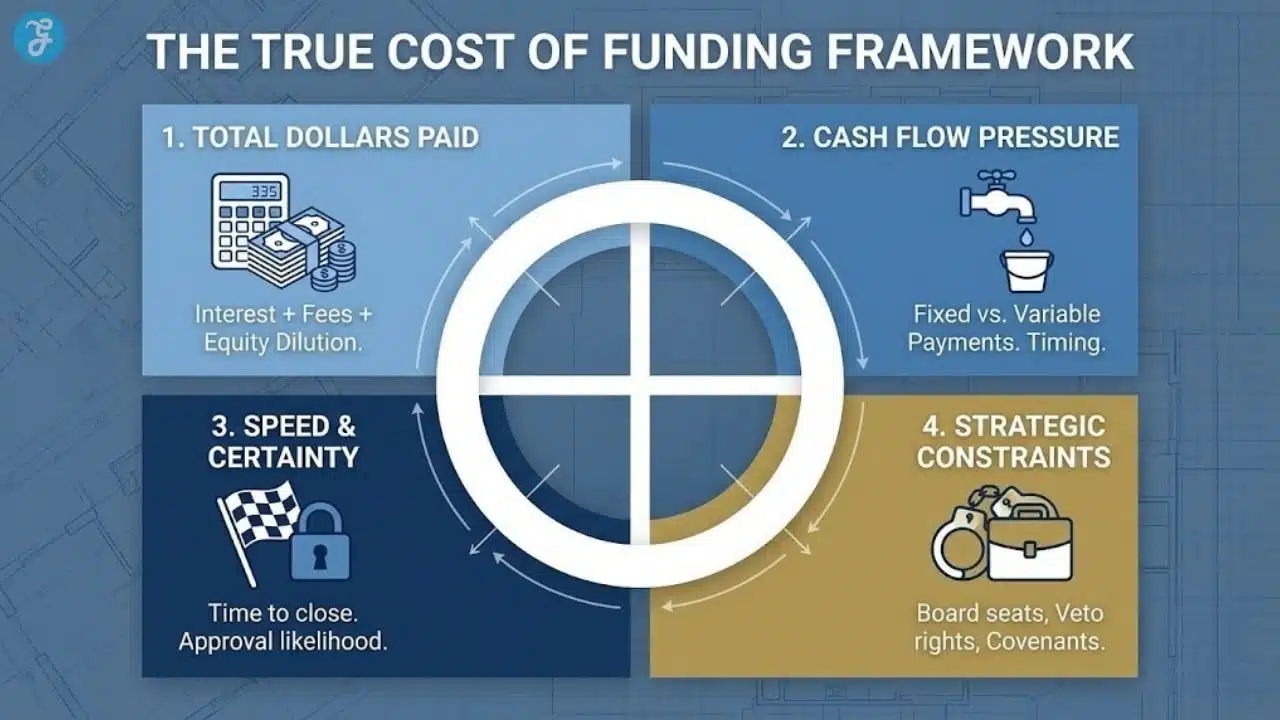

A Simple Cost Framework: Compare Funding Options on Total Impact, Not Headlines

Startups get into trouble when they compare a single number (interest rate or valuation) instead of total impact. Use this quick framework to evaluate any alternative:

1) Total dollars you’ll pay (or give up)

-

Interest + fees (for debt-like options)

-

Payback multiple (for revenue-based financing)

-

Equity dilution + future dilution impact (for investors)

2) Cash flow pressure

-

Fixed payments vs variable payments tied to revenue

-

How payment timing matches your collections cycle

-

Whether the funding forces you to stay profitable before you’re ready

3) Speed and certainty

-

How likely you are to actually close it

-

How long it takes

-

What stalls the process (paperwork, underwriting, due diligence)

4) Strategic constraints

-

Covenants, exclusivity, minimum spend rules

-

Control rights, board seats, veto provisions

-

Restrictions on use of funds

A “good” funding choice is the one that improves your odds of reaching the next milestone without creating a payment or control problem.

The 3 Buckets of Bank-Loan Alternatives (So You Choose Faster)

Most startup financing options fall into one of three buckets. Knowing your bucket helps you pick the right tool quickly.

Bucket A: Non-dilutive money (no equity given up)

Grants, credits, competitions, and some paid pilots. Best for founders who want to preserve ownership and can handle application effort or compliance.

Bucket B: Dilutive capital (equity given up)

Angels, venture capital, accelerators, equity crowdfunding. Best for high-upside businesses where speed matters and cash flow cannot support repayment.

Bucket C: Debt-like capital (repayment, but less strict than banks)

Revenue-based financing, credit cards, vendor financing, and some partner-funded structures. Best for startups with revenue or predictable cash flow who want to preserve equity.

Once you know your bucket, you can compare options inside it instead of mixing apples and oranges.

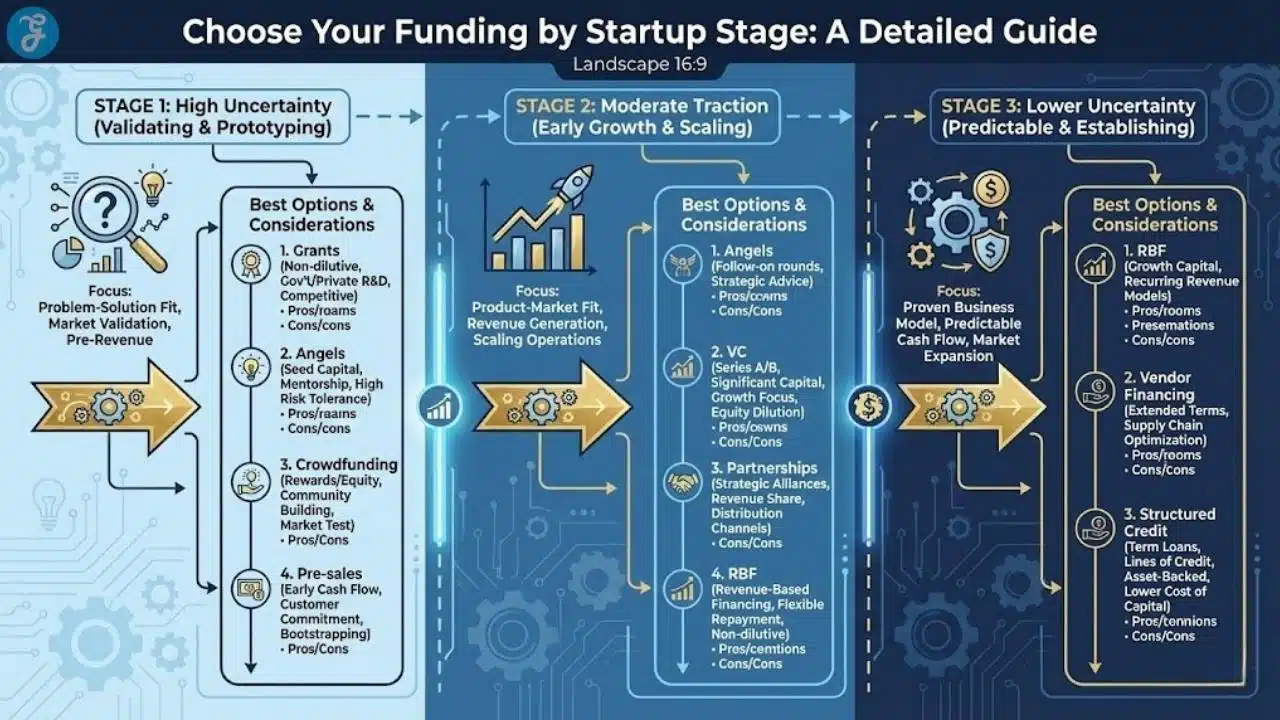

How to Choose the Right Option Based on Your Startup Stage

Early-stage startups often benefit most from flexible or non-dilutive options, especially if they are still proving demand. Later-stage startups with predictable revenue can handle more structured repayment models.

A practical way to decide is to match funding to risk:

-

High uncertainty (still validating): grants, accelerators, angels, crowdfunding, pre-sales

-

Moderate uncertainty (early traction): angels, partnerships, RBF, selective debt-like tools

-

Lower uncertainty (predictable revenue): RBF, vendor financing, structured credit options

If you choose a funding type that assumes stability when you’re still unstable, it creates pressure that can break the business.

Red Flags to Avoid When Using Loan Alternatives as a Startup

Alternative funding can keep you moving, but some deals quietly increase failure risk even if they look “approved” and “available.” Watch for these red flags before you sign anything.

First, avoid financing that depends on perfect execution. If repayment only works when sales grow immediately, customer churn stays low, and costs remain flat, the structure is too tight for startup reality. Second, be cautious of hidden control hooks: board seats, veto rights, aggressive information rights, or restrictive covenants can limit your ability to pivot when you need to.

Third, don’t accept unclear pricing. If the lender or investor can’t explain the true total cost in plain language—fees, payback multiple, penalties, or dilution—walk away. Fourth, be careful with stacked obligations. Combining a revenue share, vendor terms, and credit card balances can create a cash-flow squeeze that feels manageable until one slow month hits.

Finally, avoid dependency deals. If a partnership includes exclusivity, IP claims, or roadmap control, you may win short-term cash but lose long-term options. The best funding is boring: transparent, survivable in a bad month, and aligned with your next milestone.

What This Means for Startup Funding Decisions

Funding is not just money. It’s timing, leverage, and constraints. The strongest startups treat financing as a strategy, not a rescue plan. When you understand your real needs and pick the right instrument, you protect both your runway and your ownership.

Many founders chase the “best” option in theory, but the right option is the one that fits your revenue reality, your growth plan, and your ability to absorb risk. Best Alternatives to Traditional Bank Loans are most effective when they help you reach a clear milestone that unlocks better opportunities afterward.

Final Takeaway

There is no single perfect replacement for a bank loan, especially for startups that are still proving themselves. The smarter move is to choose a funding path that matches your stage, protects cash flow, and supports momentum without adding unbearable pressure. Best Alternatives to Traditional Bank Loans can include equity, non-dilutive programs, flexible repayment models, and customer-funded growth, and the best choice is the one that helps you build lasting traction without losing control of your future.

Frequently Asked Questions

Here are answers to some of the most commonly asked questions among readers:

Are Grants Realistic for Most Startups?

They can be, especially if you operate in innovation-heavy sectors like tech, sustainability, research, or community development. The main challenge is competition and compliance, not availability.

Is Revenue-Based Financing Better Than a Loan?

It can be better if your revenue is consistent because repayment scales with performance. It may be worse if your margins are thin or revenue fluctuates heavily.

Should Startups Avoid Giving Up Equity Early?

Not always. Equity can be the right tool when you need mentorship, speed, and capital that doesn’t strain cash flow. The key is to avoid unnecessary dilution before you have leverage.

Can Crowdfunding Replace Traditional Funding?

For some products, yes. It can validate demand and raise funds at the same time. The risk is fulfillment, so planning and logistics matter.

What’s the Fastest Funding Option on This List?

Business credit tools, customer prepayments, and vendor terms are often faster than formal fundraising. Speed depends on readiness, credibility, and your existing relationships.