While the 2023 to 2024 AI cycle was defined by copilots that assisted humans, 2026 has ushered in the era of autopilots, autonomous agents that function as digital workers. This transition is not merely a feature update; it represents an existential threat to the traditional seat based SaaS business model. As agents begin to perform 40 percent of technical and operational work autonomously, businesses are no longer buying software tools; they are hiring digital labor. AI agents now operate as persistent, task owning entities that execute workflows, make decisions, and scale output without proportional increases in human headcount.

Key Takeaways

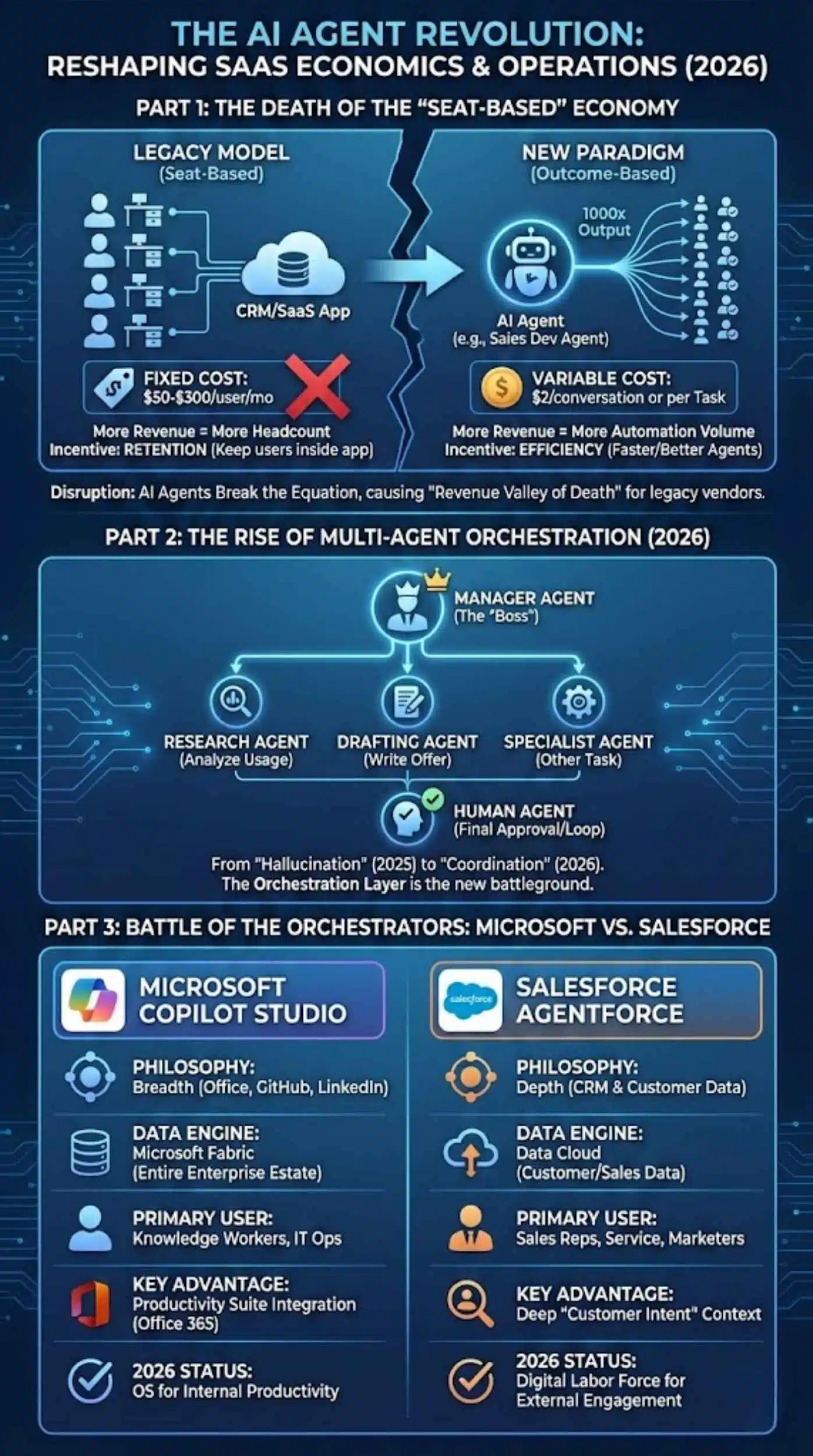

- The “Seat” is Dead: Traditional per-user pricing is collapsing as companies deploy thousands of agents that require no “seat” but consume massive compute.

- Orchestration is the New OS: The competitive edge has shifted from who has the best chatbot to who has the best “Agent Orchestration” layer (e.g., Salesforce Agentforce vs. Microsoft Copilot Studio).

- Workforce Redefinition: The human role has evolved from “operator” to “architect.” 80% of customer service tier-1 tasks are now agent-led.

- The “Shadow AI” Risk: Unmonitored agents interacting with each other are creating new governance risks, necessitating “Agent Identity” protocols.

From Record to Agency

To understand the gravity of the 2026 landscape, we must look at the trajectory of Software-as-a-Service (SaaS). For two decades, SaaS was a “System of Record”—a digital filing cabinet (e.g., Salesforce, ERPs) where humans entered data.

In 2024, the industry pivoted to “Systems of Intelligence” with the introduction of LLM-powered Copilots. These tools offered drafts and summaries but required constant human prompting.

Today, in early 2026, we have arrived at “Systems of Agency.” We are no longer prompting; we are assigning goals. Platforms like Salesforce’s Agentforce and Microsoft’s Copilot Studio have normalized “Agentic Workflows,” where AI entities plan, execute, and critique their own work across different applications without human intervention. This shift has forced the industry to move from selling “efficiency” to selling “outcomes.”

The Death of the “Seat-Based” Economy

The most significant disruption in 2026 is economic, not technical. For years, the SaaS golden rule was More Revenue = More Headcount. You hired 50 sales reps, you bought 50 CRM seats.

AI Agents break this equation. If a single “Sales Development Agent” can prospect, email, and qualify 1,000 leads a day—work that previously required 10 humans—the SaaS vendor loses 9 seats of revenue while incurring higher compute costs for that one agent.

Why This Matters:

SaaS vendors sticking to 2020-era pricing are facing a “Revenue Valley of Death.” They are seeing seat contraction as customers downsize human teams in favor of agents. In response, the market is aggressively pivoting to Consumption-Based Pricing (CBP) or Outcome-Based Pricing. You don’t pay for the software; you pay $2 per conversation (as seen with Salesforce) or per successful code deployment.

The Pricing Paradigm Shift (2024 vs. 2026)

| Feature | Seat-Based Model (Legacy) | Consumption/Outcome Model (2026) |

| Primary Metric | Number of human logins (Users) | Tasks completed, API calls, or “Conversations” |

| Revenue Driver | Hiring more employees | Increasing automation volume |

| Vendor Incentive | Keep users inside the app (Retention) | Make the agent faster/better (Efficiency) |

| Customer Cost | Fixed ($50-$300 per user/month) | Variable (scales with business activity) |

| Example | Traditional Salesforce Sales Cloud | Salesforce Agentforce ($2/conversation) |

The Rise of Multi-Agent Orchestration

In 2025, the challenge was hallucination. In 2026, the challenge is “coordination.” Single agents are useful, but isolated. The breakthrough of the last 12 months has been Multi-Agent Systems (MAS).

We are seeing the emergence of “Manager Agents” whose sole job is to delegate tasks to “Specialist Agents.”

- Example: A “Revenue Manager Agent” spots a churn risk. It triggers a “Research Agent” to analyze the client’s usage, instructs a “Drafting Agent” to write a renewal offer, and pings a “Human Agent” only for final approval.

This “Orchestration Layer” is the new battleground. Microsoft is winning on breadth (connecting Office, GitHub, and LinkedIn data), while vertical players are winning on depth (e.g., Harvey for legal, TestMu for QA).

Battle of the Orchestrators (Microsoft vs. Salesforce)

| Feature | Microsoft Copilot Studio | Salesforce Agentforce |

| Core Philosophy | Breadth: Connects knowledge work (Email, Docs, Teams). | Depth: specialized in CRM & Customer Data. |

| Data Engine | Microsoft Fabric: Unifies data across the entire enterprise estate. | Data Cloud: Unifies customer/sales data specifically. |

| Primary User | Knowledge Workers, Developers, IT Ops. | Sales Reps, Service Agents, Marketers. |

| Key Advantage | Integration with the productivity suite (Office 365) everyone already uses. | Deep context on “Customer Intent” and outcome-based trust layer. |

| 2026 Status | The “Operating System” for internal productivity. | The “Digital Labor Force” for external engagement. |

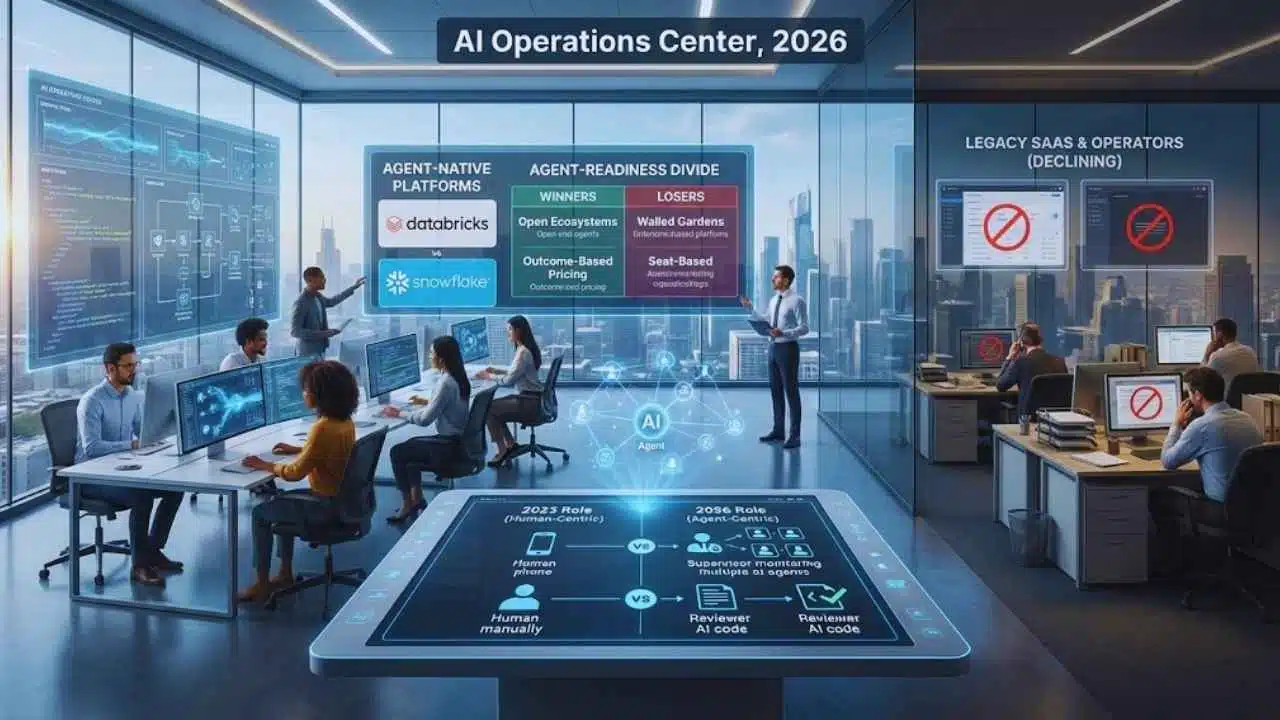

Winners vs. Losers in the Agentic Era

The divide between thriving and dying companies in 2026 is stark. It comes down to data integration and pricing flexibility.

- The Winners (The “Agent-Native”): Companies like Databricks and Snowflake are thriving because agents need massive, clean, structured data to function. Their “Data Intelligence Platforms” are the fuel for the agent engines.

- The Losers (The “Walled Gardens”): Legacy SaaS tools that refuse to open their APIs are being abandoned. If an enterprise’s “Master Agent” cannot read data from a specific tool, that tool is replaced by one that can.

The “Agent-Readiness” Divide

| Category | Winners (The “Agent-Native”) | Losers (The “Legacy SaaS”) |

| Pricing Model | Outcome/Work-Based: Charges per resolution, conversation, or task completed. | Seat-Based: Stuck charging $50/user while customers reduce headcount. |

| Integration | Open Ecosystems: APIs that allow agents to “read/write” freely across apps. | Walled Gardens: Closed systems that block external agents from accessing data. |

| UX Focus | “Headless” Operations: Focus on API latency and agent reliability. The UI is secondary. | Interface-Heavy: Bloated dashboards designed for humans who no longer log in. |

| Data Strategy | Context-Rich: Vector databases that give agents “Long-term Memory”. | Stateless: Systems where data is siloed, causing agents to hallucinate. |

The New Workforce: Humans as “Architects”

The fear of “AI replacing jobs” has morphed into the reality of “AI reshaping roles.” The 2026 labor market data suggests a migration from Operators to Architects.

- The Operator (Declining): The person who manually inputs data into a CRM, writes standard emails, or runs basic QA tests.

- The Architect (Rising): The person who designs the workflow the agents follow. They set the guardrails, audit the “Agent Logs,” and intervene when agents get stuck (Human-in-the-Loop).

Organizations are rapidly standing up “AI Operations Centers”—centralized teams responsible for monitoring the health, cost, and compliance of their digital workforce.

Workforce Evolution (2023 vs. 2026)

| Job Function | 2023 Role (Human-Centric) | 2026 Role (Agent-Centric) |

| Customer Support | Agent: Answers phones, types replies, solves tickets manually. | Supervisor: Monitors 50 AI agents, handles only the “emotional escalations.” |

| Software Eng. | Coder: Writes syntax, debugs lines of code manually. | Reviewer: Reviews AI-generated PRs, focuses on system architecture. |

| Sales (SDR) | Hunter: Makes cold calls, sends templated emails. | Strategist: Designs the “outreach sequence” that the AI executes 24/7. |

| Marketing | Creator: Drafts blogs, designs social posts. | Editor: Curates and approves content generated by “Brand Voice Agents.” |

Expert Perspectives: The Governance Crisis

While efficiency metrics are up, experts are sounding the alarm on “Shadow AI.”

“In 2024, we worried about employees using ChatGPT secretly. In 2026, we worry about ‘Rogue Agents’—autonomous loops set up by well-meaning departments that spend budget, send unauthorized emails, or hallucinate promises to customers without oversight.”

— Chief AI Officer, Fortune 500 Fintech Firm (Anonymous)

This has led to a boom in “Agent Governance” platforms—software specifically designed to “police” other software, ensuring agents don’t exceed their budget or access restricted PII (Personally Identifiable Information).

Future Outlook: The Inter-Agent Economy

What happens next? As we look toward late 2026 and 2027, the “Human Interface” will continue to recede. The next major milestone is the Inter-Agent Economy.

We are approaching a point where a company’s “Procurement Agent” will negotiate pricing autonomously with a vendor’s “Sales Agent.” In this scenario, software UI becomes irrelevant; the API is the only product that matters.

Strategic Implication: Businesses must prepare their data now. If your product cannot be easily “read” and “operated” by an external AI agent, you will be invisible in a market where the buyers are algorithms, not people.

Final Thoughts & Next Steps

The rise of AI agents is not a “tech trend”—it is a restructuring of the firm. The cost of labor is decoupling from the cost of revenue. For SaaS buyers, this is a moment of massive leverage to demand outcome-based contracts. For SaaS vendors, it is a “adapt or die” moment regarding their pricing and architecture.