The role of nuclear SMRs (Small Modular Reactors) in 2026 has shifted from theoretical discussions to concrete action. We are no longer just talking about designs; we are seeing construction crews on the ground.

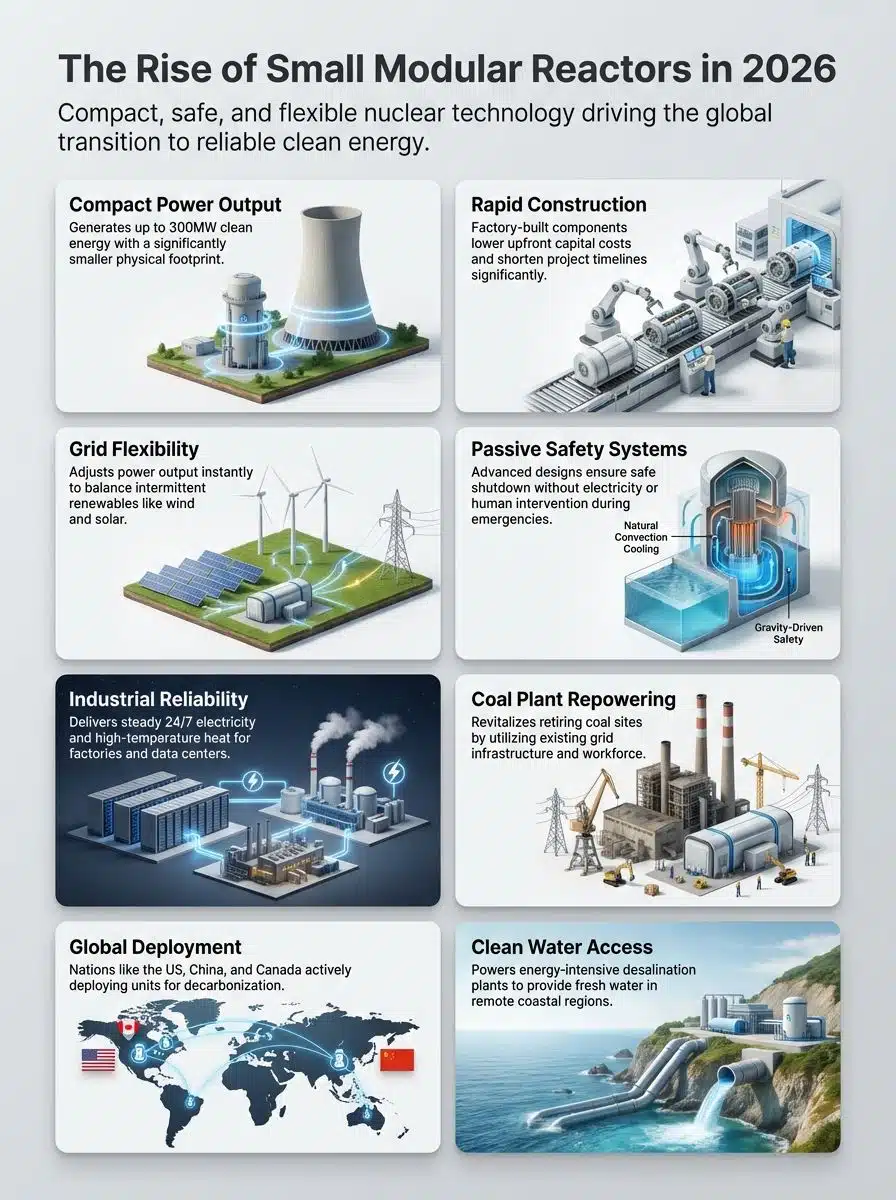

Small Modular Reactors are advanced nuclear plants that generally produce up to 300 megawatts (MWe) of power per unit. This size allows them to power grid locations that traditional gigawatt-scale reactors simply cannot reach.

You might be wondering why this is happening now. The primary driver is the explosive energy demand from artificial intelligence and data centers. In 2026, tech giants like Amazon, Google, and Microsoft are actively signing deals for nuclear power to keep their servers running 24/7 without blowing their carbon budgets.

Old coal plants are retiring, and renewables like wind and solar need a firm, reliable partner to balance the grid. SMRs fill this gap. They offer the reliability of traditional nuclear but with a flexible, factory-built approach that reduces upfront risk.

Let’s look at the data, the real-world projects breaking ground this year, and how this technology changes the energy landscape for your business and community.

What Are Small Modular Reactors (SMRs)?

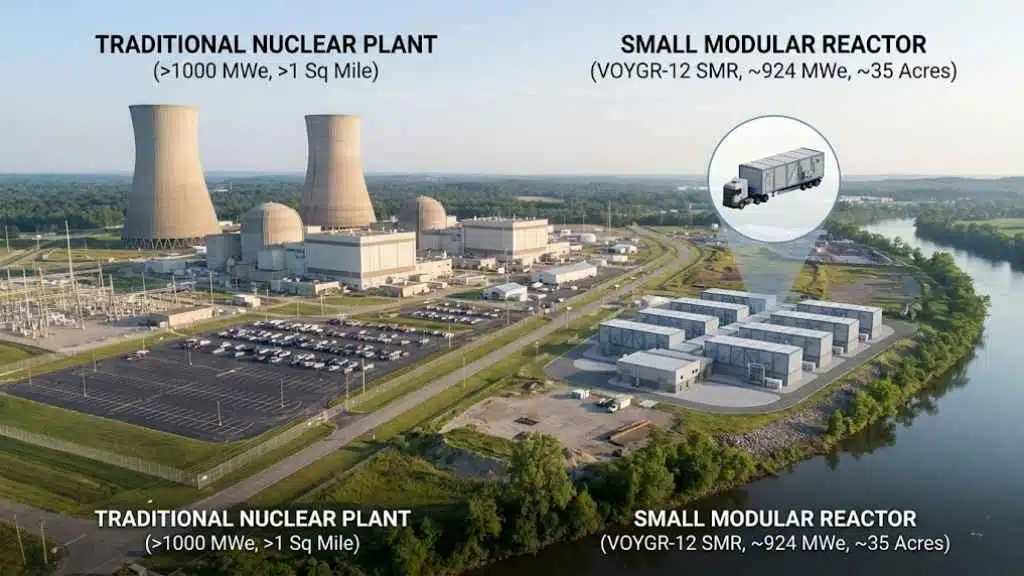

Small Modular Reactors are defined by two key features: their power output and their manufacturing process. While traditional nuclear plants are massive, custom-built construction projects, SMRs are designed to be manufactured in factories and shipped to the site.

The International Atomic Energy Agency (IAEA) typically defines them as producing under 300 MWe per module. However, the “modular” aspect is the real game-changer. It means you can install just one module for a small town or stack 12 of them together for a massive industrial complex.

Real-World Examples in 2026

To understand the scale, look at two specific designs leading the market:

- NuScale VOYGR: This system uses modules that each generate 77 MWe. A power plant can hold 4, 6, or 12 of these modules, allowing utilities to scale up as demand grows.

- Westinghouse AP300: This is a scaled-down version of their massive AP1000 reactor. It produces roughly 300 MWe and leverages supply chains that already exist, which is a major advantage for quick deployment.

The footprint difference is stark. A traditional nuclear station might require over a square mile of land. An SMR facility like the VOYGR-12 requires roughly 35 acres for the actual plant site. This allows them to fit into retiring coal plant sites or next to large factories.

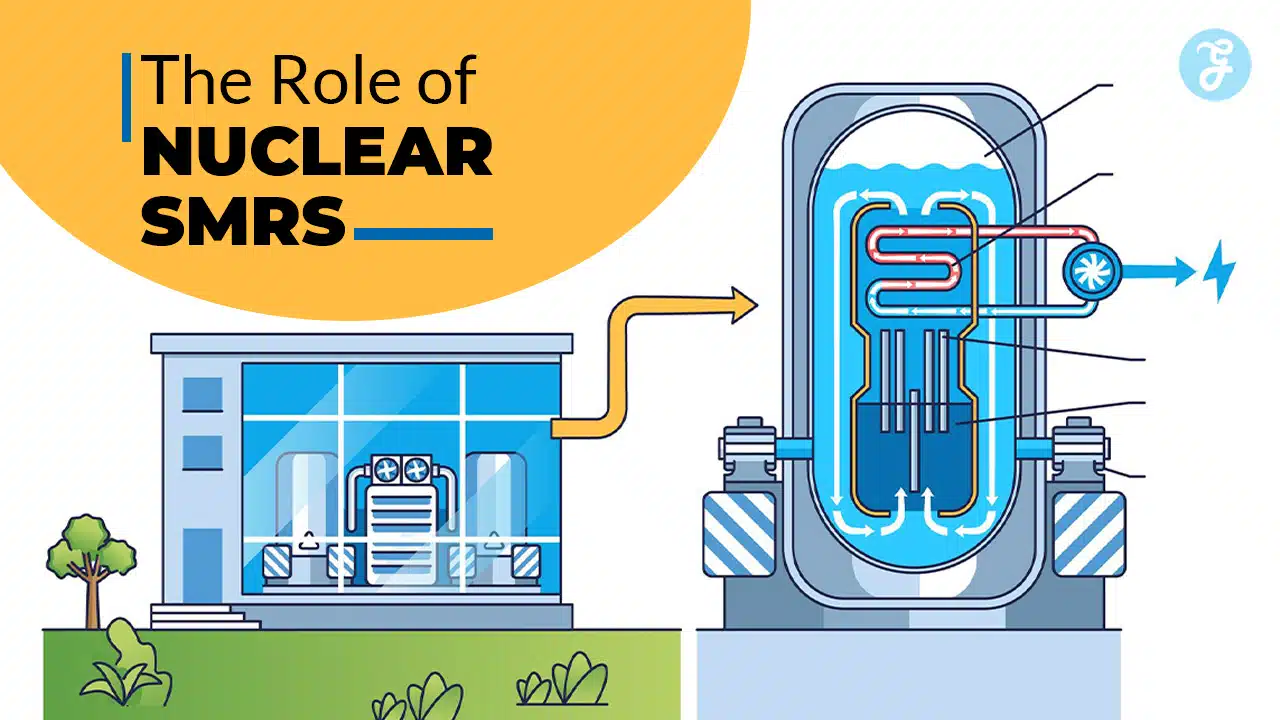

How Do SMRs Work?

SMRs generate electricity through nuclear fission, just like their larger predecessors, but they often use advanced coolants and passive safety systems that rely on the laws of physics rather than electric pumps.

Here is the standard process, updated with 2026 technology:

- The Fuel Source: The core contains nuclear fuel. Many Gen IV designs now use HALEU (High-Assay Low-Enriched Uranium), which is more energy-dense than traditional fuel.

- Heat Generation: The fission reaction creates intense heat. In a standard Light Water Reactor (LWR), this heats water. In advanced designs like Kairos Power’s Hermes, the system uses fluoride salt to transfer heat, which allows the reactor to operate at low pressure.

- Steam Production: The heat transfer fluid moves through a heat exchanger to boil water into steam.

- Electricity Generation: This steam spins a turbine connected to a generator, sending electricity to the grid.

- Passive Safety: If power is lost, gravity and natural convection cool the reactor automatically. Operators do not need to intervene for days, a feature that significantly lowers the risk profile.

Key Advantages of SMRs

The shift to modular nuclear isn’t just about size. It solves specific economic and operational problems that have held nuclear energy back for decades.

Flexibility and Load-Following

Renewables like wind and solar are intermittent. SMRs are designed to pair perfectly with them. Modern designs can ramp their power output up or down by 5% to 10% per minute. This capability, known as “load-following,” allows the nuclear plant to back off when the sun is shining and ramp up instantly when the sun sets, stabilizing the entire grid.

Reduced Capital Costs

Building a traditional nuclear plant is a multi-billion dollar bet that takes a decade. SMRs aim to break this cycle through factory fabrication. The goal is to reach a Levelized Cost of Electricity (LCOE) between $40 and $80 per MWh, making them competitive with natural gas in many regions.

“The ability to build modules in a factory reduces the risk of on-site construction delays, which historically account for the biggest cost overruns in nuclear energy.”

Enhanced Safety and Siting

Because SMRs hold less fuel and use passive safety systems, they are safer to place near populated areas or industrial centers. The U.S. Nuclear Regulatory Commission (NRC) has been reviewing proposals to shrink the Emergency Planning Zone (EPZ) from the traditional 10 miles to just the site boundary. This change enables SMRs to power hospitals, military bases, or data centers directly.

The Role of SMRs in Decarbonization

Decarbonizing the grid requires firm power that doesn’t emit carbon. SMRs provide this base layer, allowing for a deeper penetration of renewables without risking blackouts.

Repowering Retiring Coal Plants

This is one of the most practical applications we are seeing in 2026. SMRs can reuse the existing transmission lines, water cooling rights, and workforce of a retiring coal plant.

The flagship example is TerraPower’s Natrium project in Kemmerer, Wyoming. They are building a 345 MWe sodium-cooled reactor right next to the retiring Naughton coal plant. This project saves millions in infrastructure costs and preserves local energy jobs, serving as a blueprint for coal-to-nuclear transitions across the country.

Complementing Renewable Energy Sources

In states with high wind penetration, like Iowa or Texas, there are times when wind produces too much power and prices go negative. SMRs can divert their excess heat during these times to other tasks, such as hydrogen production or thermal storage, ensuring that the plant generates revenue 24/7 regardless of grid demand.

Applications of SMRs in 2026

We are seeing SMRs deployed for specific industrial tasks that go far beyond simple residential electricity.

| Application | Key Project / Example | Why SMRs Fit |

|---|---|---|

| Data Centers | Amazon & X-energy | Tech giants need 24/7 carbon-free power for AI servers that cannot tolerate outages. |

| Desalination | Linglong One (China) | Reactors provide both heat and power to turn seawater into fresh water for arid coastal cities. |

| District Heating | OPG Darlington (Canada) | Waste heat from the reactor warms homes and businesses, replacing gas boilers. |

Industrial Power and Process Heat

Heavy industries like steel and chemical manufacturing need intense heat, not just electricity. High-temperature gas-cooled SMRs, like the Xe-100 from X-energy, produce steam at 565°C. This is hot enough to support industrial processes that currently burn coal or natural gas, effectively decarbonizing the “hard-to-abate” industrial sector.

Global Developments in SMR Deployment

The race for SMR dominance is global, with major powers vying for export contracts and technological leadership.

United States

The U.S. has moved aggressively with the passage of the ADVANCE Act in July 2024. This legislation streamlines licensing for advanced reactors and reduces regulatory fees. In 2026, we are watching construction progress at the TerraPower site in Wyoming and the Kairos Power site in Tennessee. These are no longer paper projects; they are active construction zones.

United Kingdom

The UK is betting on the Rolls-Royce SMR, a 470 MWe design. In August 2026, the design is scheduled to complete Step 3 of the Generic Design Assessment (GDA). The government’s “Great British Nuclear” body is prioritizing these units to replace its aging gas fleet and secure energy independence.

Canada

Canada is arguably the furthest ahead in North America. Ontario Power Generation (OPG) has completed site preparation at Darlington for the GE Hitachi BWRX-300. They are scheduled to pour the basemat for the first unit in early 2026. This project is the first commercial grid-scale SMR in the Western world to reach this stage.

China

China continues to move fast. The Linglong One (ACP100) in Hainan Province is the world’s first land-based commercial SMR. It is entering its commissioning phase in the first half of 2026. It serves as a demonstration for how SMRs can provide electricity, heat, and desalinated water simultaneously.

Challenges Facing SMRs

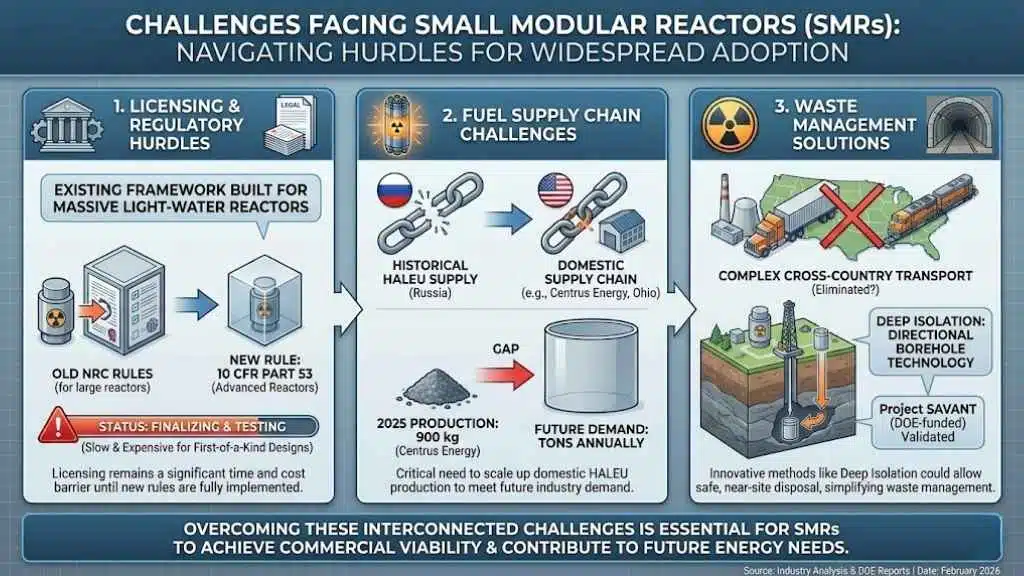

Despite the progress, the industry faces significant hurdles that could slow widespread adoption.

Licensing and Regulatory Hurdles

The existing regulatory framework was built for massive light-water reactors, not small modular ones. The U.S. NRC is finalizing a new rule, 10 CFR Part 53, specifically for advanced reactors. Until this is fully implemented and tested, licensing remains a slow and expensive process for first-of-a-kind designs.

Fuel Supply Chain

Many advanced SMRs require HALEU fuel, which was historically supplied by Russia. Building a domestic supply chain is critical. Centrus Energy in Ohio is the only U.S. company currently licensed to produce this fuel. In 2025, they successfully produced 900 kilograms of HALEU, but the industry will need tons of this material annually to scale up.

Waste Management

While SMRs produce less waste per unit, they still generate spent nuclear fuel. Innovative solutions are emerging. Deep Isolation recently completed its DOE-funded “Project SAVANT,” validating that their directional borehole technology can safely isolate waste deep underground. This method could allow waste to be disposed of safely near the reactor site, eliminating the need for complex cross-country transport.

Final thoughts

The role of Nuclear SMRs in 2026 has evolved from a promising concept to a tangible industrial reality. With construction underway in Wyoming, Tennessee, and Ontario, the technology is proving it can meet the dual demands of energy security and carbon reduction.

For business leaders and policymakers, the key takeaway is that SMRs are no longer just for utilities. They are becoming critical assets for data centers, factories, and remote communities. As the fuel supply chain matures and regulatory pathways like Part 53 become standard, you can expect SMRs to become a common fixture in the clean energy mix.

We are witnessing the start of a new nuclear era. It is smaller, safer, and more flexible than anything we have seen before.