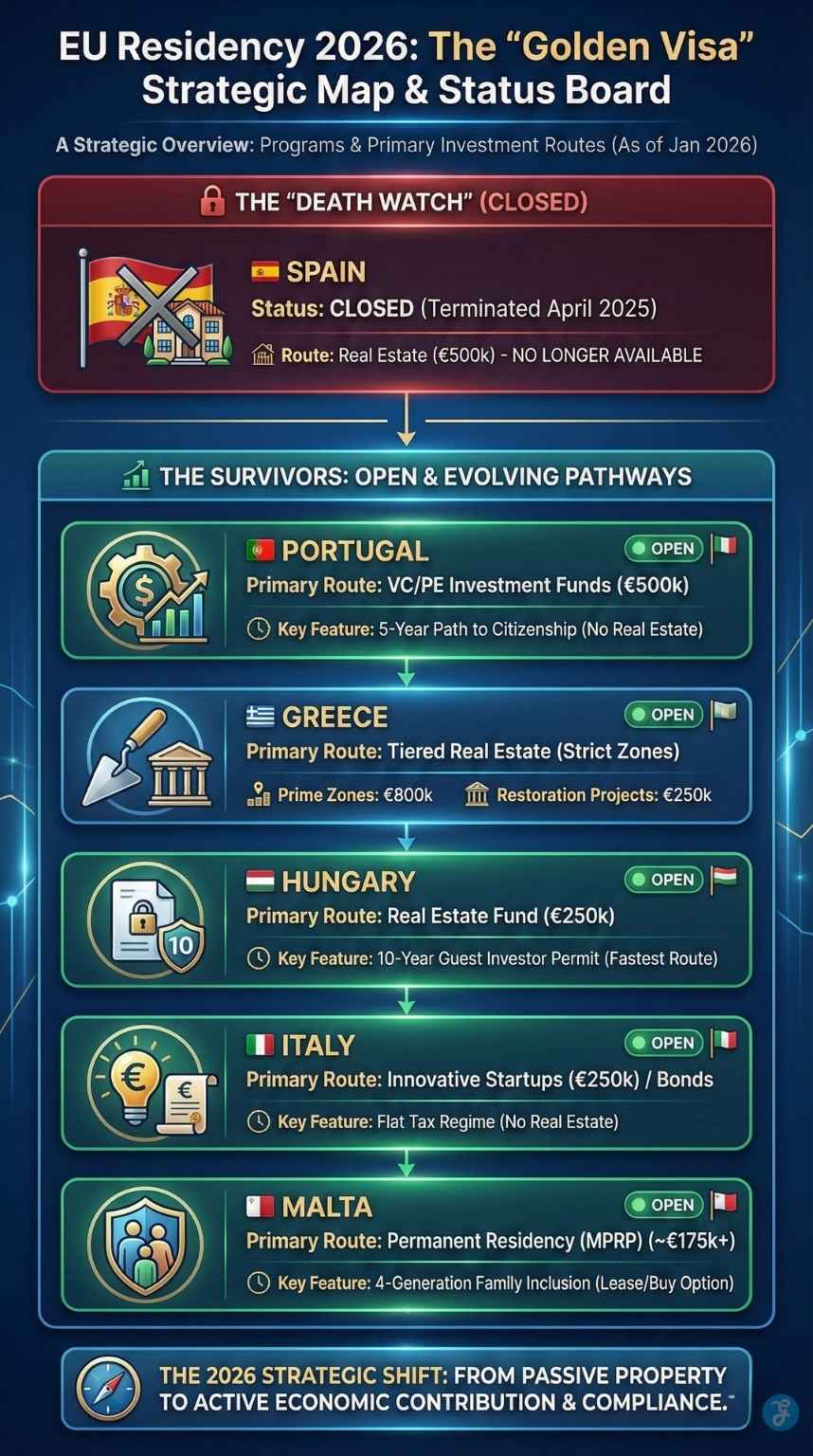

In 2026, the landscape of European residency has reached a pivotal turning point. The era of “buying a passport” is effectively over, and the traditional “Golden Visa” through simple real estate is on a “Death Watch,” as many programs have either closed or moved toward high-threshold, non-property routes. For investors, navigating EU Golden Visa Programs 2026 requires a sophisticated understanding of the new tiered investment zones, fund-based mandates, and the increasing pressure from the European Commission to eliminate “passive” residency pathways.

This comprehensive guide analyzes which programs are still open, which have fundamentally changed, and how you can strategically position yourself for EU residency in this new regulatory environment.

The 2026 EU Residency Landscape: A Strategic Overview

The theme for 2026 is Economic Productivity over Property Speculation. In previous years, an investor could simply buy a luxury apartment in Lisbon or Madrid and secure a residency card. Today, that door is largely shut. Governments have pivoted toward Venture Capital (VC) funds, innovative startups, and restoration projects that directly benefit the local housing stock or economy.

The Current Status of Major EU Programs [January 2026]

| Country | Status 2026 | Primary Investment Route | Min. Investment | Real Estate Option? |

| Spain | CLOSED | Terminated April 2025 | N/A | No |

| Portugal | Open | VC/PE Funds | €500,000 | No |

| Greece | Open | Tiered Real Estate | €250k – €800k | Yes (Strict) |

| Hungary | Open | Real Estate Funds | €250,000 | No (Indirect) |

| Italy | Open | Startups / Bonds | €250,000 | No |

| Malta | Open | Permanent Residency (MPRP) | ~€150,000+ | Yes (Lease/Buy) |

The “Death Watch”: Programs Officially Terminated

To understand the 2026 market, one must first look at the “casualties” of the EU’s crackdown on investment migration.

The Fall of the Spanish Golden Visa

The most significant blow to the industry occurred in April 2025, when Spain officially terminated its Golden Visa program. Driven by a severe domestic housing crisis, the Spanish government eliminated the €500,000 real estate route. As of 2026, no new applications are being accepted. For existing holders, “grandfathering” rules apply, allowing for renewals, but the entry door is locked for new investors.

United Kingdom & Ireland

The UK’s Tier 1 Investor Visa and Ireland’s Immigrant Investor Programme (IIP) remain closed. In 2026, the UK has shifted focus toward the Global Talent Visa and Innovator Founder Visa, which require active business participation rather than just capital.

Due Diligence and Rejection Risks [The Reality Check]

Why do applications fail in 2026? As the EU Commission increases oversight, “Know Your Customer” (KYC) checks have become exhaustive.

- Source of Wealth (SoW) Verifiability: In 2026, simply showing a bank balance is insufficient. You must provide a “Wealth Audit” showing the genealogy of your capital—be it from a 20-year-old business sale, inheritance, or crypto gains (which now require regulated exchange receipts).

- The “Sanction Shadow”: Even if you aren’t on a sanction list, having business ties to “High Risk” jurisdictions can lead to an automatic 18-month “Enhanced Due Diligence” (EDD) delay or outright rejection.

- The “Material Omission” Trap: Failing to disclose a 10-year-old visa refusal from the USA or UK is the #1 cause of Greek and Maltese visa rejections in 2026. Data sharing between Schengen and the “Five Eyes” intelligence alliance is now seamless.

Greece: The Last Bastion of Property Investment

While other nations have fled from real estate, Greece has chosen to reform rather than retreat. However, the “cheap” Greece Golden Visa is now a relic of the past. In 2026, Greece operates under a strictly tiered geographical system.

The Three-Tier Investment Structure

To curb rising rents in tourist hotspots, the Greek government implemented a price hike that remains the standard for 2026:

- The €800,000 Tier (The “Prime” Zones): This applies to the entire Administrative Region of Attica (including Athens), Thessaloniki, Mykonos, Santorini, and all islands with a population over 3,100 inhabitants.

- The €400,000 Tier: Covers all other regions of Greece. The property must be at least 120 $m^2$ to qualify.

- The €250,000 Tier (The “Restoration” Loophole): This is the only way to still secure a Greek visa at the original price point. It requires investing in:

- Commercial-to-Residential Conversion: Converting an old office or industrial building into a home.

- Listed Buildings: Purchasing and fully restoring a historically significant or “heritage” property.

Key 2026 Rule: Investors in Greece are now strictly prohibited from placing Golden Visa properties on short-term rental platforms like Airbnb. These properties must be used for personal residency or long-term rental only.

Portugal: The Shift to Private Equity & Funds

Portugal remains the most popular choice for those seeking a path to EU citizenship in 5 years. However, the “Golden Visa” as we knew it was replaced by the “Residence Permit for Investment” (ARI).

Investment Routes in 2026

- Venture Capital / Investment Funds: A minimum of €500,000 in a non-real estate fund. At least 60% of the fund’s capital must be invested in Portuguese-based commercial companies.

- Cultural Production: A €250,000 donation to national heritage or artistic projects.

- Job Creation: Creating 10 permanent full-time jobs for Portuguese citizens.

The AIMA Backlog and “Citizenship Clock”

One of the most critical updates for 2026 is the legal adjustment to the citizenship timeline. Previously, the 5-year clock for citizenship only started once the residency card was issued. Because of the massive backlog at AIMA (the successor to SEF), some waited 3 years just for their card.

The 2026 Update: The 5-year period now counts from the date of the application submission, not the card issuance. This has revitalized interest in Portugal despite the lack of property options.

Hungary: The New “Guest Investor” Contender

Launched in late 2024 and fully operational in 2026, the Hungarian Guest Investor Program (GIP) has quickly become a top alternative to the closed Spanish program.

Why Hungary is Trending in 2026

Hungary offers a unique “10+10” year residency permit, providing more long-term stability than the standard 2 or 5-year permits of other EU states.

| Option | Investment Amount | Requirement |

| Real Estate Fund | €250,000 | Must be a fund licensed by the Hungarian Central Bank. |

| Residential Purchase | €500,000 | Direct purchase of a home (must be free of encumbrances). |

| Educational Donation | €1,000,000 | Non-refundable gift to a public trust higher education institution. |

The Strategy: Most investors choose the €250k fund option because it avoids the headaches of property management while providing immediate Schengen access.

Italy: “La Dolce Visa” for Entrepreneurs

Italy does not offer a real estate golden visa, but its Investor Visa for Italy (often called the “Dolce Visa”) is incredibly efficient in 2026, with some of the fastest processing times in Europe (3–4 months).

2026 Investment Categories

- Innovative Startups: €250,000 into a company registered in the official Italian Startup Registry.

- Italian Limited Companies: €500,000 into an existing S.p.A. or S.r.l.

- Government Bonds: €2,000,000 in CCT/BTP bonds.

- Philanthropic Donation: €1,000,000 toward culture, education, or immigration management.

Tax Benefit: Italy remains a “tax haven” for high-net-worth individuals in 2026. Under the “Global Flat Tax” regime, new residents can pay a fixed annual fee of €100,000 on all foreign-sourced income, regardless of the amount.

Malta: High Costs and Higher Scrutiny

Malta’s “Golden Passport” (Citizenship by Investment) was officially struck down by the European Court of Justice in April 2025. However, the Malta Permanent Residency Programme (MPRP) remains open in 2026.

The MPRP 2026 Costs

To qualify for permanent residency in Malta, you must meet a multi-step financial requirement:

- Government Contribution: €68,000 (if buying property) or €98,000 (if leasing).

- Charitable Donation: €2,000 to a registered NGO.

- Real Estate: Buy a property for €300,000+ or lease for €10,000+ per year.

- Asset Requirement: You must prove you hold assets of at least €500,000, of which €150,000 must be liquid.

The Tax Architect’s View [Strategic Financial Planning]

Residency in Europe is more than a travel permit; it is a fiscal event. In 2026, most EU nations have tightened their tax definitions, but strategic windows remain open.

- Portugal’s Post-NHR Era: Since the original NHR (Non-Habitual Resident) program ended, Portugal introduced the IFCT (Incentive for Scientific Research and Innovation). This offers a 20% flat rate for 10 years, but it is strictly limited to “high added-value” professional roles. Golden Visa holders who do not move to Portugal permanently can often remain “Non-Tax Residents,” avoiding taxes on their global wealth.

- Italy’s €100k Lump Sum: For ultra-high-net-worth individuals, Italy’s Substitute Tax remains the most powerful tool in 2026. You pay a flat €100,000 per year, and the Italian government ignores all foreign income, dividends, and capital gains.

- Greece’s Flat Tax for Retirees: If you secure a Golden Visa and decide to retire in Greece, you may qualify for a 7% flat tax rate on all foreign pension income for 15 years.

- Cyprus: The Corporate Haven: While Cyprus’s investment threshold remains at €300,000, its 12.5% Corporate Tax rate and extensive “Non-Dom” status make it the preferred choice for business owners in 2026.

The 2026 “Zero-Shot” Comparison Checklist

Choosing the right program in 2026 is no longer about the lowest price; it is about matching your long-term goals (citizenship vs. residency) with your current capital structure. Use this definitive checklist to make your final selection.

Quick-Reference: Top EU Programs in 2026

| Country | Primary Goal | Min. Capital | Stay Req. | Path to Citizenship |

| Portugal | Citizenship | €500,000 | 7 Days/Year | 5 Years (Strongest Route) |

| Greece | Real Estate | €250,000* | None | 7 Years (Full residency req.) |

| Hungary | Speed & Security | €250,000 | None | 8 Years (Complex) |

| Italy | Entrepreneurship | €250,000 | None | 10 Years |

| Malta | Family Unity | ~€175,000 | None | Permanent Residency only |

Greece €250k is limited to restoration/conversion projects. Prime residential is now €800k.

The 2026 Family Inclusion Matrix

Defining “Family” varies widely across the EU. In 2026, “Dependency” is the most litigated part of the application.

| Country | Spouses | Children | Parents | Grandparents |

| Portugal | Yes | Up to 24 (if students) | Yes (if 65+) | No |

| Greece | Yes | Up to 21 | Yes (no age limit) | No |

| Malta | Yes | No age limit (if dependent) | Yes | Yes |

| Hungary | Yes | Up to 18 (Standard) | Case-by-case | No |

The “Age-Out” Strategy: If your child is 20, Portugal is a risk because the process takes 2 years. By the time of approval, they may no longer be considered “dependents.” In 2026, we recommend the Malta MPRP for families with adult children, as it “locks in” the child’s status at the time of application.

The Future of EU Investment Migration: 2026 and Beyond

As we look toward the latter half of 2026, it is clear that the “Golden Visa” is undergoing its most radical transformation since its inception following the 2008 financial crisis. The European Commission has moved away from merely “monitoring” these programs to treating them as a structural challenge that must be harmonized with broader EU security and housing goals. For the modern investor, “The Future” is no longer about finding the cheapest entry point; it is about finding the most politically resilient one.

In 2026, the trend has shifted toward Innovation-Led Pathways. Italy, Greece, and Portugal have all reinforced their programs by tying residency to R&D, green energy, and tech startups. These “Active Investment” models are inherently more stable because they align with the EU’s domestic agenda, creating jobs and fostering technological sovereignty. Unlike real estate, which is often blamed for domestic inflation, these investments are seen as “National Interest” projects, making them far less likely to be targeted by future legislative “Death Watches.”

Furthermore, we are seeing a “Digitalization First” approach. By mid-2026, most major programs have migrated their application processes to centralized digital platforms (like the new AIMA portal in Portugal), aimed at slashing the multi-year backlogs that plagued the industry in 2024. This evolution ensures that the “Golden Visa” remains a viable tool for global mobility, provided that the applicant can navigate a world where transparency is the new currency.

The ETIAS Factor

Starting in late 2026, the ETIAS system will require all visa-free travelers to undergo digital screening. For many, a Golden Visa is no longer just about moving; it’s about avoiding the administrative hurdle of ETIAS and ensuring “Right of Entry” during global political shifts.

Digital Nomad Visas [The Alternative]

If you don’t have €250,000, 2026 has seen the explosion of the D7 (Portugal) and Digital Nomad Visas (Spain/Greece). These are “income-based” rather than “asset-based,” requiring a monthly remote income of roughly €3,500 to €4,000.

Digital Nomads vs. Golden Visas: The 2026 “Budget” Alternative

For many, the “Golden Visa” is becoming an inaccessible luxury due to rising price floors and the elimination of real estate options. However, 2026 has seen the maturation of the Digital Nomad Visa (DNV), often called the “D8” in Portugal or the “Remote Work Visa” in Greece. While the Golden Visa is an Asset-Based program (what you have), the DNV is an Income-Based program (what you earn).

The Core Trade-Off: Capital vs. Presence

The fundamental difference in 2026 isn’t just the price tag; it’s the physical stay requirement.

- Golden Visas: Designed for those who want a “Plan B.” You only need to visit for about 7 days a year. You can keep your tax residency in your home country.

- Digital Nomad Visas: Designed for those who actually want to live in Europe. Most DNVs require you to spend at least 183 days a year in the country, which automatically makes you a local tax resident.

Top 2026 Digital Nomad Programs by Income Requirement

| Country | Monthly Income (2026) | Initial Validity | Path to Citizenship? |

| Portugal (D8) | €3,680+ | 2 Years | Yes (After 5 years) |

| Spain | €2,850+ | 3 Years | Yes (After 10 years*) |

| Greece | €3,500+ | 2 Years | Yes (After 7 years) |

| Italy | €2,333+ | 1 Year | Yes (After 10 years) |

| Hungary | €3,000+ | 1 Year | No (Renewable only) |

Note: For citizens of Ibero-American countries, Spain’s path is shortened to 2 years.

2026 Tax Incentives: The “Nomad’s Bonus”

In 2026, countries are competing for remote talent by offering aggressive tax breaks that Golden Visa holders often don’t qualify for:

- Spain’s “Beckham Law”: Digital Nomads can apply for a flat 24% tax rate on income up to €600,000 for their first six years. This is a massive saving compared to the progressive rates that can hit 47%.

- Greece’s 50% Break: If you commit to staying in Greece for at least two years under a DNV, you can receive a 50% exemption on your income tax for up to seven years.

- Italy’s “Highly Skilled” Decree: Italy is piloting a new 2026 tax incentive specifically for nomads that may reduce taxable income by up to 60% for those moving to Southern Italy.

Who Should Choose the DNV in 2026?

The Digital Nomad Visa is the superior choice if:

- You lack €250k–€500k in liquid capital: You only need to prove a consistent monthly salary or freelance contracts.

- You want to “Test Drive” a country: Most DNVs allow you to move in within 60–90 days, whereas Golden Visas can take 12–18 months to process.

- You are a solo professional: The income requirements for a single person are manageable, though they scale up significantly (usually +25-75%) if you bring a spouse or children.

Final Thought: The End of an Era and the Rise of the Strategic Resident

The “Golden Visa” is not dead, but the “Golden Age” of easy, low-cost property residency is certainly behind us. As we move through 2026, the European Union’s focus has shifted toward security, transparency, and genuine economic ties.

Choosing an EU Golden Visa Program in 2026 is no longer just a real estate transaction; it is a complex legal and financial relocation strategy. With the launch of the ETIAS (European Travel Information and Authorisation System) later this year, having a secure residency card will be more valuable than ever for global mobility.

Investors who act now on the remaining “restoration” loopholes in Greece or the fund-based routes in Portugal will likely be the last to benefit from these programs before the EU moves toward a unified, even more restrictive, “European Residency” framework. The “Death Watch” continues, and for those waiting on the sidelines, the clock is ticking.