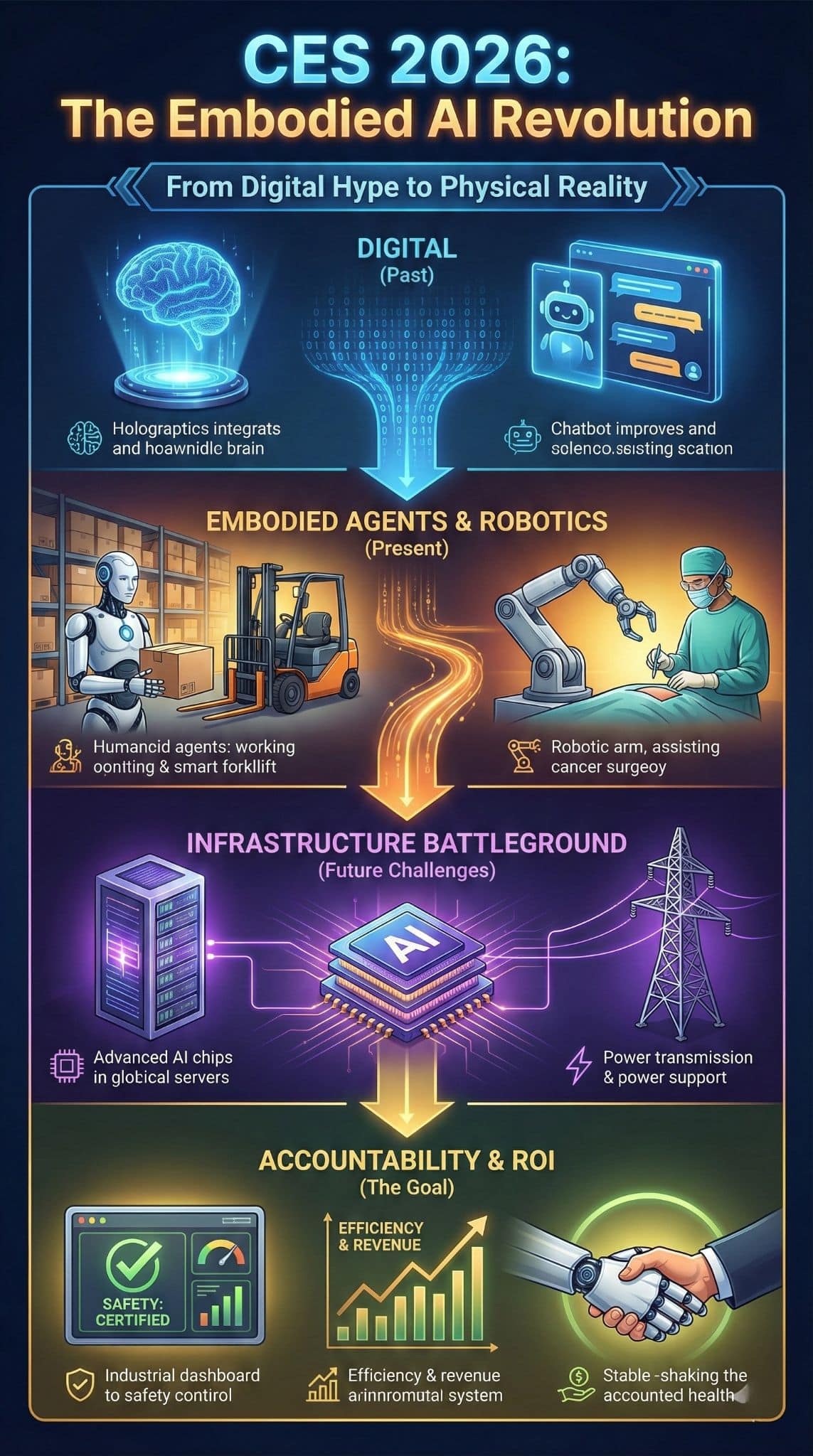

CES 2026 AI is not “more AI demos.” It is a turning point where AI agents and humanoid robotics move from hype to product roadmaps, forcing new bets on chips, energy, and regulation as 2026 becomes the year AI shifts from screens to the physical world.

Key Statistics To Watch In 2026

- CES footprint: 142K+ attendees and 4,500+ exhibitors (latest audited benchmark)

- AI PCs: ~143 million units in 2026, about 55% of the PC market (Gartner forecast)

- Total AI spending: forecast ~ $2.02T in 2026 (Gartner, via Network World)

- Data centre electricity: ~415 TWh in 2024, projected ~945 TWh by 2030 base case (IEA)

- PC market risk: potential 2026 shipment declines up to ~9% in a downside scenario (IDC-linked reporting)

How We Got Here: From Gadget Show To AI Infrastructure Forum

CES has always worked as a “first-quarter mood ring” for tech. In the 2010s, that meant TVs, smartphones, and app-driven consumer ecosystems. In the early 2020s, CES expanded toward mobility, health tech, and enterprise tools. By 2025 and now into CES 2026, the center of gravity has shifted again: AI is no longer a feature category. It is the underlying platform that reshapes every category. Two forces explain the shift.

First, AI moved from cloud novelty to mainstream distribution. When AI is embedded into operating systems, phones, PCs, and devices, the bottleneck becomes infrastructure: chips, memory, power, and data pipelines. Gartner’s sector breakdown shows how quickly spending tilts toward AI chips, AI servers, and AI-capable consumer devices.

Second, the tech industry is now trying to “embody” AI. It wants AI that can see, hear, plan, and act in real environments, not just answer prompts. That is why CES 2026’s headline themes cluster around AI agents, robotics, smart glasses, and industrial machines, not just apps.

CES 2026’s schedule also reflects this strategic pivot. The keynote lineup skews toward AI-era computing (AMD), industrial software and automation (Siemens, Caterpillar, Lenovo), and management and investment logic (McKinsey and General Catalyst).

The Scale Of CES As A Global Market Signal

The “why it matters” begins with scale. CES remains one of the few places where supply chains, media narratives, startup capital, and enterprise buyers collide in a single week.

| Metric (CES 2025 Audit) | What It Shows |

| Total attendance: 142K+ | Demand-side visibility for what ships next |

| Countries/regions represented: 158 | Global diffusion of tech standards |

| Total exhibitors: 4,500+ (including 1,400 startups) | Innovation funnel plus commercialization pipeline |

| Conference sessions: 300+ and 1,200+ speakers | Narrative-setting power |

| International attendance: 40% | Cross-border competition and policy exposure |

CES 2026 AI Marks The Rise Of “Agentic” Products

The industry spent 2023–2025 making generative AI usable. The next step is making it autonomous, within limits: AI agents that can plan tasks, chain actions, and operate across apps and devices.

CES 2026’s “AI everywhere” messaging fits a real product logic: if AI becomes built into consumer devices, then the differentiator shifts from “who has AI” to “whose AI can reliably do work.” That means:

- On-device models for speed, privacy, and offline capability

- Tool-using agents that can execute workflows, not just chat

- New UI patterns beyond typing, like voice, vision, and wearables

The key insight is that agents drag AI out of the novelty zone and into the accountability zone. If an agent books travel, changes settings, drives a robot vacuum, or pilots a warehouse robot, errors stop being funny and start being expensive. This is one reason CES 2026 is leaning hard into enterprise and industrial contexts where ROI and reliability can be measured.

The AI Hardware Stack Is Becoming The Real Battleground

When AI becomes a default layer, the real contest shifts down the stack: compute, memory, bandwidth, and power.

Gartner projects AI PCs will jump from 31% of the worldwide PC market in 2025 to about 55% in 2026, with AI PC units rising to roughly 143 million in 2026. That scale matters because it suggests AI capability is becoming a baseline expectation, not a premium niche.

At the same time, Gartner’s broader AI spending forecast implies the 2026 AI economy is heavily infrastructure-led: total AI expenditure forecast at about $2.02 trillion in 2026, with very large lines for AI chips and AI-optimized servers.

The CES implication: many “new products” on the floor are actually downstream of one upstream constraint, the AI supply chain. If you cannot secure enough GPUs, high-bandwidth memory, and advanced packaging capacity, your roadmap slips. If you can, you win distribution.

AI PCs Move From Curiosity To Default (Gartner)

| Metric | 2024 | 2025 | 2026 |

| AI PC share of total PC market | 15.6% | 31.0% | 54.7% |

| Total AI PC units (thousands) | 38,145 | 77,792 | 143,113 |

The forward-looking takeaway: CES 2026 is not just about shinier gadgets. It is a preview of how AI compute gets “consumed” at the edge, which then reshapes platform power across Microsoft, Apple, Google, Qualcomm, AMD, Intel, and Nvidia.

AI’s “Physical Turn” Brings Robots, Mobility, And Industrial Machines To Center Stage

CES used to be dismissed as consumer fluff. That critique is getting outdated.

Coverage heading into CES 2026 highlights AI moving into robotics, wearables, smart glasses, robotaxis, and industrial machines. This matters because embodied AI is where the next wave of defensible value may sit. A chatbot can be copied. A reliable robot in a warehouse, hospital, or construction site is a full-stack challenge: sensors, models, safety engineering, and service networks.

Expect CES 2026’s robotics narrative to split into three lanes:

- Humanoids and general-purpose robots: attention-grabbing, still early, but attracting capital

- Task-specific automation: exoskeletons, warehouse bots, cleaning and inspection robots, nearer-term ROI

- Mobility autonomy: robotaxis, assisted driving, and logistics automation

The business significance is that robotics converts AI from software margins to hardware margins, service contracts, and regulated markets. It also forces serious conversations about safety standards, liability, and certification.

AI’s Biggest Near-Term Risk Is Not Intelligence, It Is Economics

CES 2026’s AI optimism runs into a practical question that investors and enterprises are quietly asking: can this scale profitably?

Gartner’s spending table shows huge growth lines across AI chips, AI servers, and “AI-optimized” infrastructure categories through 2026.

That level of capital intensity raises a basic tension:

- Enterprises want productivity gains and cost reductions

- The AI supply chain demands massive, continuous investment

Skeptics argue that parts of generative AI are producing low-quality output at scale and that profitability remains unclear across many AI-first firms. Even if you disagree with the harshest critiques, the warning is useful: once AI becomes embedded everywhere, the market punishes waste fast. In 2026, buyers will likely ask less about “can it generate” and more about “does it reduce cycle time, prevent incidents, or increase revenue per employee.”

This economic filter is why industrial AI, automation, and edge deployments show up so prominently at CES 2026: they offer clearer unit economics than “AI for everything” consumer subscriptions.

The AI Boom Is Rewriting The Memory And Components Market

A less glamorous but crucial CES 2026 storyline sits inside the bill of materials.

IDC-linked reporting warns the PC market could decline in 2026 due to skyrocketing memory prices, with downside scenarios projecting a drop as large as 9% and a moderate scenario around 5%. The mechanism is straightforward: AI infrastructure demand pulls memory supply toward higher-margin enterprise use cases, while consumer devices get squeezed on price and availability.

That changes how to interpret “AI PCs everywhere.” Adoption may be strong, but affordability becomes the friction point.

2026 Memory Squeeze Scenarios (IDC-Linked Reporting)

| Market Impact Area | What’s Changing In 2026 | Why It Matters |

| PC shipments | Potential declines of ~5% to ~9% | Higher costs collide with upgrade cycles |

| Device pricing | Vendors signal price increases in the mid-single digits | AI features become “bundled,” not chosen |

| Winners | Memory and accelerator suppliers | AI shifts value to scarce components |

| Losers | Smaller OEMs and price-sensitive segments | Less leverage on supply contracts |

Energy And Grid Constraints Are Becoming AI’s Hidden Governance Layer

CES 2026’s “AI everywhere” vision runs into a physical boundary: electricity.

The IEA projects global electricity consumption for data centres at about 415 TWh in 2024 (around 1.5% of global electricity), rising toward about 945 TWh by 2030 in its base case, with data centre electricity consumption growing about 15% per year from 2024 to 2030. The IEA also flags that accelerated servers, mainly driven by AI adoption, grow faster than conventional servers and contribute heavily to the net increase.

This matters for CES 2026 for three reasons:

- AI product roadmaps are now tied to energy roadmaps. The limiting factor may be interconnection queues, cooling, and local grid capacity, not model quality.

- “Edge AI” becomes an efficiency strategy. Running smaller models on-device can reduce cloud inference demand and latency, and it can lower reliance on constant connectivity. Gartner explicitly points to small language models running locally on PCs as a 2026 trend.

- Energy becomes a policy battlefield. Data centre expansion triggers permitting fights, water concerns, and community politics in 2026.

CES 2026 is likely to showcase “AI efficiency” as a selling point, not just raw capability, because power costs increasingly decide what can scale.

Comparative Table: Winners Vs Losers If CES 2026 AI Trends Hold

| Likely Winners | Why | Likely Losers | Why |

| AI chip and memory suppliers | Scarcity pricing, structural demand | Low-end device segments | Cost inflation erodes demand |

| PC makers with tight silicon partnerships | Can ship AI PCs at scale | Smaller OEMs | Less leverage, weaker supply priority |

| Industrial automation platforms | Clear ROI, measurable outcomes | “AI-only” gadget fads | Hard to sustain without utility |

| Edge AI ecosystems | Lower latency, efficiency, privacy appeal | Overbuilt cloud inference plays | Energy and capex pressure rises |

Expert Perspectives And Counter-Arguments

The bullish view: AI is becoming the default interface and automation layer for everything. The spending forecasts suggest enterprises and consumers will get AI whether they explicitly demand it or not, because it will be embedded into devices and operating systems.

The cautious view: The economics remain unsettled. If AI-generated output quality degrades, or if the cost base stays too high, some AI investments will be written down. Critics also warn about incentive loops that reward quantity over quality.

The operational view: Even if AI value is real, supply chain and energy bottlenecks can slow deployment. Memory constraints and electricity constraints can reshape which AI visions become practical in 2026.

A balanced interpretation for CES 2026: the show is less a victory lap for AI and more a public negotiation over what version of AI can actually ship at scale.

The Look Ahead: What Comes Next After CES 2026

If CES 2026 is the “opening chapter,” the next milestones will determine whether the AI agent and humanoid story becomes a durable cycle or a correction.

- AI PC reality check (Q1–Q4 2026): Gartner’s 2026 penetration forecast is aggressive. If memory prices rise sharply, the market could hit a volume-speed bump even while AI capability becomes standard. Watch pricing and mid-range configurations.

- Robotics proof (2026 pilots): The winners will be the companies that turn demos into deployments, especially in logistics, manufacturing, healthcare, and construction. CES buzz will matter less than uptime and safety metrics.

- Energy constraint becomes strategy (2026 permitting and grid upgrades): IEA projections imply data centres and accelerated compute remain on a steep curve. Expect more AI efficiency messaging and more political fights over siting.

- Agent trust and governance: As agents act more autonomously, “trust” becomes measurable: audit trails, permissioning, privacy guarantees, and liability frameworks. This will shape which ecosystems enterprises adopt.

CES 2026 AI, in other words, is not just a show theme. It is a signal that 2026 will be the year AI stops being a layer you add and becomes the layer you must manage.