Electric bills have a sneaky way of climbing—season after season, rate change after rate change—until you’re paying more for the same comfort at home. That’s why more homeowners are looking at solar not as a “green upgrade,” but as a practical way to control monthly costs and protect their budgets for the long run.

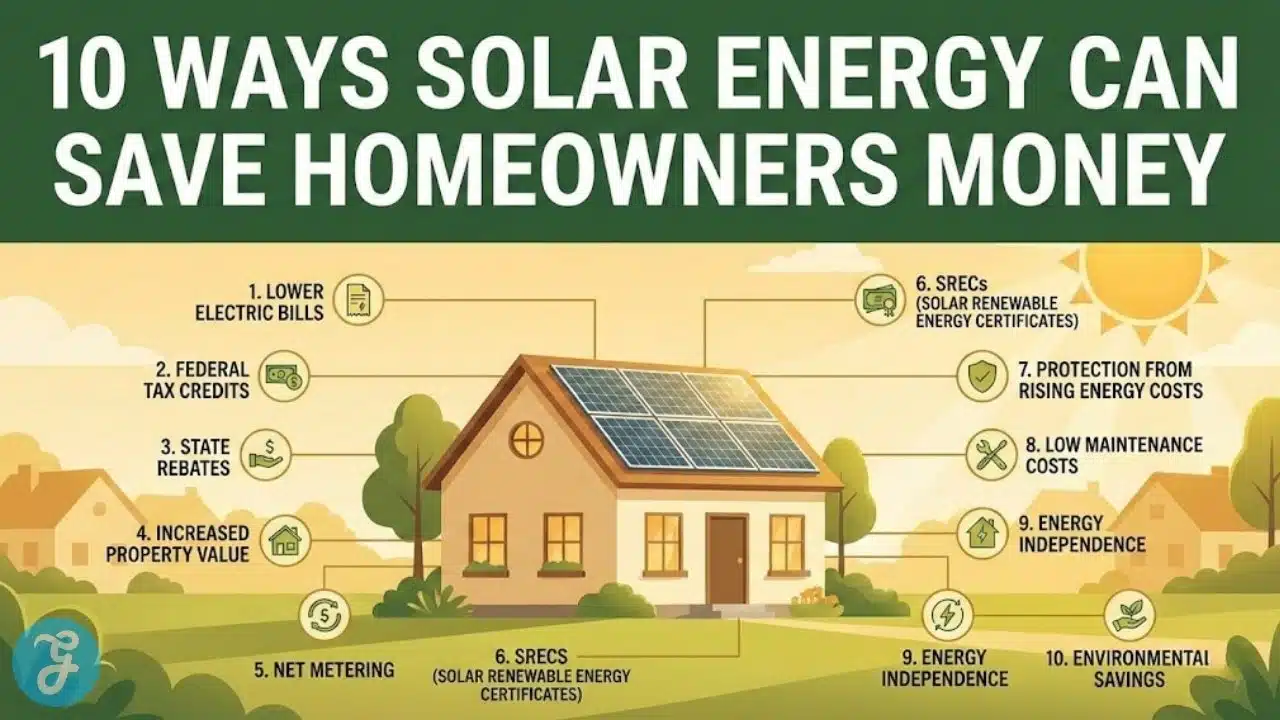

In this guide, you’ll learn 10 effective ways on how solar energy saves homeowners money—from cutting what you pay the utility each month to earning credits, using incentives, and boosting your home’s value. You’ll also see where the biggest savings usually come from, what can reduce your payback, and how to make smart choices before you sign a contract.

Why does this Topic Matter Right Now?

Solar is no longer a niche upgrade. It’s a bill-control tool. In many areas, the math works because grid power is getting more expensive while residential solar quotes have become more competitive.

And incentives still play a major role. In the U.S., the federal Residential Clean Energy Credit is 30% for eligible systems installed from 2022 through 2032, before stepping down later.

The big idea: solar savings come from multiple streams—lower bills, credits, tax benefits, and resale value—not just one.

Quick Snapshot of Real Numbers

Here are a few reference points to keep your expectations realistic:

-

Average quoted solar price (example benchmark): about $2.53 per watt (varies by location and roof).

-

Example system size/cost: a 12 kW system around $29,649 before incentives (example dataset).

-

Federal credit: 30% of eligible costs (U.S. rules; eligibility matters).

-

Electricity rate benchmark: The U.S. total residential average is shown around 18.07¢/kWh (EIA table; 2025 is listed as preliminary).

A simple way to think about payback: many homeowners aim for “break-even” inside the warranty window. EnergySage reports an average break-even of about 10.5 years for shoppers on its platform (your result can be faster or slower).

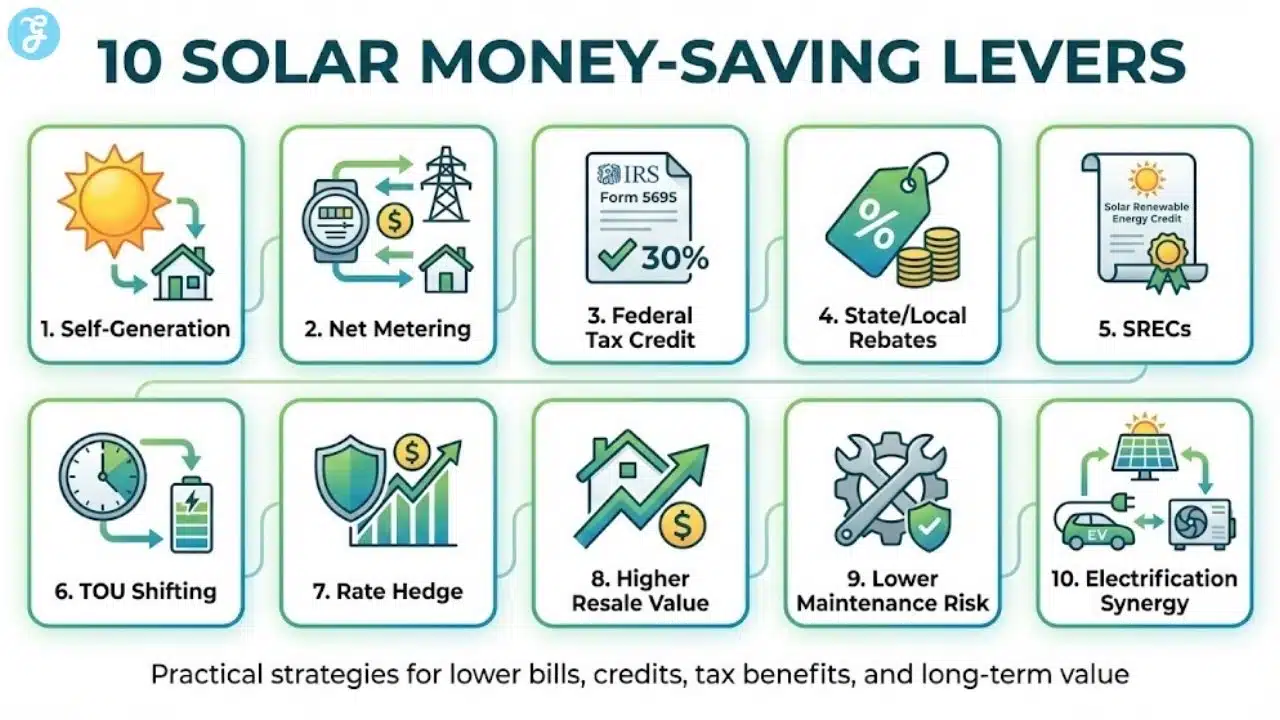

Optional Overview Table: The 10 Money-Saving Levers

| # | Savings lever | What it reduces | Who benefits most |

|---|---|---|---|

| 1 | Self-generation | Monthly kWh purchases | High-usage homes, high-rate areas |

| 2 | Net metering/export credits | Bill via credits | Homes with daytime surplus |

| 3 | Federal tax credit | Upfront cost | Owners with tax liability |

| 4 | State/local rebates | Upfront cost | Incentive-rich states/cities |

| 5 | SRECs / performance pay | Bills via income | Eligible SREC markets |

| 6 | Time-of-use shifting | Peak-rate charges | TOU customers and battery owners |

| 7 | Hedge against rate hikes | Future bills | Anyone planning to stay put |

| 8 | Higher resale value | Net cost (recoup) | Sellers in strong solar markets |

| 9 | Lower maintenance risk | Repair costs | Buyers of strong warranties |

| 10 | Electrification synergy | Gas and electric costs | EV/heat pump households |

10 Ways Solar Energy Saves Homeowners Money Explained:

Solar savings don’t come from one “magic” benefit. They come from several money-saving levers that work together—lower monthly bills, credits for extra power, tax incentives, and long-term value gains.

The list below breaks down 10 Ways Solar Energy Saves Homeowners Money into clear, practical strategies you can actually use. Each item explains where the savings come from, what affects the size of the benefit, and what to check before you invest.

Think of it like a homeowner’s ROI checklist. Even if solar is already popular in your area, these details can be the difference between “good idea” and “great financial move.”

Here are 10 ways solar energy saves homeowners money:

1) Slash Your Monthly Electric Bill by Producing Your Own Power

Solar offsets the electricity you would have bought from the utility. The more of your usage solar covers, the more your bill drops.

A quick example: if your home uses 900 kWh/month and your all-in rate is ~18¢/kWh, that’s about $162/month before fixed fees. If solar offsets 70%–90% of that usage, the energy portion can fall sharply (fees may remain).

You can maximize this by:

-

Sizing the system to match real usage (12 months of bills helps).

-

Watching the shading, roof angle, and panel placement.

-

Using high-load appliances (laundry, dishwashing) during solar hours.

| Key point | What it means |

|---|---|

| Main savings source | Fewer kWh purchased from the grid |

| Biggest driver | Your electricity rate + system production |

| Best for | High-usage homes and high-rate utilities |

| Fast win | Shift daytime loads to solar hours |

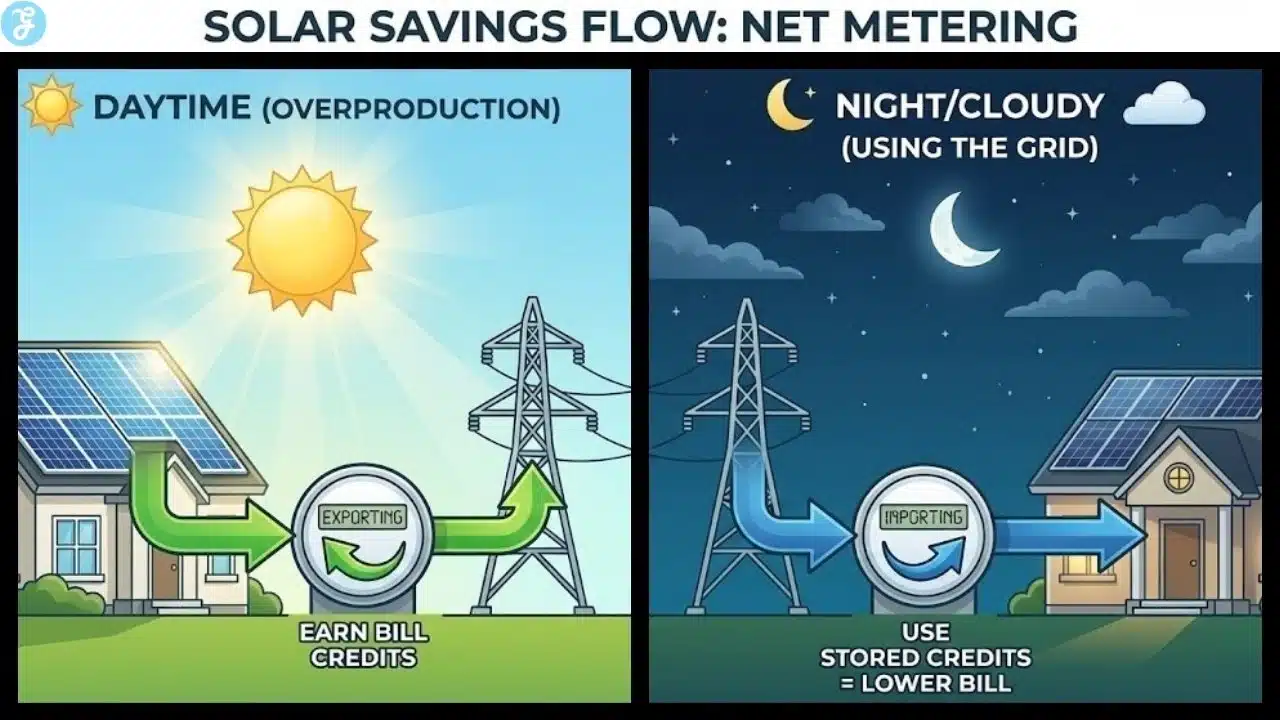

2) Earn Bill Credits Through Net Metering or Export Programs

In many places, excess solar flows back to the grid. Net metering programs can credit that export against what you draw later. The U.S. DOE describes net metering as allowing electricity to flow both ways through a bidirectional meter, offsetting consumption at another time in the billing cycle.

But the value of exported power varies a lot by location and utility. Some areas credit close to retail rates; others credit less.

You can maximize this by:

-

Asking how export credits are valued (retail vs avoided-cost style).

-

Asking if credits roll month-to-month and when they expire.

-

Adapting, if export value is low, consider adding storage or shifting loads.

| Key point | What it means |

|---|---|

| Main savings source | Bill credits for excess solar |

| Biggest driver | Your utility’s export credit rules |

| Best for | Homes that overproduce midday |

| Fast win | Understand credit expiration policies |

3) Cut the Upfront Price with the Federal Residential Clean Energy Credit (U.S.)

In the U.S., the IRS states the Residential Clean Energy Credit equals 30% of eligible costs for systems installed from 2022 through 2032, then steps down after that.

Using the earlier example cost of $29,649, a 30% credit would be about $8,895, bringing a “net-after-credit” view to roughly $20,754 (before any state/local incentives).

You can maximize this by:

-

Confirming what costs qualify (panels, inverters, labor, storage rules).

-

Keeping invoices and proof of “placed in service” timing.

-

Reading the IRS “how to claim” steps.

| Key point | What it means |

|---|---|

| Main savings source | A tax credit reduces the effective system cost |

| Biggest driver | Eligibility and timing (placed in service) |

| Best for | Homeowners with tax liability |

| Fast win | Keep documentation organized |

4) Stack State, Local, and Utility Incentives to Reduce Your Net Cost Further

Beyond federal incentives, many states and utilities offer rebates, tax exemptions, or performance programs. DSIRE is widely used as a central database for U.S. incentive and policy information.

Some states also offer sales or property tax exemptions related to solar; SEIA maintains guidance and links for solar tax exemptions by state.

You can maximize this by:

-

Checking DSIRE first for your state and utility territory.

-

Asking your installer which incentives are “first come, first served.”

-

Confirming whether rebates affect the basis for tax credits (rules vary).

| Key point | What it means |

|---|---|

| Main savings source | Rebates/exemptions lower out-of-pocket cost |

| Biggest driver | Your zip code and utility territory |

| Best for | Incentive-rich states/municipalities |

| Fast win | Verify current program funding/status |

5) Get Paid for Solar Production Through SRECs

Solar Renewable Energy Credits (SRECs) can create an extra income stream in certain markets. EnergySage notes SREC availability and value vary by state and utility program.

Solar.com explains the basic structure: an SREC is typically earned based on production (commonly per MWh generated) and can be sold in eligible markets.

You can maximize this by:

-

Asking if your system must be registered (and who does it).

-

Comparing “aggregator” options vs selling directly if allowed.

-

Treating SREC revenue as variable, not guaranteed.

| Key point | What it means |

|---|---|

| Main savings source | Income from production credits |

| Biggest driver | Your state’s market rules and pricing |

| Best for | Homes in active SREC markets |

| Fast win | Confirm registration and payout method |

6) Reduce Expensive Peak-Hour Power with Time-of-Use (TOU) Strategy

Utilities increasingly use TOU pricing in some regions, where electricity costs more during peak periods. Batteries can help by storing cheaper or solar-generated electricity and using it during peak prices.

Southface describes “energy arbitrage” as using a battery to buy/store lower-cost electricity and reduce purchases during high-price periods under TOU rates.

You can maximize this by:

-

Asking your utility about TOU windows (peak vs off-peak hours).

-

Adjusting. If TOU is steep, battery savings can be meaningful.

-

Starting with load shifting first (it’s cheaper than hardware).

| Key point | What it means |

|---|---|

| Main savings source | Avoid buying electricity at peak rates |

| Biggest driver | TOU price spread + battery control settings |

| Best for | TOU customers and high evening usage |

| Fast win | Shift loads before buying storage |

7) Hedge Against Future Utility Rate Increases

Solar is also a pricing hedge. When your utility rate rises, the value of each solar kWh you produce rises too (because it replaces a more expensive grid kWh).

Recent reporting using EIA data shows residential electricity prices have increased year-over-year in the U.S. (example: May 2024 to May 2025 cited increase).

You can maximize this by:

-

If you plan to stay in your home, hedging matters more.

-

Avoiding “overbuying” panels—right-size to your likely future use.

-

If you’re planning an EV or heat pump, size it with that in mind.

| Key point | What it means |

|---|---|

| Main savings source | Protection from rate hikes |

| Biggest driver | Local utility rate trajectory |

| Best for | Long-term homeowners |

| Fast win | Model savings with conservative rate growth |

8) Increase Home Resale Value and Recover Part of Your Cost When You Sell

Multiple studies have found homebuyers often pay more for homes with solar—especially when the system is owned (not leased). Berkeley Lab reported buyers have paid an average premium of about $4 per watt, translating to roughly $15,000 for an average-sized system in its study context.

The U.S. Department of Energy has also highlighted evidence that solar can raise home value and may help homes sell faster in some markets.

You can maximize this by:

-

Owning systems typically appraise more cleanly than leases.

-

Keeping a production report and warranty documents for buyers.

-

If you finance, know your payoff terms before listing.

| Key point | What it means |

|---|---|

| Main savings source | Higher resale value / faster sale |

| Biggest driver | Owned system + local buyer demand |

| Best for | Sellers in active solar markets |

| Fast win | Maintain documentation for appraisers/buyers |

9) Reduce Surprise Repair Costs With Strong Warranties and Smarter Equipment Choices

Solar systems have few moving parts, but inverters and roof penetrations still matter. Strong warranties reduce the odds you pay out-of-pocket for a major failure. This isn’t the flashiest savings lever, but it protects your payback math. One big repair at the wrong time can erase a year or two of savings.

Tips to maximize this lever

-

Prefering equipment with clear manufacturer support.

-

Asking what’s covered: parts, labor, shipping, and diagnostics.

-

Verifying the installer’s workmanship warranty length.

| Key point | What it means |

|---|---|

| Main savings source | Avoided repair/replacement costs |

| Biggest driver | Warranty terms and installer quality |

| Best for | Everyone (risk control) |

| Fast win | Get warranty terms in writing |

10) Multiply savings when solar supports EVs, heat pumps, and all-electric upgrades

Solar savings get bigger when you use that solar power to replace higher-cost fuels or higher-cost charging. If you plan to add:

-

an EV

-

a heat pump (HVAC or water heater)

-

induction cooking

-

electric dryer

You may shift more of your household energy spending into electricity—and then offset it with solar.

You can maximize this by:

-

Sizing the system for “future you,” not just today.

-

Asking for an EV-ready load forecast from your installer.

-

Considering a smart panel or load management if your service is limited.

| Key point | What it means |

|---|---|

| Main savings source | Offset new electric loads with solar |

| Biggest driver | EV miles + heating/cooling profile |

| Best for | EV owners and electrifying households |

| Fast win | Forecast usage before choosing system size |

How to Maximize Savings Before You Sign

Small choices can move your ROI by years. Here’s a simple, homeowner-friendly checklist:

-

Compare multiple quotes. Pricing varies by installer and equipment.

-

Confirm your incentives. Use DSIRE for local programs and confirm availability.

-

Ask about export value. Net metering rules can make or break savings.

-

Avoid bad financing math. A low monthly payment can hide a high total cost.

-

Model conservative production. Shade, orientation, and weather variability matter.

How to Estimate Your Solar Savings Before You Sign

Start with your last 12 months of electric bills. Write down two numbers: total annual kWh usage and your average all-in electricity rate (total paid ÷ total kWh). This gives you a realistic baseline to compare solar against.

Next, estimate how much of your usage solar will offset. Savings come mainly from the kWh you don’t buy from the utility. If you use more power during the day (work-from-home, daytime AC, laundry, EV charging), you’ll typically self-consume more solar and save more per kWh.

Then factor in export credits (net metering or similar programs). If your system produces extra power midday, you may earn credits that reduce your bill later. The key is the export value: some utilities credit near retail rates, others pay much less. If export value is low, you can improve outcomes by shifting loads to solar hours or considering storage.

Finally, calculate a conservative payback:

-

Net system cost (after incentives you qualify for)

-

Estimated annual bill savings (self-use savings + export credits)

-

Payback = net cost ÷ annual savings

Keep your assumptions cautious: production varies by roof angle, shading, weather, and system design. A “good” solar deal is one that still looks solid under conservative estimates—not just best-case projections.

Common Pitfalls that Shrink Savings

Solar can still be a great deal—but these mistakes reduce the payoff:

-

Overestimating export credits. Not all utilities credit exports at retail value.

-

Signing a contract without reading the escalators/fees. Especially important for leases/PPAs.

-

Underestimating roof work. A roof replacement later can add costs if you remove/reinstall panels.

-

Ignoring usage timing. If most usage is at night, storage or load shifting matters more.

-

Skipping documentation. Incentives and resale value both depend on clean records.

If you want 10 Ways Solar Energy Saves Homeowners Money to be true for your home, treat the quote review like a mini financial audit.

Final Thoughts

Solar savings stack when you combine bill reduction, smart rate strategy, and incentives—and when you size the system for how you actually live. Use your past bills, confirm your export credit rules, and keep your assumptions conservative.

If you do that, 10 Ways Solar Energy Saves Homeowners Money stops being a headline and becomes a plan: lower bills now, better protection from future rate increases, and a stronger home asset long-term.