President Donald Trump has drawn a new, sharp red line in the escalating technology war with China, declaring that Nvidia’s Blackwell AI chip—the world’s most powerful semiconductor for artificial intelligence—will be reserved for domestic use, barring “other people” from accessing America’s top-tier technology.

The comments, made in a “60 Minutes” interview aired Sunday and in remarks to reporters, end weeks of speculation and signal a significant hardening of U.S. policy aimed at preserving America’s dominance in generative AI.

“The most advanced, we will not let anybody have them other than the United States,” Trump stated emphatically during the CBS interview. “We don’t give (the Blackwell) chip to other people.”

The president’s declaration specifically targets China. While stopping short of a blanket ban on all sales, Trump drew a clear distinction between high-end and lower-end technology. We will let them deal with Nvidia,” he said, “but not in terms of the most advanced.

This statement effectively slams the door on any possibility that Chinese tech giants like Huawei, Alibaba, or Tencent could purchase the flagship B200 or GB200 “Superchips,” the engines expected to power the next generation of large language models. The move clarifies the administration’s position following a U.S.-China summit in South Korea last week, after which Trump told reporters, “We’re not talking about the Blackwell.

The new policy confirms that the “silicon schism” between the world’s two largest economies is deepening, with Nvidia’s latest creation designated as a strategic national asset, too powerful to export.

A Generational Leap: Why Blackwell is a Geopolitical Prize

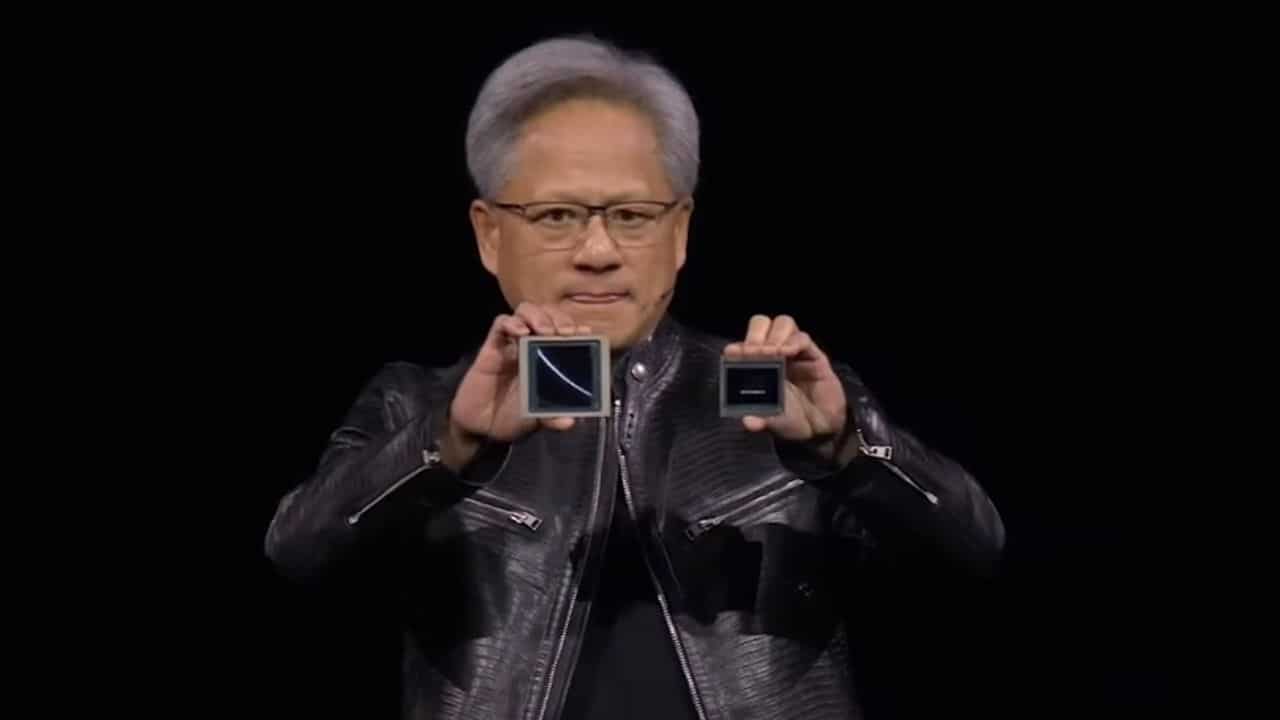

The technology at the heart of this policy is not merely an incremental update; it is a generational leap in computing power. Unveiled at Nvidia’s GTC conference in March 2024, the Blackwell platform has been described by Nvidia CEO Jensen Huang as a “processor for the generative AI era.

The specifications of the flagship B200 GPU illustrate why it is now a matter of U.S. national security:

- Massive Transistor Count: The B200 packs 208 billion transistors on a dual-die chip, a massive increase from the 80 billion on its predecessor, the H100.

- Exponential Performance Gains: It offers up to 4 times the AI training performance and a staggering 30 times the inference performance (the speed of running a trained AI model) compared to the H100.

- Unprecedented Scale: The technology is designed for “trillion-parameter” models. A single Nvidia GB200 NVL72 rack—which combines 72 Blackwell GPUs with 36 Grace CPUs—can train models with up to 27 trillion parameters.

- New AI Capabilities: Blackwell introduces a new, highly efficient processing precision called FP4, which is critical for operating the massive “Mixture of Experts” (MoE) models that represent the frontier of AI research.

This chip is, in short, the key to building faster, smarter, and vastly larger AI systems. The demand has been unprecedented. In late 2024, it was reported that Nvidia’s entire 2025 production capacity for the Blackwell silicon was “already sold out,” primarily to U.S. tech giants like Google, Meta, Microsoft, and OpenAI, all of which endorsed the platform at its launch.

The ‘Downgraded Chip’ Strategy Ends

Trump’s new directive marks a significant escalation from previous U.S. export controls. The U.S. government first implemented sweeping restrictions on October 7, 2022, designed to prevent China’s military from using advanced U.S. chips for AI-powered weapons, surveillance, and code-breaking.

Those rules created a performance threshold, effectively banning the sale of Nvidia’s then-flagship H100 chip to China. In response, Nvidia adopted a strategy of compliance by creating “downgraded” chips—most notably the H20—which were specifically designed for the Chinese market to be powerful enough to be commercially viable but slow enough to be legal for export.

This created a gray area where the U.S. was simultaneously trying to “choke” China’s high-end AI development while U.S. firms continued to profit from lower-end sales.

Trump’s new comments end that ambiguity for the Blackwell generation. His distinction—”not in terms of the most advanced”—suggests that while a similar “downgraded” Blackwell chip might eventually be permitted, the top-tier models are now unequivocally off-limits. This aligns with the fears of U.S. China hawks, who warned that even a scaled-down Blackwell could supercharge China’s military capabilities.

Nvidia: Caught Between Washington and a Trillion-Dollar Market

The policy shift places Nvidia and its CEO, Jensen Huang, in a difficult position. China remains a critical market, and Huang has consistently advocated for continued trade.

In an interview just last week, Huang reiterated his stance:

“We’re always hoping to return to China, and I think that Nvidia in China is very good. It’s in the best interest of United States. It’s in the best interest of China,” Huang said..

Huang’s core argument has been economic and strategic: selling to China provides the massive revenue needed to fund Nvidia’s next-generation research and development in the U.S. He has also argued that Chinese AI firms’ dependence on U.S. hardware is a strategic positive for America.

However, the administration’s calculus has clearly shifted. The national security concern—that any advanced AI chip could be diverted to military use by the People’s Liberation Army—now outweighs the commercial arguments.

Nvidia, for its part, has stated it is not currently fighting the restrictions. Huang said last week that the company has not applied to the U.S. government for export permits for Blackwell to the Chinese market.

The long-term impact of this “Blackwell blockade” will be twofold.

First, it solidifies the technological divide. U.S. cloud providers and AI labs (Amazon, Google, Microsoft, OpenAI) will have exclusive access to the fastest AI accelerators, widening their competitive lead.

Second, it will force China to accelerate its domestic chip industry. Beijing is already pouring billions into its “Big Fund” to achieve “technological self-sufficiency”. Deprived of Nvidia’s best, Chinese firms will have no choice but to rely on homegrown, and currently less-powerful, alternatives from companies like Huawei.

President Trump’s statement is the clearest sign yet that the race for AI supremacy is no longer a commercial competition but a core component of national strategy. The U.S. has decided that its most powerful “pickaxes” in the new AI gold rush are not for sale.

The Information is Collected from The Hindu and Yahoo Finance.