Are you stuck in a maze of virtual currency rules in Romania? You track prices, you watch blockchain technology trends, but you fear a call from ANAF. You worry about hidden taxes on capital gains or mining income.

That fear can stop you from buying a single token.

Here is one fact, the government does not tax personal gains from virtual currency until July 31, 2025. This post will lay out five legal points on income tax, anti-money laundering, and rules from the central bank and digital wallet providers.

You will learn how to report trades to avoid fines and how to keep your gains safe. We will guide you step by step. Ready?

Key Takeaways

- Romania won’t tax personal crypto gains until July 31, 2025 under current law.

- Law 227/2015 (Art. 116(1)) treats crypto as digital assets. Law 129/2019 makes wallet providers register with the National Bank of Romania and follow EU 5AMLD KYC rules.

- Crypto profits over 600 lei face a flat 10 % personal income tax; annual gains under 600 lei stay tax-free. Losses carry forward for seven years.

- In June 2022 ANAF audited 63 investors, found 131 million lei in gains and 49 million lei unreported.

- Key regulators: ANAF for taxes, National Bank of Romania for e-money tokens, Financial Supervisory Authority for security tokens, Financial Intelligence Unit for AML, and ESMA for EU oversight.

Legal Status of Cryptocurrency in Romania

Romania treats crypto coins as digital assets, not as legal tender, so you stash them in a crypto purse. Banca Națională a României logs each move on a ledger system, and wallet apps must vet traders under EU anti-money-laundering law.

Cryptocurrency classification

Under Article 116(1) of Law 227/2015, the Romanian Fiscal Code ranks cryptocurrency as income from alternative sources. The National Bank of Romania does not grant legal tender status to any crypto asset.

The tax office treats trading of virtual currencies like other digital assets. Taxes apply when you sell or swap these crypto assets.

Law No. 129/2019 defines digital wallet providers as entities that offer secure storage of private cryptographic keys. They must comply with anti-money-laundering rules. They register with the National Bank of Romania as electronic money issuers.

This setup covers crypto exchanges and other financial services.

Government attitude towards crypto trading

The Romanian government treats digital currencies as regulated assets, not legal tender. National Bank of Romania warns on terrorist financing risks in blockchain technology and crypto trading.

Parliament adopted EU AML5 rules for combating money laundering in digital wallets and crypto exchanges. The move aligns with FATF goals and European banking authority standards. The Ministry of Finance enforces KYC checks on digital wallet providers and sets capital gains tax rules in the Romanian Fiscal Code.

It covers income taxes on cryptocurrency mining and staking rewards. The state also monitors initial coin offerings and non-fungible tokens as financial instruments.

ANAF audited 63 crypto investors in June 2022 under its tax administration mandate. Inspectors discovered 131 million lei in gains and found 49 million lei unreported, a sign of tax evasion.

ANAF relies on data from the financial crimes enforcement network to track crypto transactions. The agency still has not clarified how it will treat lost or stolen crypto under current tax rules.

This gap frustrates taxpayers and crypto exchanges alike. Romania continues to balance innovation with tax compliance and anti-money laundering efforts.

Cryptocurrency Regulation in Romania

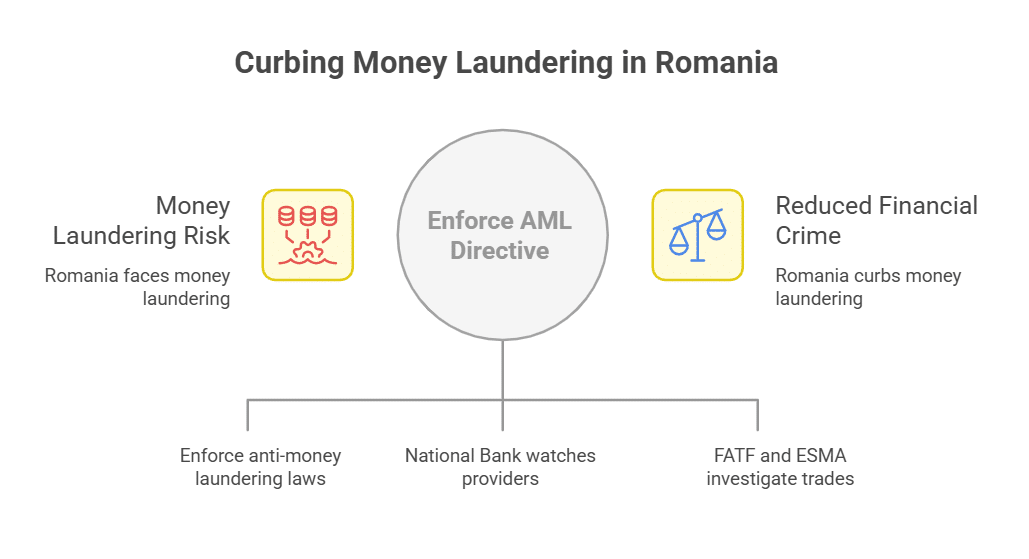

Romania enforces the EU anti-money laundering directive 5 to curb money laundering, and the National Bank of Romania watches digital cash providers. The financial action task force and the European securities and markets authority sniff out bad trades; head to the next section for more.

Key regulations governing cryptocurrencies

Law No. 129/2019 lays out clear steps. Firms must meet tight rules.

- Under Law No. 129/2019, enacted in 2019, crypto exchanges and digital wallet providers register with the Romanian government for licensing.

- 5AMLD demands thorough know your customer checks, mandatory reporting for suspicious transactions, and disclosure of ultimate beneficial owners.

- That law defines a digital wallet provider as any entity that offers secure storage of private cryptographic keys for virtual currencies.

- New Markets in Crypto-Assets rules from the European Union will govern e-money tokens, security tokens, and payment methods across member states.

- National Bank of Romania teams up with the European Securities and Markets Authority to track blockchain technology and monitor electronic payments.

Principal regulators overseeing the crypto space

Regulators shape the crypto space in Romania. They set rules for digital wallet providers, exchanges, and issuers of e-money tokens.

- ANAF drives tax compliance. The agency audited 63 crypto investors in June 2022 and found over 131 million lei in gains; it flagged 49 million lei as unreported. It enforces how gains are taxed under the Romanian Fiscal Code.

- National Bank of Romania tracks e-money tokens and virtual currencies. It issues warnings on social security risks, medium of exchange limits, and monitors foreign exchange flows.

- Financial Supervisory Authority controls security tokens and financial instruments. It registers digital wallet providers, limits issuance, and forces know your customer (kyc) checks under MIFID II rules.

- Financial Intelligence Unit monitors money laundering and terrorism financing. It applies amld5 rules, logs suspicious transactions, and blocks proceeds of crime.

- European Securities and Markets Authority guides crypto trading across the European Union. It shapes passporting for cryptocurrency exchanges and advises on asset-referenced tokens.

Taxation of Cryptocurrency in Romania

Romanian Fiscal Code calls gains from digital assets taxable as dividend income, so you must note every trade in your coin wallet. Digital wallet providers and cryptocurrency exchanges will issue detailed statements, so your flat-rate return shows every token sale in neat rows.

Capital gains tax on cryptocurrency

Tax code treats profits from blockchain technology trades in the form of virtual currencies as taxable income. It applies a flat 10 percent PIT rate under the romanian fiscal code.

Taxpayers owe the 10 percent levy once yearly if crypto gains exceed 600 lei. Small deals under 200 lei need no tax report or payment when yearly gains stay below 600 lei. Digital wallet providers and exchanges follow strict tax compliance rules and share data with the central bank of romania.

Losses can lower future tax bills for up to seven years. This rule acts like a safety net. Miners and stakers record their rewards separately. Both e-money tokens and security tokens face the same 10 percent levy.

Taxpayers file their gains each spring via the annual tax form. Keep accurate cost-basis logs to avoid penalties.

Taxation of mining and staking rewards

Romanian laws count mining and staking rewards as taxable income. They value each token at its fair market price in RON when you receive it. This amount faces a 10% personal income tax.

DeFi gains follow the same rule. Digital wallet providers log the token value. Blockchain technology traces each reward.

Taxpayers pay another 10% PIT when they sell or use mined digital assets or staked crypto. Gains above the initial value incur this flat rate. They must report each digital asset transaction under the Romanian Fiscal Code.

National Bank of Romania guidelines link to tax compliance. Crypto miners and stakers must file and pay on time.

Reporting requirements for crypto transactions

Investors must file a Personal Income Tax Return with ANAF by May 25 each year. Each transaction lands on that form. Reports list coin names, dates, RON values, counterparties, and reasons.

Crypto exchanges and digital wallet providers owe no tax report duties. ANAF enforces these rules under the Romanian Fiscal Code.

Think of your ledger as game tape. Blockchain technology deals cover mining rewards, staking bonuses, NFT trades, and usdt sales. Gains on e-money tokens, virtual currencies, or security tokens go there too.

Then you add all sums to your annual return. Solid records block audit headaches.

Anti-Money Laundering (AML) Laws and Requirements

Romania’s EU-aligned AML regulations force digital wallet providers to run KYC, monitor odd flows with blockchain analysis platforms, and file Suspicious Activity Reports to the Financial Intelligence Unit.

These strict checks set the stage for licensing hurdles that follow, so get ready for more on crypto business rules ahead.

Compliance with EU AML directives

EU AML directives force crypto firms to vet clients. The Fifth Anti-Money Laundering and Terrorism Financing Directive, or 5AMLD, covers virtual currencies and digital wallet providers.

It also applies to trading platforms and security tokens. Rules demand data sharing among EU states to spot illicit transfers.

Law No. 129/2019 builds on EU rules to fight money laundering. Regulators must report suspicious transactions involving asset-referenced tokens or nfts. Providers must appoint a permanent agent in Romania for legal representation.

National Bank of Romania and EU bodies check compliance with these rules.

Reporting obligations for suspicious transactions

Users and crypto firms must watch for odd trades or transfers. Providers file reports for suspicious transactions under Law No. 129/2019 and the Fifth Anti-Money Laundering and Terrorism Financing Directive.

- Trading platforms must scan digital currency trades under 5AMLD and Law No. 129/2019, flagging deals that smell fishy or lack clear money sources.

- Digital wallet providers must register with the government, then file a report to the National Bank of Romania within 24 hours of spotting suspicious activity.

- Firms must list client names, account data, transaction dates, amounts, virtual currencies involved, blockchain IDs and any links to known money laundering or terrorist financing schemes.

- Reports must follow templates set by the Romanian fiscal code and note e-money tokens, security tokens, NFTs and other financial instruments.

- Authorities review each report. They check data from the National Bank of Romania, European Union AML directives, the Commodity Futures Trading Commission and DMCC.

- Missed filings trigger fines under Law No. 129/2019. Providers risk losing internet, radio, and TV access in Romania.

Licensing and Ownership Requirements

Crypto firms must secure a license from the financial authority and register electronic tokens under the fiscal code. Owners hold stakes in wallet hosts built on blockchain technology and must report asset titles to stay compliant.

Licensing requirements for crypto businesses

Law No.129/2019 plowed through the legal soil in July 2019. It steers virtual currencies toward formal channels by forcing trading platforms and wallet services to register with the Romanian government.

Each provider must hire a local agent for legal papers, audits, and calls. They must also obey the Fifth Anti-Money Laundering and Terrorism Financing Directive. If a firm skips these steps, it can lose its feed to Romanian internet, radio, and TV.

Blockchain technology firms and e-money tokens issuers must prove they mind local tax rules and anti-fraud laws. They need to file under the Romanian fiscal code and share data on digital assets with the regulator.

A missed deadline can spark fines or block lists.

Ownership rules for digital assets

A “digital wallet provider” has a clear place in Law No. 129/2019, as an entity that stores private cryptographic keys. These firms offer safe storage of private keys. Owners hold virtual currencies, e-money tokens or security tokens and see their digital assets recorded on a blockchain ledger.

Romania imposes no wealth tax on crypto holdings. Gifting stays tax-free since gift levies do not apply and ANAF has not issued a stance. Owners move tokens by sending them from one wallet to another but they must still report trades for capital gains under the Romanian fiscal code.

Key Legal Considerations for Crypto Transactions

Any trade of e-money tokens on a crypto exchange can trigger a capital gains tax, so log each swap in your report and stay ahead of the tax office. A digital wallet provider might ask for ID checks under anti-money-laundering rules, and that can stall a late-night shift of security tokens.

Buying and selling cryptocurrency

You log into a cryptocurrency exchange and sell your bitcoin for lei. You pay a 10% personal income tax on any profit. You calculate profit by subtracting your cost basis, that is your purchase price plus fees, from the sale price.

The digital wallet provider or exchange does not withhold this tax for you.

Swapping feels like trading cards, but tax still applies. You swap ether for tether and still pay 10% PIT on gains. You track each trade under the Romanian Fiscal Code. You report your crypto trading in your annual tax return.

You treat virtual currencies and e-money tokens like other financial instruments under Romanian law.

Spending crypto on goods and services

Spending crypto tokens on goods or services triggers a taxable event under the Romanian Fiscal Code. Investors must calculate gains by comparing cost basis with fair market value in RON at the time of each purchase.

Romania applies a 10 percent capital gains tax on those net profits. The rule covers digital assets held in e-wallet services and on trading platforms built on blockchain technology.

Tax compliance also covers mining and staking rewards. Investors report those gains as taxable income. The tax law treats mined coins and staking rewards like other crypto tokens. Authorities levy a 10 percent personal income tax on all such profits.

Digital wallet providers and trading platforms must share transaction data on each sale or purchase of virtual currencies.

Transferring and gifting cryptocurrency

You move digital assets on blockchain technology, between accounts at digital wallet providers, with no tax due. Purchases made with lei or euros remain tax-exempt under the Romanian fiscal code.

Gifting virtual currencies feels like passing the baton, as no gift tax exists right now, but the tax office ANAF has not issued a clear ruling. This gray zone means you might log your gifts, to ease any future queries from ANAF over digital assets.

Criminal Law and Cryptocurrency

Romanian prosecutors use blockchain analytics tools to trace illicit transfers on digital wallets, and they punish fraudsters under the Criminal Code—read more.

Fraud and illegal activities involving crypto

Scammers use blockchain technology and virtual currencies to launder illegal monies, they hide funds like magicians hide cards. Law No.129/2019 forces digital wallet providers and crypto exchanges to check suspicious transactions to stop money laundering and terrorist financing.

The government adopted 5AMLD under European Union rules, it makes providers report odd trades to the national bank of romania.

In June 2022, ANAF auditors seized data from 63 crypto investors, they found 131 million lei in gains, 49 million lei unreported to the taxman. Virtual assets like e-money tokens, security tokens and NFTs now face scrutiny under the romanian fiscal code, tax compliance rules bite hard.

Tax authorities demand detailed reports on crypto mining, staking rewards and trading profits.

Penalties for non-compliance with regulations

Law No. 129/2019 cuts internet, radio, and TV access for providers that dodge crypto rules. Providers must appoint a permanent agent in Romania for legal representation. ANAF hit 63 investors in June 2022 and flagged 49 million lei in unreported virtual currency gains.

The tax agency can impose fines, interest, and overdue dividend tax for missed filings. Crypto exchanges and digital wallet providers risk losing their license under the Romanian fiscal code if they flout AML or e-money tokens laws.

Courts may levy prison time too, for serious fraud or money laundering.

Takeaways

Understanding the legal facts about cryptocurrency in Romania is no longer optional—it’s essential for anyone involved in the digital asset ecosystem. From tax obligations and KYC/AML compliance to regulatory oversight and crypto exchange registration, Romania is actively shaping a structured and secure crypto environment that aligns with EU standards.

These five legal facts serve as a crucial guide to help you make informed decisions, whether you’re investing in Bitcoin, launching a blockchain startup, or simply trading altcoins from home. The Romanian government’s approach is clear: support innovation while maintaining consumer protection and financial stability.

As the regulatory framework continues to evolve, staying updated on the legal facts about cryptocurrency in Romania will be vital for avoiding risks and leveraging opportunities. The country’s pro-digital attitude, combined with EU directives, makes Romania an increasingly attractive place for crypto investors and businesses alike.

FAQs on Legal Facts About Cryptocurrency in Romania

1. What is the legal status of virtual currencies in Romania?

Romania classifies virtual currencies as digital assets, not legal tender. The national bank of romania watches them. The european union has draft rules, but no full law yet. You trade them on cryptocurrency exchanges, under the romanian fiscal code. Think of the code as your road map.

2. How are gains from crypto currency taxed?

Romania treats gains from crypto currency as income. You record them under the romanian fiscal code. You pay tax on corporate income or personal income. The flat tax rate is 10 percent. File returns on time, keep records for tax compliance, or the tax office may start knocking.

3. Do digital wallet providers need a license in Romania?

Yes, digital wallet providers need a license. They must register as e-money tokens issuers. They follow european union rules for anti-money laundering. The national bank of romania checks them. They vet clients, to fight terrorist financing. It is no joke, they watch every move.

4. Can a limited liability company hold digital assets?

Yes, a limited liability company can hold digital assets. It can buy crypto currencies, security tokens, asset-referenced tokens, and nfts. It must list them as financial instruments. It follows romanian tax laws and anti-money laundering rules. The company must play by the book.

5. What rules fight money laundering and terrorist financing?

Romania uses european union rules. These rules cover crypto currency, blockchain technology, e-money tokens, security tokens, asset-referenced tokens. Digital wallet providers and cryptocurrency exchanges must check clients, report suspicious deals. The national bank of romania keeps an eye on the whole scene.

6. Where can I trade security tokens and NFTs?

You can trade security tokens and nfts on licensed cryptocurrency exchanges. Some platforms offer asset-referenced tokens too. Think of your digital wallet as a safe in the cloud, you need one from a registered provider. Link it to the exchange. Follow the romanian fiscal code for tax payments.