Choosing the best payment gateways for online stores is crucial for seamless transactions, enhanced security, and a better customer experience. With digital commerce evolving rapidly, businesses must select a reliable and feature-rich payment solution to stay ahead.

In 2025, the eCommerce landscape demands payment gateways that offer multiple currency support, fraud protection, and smooth integrations with popular shopping platforms.

Beyond simple transaction processing, modern payment gateways now include features like AI-powered fraud detection, one-click checkout experiences, and real-time analytics to optimize business performance.

A well-chosen payment gateway can increase conversion rates, reduce cart abandonment, and provide flexibility for both businesses and customers.

In this guide, we explore the 10 best payment gateways for online stores in 2025, their benefits, and how to choose the right one for your business.

What is a Payment Gateway and Why Does It Matter?

A payment gateway is a technology that securely processes online transactions, acting as a bridge between customers, merchants, and banks.

It ensures encrypted data transmission, verifies cardholder details, and authorizes payments instantly.

Payment gateways streamline the entire purchasing process, ensuring that transactions are completed smoothly without unnecessary delays.

Key Features of a Reliable Payment Gateway

- PCI Compliance & Encryption – Ensures data security and prevents breaches.

- Multi-Currency Support – Enables businesses to accept payments worldwide.

- Fast Transaction Processing – Reduces checkout time, minimizing cart abandonment.

- Fraud Detection & Prevention – Uses AI and machine learning to flag suspicious transactions.

- Seamless Integration – Works with popular eCommerce platforms like Shopify, WooCommerce, and Magento.

- Flexible Payment Methods – Supports credit/debit cards, eWallets, BNPL (Buy Now, Pay Later), and cryptocurrency transactions.

How to Choose the Right Payment Gateway for Your Online Store

- Transaction Fees & Hidden Costs – Compare processing fees, chargebacks, and additional expenses.

- Payment Methods – Ensure support for credit/debit cards, eWallets, BNPL (Buy Now, Pay Later), and cryptocurrency.

- Security & Compliance – Look for PCI DSS compliance and tokenization features.

- User Experience & Checkout Process – A smooth, frictionless checkout leads to better conversions.

- Customer Support & Service Reliability – 24/7 assistance and robust downtime management are crucial.

- Scalability & Growth Potential – Choose a gateway that can handle increasing transaction volumes as your business grows.

Hosted vs. Integrated Payment Gateways

- Hosted Gateways – Redirect customers to a third-party processor (e.g., PayPal, Stripe) for payment completion.

- Pros: Easy setup, secure, reduced compliance burden.

- Cons: Less control over user experience.

- Integrated Gateways – Process payments within the website (e.g., Stripe, Braintree).

- Pros: Seamless checkout, improved branding.

- Cons: Requires technical setup and PCI compliance.

10 Best Payment Gateways for Online Stores in 2025

Each of these payment gateways has been evaluated based on security, pricing, user experience, and compatibility with eCommerce platforms.

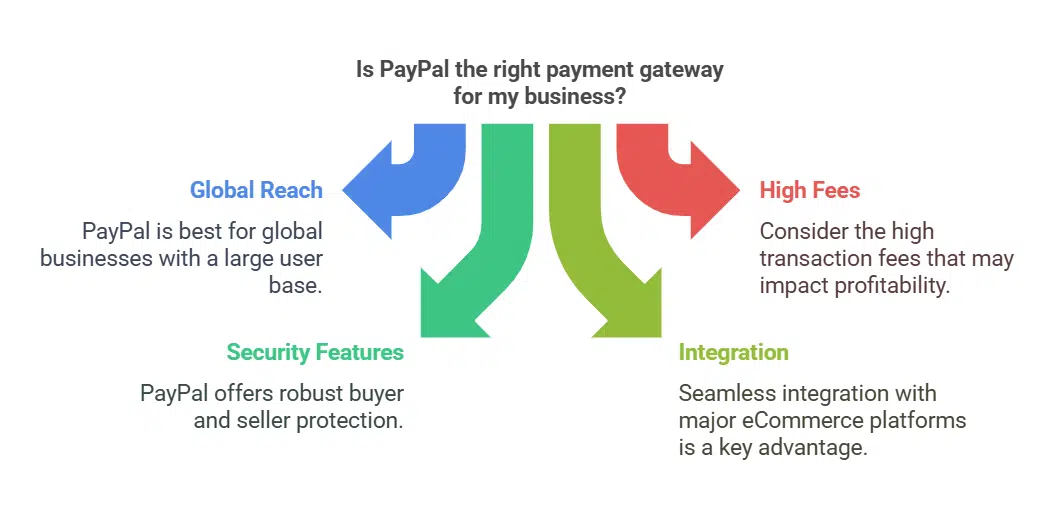

1. PayPal

PayPal is one of the most widely used payment gateways, with over 400 million active users worldwide. It offers a range of payment solutions for businesses, including PayPal Standard, PayPal Pro, and PayPal Checkout.

PayPal’s Buyer and Seller Protection features ensure secure transactions, and it integrates seamlessly with major eCommerce platforms.

| Feature | Details |

| Transaction Fee | 2.9% + $0.30 per transaction |

| Supported Currencies | 25+ |

| Payment Methods | Credit/Debit Cards, PayPal Balance, BNPL |

| Best For | Global businesses |

Pros & Cons

- Easy integration with major platforms.

- Trusted by customers worldwide.

- High transaction fees.

2. Stripe

Stripe is a developer-friendly payment gateway offering extensive customization and integration options. It supports global transactions and is ideal for businesses that require recurring payments, subscription models, and advanced fraud prevention.

| Feature | Details |

| Transaction Fee | 2.9% + $0.30 per transaction |

| Supported Currencies | 135+ |

| Payment Methods | Credit/Debit Cards, ACH, Cryptocurrency |

| Best For | Developers & subscription businesses |

Pros & Cons

- Advanced fraud detection with Stripe Radar.

- Competitive pricing.

- Complex setup for beginners.

3. Square

Square is an excellent option for small businesses and omnichannel retailers. It provides an easy-to-use payment gateway, mobile POS systems, and invoicing solutions. Square’s flat-rate pricing makes it a simple and transparent option.

| Feature | Details |

| Transaction Fee | 2.6% + $0.10 per transaction |

| Supported Currencies | Limited |

| Payment Methods | Credit/Debit Cards, Mobile Payments |

| Best For | Small businesses |

Pros & Cons

- Quick setup with simple pricing.

- Supports mobile and in-person payments.

- Limited international support.

4. Authorize.Net

Authorize.Net is one of the oldest and most trusted payment gateways, making it a solid choice for businesses that need a reliable and secure payment solution. It provides advanced fraud detection, automated recurring billing, and supports multiple payment methods, including digital wallets and ACH transfers.

| Feature | Details |

| Transaction Fee | 2.9% + $0.30 per transaction + $25 monthly fee |

| Supported Currencies | USD & select international currencies |

| Payment Methods | Credit/Debit Cards, Digital Wallets, ACH |

| Best For | Enterprise businesses & high-volume merchants |

Pros & Cons

- Strong security and fraud detection tools.

- Excellent customer support.

- Monthly fees may not be ideal for small businesses.

5. Adyen

Adyen is a global payment gateway trusted by companies like Uber, eBay, and Spotify. It offers a unified payment platform with features like multi-currency support, AI-driven fraud protection, and omnichannel payment processing.

| Feature | Details |

| Transaction Fee | Varies based on volume and region |

| Supported Currencies | 150+ |

| Payment Methods | Credit/Debit Cards, BNPL, Local Payment Methods |

| Best For | Large enterprises & international eCommerce |

Pros & Cons

- Supports over 250 payment methods globally.

- No setup fees; charges based on transaction volume.

- May not be cost-effective for small businesses.

6. Checkout (now Verifone)

2Checkout, now part of Verifone, is an ideal solution for businesses that operate globally. It supports digital goods, subscription-based services, and localized payment options across different countries.

| Feature | Details |

| Transaction Fee | 3.5% + $0.35 per transaction |

| Supported Currencies | 80+ |

| Payment Methods | Credit/Debit Cards, PayPal, Local Methods |

| Best For | Global digital businesses |

Pros & Cons

- Great for international eCommerce transactions.

- Comprehensive subscription management.

- Higher fees compared to competitors.

7. Amazon Pay

Amazon Pay simplifies the checkout process by allowing customers to use their Amazon account for payments. This is beneficial for businesses targeting Amazon users who value a streamlined checkout experience.

| Feature | Details |

| Transaction Fee | 2.9% + $0.30 per transaction |

| Supported Currencies | USD, EUR, GBP, JPY |

| Payment Methods | Amazon Account, Credit/Debit Cards |

| Best For | Businesses targeting Amazon customers |

Pros & Cons

- Familiar and trusted by millions of Amazon users.

- Secure and fast transactions.

- Limited to Amazon customers.

8. Braintree

Braintree, owned by PayPal, provides a robust payment gateway for businesses looking for flexibility and scalability. It supports multiple payment methods, including digital wallets like Apple Pay and Google Pay.

| Feature | Details |

| Transaction Fee | 2.9% + $0.30 per transaction |

| Supported Currencies | 130+ |

| Payment Methods | Credit/Debit Cards, PayPal, Digital Wallets |

| Best For | Businesses needing multiple payment options |

Pros & Cons

- No setup fees or monthly charges.

- Excellent for businesses handling multiple currencies.

- Requires some technical knowledge for integration.

9. WePay (Chase)

WePay, a Chase company, specializes in integrated payments for platforms and marketplaces. It offers flexible API-driven solutions and strong fraud protection.

| Feature | Details |

| Transaction Fee | Varies based on business model |

| Supported Currencies | USD |

| Payment Methods | Credit/Debit Cards, ACH, Digital Payments |

| Best For | Platforms & SaaS businesses |

Pros & Cons

- Strong banking infrastructure via Chase.

- Advanced API customization for businesses.

- Limited availability outside the U.S.

10. Razorpay

Razorpay is a popular payment gateway in India, supporting multiple payment modes, including UPI, net banking, and digital wallets.

It is well-suited for startups and mid-sized businesses in the region.

| Feature | Details |

| Transaction Fee | 2% per transaction |

| Supported Currencies | INR |

| Payment Methods | UPI, Credit/Debit Cards, Net Banking |

| Best For | Indian businesses & startups |

Pros & Cons

- Supports a variety of local payment methods.

- Zero setup and maintenance fees.

- Limited to the Indian market.

Takeaways

Selecting the best payment gateways for online stores depends on your business needs. Whether you prioritize global payments, lower fees, or seamless integration, there’s a perfect solution.

Optimize your store’s payment processing by choosing a gateway that enhances security, customer trust, and checkout efficiency.

By evaluating transaction fees, security, and compatibility with your eCommerce platform, you can make an informed decision that helps scale your business effectively.

As online shopping continues to grow, choosing the right payment gateway will be a crucial factor in your store’s success.