Understanding motor insurance in India has never been more critical. With changing regulations, innovative products, and evolving customer needs, being well-informed ensures you make the right decisions.

Here, we address FAQs About Motor Insurance in India to help you navigate the complexities of motor insurance and secure the best coverage for your vehicle.

What is Motor Insurance and Why is it Important?

Definition of Motor Insurance

Motor insurance is a contract between a vehicle owner and an insurance provider that offers financial protection against damages, theft, and third-party liabilities.

In India, motor insurance is mandatory under the Motor Vehicles Act, ensuring road safety and legal compliance.

It also provides essential support in the event of accidents, offering a financial safety net during emergencies.

Motor insurance policies typically cover:

- Damage to your vehicle due to accidents, fire, or natural disasters.

- Third-party liabilities, including injury or property damage caused to others.

- Theft of the insured vehicle.

Importance of Motor Insurance in India (2025)

Motor insurance serves multiple purposes:

- Legal Requirement: Driving without valid insurance can result in hefty fines and penalties, with stricter enforcement in 2025.

- Financial Security: It mitigates the financial burden of accidents or unforeseen incidents, especially in high-cost repairs.

- Peace of Mind: Knowing that you are covered allows you to drive confidently, even in uncertain traffic conditions.

Frequently Asked Questions About Motor Insurance in India (2025)

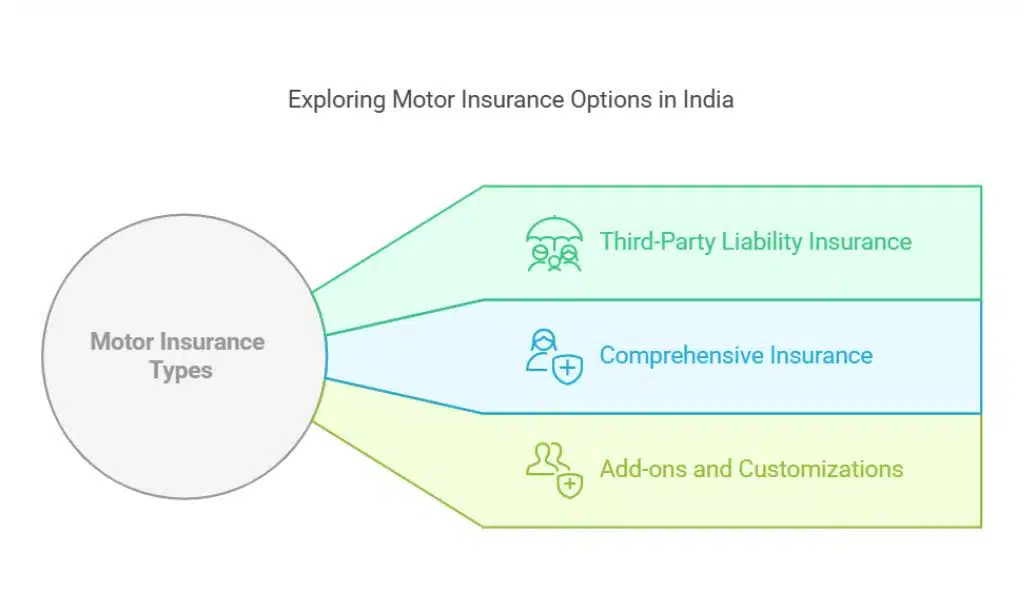

1. What Are the Different Types of Motor Insurance Available?

There are several types of motor insurance in India, each tailored to meet different needs. Choosing the right policy depends on factors like vehicle usage, risk factors, and personal preferences.

In India, motor insurance is broadly categorized into:

- Third-Party Liability Insurance: Covers damages or injuries caused to third parties. It is the minimum legal requirement for all vehicles on the road.

- Comprehensive Insurance: Provides coverage for third-party liabilities as well as damage to your own vehicle, offering a wider safety net.

- Add-ons and Customizations: Enhance your policy with features like:

- Zero Depreciation Cover

- Engine Protection Cover

- Roadside Assistance

- Consumables Cover (e.g., oil, nuts, and bolts)

| Type of Insurance | Coverage | Who Should Opt For It |

| Third-Party Only | Third-party injury or property damage | Mandatory for all vehicle owners |

| Comprehensive | Own damage + third-party liabilities | Ideal for new or high-value vehicles |

| Add-ons | Enhanced coverage options | Drivers seeking specific risk coverage |

2. How is the Premium Calculated for Motor Insurance?

Premium calculations can seem complex, but understanding the factors at play can make it simpler. The premium is essentially a balance between risk and the level of coverage chosen.

Here are some key factors:

- Type of Vehicle: Higher premiums for luxury or high-performance vehicles due to higher repair costs.

- Age of the Vehicle: Older vehicles often attract lower premiums due to reduced Insured Declared Value (IDV).

- Driver Profile: Factors like age, driving history, and location play a role in determining risk.

- Selected Add-Ons: Each add-on increases the premium amount based on its scope.

| Factor | Impact on Premium | Example |

| Vehicle Type | High for SUVs, low for hatchbacks | Hatchback: ₹5,000; SUV: ₹10,000 |

| Add-ons (Zero Depreciation, etc.) | Increases premium | With add-ons: ₹7,500; Without: ₹5,000 |

| Driver Age and History | Young drivers pay more | 25-year-old: Higher; 45-year-old: Lower |

3. What Documents Are Required to Purchase Motor Insurance?

To purchase motor insurance, having the correct documents ready ensures a smooth process. These documents serve to verify the vehicle’s details and establish the owner’s identity:

- Vehicle Registration Certificate (RC)

- Identity Proof (Aadhaar, PAN, or Passport)

- Address Proof (Utility bills or rental agreements)

- Previous Insurance Policy (if applicable)

- Pollution Under Control (PUC) Certificate

| Document | Purpose |

| RC | Verifies ownership and vehicle details |

| Identity Proof | Establishes the owner’s identity |

| PUC | Confirms compliance with pollution norms |

4. How Can I Renew My Motor Insurance Policy?

Renewing a motor insurance policy on time is vital to avoid interruptions in coverage. A lapse in policy could lead to penalties or the need for inspections.

Here’s an overview:

- Visit your insurer’s website or app.

- Enter policy details and vehicle information.

- Review and modify your coverage if needed.

- Make the payment and download your policy instantly.

Pro Tip: Renew your policy at least 7-10 days before the expiry date to avoid lapses and penalties. Delays could lead to higher premiums or inspections.

5. What Should I Do in Case of an Accident?

Accidents can be unexpected, but knowing how to respond ensures a smoother claim process.

Here’s an overview of what you should do:

- Inform your insurer immediately via their helpline or app.

- File an FIR if required (for major accidents, theft, or third-party claims).

- Document the damages with photos and videos as evidence.

- Submit the claim form with necessary documents like FIR, RC, and policy details.

- Cooperate with the surveyor during inspection.

| Step | Action Required |

| Inform Insurer | Call or use the insurer’s app |

| File FIR | Required for legal or theft cases |

| Submit Evidence | Photos, videos, and documents |

6. Can I Transfer My Motor Insurance When Selling My Vehicle?

Yes, transferring your motor insurance is possible and recommended to avoid liabilities. The transfer process involves notifying your insurer and submitting specific documents.

This ensures the new owner benefits from the coverage and you are relieved of liability:

- Notify your insurer about the ownership transfer.

- Submit the following documents:

- Sale agreement

- New RC in the buyer’s name

- NOC from the existing owner

Example Scenario: A seller who transferred the policy promptly avoided liability for an accident caused by the new owner days after the sale.

7. How Does No-Claim Bonus (NCB) Work?

The No-Claim Bonus is a significant reward for claim-free driving. Over the years, it accumulates and offers substantial discounts on premiums.

Here’s how it works:

- NCB discounts range from 20% to 50% on premiums.

- Retaining NCB while switching insurers is possible with an NCB Certificate.

- NCB is linked to the policyholder, not the vehicle.

| Claim-Free Years | NCB Discount |

| 1 | 20% |

| 2 | 25% |

| 5 | 50% |

8. What Are the Common Exclusions in Motor Insurance Policies?

Understanding exclusions is just as important as knowing what’s covered.

Policies typically do not cover the following:

- Damages caused under the influence of alcohol or drugs.

- Regular wear and tear or mechanical breakdown.

- Consequential damages (e.g., driving a flood-damaged vehicle).

- Usage of the vehicle for illegal activities.

9. How Can I Compare Motor Insurance Policies Effectively?

Comparing motor insurance policies ensures you get the best value for your money.

Use these tips:

- Use online comparison tools to evaluate policies side by side.

- Consider factors like premium, coverage, claim settlement ratio, and customer reviews.

- Check for hidden costs or exclusions.

10. What Are the Recent Trends in Motor Insurance in India (2025)?

The motor insurance landscape in 2025 is dynamic and innovative.

Key trends include:

- AI-Driven Claims Processing: Faster and more accurate claim settlements.

- Usage-Based Insurance (UBI): Premiums based on driving behavior and mileage, popular among city dwellers.

- Customizable Policies: Tailored coverage options for individual needs, such as e-vehicle-specific policies.

Additional Tips for Motor Insurance Buyers

How to Select the Best Policy for Your Needs

- Evaluate your driving habits and vehicle usage.

- Opt for a comprehensive plan with essential add-ons.

- Check the insurer’s reputation and claim settlement process.

Avoiding Common Mistakes While Purchasing Insurance

- Ignoring exclusions and policy terms.

- Focusing only on the premium instead of overall benefits.

- Delaying policy renewal.

Frequently Used Terms in Motor Insurance

Glossary of Key Terms

- IDV (Insured Declared Value): The maximum claim amount for total loss or theft.

- Deductibles: The portion of the claim amount paid by the policyholder.

- Third-Party Liability: Legal liability for damages caused to others.

Takeaways

By addressing these FAQs About Motor Insurance in India, we hope to equip you with the knowledge to make informed decisions.

Motor insurance isn’t just a legal formality; it’s a crucial tool for financial protection and peace of mind.

Take the time to compare policies, understand your coverage, and drive safely knowing you’re prepared for any eventuality.