Digital payments have changed how we handle money. Yet, many people struggle to find secure and user-friendly ways to pay online. This issue affects both consumers and businesses, leading to missed opportunities and financial stress.

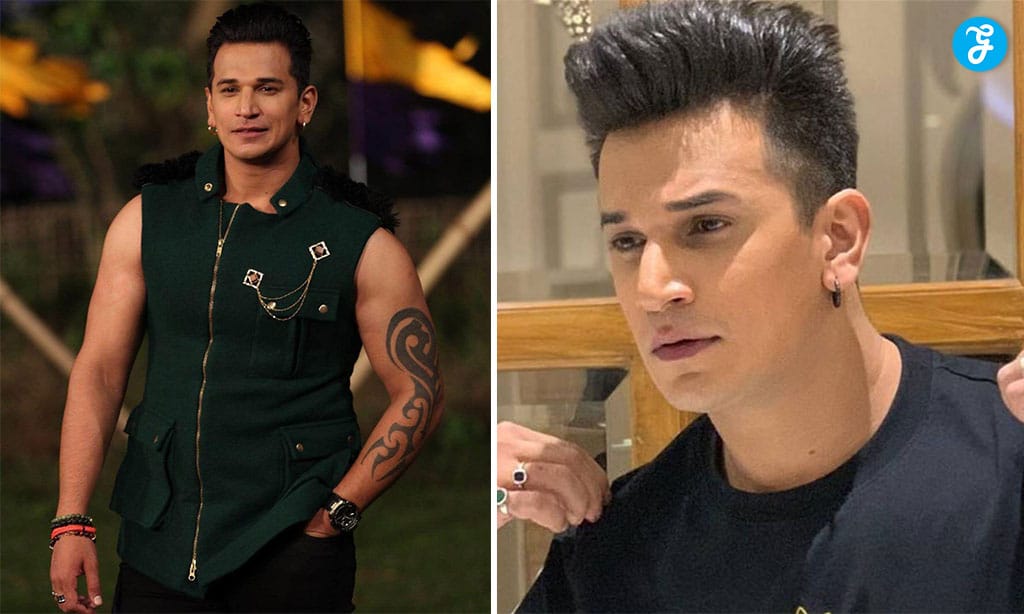

Prince Narula, a well-known figure in India, has partnered with PayPal to create innovative digital payment solutions. His approach combines enhanced security measures with an easy-to-use interface.

This article will explore Prince Narula digital PayPal innovations and how they can benefit you. Get ready to discover a new world of safe and simple online transactions.

Overview of Prince Narula Digital PayPal System

Prince Narula’s digital payment solutions represent a cutting-edge approach to online transactions. His partnership with PayPal and shift to digital platforms have revolutionized how influencers handle financial exchanges with their audience.

Partnership with PayPal

Prince Narula’s collaboration with PayPal marks a significant step in his digital payment solutions. This partnership leverages PayPal’s robust security features, including end-to-end encryption and advanced fraud detection mechanisms.

Users benefit from PayPal’s comprehensive services, such as digital wallets, merchant services, and international transfers, all integrated into Narula’s platform.

The alliance offers streamlined cross-border transactions, with fees set at 5.00% for international personal transfers. A minimum charge of $0.99 and a maximum of $4.99 apply. Narula’s system incorporates PayPal’s user-friendly refund policy, allowing eligible transaction refunds through a dashboard or mobile app.

This integration enhances financial inclusion and simplifies global monetary exchanges for Narula’s audience.

Transition to Digital Platforms

Prince Narula’s transition to digital platforms marks a significant shift in his business strategy. His partnership with PayPal enables seamless online transactions, catering to a global audience.

This move aligns with current digital payment trends, incorporating advanced security measures like biometric authentication and AI-driven processes.

Narula’s adoption of digital platforms expands his reach beyond traditional boundaries. E-commerce integration and mobile payment solutions allow fans to engage with his brand more easily.

The shift also streamlines financial operations, reducing reliance on cash transactions and improving record-keeping through digital receipts and automated spreadsheets.

Key Features of Prince Narula Digital PayPal Innovations

Prince Narula’s digital payment solutions offer cutting-edge features. These innovations focus on security and user experience to meet modern consumer needs.

Enhanced Security Measures

Prince Narula’s digital payment solutions prioritize security with end-to-end encryption and advanced fraud detection systems. These measures protect users’ financial data and transactions from unauthorized access.

PayPal’s partnership enhances these safeguards, offering robust protection for sensitive information.

Security features build trust and encourage customer loyalty in digital payments. Strong encryption and fraud prevention tools give users peace of mind when conducting online transactions.

This focus on safety helps drive adoption of Narula’s innovative payment platforms among consumers and businesses alike.

User-Friendly Interface

Prince Narula digital PayPal solutions prioritize user experience with an intuitive interface. The platform offers clear navigation and simple menu structures, making it accessible for users of all tech skill levels.

Icons and buttons are designed for easy recognition, reducing confusion and streamlining the payment process.

This user-friendly approach extends to mobile devices, ensuring seamless transactions on smartphones and tablets. The interface adapts to different screen sizes, maintaining functionality and readability.

Quick-access features and customizable settings allow users to tailor their experience, further enhancing ease of use in digital transactions.

Benefits of Prince Narula Digital PayPal Solutions

Prince Narula digital PayPal solutions offer significant advantages for users and businesses alike. These innovations promote financial inclusion by providing easy access to digital transactions for underserved populations.

The streamlined payment process enhances efficiency and reduces transaction costs for both consumers and merchants.

Increased Financial Inclusion

Prince Narula’s digital PayPal solutions have made significant strides in increasing financial inclusion. His initiatives focus on bringing digital banking services to underserved communities, particularly in rural areas.

Through partnerships with local organizations, Narula has launched educational workshops to improve digital literacy and promote the use of online payment systems. These efforts have helped bridge the gap between traditional banking and modern financial technologies, enabling more people to access and benefit from digital economic opportunities.

Narula’s platform incorporates user-friendly interfaces and enhanced security measures, making it accessible to a wider range of users. This approach has led to a notable increase in the adoption of digital payment methods among previously unbanked populations.

By streamlining transactions and reducing barriers to entry, Narula’s solutions have empowered individuals and small businesses to participate more fully in the digital economy, fostering economic growth and financial independence in underserved regions.

Streamlined Transactions

Prince Narula’s digital PayPal solutions offer streamlined transactions for users worldwide. These systems process payments quickly and efficiently, allowing for seamless global transactions.

Users benefit from detailed transaction histories, enabling better financial tracking and management.

The platform simplifies currency conversions, making international payments hassle-free. It adheres to global payment regulations, ensuring secure and compliant cross-border transactions.

This approach reduces friction in online commerce, benefiting both businesses and consumers engaged in e-commerce activities.

Enhanced Fan Engagement

Prince Narula digital PayPal solutions offer enhanced fan engagement through innovative features. Fans can now interact directly with their favorite influencer using secure, user-friendly platforms.

These solutions enable seamless transactions for content subscriptions, merchandise purchases, and virtual meet-and-greets. The integration with social media platforms allows for real-time engagement during live streams and events.

Narula’s collaboration with PayPal has simplified payment processes, fostering trust and loyalty among his audience. This partnership has led to increased financial inclusion, allowing fans from diverse backgrounds to participate in his digital ecosystem.

The streamlined transaction system encourages more frequent interactions, creating a stronger bond between Narula and his followers. As a result, fan engagement metrics have shown significant improvement since the implementation of these digital payment solutions.

Challenges in Digital Payment Innovation

Digital payment innovation faces constant threats from cybercriminals. Market adaptation remains a hurdle as some users resist new technologies.

Security Concerns

Prince Narula digital PayPal solutions prioritize robust security measures to protect users’ financial information. Advanced encryption technologies safeguard sensitive data during transactions, while real-time fraud detection systems monitor for suspicious activities.

These security features build consumer trust and encourage repeat business, crucial for long-term success in the competitive online payment landscape.

To combat cybercriminals, Narula’s platform implements multi-factor authentication and identity verification processes. Users benefit from secure login methods, such as biometric scans or one-time passwords sent to mobile devices.

The system also employs machine learning algorithms to analyze transaction patterns and flag potential security breaches, enhancing overall protection for customers and merchants alike.

Market Adaptation

Digital payment solutions face challenges in market adaptation. Consumers and businesses often hesitate to adopt new financial technologies due to security concerns and habit. Prince Narula’s innovations address these issues through enhanced security measures and user-friendly interfaces.

His platforms incorporate biometric authentication and AI-driven processes to build trust and ease of use.

Narula’s approach to market adaptation focuses on education and gradual integration. His team provides clear guides and customer support to help users transition smoothly. The solutions also offer compatibility with existing payment methods, allowing for a phased adoption process.

This strategy aims to increase financial inclusion and streamline transactions for both individuals and businesses in the digital economy.

Future Prospects for Prince Narula Digital PayPal

Prince Narula digital PayPal solutions stand poised for significant growth in the coming years. Expansion into new markets and the introduction of innovative features will likely drive this progress.

Virtual reality experiences integrated with payment systems could revolutionize how users interact with financial services. These advancements may allow customers to visualize transactions, manage accounts, and receive financial advice in immersive digital environments.

Artificial intelligence and blockchain technology will play crucial roles in shaping Narula’s future payment offerings. AI-powered chatbots could provide 24/7 customer support, while machine learning algorithms might detect fraudulent activities more effectively.

Blockchain integration could enhance transaction security and enable faster, cheaper cross-border payments. These technological advancements, combined with Narula’s influencer status, position his digital payment solutions for widespread adoption and continued success in the evolving fintech landscape.

Takeaways

Prince Narula digital PayPal solutions mark a significant shift in financial transactions. His partnership with PayPal fosters innovation and accessibility in the digital economy.

The collaboration promotes financial literacy and inclusion, especially in underserved areas. These efforts contribute to a future where digital payments become the norm. Narula’s venture showcases the power of celebrity influence in driving digital transformation and financial empowerment.