Car insurance is an essential expense for most Americans, offering financial protection and peace of mind in case of accidents, theft, or other unforeseen events. However, many drivers have noticed a steady increase in their premiums over the years, leaving them wondering, why are car insurance rates rising in the USA?

Understanding the factors driving these changes can help consumers make informed decisions and potentially save on their premiums.

This article explores the top 10 reasons behind the rising costs and provides actionable tips to mitigate the impact on your wallet.

Understanding the Basics of Car Insurance Rates

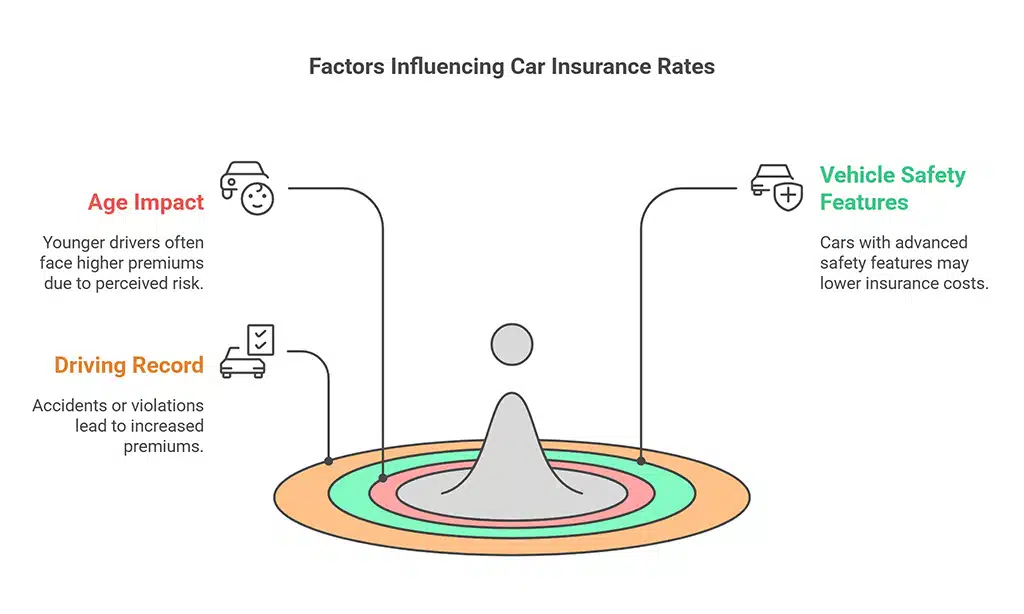

What Influences Car Insurance Rates?

Car insurance rates are determined by a variety of factors, including:

- Driver Profile: Age, gender, driving history, and credit score.

- Vehicle Type: The make, model, and age of your car.

- Location: Rates vary by state, city, and even neighborhood.

Insurers use complex algorithms to assess risk and set premiums, which means even small changes in these factors can have a significant impact on what you pay.

Common Factors Affecting Car Insurance Rates

| Factor | Impact on Rates |

| Age | Younger drivers often face higher premiums |

| Vehicle Safety Features | Cars with advanced features may lower costs |

| Driving Record | Accidents or violations increase premiums |

Why Are Car Insurance Rates Rising in 2025?

The upward trend in car insurance costs isn’t new, but 2025 has seen a sharper increase due to several contributing factors. Understanding these reasons can shed light on why are car insurance rates rising in the USA and what consumers can do about it.

10 Key Factors Behind Rising Car Insurance Rates

Car insurance premiums in the USA are influenced by numerous dynamic factors. By breaking these down, we can better understand why rates are climbing and what consumers should know to address the changes effectively.

1. Increased Accident Rates

Accident rates have been on the rise in the USA, fueled by factors such as increased road congestion and distracted driving. More accidents mean more claims, which drives up costs for insurers—costs that are ultimately passed on to consumers in the form of higher premiums.

Key Data:

- The National Highway Traffic Safety Administration (NHTSA) reported a 10% increase in traffic fatalities in the last year.

- Insurance payouts for accident-related claims have risen by 15% over the same period.

Example: An urban area like Los Angeles has seen a 12% increase in minor collisions in the last five years, contributing to premium hikes.

Accident Rate Trends

| Year | Traffic Fatalities (%) | Claims Paid (%) |

| 2020 | +8% | +12% |

| 2023 | +10% | +15% |

2. Rising Medical Costs

Healthcare expenses in the USA are among the highest in the world, and this directly affects car insurance premiums. When medical bills for accident-related injuries increase, insurers have to cover higher payouts, leading to increased premiums for policyholders.

Example: The average medical claim cost per accident has risen from $15,000 in 2010 to over $25,000 in recent years.

Rising Medical Costs Over Time

| Year | Average Medical Claim Cost |

| 2010 | $15,000 |

| 2025 | $25,000 |

3. Expensive Vehicle Repairs

Modern vehicles are equipped with advanced technology, such as sensors, cameras, and driver-assistance systems. While these features improve safety, they also make repairs more expensive. This is a major reason why car insurance rates are rising in the USA.

Comparison:

| Repair Type | Traditional Cars | Modern Cars |

| Bumper Replacement | $500 | $2,000 |

| Windshield Replacement | $300 | $1,200 |

Insight: Advanced features like lane departure warning systems can increase repair costs by up to 40%.

4. Inflation Impact

General inflation affects almost every industry, and car insurance is no exception. As the cost of goods and services rises, insurers face higher operational expenses, which are reflected in premiums.

Example: A 5% inflation rate can result in a 3% increase in operational costs for insurers, impacting premiums.

5. Higher Litigation Costs

Lawsuits related to car accidents have become more frequent and expensive. High litigation costs often result in larger settlements or awards, which insurance companies factor into their pricing models.

Stat: Legal costs account for nearly 20% of the total expenses for auto insurance claims.

Breakdown of Claim Expenses

| Expense Type | Percentage of Total Claims |

| Legal Costs | 20% |

| Medical Costs | 40% |

| Vehicle Repairs | 30% |

6. Rising Instances of Natural Disasters

Natural disasters like hurricanes, wildfires, and floods have been increasing in frequency and intensity. These events result in higher claims for vehicle damage, especially in disaster-prone areas.

Example: Hurricane Ida alone caused over $1 billion in insured vehicle losses.

Vehicle Losses Due to Natural Disasters

| Disaster | Insured Vehicle Losses |

| Hurricane Ida | $1 Billion |

| California Wildfires | $600 Million |

7. Increasing Cases of Auto Theft

Auto theft rates have surged in many parts of the USA, driving up comprehensive insurance costs. Insurers adjust premiums to cover the higher risk of theft claims.

Data: The National Insurance Crime Bureau (NICB) reported a 25% increase in auto thefts over the past five years.

Insight: Luxury cars are more frequently targeted, increasing premiums for owners.

8. Changing State Regulations

State-specific laws and regulations can have a significant impact on car insurance rates. For example, some states require higher minimum coverage levels, which can increase premiums.

Example: Recent regulatory changes in Florida have led to a 10% rise in average premiums.

9. Distracted Driving Incidents

Distracted driving, particularly due to mobile phone usage, has become a major cause of accidents. This trend has contributed to higher claim frequencies and, consequently, higher premiums.

Stat: Texting while driving increases the risk of a crash by 23 times, according to the NHTSA.

Impact of Distracted Driving

| Activity | Crash Risk Increase |

| Texting | 23x |

| Phone Calls | 4x |

10. Changes in Insurance Industry Practices

Insurance companies continuously update their risk assessment models, incorporating new data and trends. For example, the adoption of telematics—devices that monitor driving behavior—has led to mixed impacts on premiums.

Insight: Safe drivers using telematics have reported savings of up to 15% on their premiums.

How Consumers Can Mitigate Rising Insurance Costs?

1. Shop Around for Better Rates

Not all insurance providers are created equal. By comparing quotes from multiple companies, you can find a policy that offers the best value.

Tip: Use online comparison tools to review options from at least five insurers.

2. Take Advantage of Discounts

Many insurers offer discounts for:

- Bundling policies (e.g., auto and home insurance).

- Maintaining a clean driving record.

- Installing anti-theft devices in your vehicle.

Table:

| Discount Type | Average Savings |

| Safe Driver Discount | 10-20% |

| Multi-Policy Discount | 15-25% |

3. Improve Your Driving Record

Avoiding accidents and traffic violations can lead to significant savings over time. Many insurers reward safe driving with lower premiums.

4. Opt for Usage-Based Insurance (UBI)

Usage-based insurance programs use telematics to track your driving habits. Safe drivers can benefit from lower rates under these plans.

Tip: Enroll in a trial UBI program to see if it’s a good fit for you.

Takeaways

The question of why are car insurance rates rising in the USA has no single answer—it’s a combination of economic, technological, and societal factors. However, by understanding these drivers and taking proactive steps, consumers can better navigate the challenges of rising premiums.

Whether it’s shopping around for the best rates, improving your driving habits, or leveraging discounts, there are ways to minimize the financial impact. Stay informed and make smart choices to protect your wallet while staying insured.